Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please only answer parts e and f: 18. APT (S8.4)The following question illustrates the APT. Imagine that there are only two pervasive macroeconomic factors. Investments

Please only answer parts e and f:

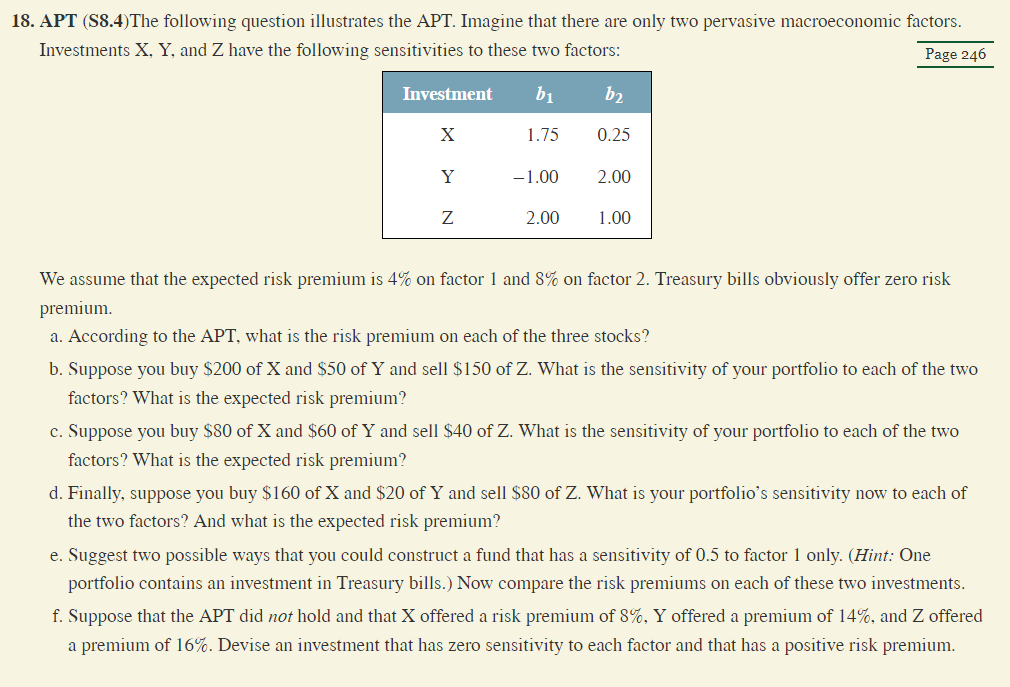

18. APT (S8.4)The following question illustrates the APT. Imagine that there are only two pervasive macroeconomic factors. Investments X,Y, and Z have the following sensitivities to these two factors: Page 246 We assume that the expected risk premium is 4% on factor 1 and 8% on factor 2 . Treasury bills obviously offer zero risk premium. a. According to the APT, what is the risk premium on each of the three stocks? b. Suppose you buy $200 of X and $50 of Y and sell $150 of Z. What is the sensitivity of your portfolio to each of the two factors? What is the expected risk premium? c. Suppose you buy $80 of X and $60 of Y and sell $40 of Z. What is the sensitivity of your portfolio to each of the two factors? What is the expected risk premium? d. Finally, suppose you buy $160 of X and $20 of Y and sell $80 of Z. What is your portfolio's sensitivity now to each of the two factors? And what is the expected risk premium? e. Suggest two possible ways that you could construct a fund that has a sensitivity of 0.5 to factor 1 only. (Hint: One portfolio contains an investment in Treasury bills.) Now compare the risk premiums on each of these two investments. f. Suppose that the APT did not hold and that X offered a risk premium of 8%, Y offered a premium of 14%, and Z offered a premium of 16%. Devise an investment that has zero sensitivity to each factor and that has a positive risk premium

18. APT (S8.4)The following question illustrates the APT. Imagine that there are only two pervasive macroeconomic factors. Investments X,Y, and Z have the following sensitivities to these two factors: Page 246 We assume that the expected risk premium is 4% on factor 1 and 8% on factor 2 . Treasury bills obviously offer zero risk premium. a. According to the APT, what is the risk premium on each of the three stocks? b. Suppose you buy $200 of X and $50 of Y and sell $150 of Z. What is the sensitivity of your portfolio to each of the two factors? What is the expected risk premium? c. Suppose you buy $80 of X and $60 of Y and sell $40 of Z. What is the sensitivity of your portfolio to each of the two factors? What is the expected risk premium? d. Finally, suppose you buy $160 of X and $20 of Y and sell $80 of Z. What is your portfolio's sensitivity now to each of the two factors? And what is the expected risk premium? e. Suggest two possible ways that you could construct a fund that has a sensitivity of 0.5 to factor 1 only. (Hint: One portfolio contains an investment in Treasury bills.) Now compare the risk premiums on each of these two investments. f. Suppose that the APT did not hold and that X offered a risk premium of 8%, Y offered a premium of 14%, and Z offered a premium of 16%. Devise an investment that has zero sensitivity to each factor and that has a positive risk premium Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started