Answered step by step

Verified Expert Solution

Question

1 Approved Answer

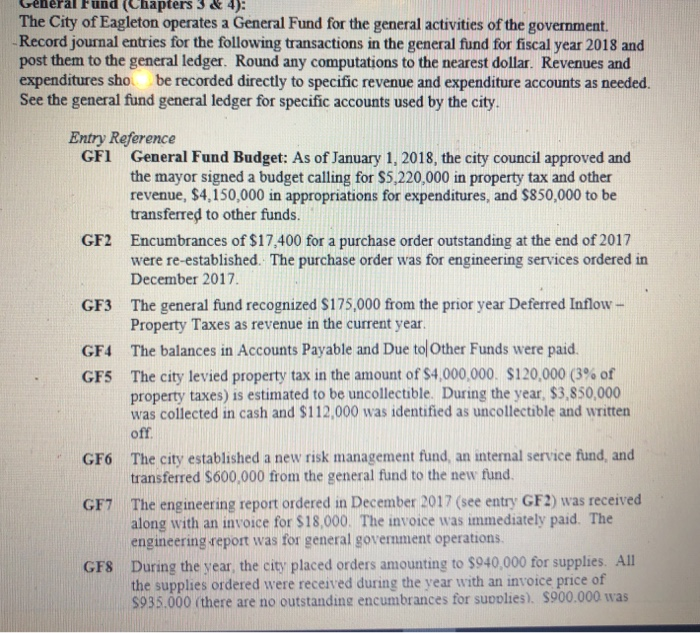

please make the general journal if you can please General Fund (Chapters 3 &4) The City of Eagleton operates a General Fund for the general

please make the general journal if you can please

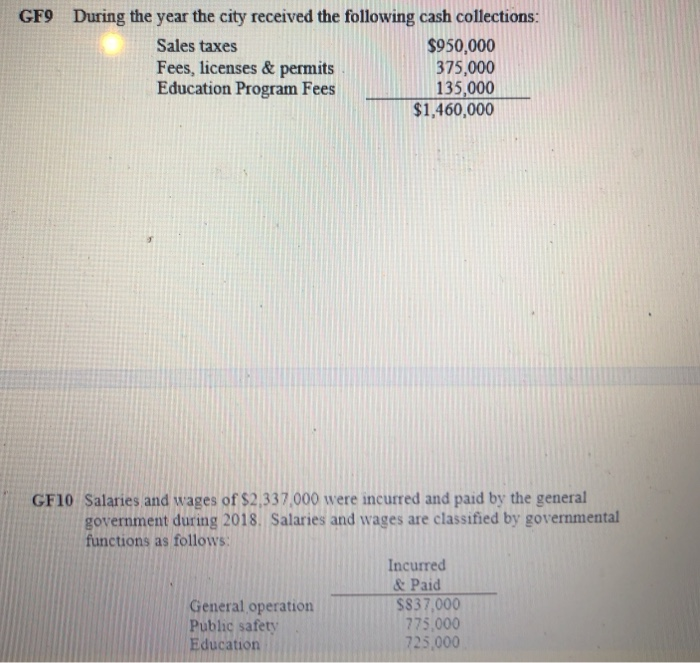

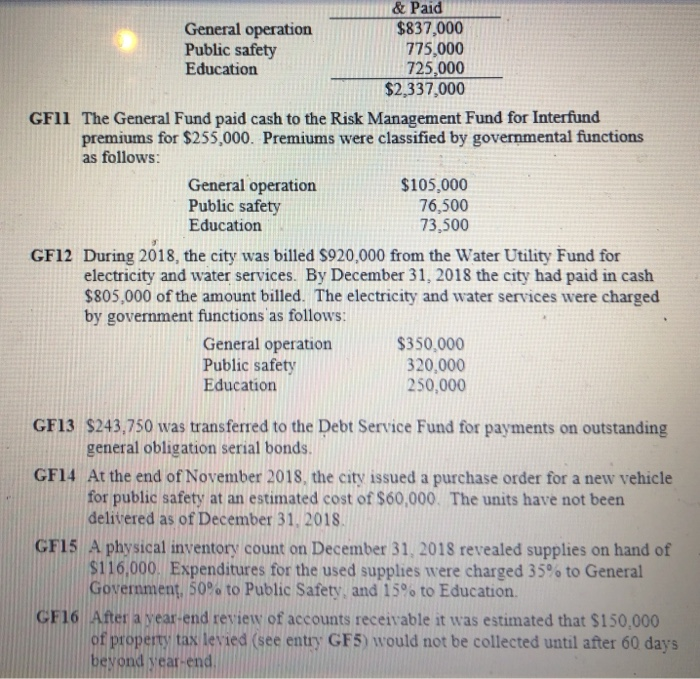

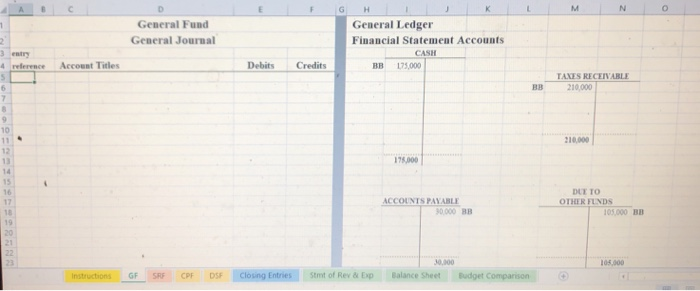

General Fund (Chapters 3 &4) The City of Eagleton operates a General Fund for the general activities of the government. Record journal entries for the following transactions in the general fund for fiscal year 2018 and post them to the general ledger. Round any computations to the nearest dollar. Revenues and expenditures sho be recorded directly to specific revenue and expenditure accounts as needed. See the general fund general ledger for specific accounts used by the city Entry Reference GFI General Fund Budget: As of January 1, 2018, the city council approved and the mayor signed a budget calling for S5,220,000 in property tax and other revenue, $4,150,000 in appropriations for expenditures, and $850,000 to be transferred to other funds. Encumbrances of $17,400 for a purchase order outstanding at the end of 20 were re-established. The purchase order was for engineering services ordered in December 2017 GF2 The general fund recognized $175,000 from the prior year Deferred Inflow Property Taxes as revenue in the current year GF3 GF4 The balances in Accounts Payable and Due to Other Funds were paid GFS The city levied property tax in the amount of S4,000,000. S 120,000 (3% of property taxes) is estimated to be uncollectible. During the year, $3,850,000 was collected in cash and $112,000 was identified as uncollectible and written off The city established a new risk management fund, an internal service fund, and transferred S600,000 from the general fund to the new fund GF6 The engineering report ordered in December 2017 (see entry GF2) was received along with an invoice for $18,000. The invoice was immediately paid. The engineering report was for general govemment operations During the year, the city placed orders amounting to $940,000 for supplies. All the supplies ordered were received during the year with an invoice price S935.000 (there are no outstanding encumbrances for supolies). $900.000 was GF7 GF8 GF9 During the year the city received the following cash collections: Sales taxes Fees, licenses & permits Education Program Fees $950,000 375,000 135,000 $1,460,000 GF10 Salaries and wages of $2,337 000 were incurred and paid by the general govenment during 2018. Salaries and wages are classified by governmental functions as follows Incurred & Paid General operation Public safety Education $$37,000 775,000 725,000 & Paid General operation Public safety Education $837,000 775,000 725,000 $2,337000 0 GFIl The General Fund paid cash to the Risk Management Fund for Interfund premiums for $255,000. Premiums were classified by governmental functions as follows: General operation Public safety Educatiorn $105,000 76,500 73,500 GF12 During 2018, the city was billed $920,000 from the Water Utility Fund for electricity and water services. By December 31, 2018 the city had paid in cash $805,000 of the amount billed. The electricity and water services were charged by government functions as follows: General operation Public safety Education $350,000 320,000 250,000 GF13 $243.750 was transferred to the Debt Service Fund for payments on outstanding general obligation serial bonds At the end of November 201S, the city issued a purchase order for a new vehicle for public safety at an estimated cost of $60,000. The units have not been delitered as of December 31,2018 GF14 GF15 A physical inventory count on December 31, 2018 revealed supplies on hand of 116,000 Expenditures for the used supplies were charged 35% to General Government, 50% to Public Safety, and 15% to Education. CF16 After a year-end review of accounts receivable it was estimated that $150,000 of property tax levied (see entry GF5) would not be collected until after 60 days beyond year-end G H General Fund General Journal General Ledger Financial Statement Accounts CASH entry 4 relerence Account Titles Debits Credits BB 175,000 AXES RECEIVABLE BB 210,000 10 210,000 12 178,000 DLE TO OTHER FLNDS 16 17 18 19 20 ACCOUNTS PAYABLE 90000 BB 105,000 BB 0.300 105,000 GF SRF CPF DSF Closing Entries Stmt of Rev & EpBalance Sheet Budget Comparison Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started