Answered step by step

Verified Expert Solution

Question

1 Approved Answer

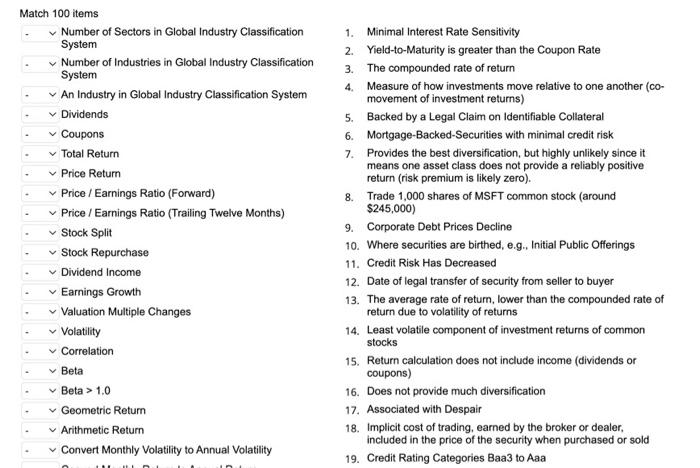

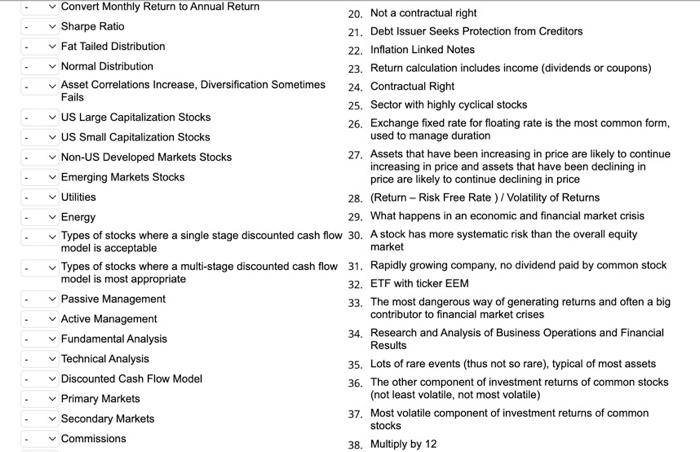

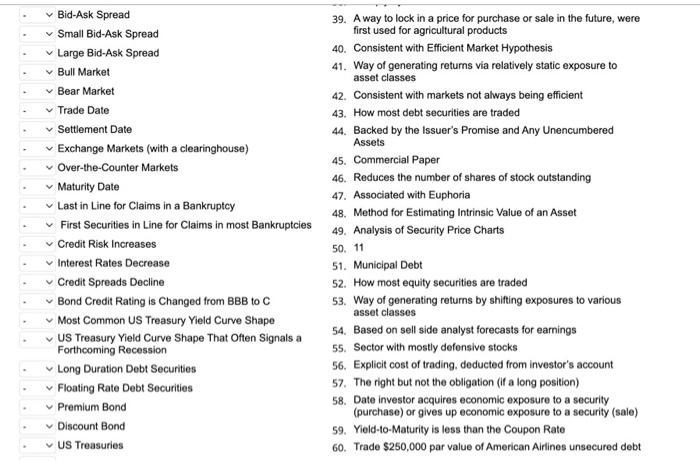

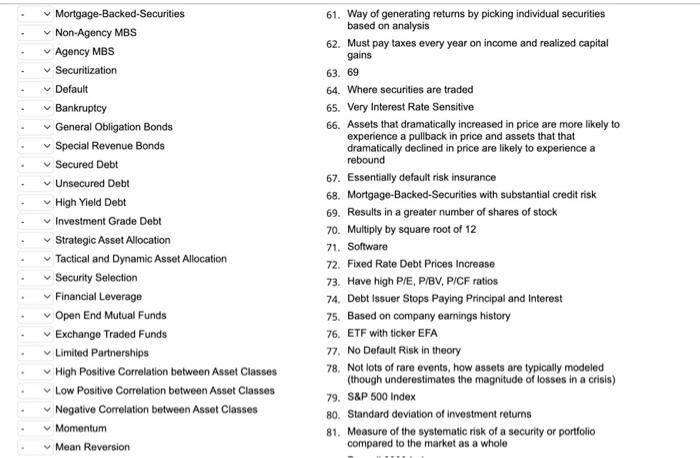

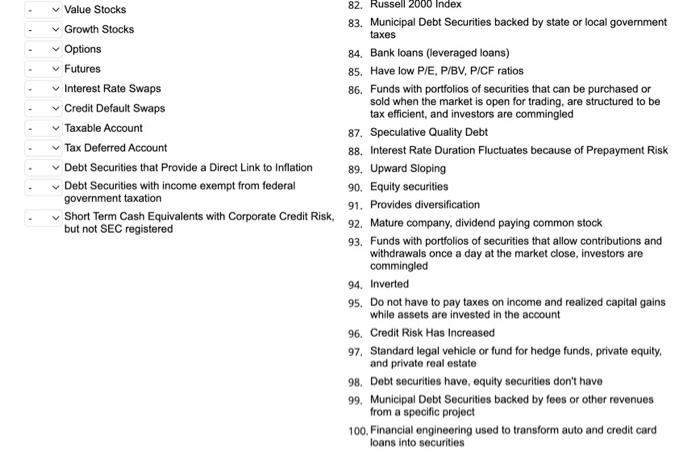

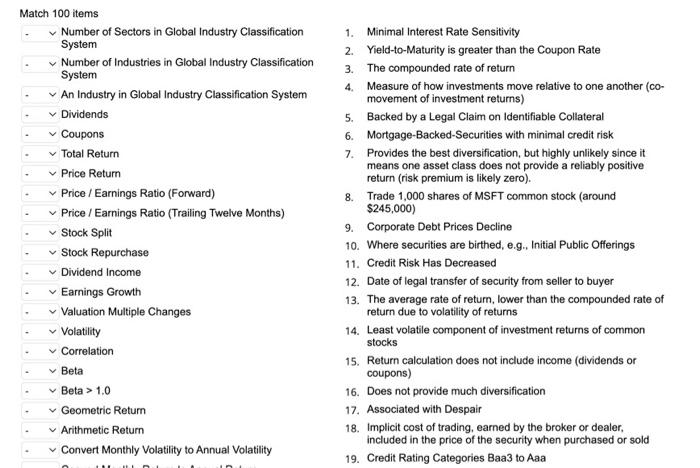

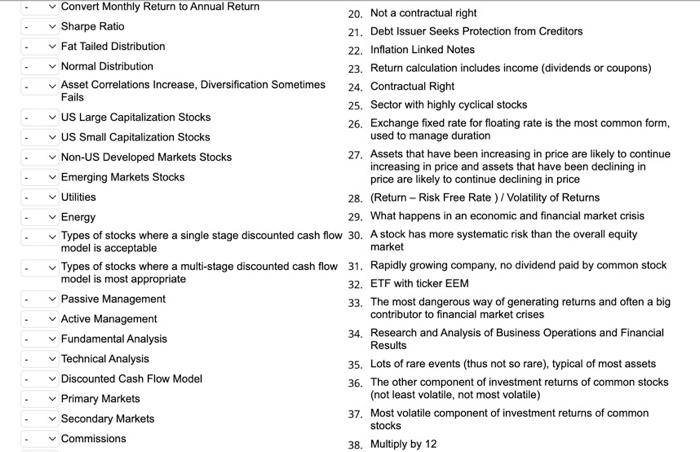

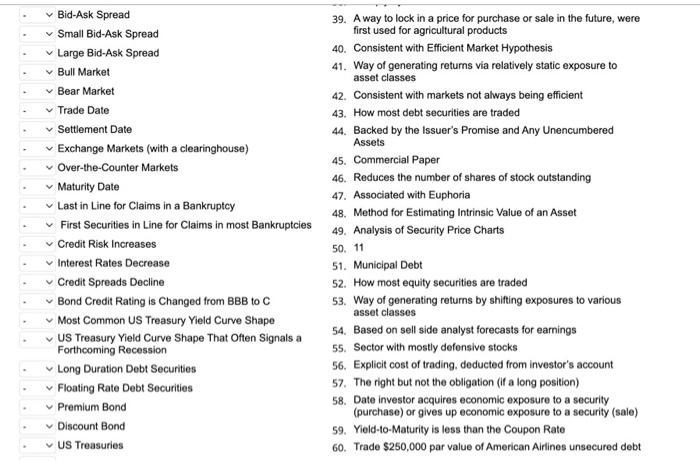

please match correctly . 1. Minimal Interest Rate Sensitivity 2. Yield-to-Maturity is greater than the Coupon Rate 3. The compounded rate of return 4. Measure

please match correctly .

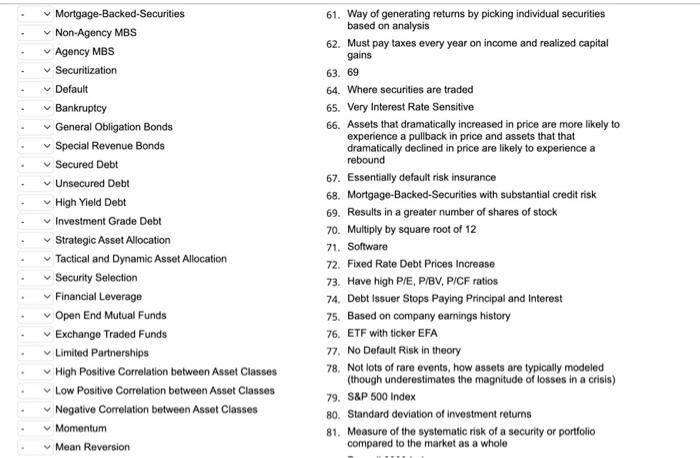

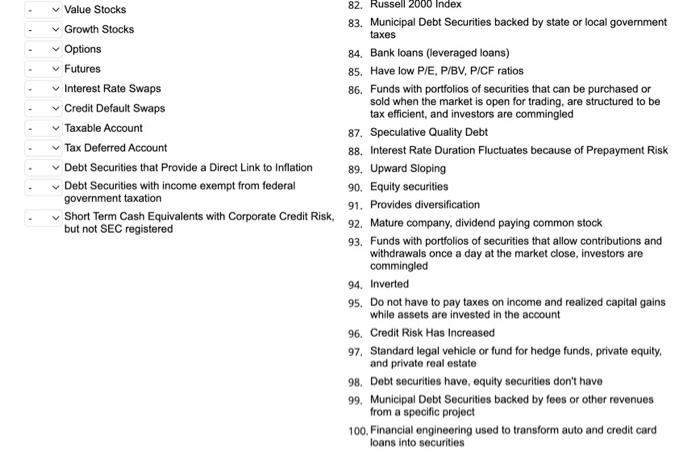

1. Minimal Interest Rate Sensitivity 2. Yield-to-Maturity is greater than the Coupon Rate 3. The compounded rate of return 4. Measure of how investments move relative to one another (comovement of investment returns) 5. Backed by a Legal Claim on Identifiable Collateral 6. Mortgage-Backed-Securities with minimal credit risk 7. Provides the best diversification, but highly unlikely since it means one asset class does not provide a reliably positive return (risk premium is likely zero). 8. Trade 1,000 shares of MSFT common stock (around \$245,000) 9. Corporate Debt Prices Decline 10. Where securities are birthed, e.g., Initial Public Offerings 11. Credit Risk Has Decreased 12. Date of legal transfer of security from seller to buyer 13. The average rate of return, lower than the compounded rate of return due to volatility of returns 14. Least volatile component of investment returns of common stocks 15. Return calculation does not include income (dividends or coupons) 16. Does not provide much diversification 17. Associated with Despair 18. Implicit cost of trading, earned by the broker or dealer, included in the price of the security when purchased or sold 19. Credit Rating Categories Baa3 to Aaa Convert Monthly Return to Annual Return 20. Not a contractual right Sharpe Ratio 21. Debt Issuer Seeks Protection from Creditors Fat Tailed Distribution 22. Inflation Linked Notes - Normal Distribution 23. Return calculation includes income (dividends or coupons) - Asset Correlations Increase, Diversification Sometimes 24. Contractual Right Fails 25. Sector with highly cyclical stocks - US Large Capitalization Stocks 26. Exchange fixed rate for floating rate is the most common form, - US Small Capitalization Stocks used to manage duration - Non-US Developed Markets Stocks 27. Assets that have been increasing in price are likely to continue increasing in price and assets that have been declining in - Emerging Markets Stocks price are likely to continue declining in price - Utilities 28. (Return - Risk Free Rate ) / Volatility of Returns - Energy 29. What happens in an economic and financial market crisis - Types of stocks where a single stage discounted cash flow 30. A stock has more systematic risk than the overall equity model is acceptable market - Types of stocks where a multi-stage discounted cash flow 31. Rapidly growing company, no dividend paid by common stock model is most appropriate 32. ETF with ticker EEM Passive Management 33. The most dangerous way of generating returns and often a big - Active Management contributor to financial market crises - Fundamental Analysis 34. Research and Analysis of Business Operations and Financial Results - Technical Analysis 35. Lots of rare events (thus not so rare), typical of most assets - Discounted Cash Flow Model 36. The other component of investment returns of common stocks - Primary Markets (not least volatile, not most volatile) - Secondary Markets 37. Most volatile component of investment returns of common Commissions stocks 38. Multiply by 12 Bid-Ask Spread 39. A way to lock in a price for purchase or sale in the future, were first used for agricultural products 40. Consistent with Efficient Market Hypothesis 41. Way of generating returns via relatively static exposure to asset classes 42. Consistent with markets not always being efficient 43. How most debt securities are traded 44. Backed by the Issuer's Promise and Any Unencumbered Assets 45. Commercial Paper 46. Reduces the number of shares of stock outstanding 47. Associated with Euphoria 48. Method for Estimating Intrinsic Value of an Asset 49. Analysis of Security Price Charts 50. 11 51. Municipal Debt 52. How most equity securities are traded 53. Way of generating returns by shifting exposures to various asset classes - Most Common US Treasury Yield Curve Shape 54. Based on sell side analyst forecasts for earnings US Treasury Yield Curve Shape That Often Signals a 55. Sector with mostly defonsive stocks Forthcoming Recession 56. Explicit cost of trading. deducted from investor's account Long Duration Debt Securities 57. The right but not the obligation (if a long position) Floating Rate Debt Securities 58. Date investor acquires economic exposure to a security Premium Bond (purchase) or gives up economic exposure to a security (sale) - Discount Bond 59. Yield-to-Maturity is less than the Coupon Rate - US Treasuries 60. Trade $250,000 par value of American Airlines unsecured debt Mortgage-Backed-Securities 61. Way of generating returns by picking individual securities Non-Agency MBS based on analysis Agency MBS 62. Must pay taxes every year on income and realized capital gains Securitization 63. 69 Default 64. Where securities are traded Bankruptcy 65. Very Interest Rate Sensitive General Obligation Bonds 66. Assets that dramatically increased in price are more likely to Special Revenue Bonds experience a pullback in price and assets that that Secured Debt dramatically declined in price are likely to experience a Unsecured Debt rebound High Yield Debt 67. Essentially default risk insurance Investment Grade Debt 68. Mortgage-Backed-Securities with substantial credit risk 69. Results in a greater number of shares of stock Strategic Asset Allocation 70. Multiply by square root of 12 Tactical and Dynamic Asset Allocation 71. Software Security Selection 72. Fixed Rate Debt Prices Increase Financial Leverage 73. Have high P/E, P/BV, P/CF ratios Open End Mutual Funds 74. Debt Issuer Stops Paying Principal and Interest Exchange Traded Funds 75. Based on company earnings history Limited Partnerships 76. ETF with ticker EFA High Positive Correlation between Asset Classes 77. No Default Risk in theory Low Positive Correlation between Asset Classes 78. Not lots of rare events, how assets are typically modeled (though underestimates the magnitude of losses in a crisis) Negative Correlation between Asset Classes 79. S8P 500 Index Momentum 80. Standard deviation of investment returns Mean Reversion 81. Measure of the systematic risk of a security or portfolio compared to the market as a whole 83. Municipal Debt Securities backed by state or local government taxes 84. Bank loans (leveraged loans) 85. Have low P/E, P/BV, P/CF ratios 86. Funds with portfolios of securities that can be purchased or sold when the market is open for trading, are structured to be tax efficient, and investors are commingled 87. Speculative Quality Debt 88. Interest Rate Duration Fluctuates because of Prepayment Risk 89. Upward Sloping 90. Equity securities 91. Provides diversification 92. Mature company, dividend paying common stock 93. Funds with portfolios of securities that allow contributions and withdrawals once a day at the market close, investors are commingled 94. Inverted 95. Do not have to pay taxes on income and realized capital gains while assets are invested in the account 96. Credit Risk Has Increased 97. Standard legal vehicle or fund for hedge funds, private equity. and private real estate 98. Debt securities have, equity securities don't have 99. Municipal Debt Securities backed by fees or other revenues from a specific project 100. Financial engineering used to transform auto and credit card loans into securities 1. Minimal Interest Rate Sensitivity 2. Yield-to-Maturity is greater than the Coupon Rate 3. The compounded rate of return 4. Measure of how investments move relative to one another (comovement of investment returns) 5. Backed by a Legal Claim on Identifiable Collateral 6. Mortgage-Backed-Securities with minimal credit risk 7. Provides the best diversification, but highly unlikely since it means one asset class does not provide a reliably positive return (risk premium is likely zero). 8. Trade 1,000 shares of MSFT common stock (around \$245,000) 9. Corporate Debt Prices Decline 10. Where securities are birthed, e.g., Initial Public Offerings 11. Credit Risk Has Decreased 12. Date of legal transfer of security from seller to buyer 13. The average rate of return, lower than the compounded rate of return due to volatility of returns 14. Least volatile component of investment returns of common stocks 15. Return calculation does not include income (dividends or coupons) 16. Does not provide much diversification 17. Associated with Despair 18. Implicit cost of trading, earned by the broker or dealer, included in the price of the security when purchased or sold 19. Credit Rating Categories Baa3 to Aaa Convert Monthly Return to Annual Return 20. Not a contractual right Sharpe Ratio 21. Debt Issuer Seeks Protection from Creditors Fat Tailed Distribution 22. Inflation Linked Notes - Normal Distribution 23. Return calculation includes income (dividends or coupons) - Asset Correlations Increase, Diversification Sometimes 24. Contractual Right Fails 25. Sector with highly cyclical stocks - US Large Capitalization Stocks 26. Exchange fixed rate for floating rate is the most common form, - US Small Capitalization Stocks used to manage duration - Non-US Developed Markets Stocks 27. Assets that have been increasing in price are likely to continue increasing in price and assets that have been declining in - Emerging Markets Stocks price are likely to continue declining in price - Utilities 28. (Return - Risk Free Rate ) / Volatility of Returns - Energy 29. What happens in an economic and financial market crisis - Types of stocks where a single stage discounted cash flow 30. A stock has more systematic risk than the overall equity model is acceptable market - Types of stocks where a multi-stage discounted cash flow 31. Rapidly growing company, no dividend paid by common stock model is most appropriate 32. ETF with ticker EEM Passive Management 33. The most dangerous way of generating returns and often a big - Active Management contributor to financial market crises - Fundamental Analysis 34. Research and Analysis of Business Operations and Financial Results - Technical Analysis 35. Lots of rare events (thus not so rare), typical of most assets - Discounted Cash Flow Model 36. The other component of investment returns of common stocks - Primary Markets (not least volatile, not most volatile) - Secondary Markets 37. Most volatile component of investment returns of common Commissions stocks 38. Multiply by 12 Bid-Ask Spread 39. A way to lock in a price for purchase or sale in the future, were first used for agricultural products 40. Consistent with Efficient Market Hypothesis 41. Way of generating returns via relatively static exposure to asset classes 42. Consistent with markets not always being efficient 43. How most debt securities are traded 44. Backed by the Issuer's Promise and Any Unencumbered Assets 45. Commercial Paper 46. Reduces the number of shares of stock outstanding 47. Associated with Euphoria 48. Method for Estimating Intrinsic Value of an Asset 49. Analysis of Security Price Charts 50. 11 51. Municipal Debt 52. How most equity securities are traded 53. Way of generating returns by shifting exposures to various asset classes - Most Common US Treasury Yield Curve Shape 54. Based on sell side analyst forecasts for earnings US Treasury Yield Curve Shape That Often Signals a 55. Sector with mostly defonsive stocks Forthcoming Recession 56. Explicit cost of trading. deducted from investor's account Long Duration Debt Securities 57. The right but not the obligation (if a long position) Floating Rate Debt Securities 58. Date investor acquires economic exposure to a security Premium Bond (purchase) or gives up economic exposure to a security (sale) - Discount Bond 59. Yield-to-Maturity is less than the Coupon Rate - US Treasuries 60. Trade $250,000 par value of American Airlines unsecured debt Mortgage-Backed-Securities 61. Way of generating returns by picking individual securities Non-Agency MBS based on analysis Agency MBS 62. Must pay taxes every year on income and realized capital gains Securitization 63. 69 Default 64. Where securities are traded Bankruptcy 65. Very Interest Rate Sensitive General Obligation Bonds 66. Assets that dramatically increased in price are more likely to Special Revenue Bonds experience a pullback in price and assets that that Secured Debt dramatically declined in price are likely to experience a Unsecured Debt rebound High Yield Debt 67. Essentially default risk insurance Investment Grade Debt 68. Mortgage-Backed-Securities with substantial credit risk 69. Results in a greater number of shares of stock Strategic Asset Allocation 70. Multiply by square root of 12 Tactical and Dynamic Asset Allocation 71. Software Security Selection 72. Fixed Rate Debt Prices Increase Financial Leverage 73. Have high P/E, P/BV, P/CF ratios Open End Mutual Funds 74. Debt Issuer Stops Paying Principal and Interest Exchange Traded Funds 75. Based on company earnings history Limited Partnerships 76. ETF with ticker EFA High Positive Correlation between Asset Classes 77. No Default Risk in theory Low Positive Correlation between Asset Classes 78. Not lots of rare events, how assets are typically modeled (though underestimates the magnitude of losses in a crisis) Negative Correlation between Asset Classes 79. S8P 500 Index Momentum 80. Standard deviation of investment returns Mean Reversion 81. Measure of the systematic risk of a security or portfolio compared to the market as a whole 83. Municipal Debt Securities backed by state or local government taxes 84. Bank loans (leveraged loans) 85. Have low P/E, P/BV, P/CF ratios 86. Funds with portfolios of securities that can be purchased or sold when the market is open for trading, are structured to be tax efficient, and investors are commingled 87. Speculative Quality Debt 88. Interest Rate Duration Fluctuates because of Prepayment Risk 89. Upward Sloping 90. Equity securities 91. Provides diversification 92. Mature company, dividend paying common stock 93. Funds with portfolios of securities that allow contributions and withdrawals once a day at the market close, investors are commingled 94. Inverted 95. Do not have to pay taxes on income and realized capital gains while assets are invested in the account 96. Credit Risk Has Increased 97. Standard legal vehicle or fund for hedge funds, private equity. and private real estate 98. Debt securities have, equity securities don't have 99. Municipal Debt Securities backed by fees or other revenues from a specific project 100. Financial engineering used to transform auto and credit card loans into securities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started