Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please make sure the answer is correct. plz plz plz thank you. Question 4 (1 point) Listen Indicate which of the following is NOT listed

please make sure the answer is correct. plz plz plz thank you.

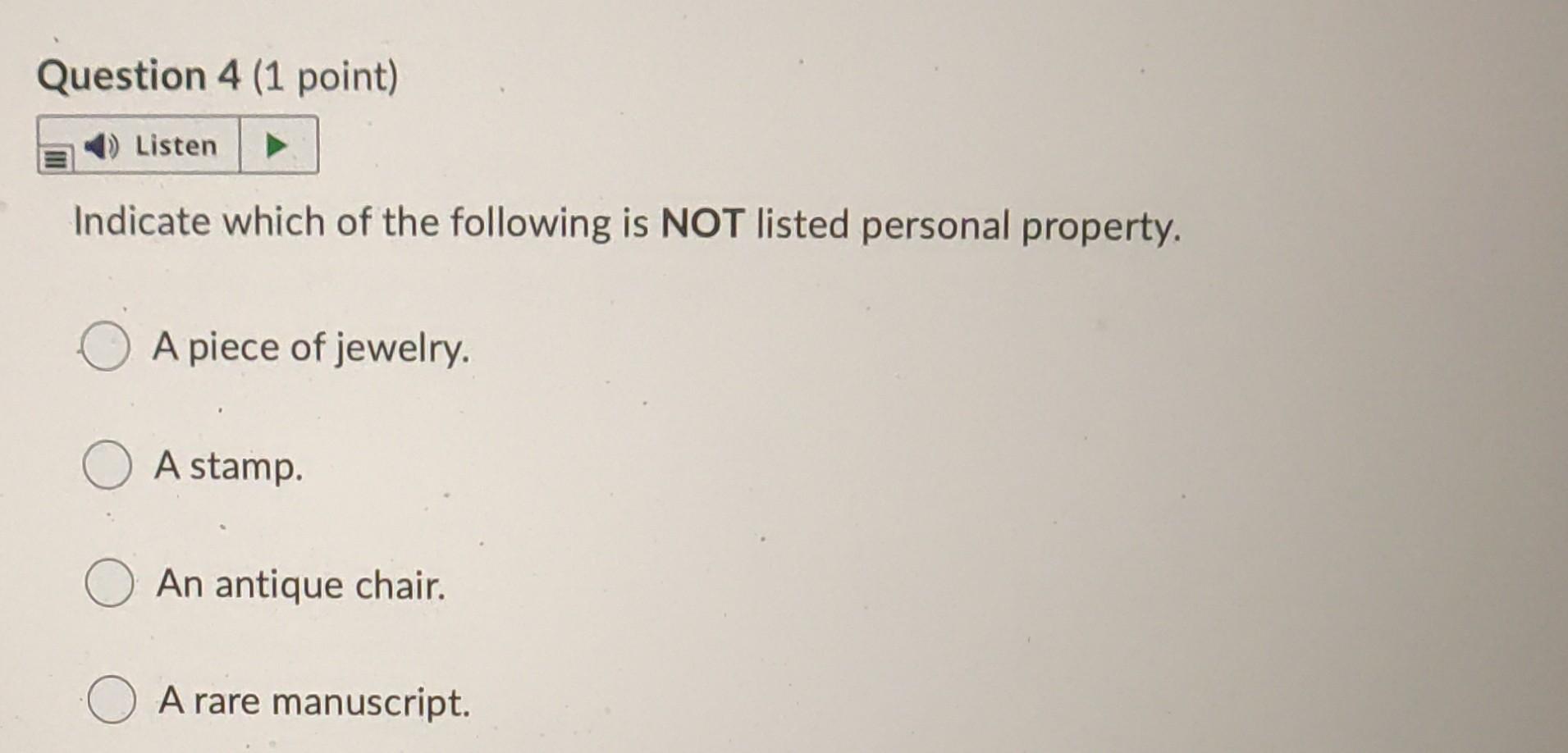

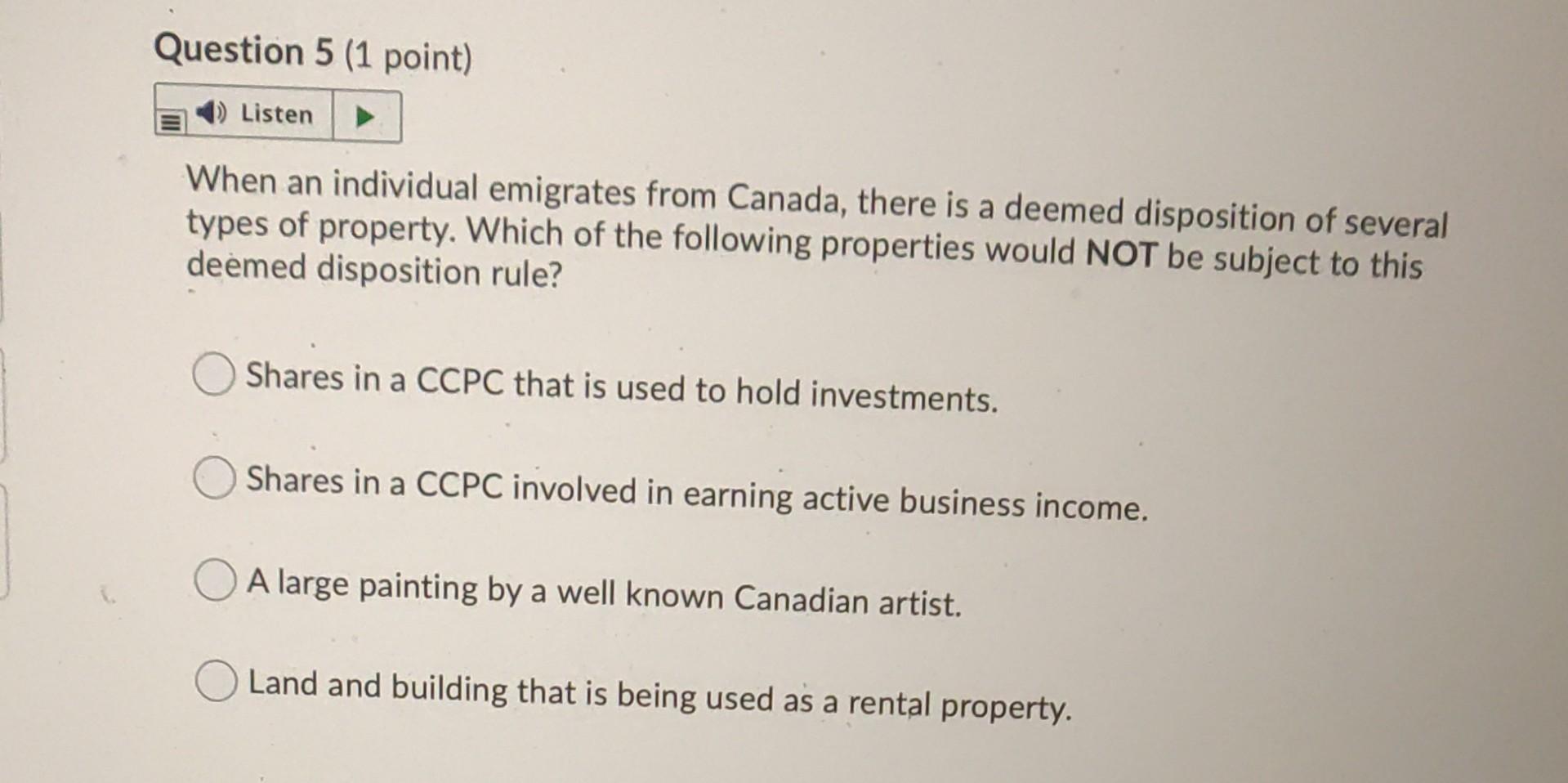

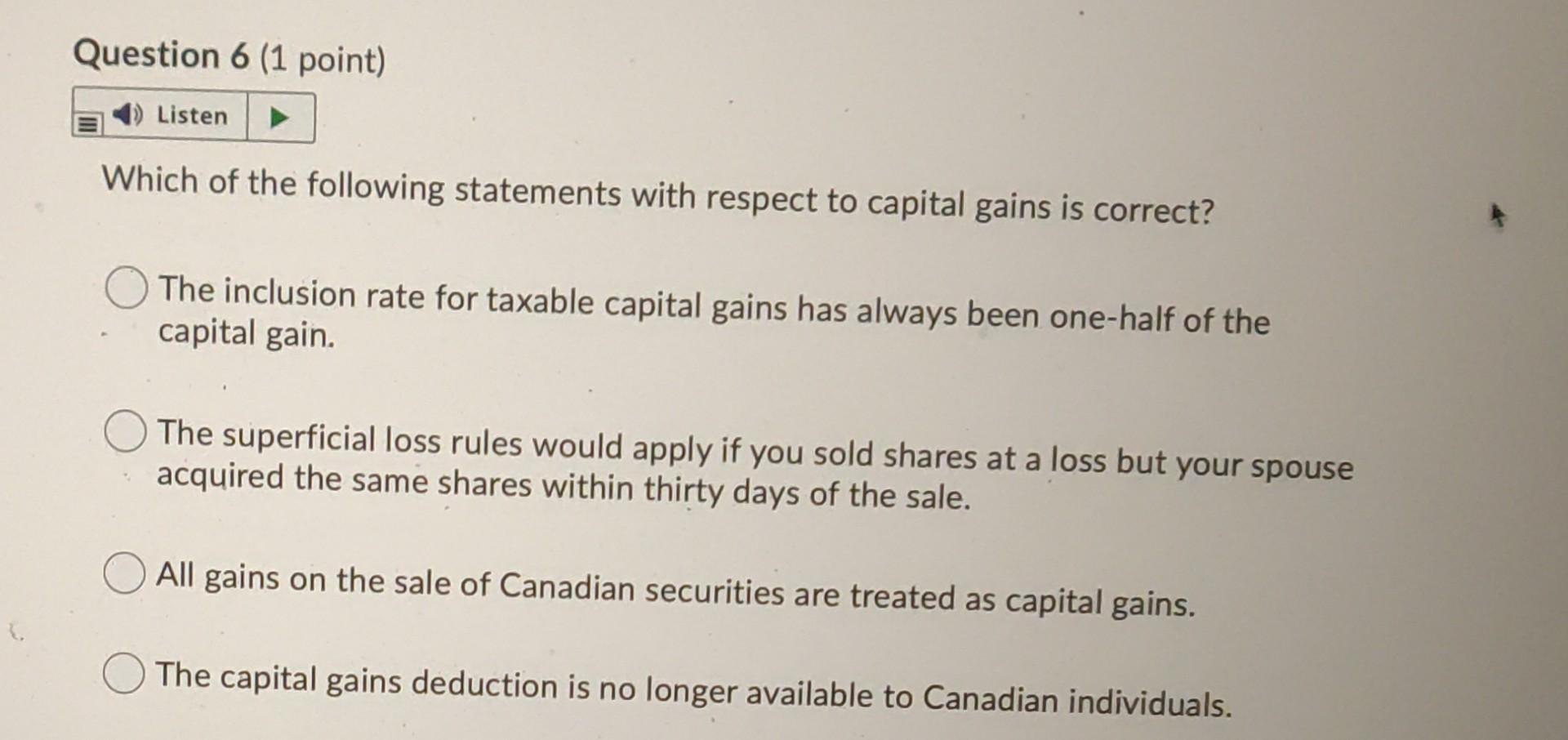

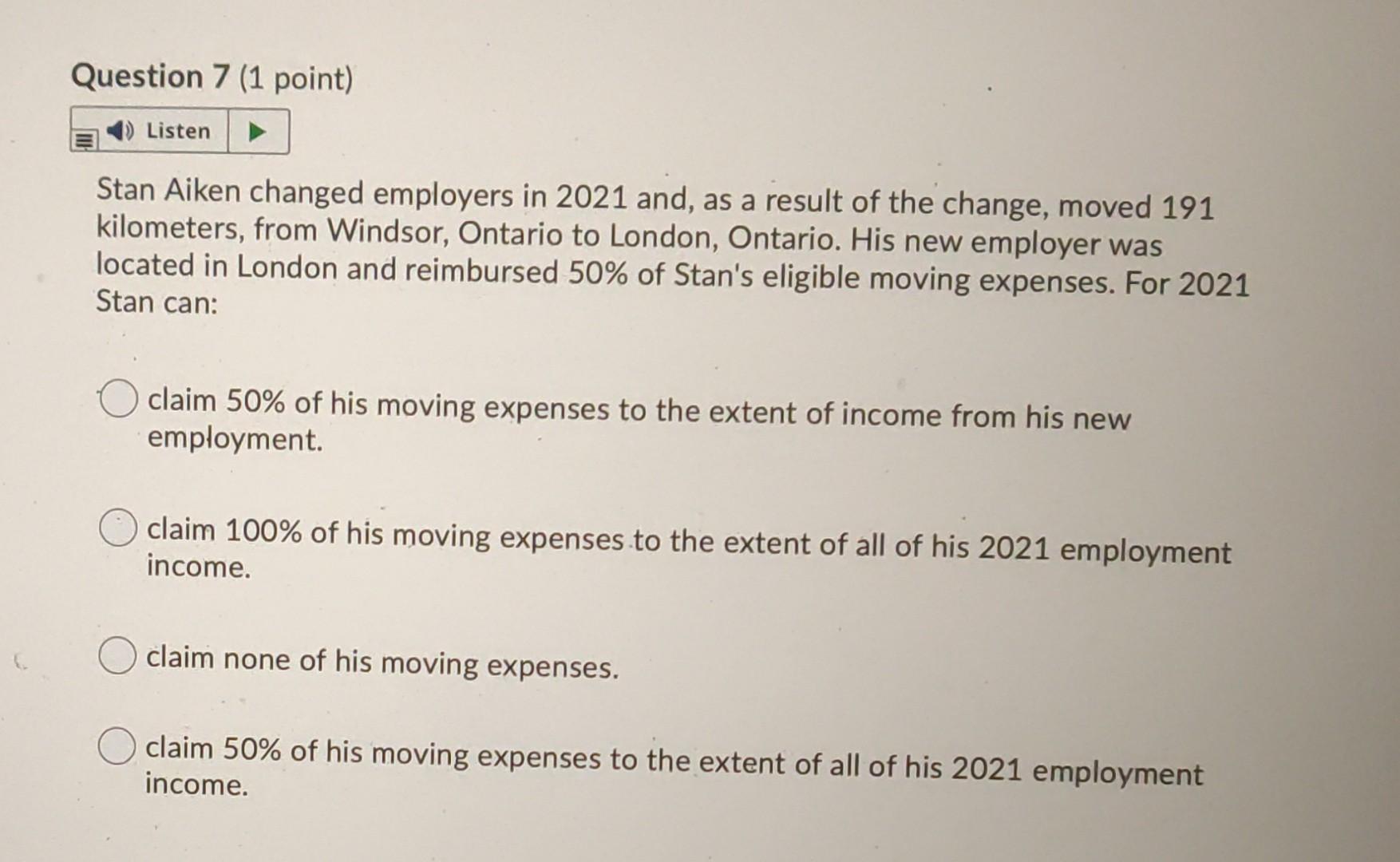

Question 4 (1 point) Listen Indicate which of the following is NOT listed personal property. A piece of jewelry. A stamp. O An antique chair. A rare manuscript. Question 5 (1 point) 1) Listen When an individual emigrates from Canada, there is a deemed disposition of several types of property. Which of the following properties would NOT be subject to this deemed disposition rule? Shares in a CCPC that is used to hold investments. Shares in a CCPC involved in earning active business income. A large painting by a well known Canadian artist. Land and building that is being used as a rental property. Question 6 (1 point) C) Listen Which of the following statements with respect to capital gains is correct? The inclusion rate for taxable capital gains has always been one-half of the capital gain. The superficial loss rules would apply if you sold shares at a loss but your spouse a acquired the same shares within thirty days of the sale. All gains on the sale of Canadian securities are treated as capital gains. The capital gains deduction is no longer available to Canadian individuals. Question 7 (1 point) Listen Stan Aiken changed employers in 2021 and, as a result of the change, moved 191 kilometers, from Windsor, Ontario to London, Ontario. His new employer was located in London and reimbursed 50% of Stan's eligible moving expenses. For 2021 Stan can: claim 50% of his moving expenses to the extent of income from his new employment. claim 100% of his moving expenses to the extent of all of his 2021 employment income. claim none of his moving expenses. claim 50% of his moving expenses to the extent of all of his 2021 employment incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started