Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please make sure to include detailed step-by-step calculations. If possible, describe your thought process in each step so I can learn the methodology for future

Please make sure to include detailed step-by-step calculations. If possible, describe your thought process in each step so I can learn the methodology for future problems. Will leave a thumbs up if answer is detailed! Thank you :)

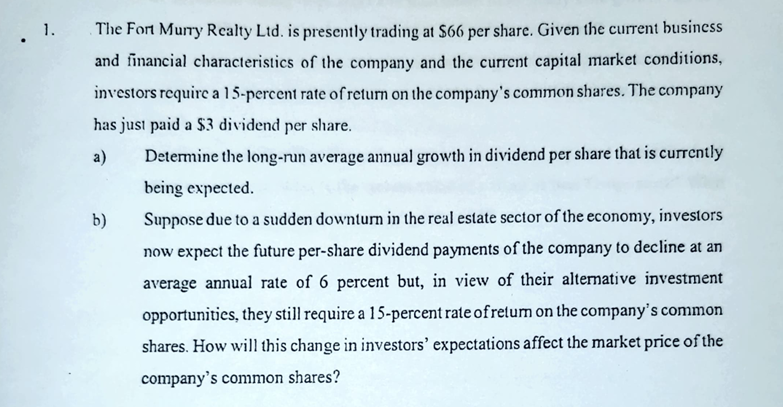

1. The Fort Murry Rcalty Ltd. is presently trading at $66 per share. Given the current business and financial characteristics of the company and the current capital market conditions, investors require a 15-percent rate of refurn on the company's common shares. The company has jus paid a $3 dividend per share. a) Determine the long-run average annual growth in dividend per share that is currently being expected. b) Suppose due to a sudden downturn in the real estate sector of the economy, investors now expect the future per-share dividend payments of the company to decline at an average annual rate of 6 percent but, in view of their altemative investment opportunities, they still require a 15-percent rate of retum on the company's common shares. How will this change in investors' expectations affect the market price of the company's common sharesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started