Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please only answer if you know how to correctly. Please answer all parts and label them 1,2,3,4 LO3 Pricing Decision P 1. Ed Vetz &

Please only answer if you know how to correctly. Please answer all parts and label them 1,2,3,4

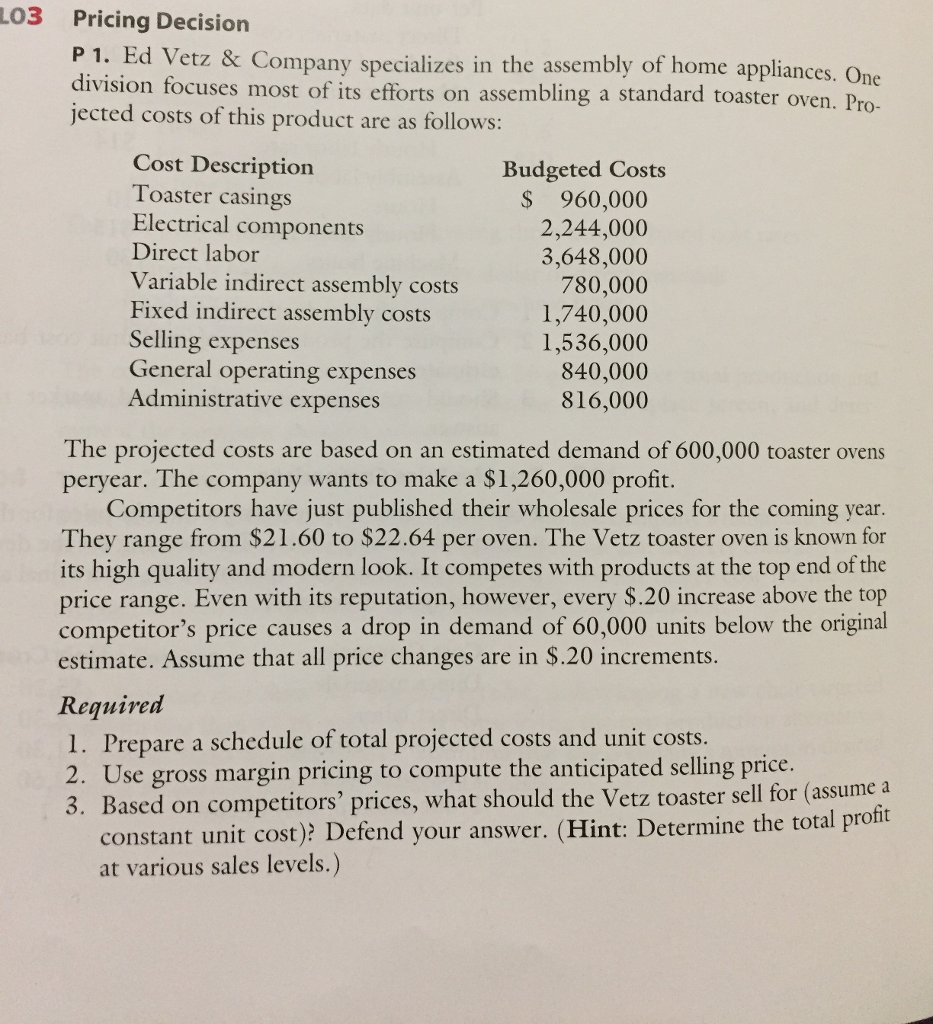

LO3 Pricing Decision P 1. Ed Vetz & Company specializes in the assembly of home applian One division focuses most of its efforts on assembling a toaster oven. costs of this product are as follows: Cost Description Budgeted Costs Toaster casings 960,000 Electrical components 2,244,000 Direct labor 3,648,000 Variable indirect assembly costs 780,000 Fixed indirect assembly costs 1,740,000 Selling expenses 1,536,000 General operating expenses 840,000 Administrative expenses 816,000 The projected costs are based on an estimated demand of 600,000 toaster ovens peryear. The company wants to make a $1,260,000 profit. Competitors have just published their wholesale prices for the coming year. They range from $21.60 to $22.64 per oven. The Vetz toaster oven is known for its high quality and modern look. It competes with products at the top end of the price range. Even with its reputation, however, every $.20 increase above the top competitor's price causes a drop in demand of 60,000 units below the original estimate. Assume that all price changes are in $.20 increments. Required l. Prepare a schedule of total projected costs and unit costs. 2. Use gross margin pricing to compute the anticipated selling price 3. Based on competitors' prices, what should the Ve toaster sell for (assume a constant unit cost)? Defend your answer. (Hint: Determine the total profit at various sales levels.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started