please no cursive writing

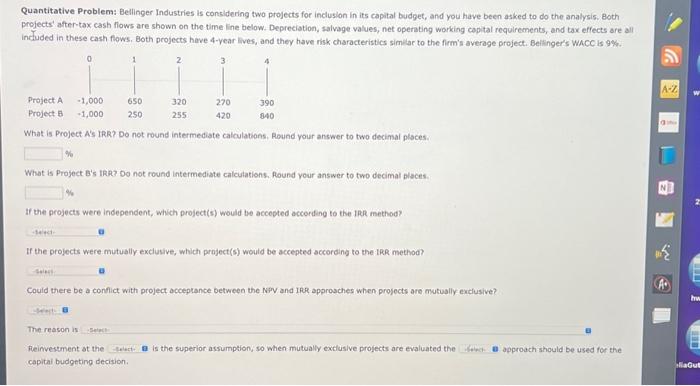

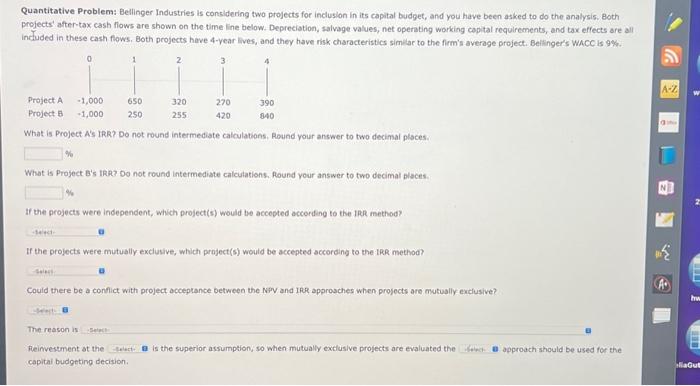

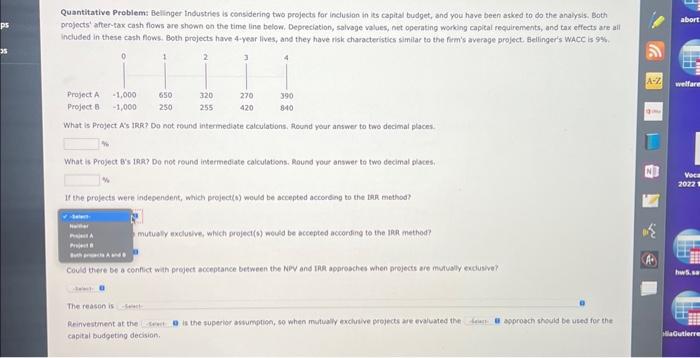

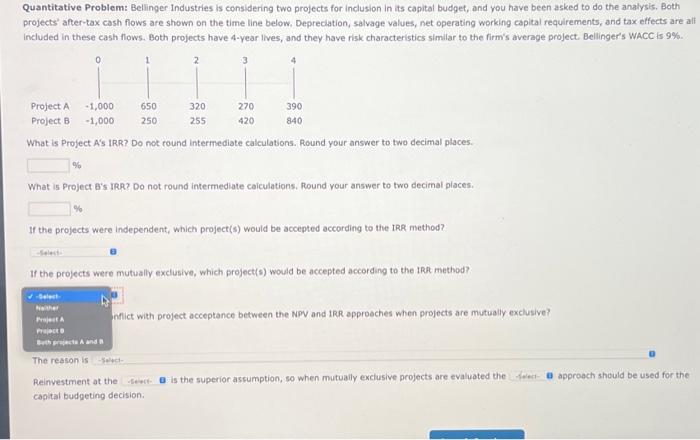

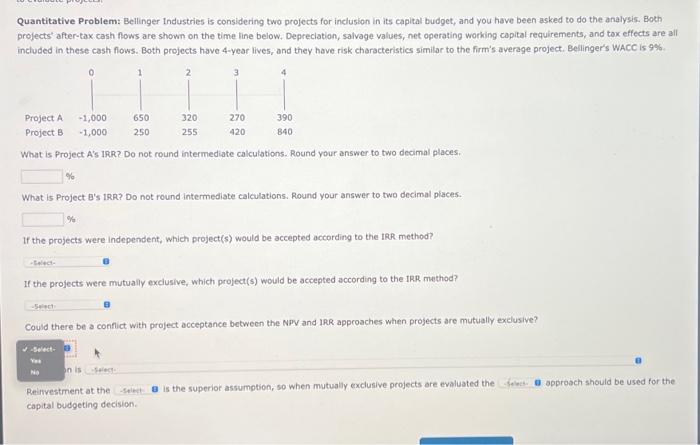

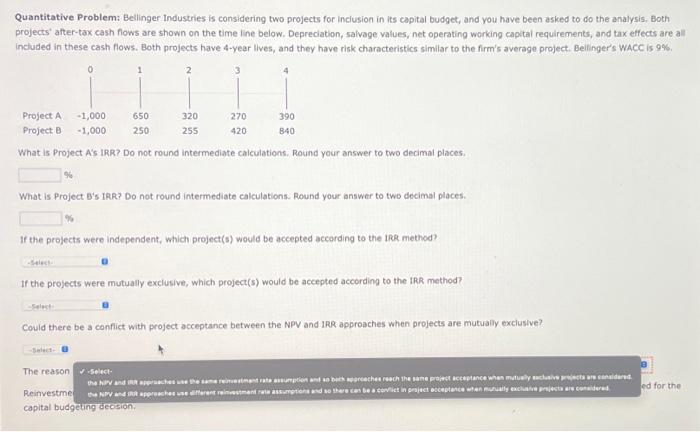

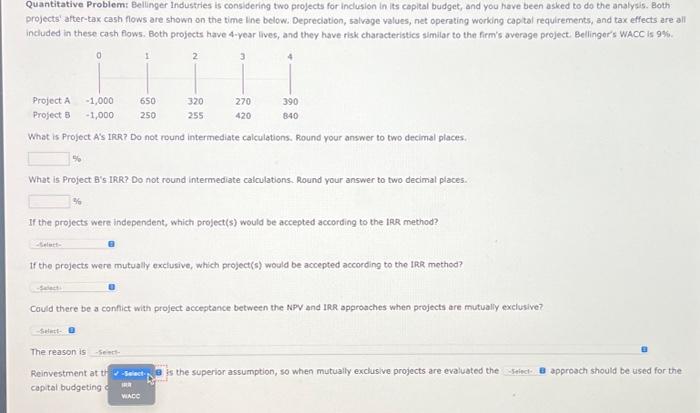

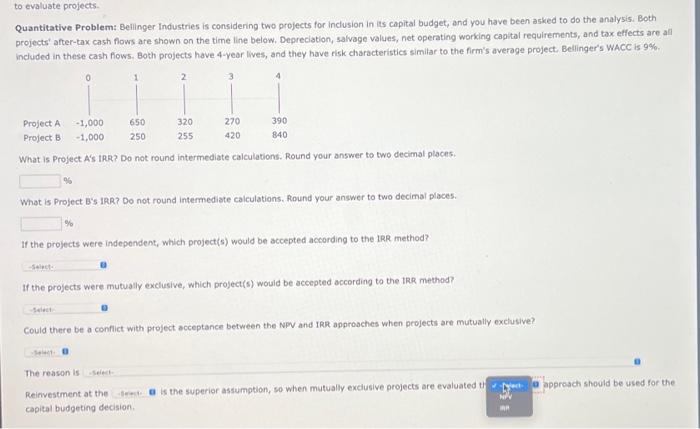

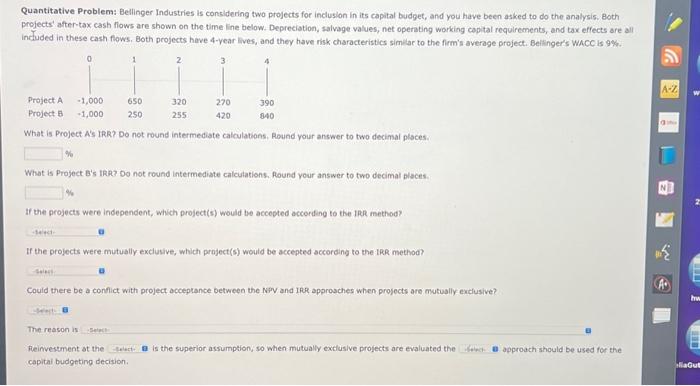

Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working copital requlrements, and tax effects are all inctuded in these cash fows. Both projects have 4-vear lives, and they have risk characteristics similar to the firm's average project. Befilinger's WhcC is 9%. What is Project A's IRR? Do not round intermediste calculations. Round your answer to two decimal plsces. What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal blsces. If the projects were independent, which project(s) would be accepted according to the Ine method? If the projects were mutually exclusive, which project(s) would be accepted according to the trR method? Could there be a conflict with project occeptance between the NirV and Ifr approsches when projects are mutually exclusive? The reason is fieimestment at the is the superior assumption, so when mutually exclusive projects are evaluated the capitai budgeting decision. Quantitative Problem: Belinger industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis, Both projects' after-pax cash flows are shown en the time line below, Depreciation, salvege values, net operating working capital requirements, and tax elfects are all included in these cash fows. Beth projects have 4.year lives, and they have risk characteristics similar to the frem's average project. Biellinger's Wacc is 9 Wh. What is Project A's IRR? Do not round intermediate calculabions. Round your answer to two decimal places. What is Project B's 199? Do not round ingermediate calculatsons. Round your anwer to two decimal places. It the prolects were independent, which project(t) weuld be accepted according to the tar method? wutuscy excluelve, which project(s) neuld be sccepted accerding to the len method? Could there be a confict with pegect acceptarice between the NoV and thl approbches when projects are muivaly eucusive? The reasen is Reinvestinent at the is the zuperior asfurytipe, so when mulualy excluive projects are evaluated the approach should be used for the capital budgeting decision. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are alf included in these cash flows. Both projects have 4 -year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WAcC is 9%. What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % What is Project B's IRR? Do not round intermediate caiculations. Round your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? Ifict with Droject acceptance between the NPV and IRR approoches when projects are mutually exclusive? The reason is Reinvestment at the is the superior assumption, so when mutually excluslve projects are evaluated the approach should be used for the capital budgeting decision: Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all. included in these cash flows. Both projects have 4 -year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WAcc is 9%. What is Project A's 1RR? Do not round intermediate calculations. Round your answer to two decimal places. What is Project B's 1RR? Do not round intermediate calculations. Round your answer to two decimal piaces. Y4 If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which project(s) would be accepted according to the IRR, mithod? Could there be a confict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? Rieinvestment at the is the superior assumption, so when mutually exclusive projects are evaluated the approach should be used for the capital budgeting decision. Quantitative Problem: Bellinger Industries is considering two projects for inciusion in its capital budget, and you have been asked to do the analysis, Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are al included in these cash flows. Both projects have 4-year llves, and they have risk characteristics similar to the firm's average project. Beilinger's WACC is 9$6. What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. o What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exciusive, which project(s) would be accepted according to the IRR method? Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually excluslive? Quantitative Problem: Belinger Industries is considering two projects for inclusion in its capikal budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time lne below. Depreciation, salvage values, net operating working cap tal requirements, and tax effects are all included in these cash flow5, Both projects have 4-year lives, and they have risk characteristies similar to the firm's average project. Bellinger's WAcC is 9\%. What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal piaces. If the projects were independent, which project(s) would be accepted according to the IfR method? If the projects were mutually excfusive, which project(s) would be accepted according to the IRR method? Couid there be a confict with project occeptonce between the NPV and IRR approwches when projects are mutually exelusive? The reason is Reinvestment at t is the superion assumption, so when mutually exclusive projects are evaluated the capitel budgeting Quantitative Problem: Bellinger Industries is considering two projects for Inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all inciuded in thase cash flows, Both projects have 4-vear lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 9%. What is Project A's tRa? Do not round intermediate calculations. Round your answer to two decimal places. What is Project B's IRR? Do not round intermediate calculations. Aound your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? Could there be a confict with project acceptance between the NPV and IRa approsches when projects are mutually exclusive? The reasen is Reirvestment at the is the superior assumption, so when mutually exciusive projects are evaluated ti capital budgeting decision