Answered step by step

Verified Expert Solution

Question

1 Approved Answer

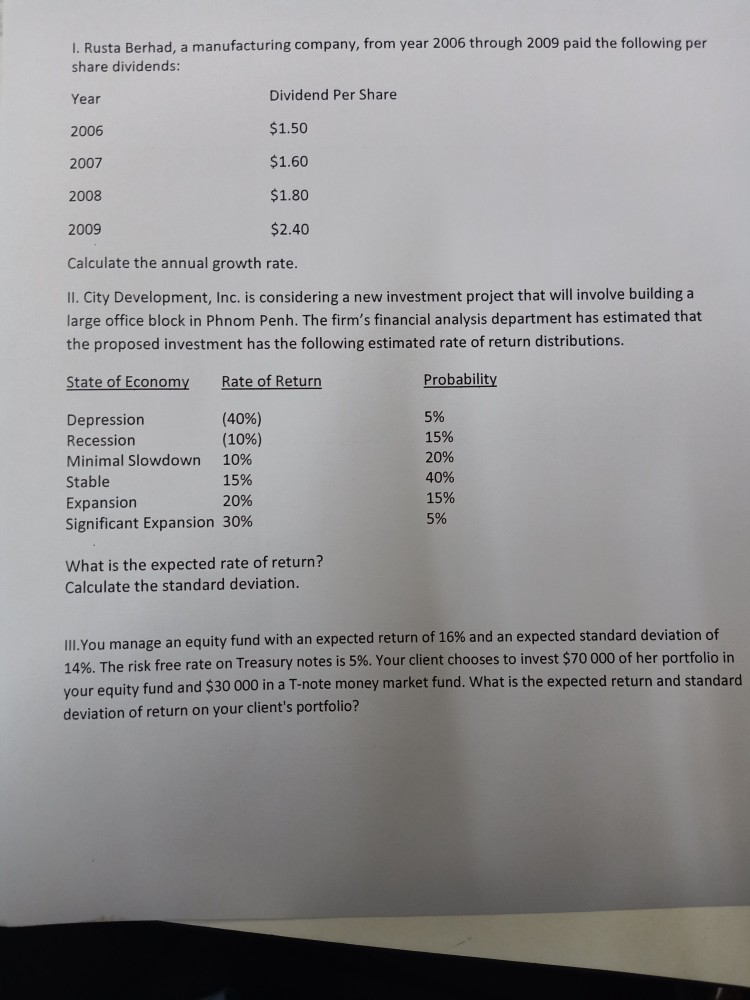

please me all the questions? 1. Rusta Berhad, a manufacturing company, from year 2006 through 2009 paid the following per share dividends: Year Dividend Per

please me all the questions?

1. Rusta Berhad, a manufacturing company, from year 2006 through 2009 paid the following per share dividends: Year Dividend Per Share $1.50 2006 2007 $1.60 2008 $1.80 2009 $2.40 Calculate the annual growth rate. II. City Development, Inc. is considering a new investment project that will involve building a large office block in Phnom Penh. The firm's financial analysis department has estimated that the proposed investment has the following estimated rate of return distributions. State of Economy Rate of Return Probability 10% Depression (40%) Recession (10%) Minimal Slowdown Stable 15% Expansion 20% Significant Expansion 30% 5% 15% 20% 40% 15% 5% What is the expected rate of return? Calculate the standard deviation. III.You manage an equity fund with an expected return of 16% and an expected standard deviation of 14%. The risk free rate on Treasury notes is 5%. Your client chooses to invest $70 000 of her portfolio in your equity fund and $30 000 in a T-note money market fund. What is the expected return and standard deviation of return on your client's portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started