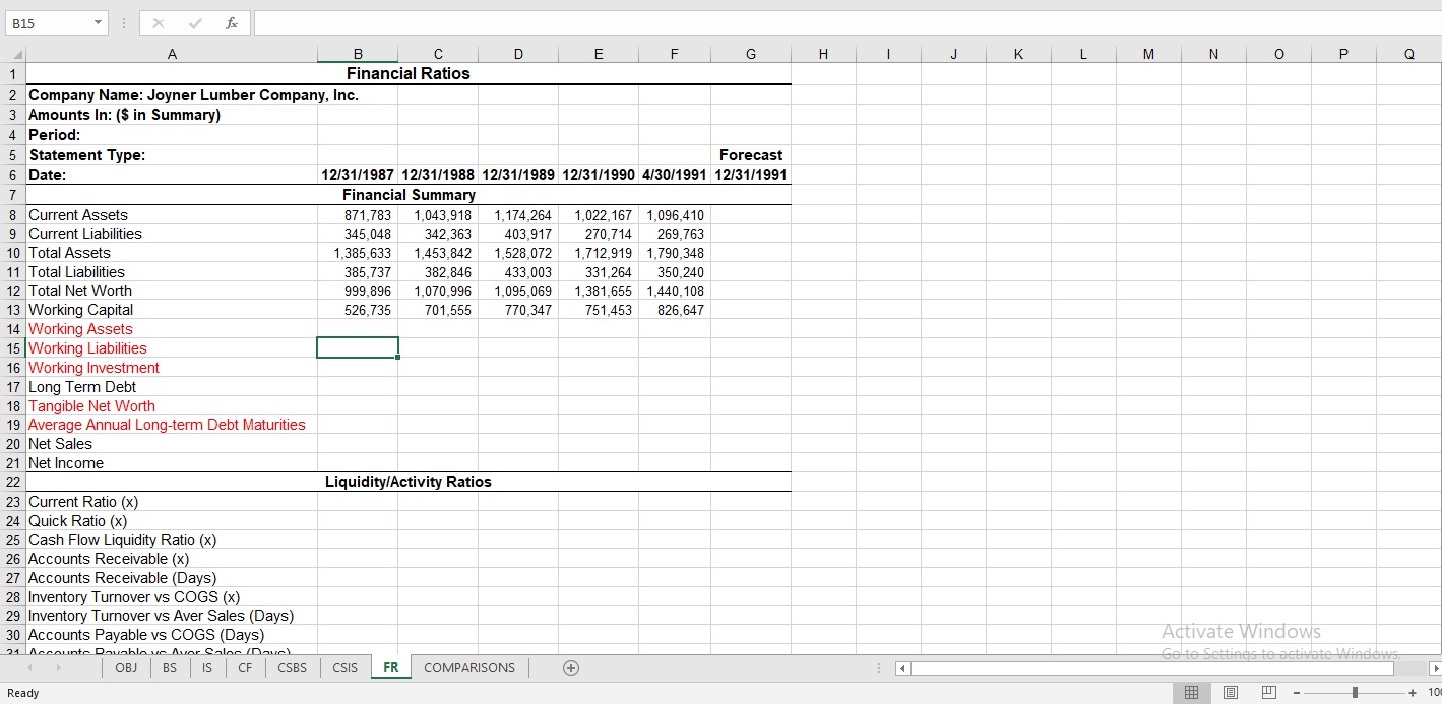

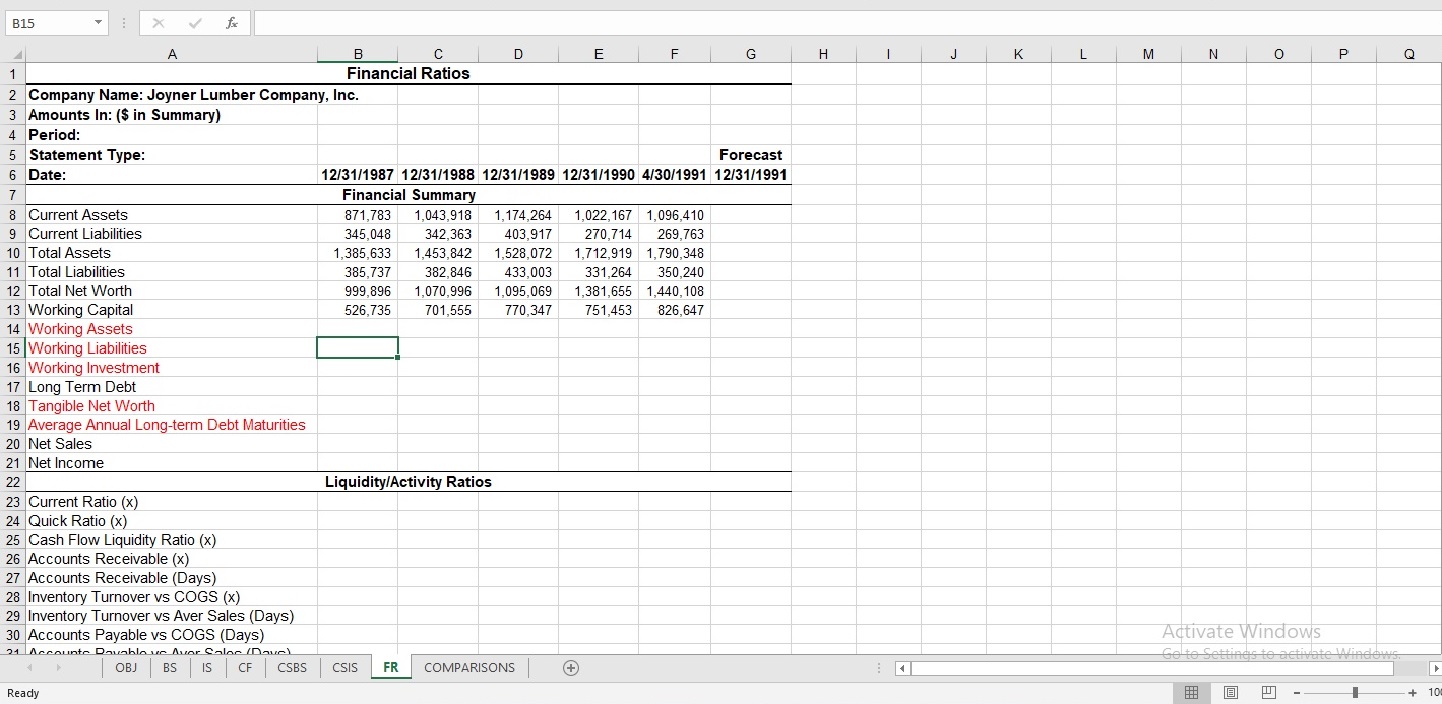

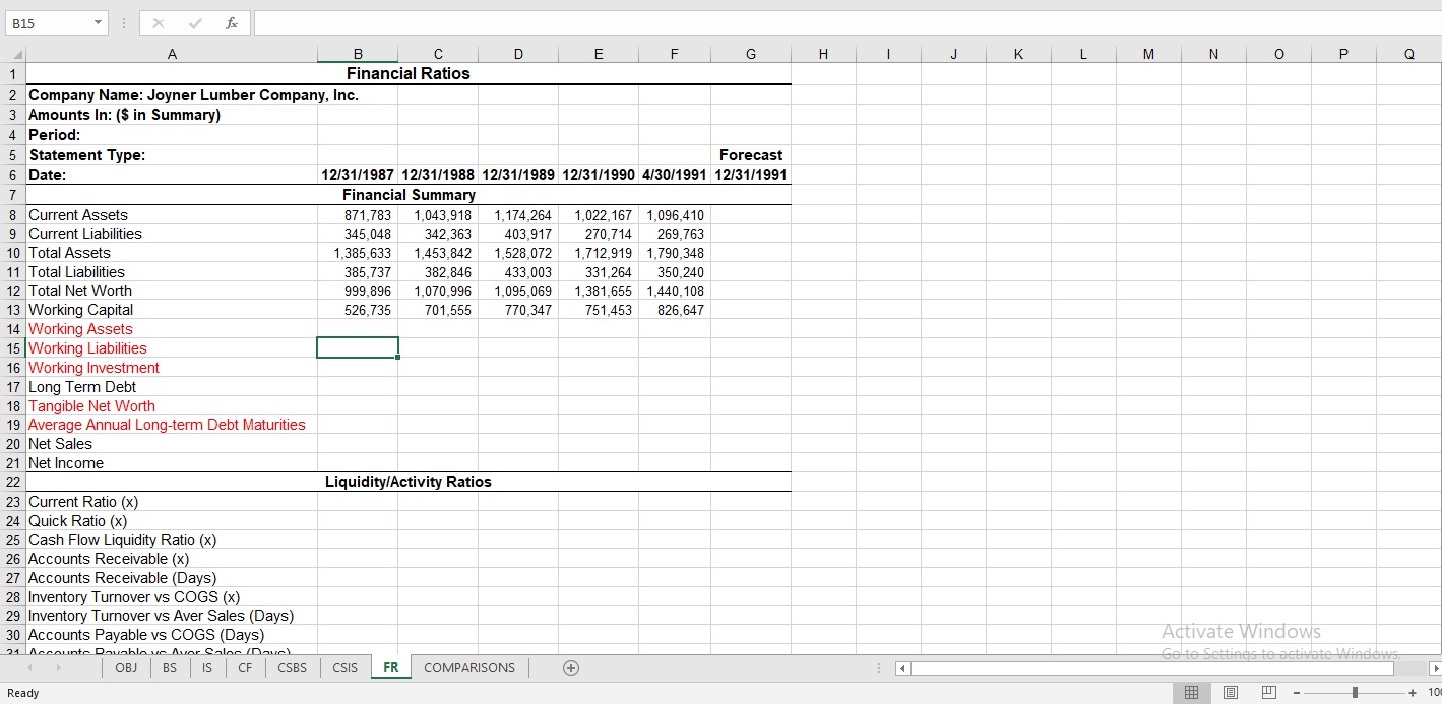

Please need help solving for those in red, the other picture is my balance sheet. Thanks.

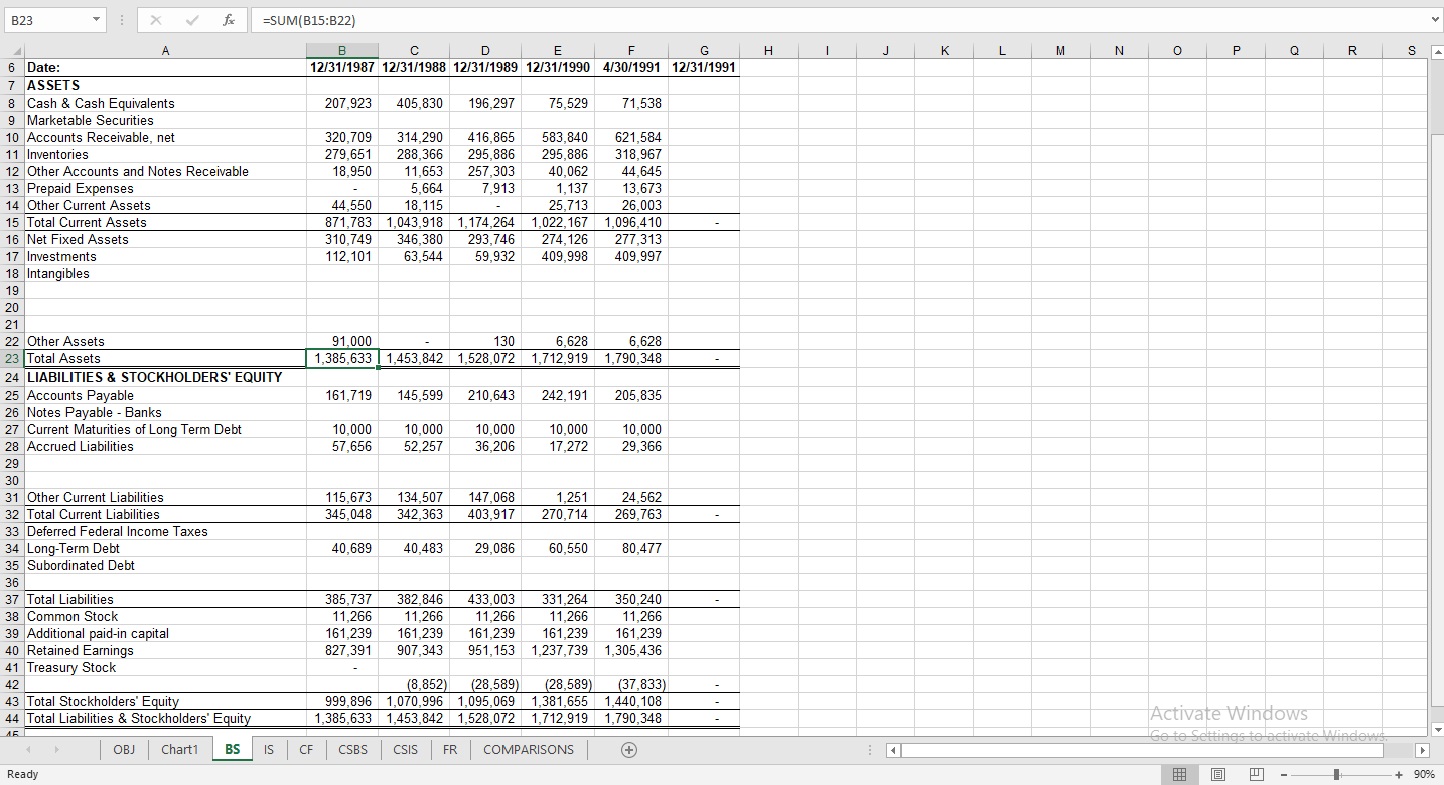

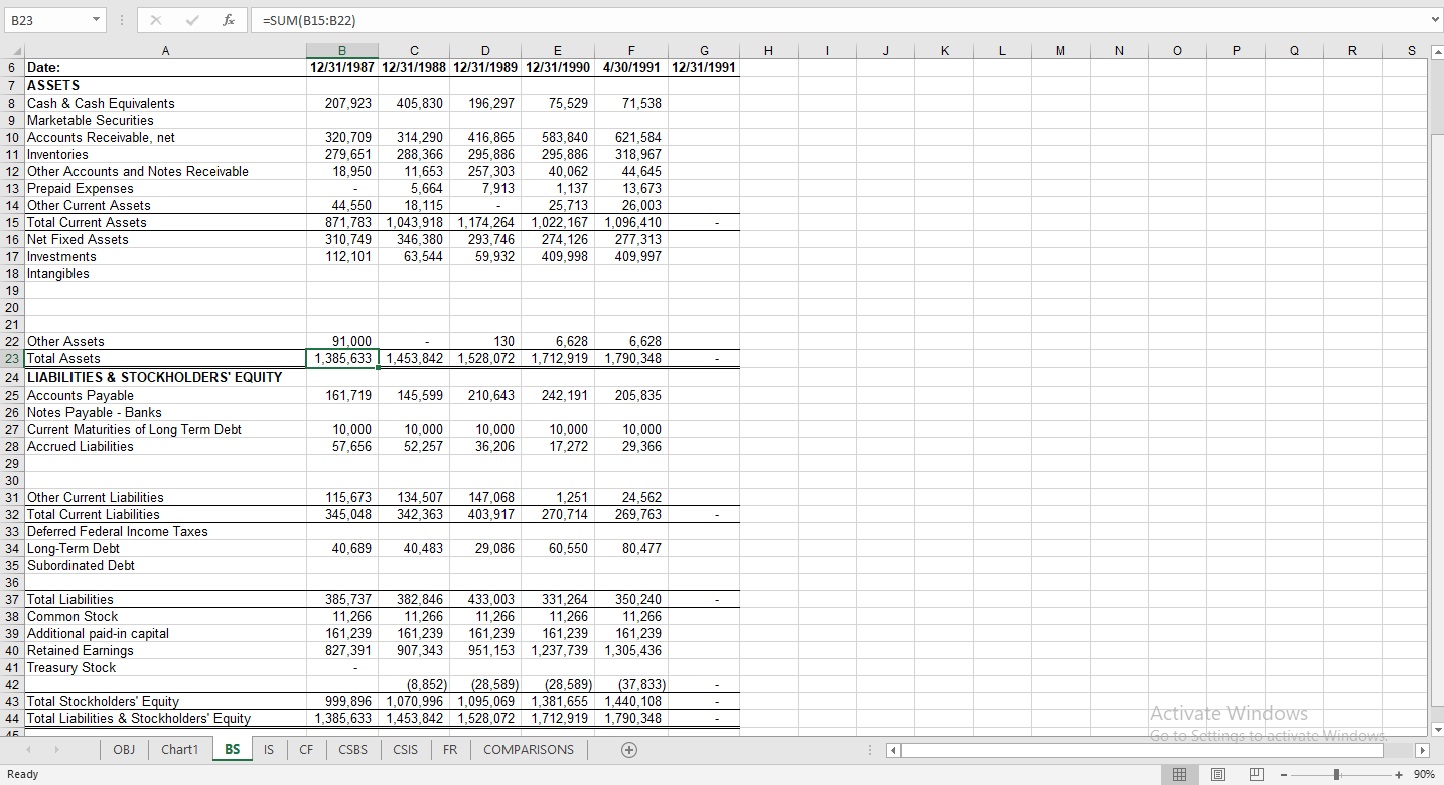

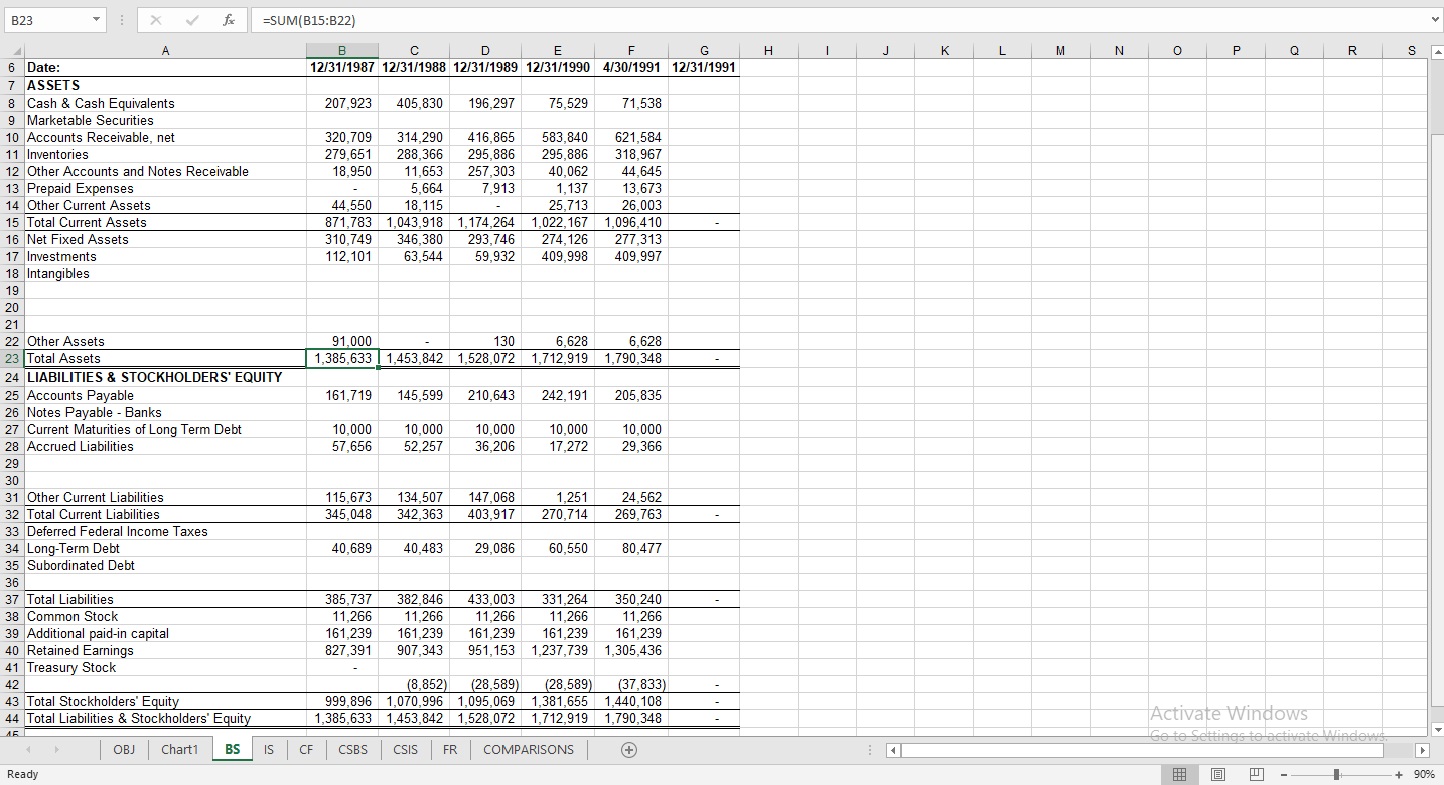

B15 A B C D E F G H K M N O P Q Financial Ratios 2 Company Name: Joyner Lumber Company, Inc. 3 Amounts In: ($ in Summary) 4 Period: 5 Statement Type: Forecast 6 Date: 12/31/1987 12/31/1988 12/31/1989 12/31/1990 4/30/1991 12/31/1991 Financial Summary 8 Current Assets 871,783 1,043,918 1, 174,264 1,022, 167 1, 096,410 9 Current Liabilities 345,048 342,363 403,917 270,714 269,763 10 Total Assets 1, 385,633 1,453,842 1,528,072 1,712,919 1, 790,348 11 Total Liabilities 385,737 382,846 433,003 331,264 350,240 12 Total Net Worth 999,896 1,070,996 1,095,069 1,381,655 1,440, 108 13 Working Capital 526,735 701,555 770,347 751,453 826,647 14 Working Assets 15 Working Liabilities 16 Working Investment 17 Long Term Debt 18 Tangible Net Worth 19 Average Annual Long-term Debt Maturities 20 Net Sales 21 Net Income 22 Liquidity/Activity Ratios 23 Current Ratio (x) 24 Quick Ratio (x) 25 Cash Flow Liquidity Ratio (x) 26 Accounts Receivable (x) 27 Accounts Receivable (Days) 28 Inventory Turnover vs COGS (x) 29 Inventory Turnover vs Aver Sales (Days) 30 Accounts Payable vs COGS (Days) Activate Windows 21 Accounte Dougblo ue Auor Calar /Dauc) OBJ BS IS CF CSBS CSIS FR COMPARISONS ReadySUM ( B 15 822 ) 12137/ 1987 12137/1988 12/31/ 1989 12/37 / 1996 4130/ 1991 12131/ 1991 ASSETS 8 Cash & Cash Equivalents 207 923 405 830 196 297 9 Marketable Securities 10 Accounts Receivable net 320.709 314 290 416.865 583 840 621 584 17 Inventories 279 651 288 366 295 886 295 986 318 967 12 Other Accounts and Notes Receivable 17 653 257 303 13 Prepaid Expenses 14 Other Current Assets 15 Total Current Assets 871 783 1 043 . 918 1 174 264 1 022 167 1 096 41 16 Net Fixed Assets 310.749 346 . 380 293 746 274 126 277 313 17 Investments 59 932 409 . 998 409 997 18 Intangibles 2 Other Assets 23 Total Assets 1 385 633 1 453 842 4 528 072 1 7 12 919 1 790 348 24 LIABILITIES & STOCKHOLDERS EQUITY 25 Accounts Payable 161 719 145 599 210 643 242 191 205 835 26 Notes Payable Banks 27 Current Maturities of Long Term Debt 8 Accrued Liabilities 31 Other Current Liabilities 115 673 134 507 147 068 32 Total Current Liabilities 345 048 342 . 363 403 917 270 714 269 763 33 Deferred Federal Income Taxes 34 Long - Term Debt 35 Subordinated Debt 37 Total Liabilities 385 737 382 846 433, 003 331 264 350 240 8 Common Stock 39 Additional paid in capital 161 239 161 239 161 239 161 239 161 239 0 Retained Earnings 827 391 907 343 951 153 1 237 739 1 305 436 41 Treasury Stock holders Equit 3 Total Stockholde 9 9 896 1070996 1095 069 1 381 655 1 4 40 108 4 4 Total Liabilities & Stockholders Equity 1 385 633 1 . 453 842 1 528 072 1712919 1.790 . 348 Activate Windows BS IS CF CABS CSIS FRI COMPARISONS