Please only comment, if you are sure about the answer. Some replied $245 and that is not the correct answer. I have to post again due to him. Please HELP

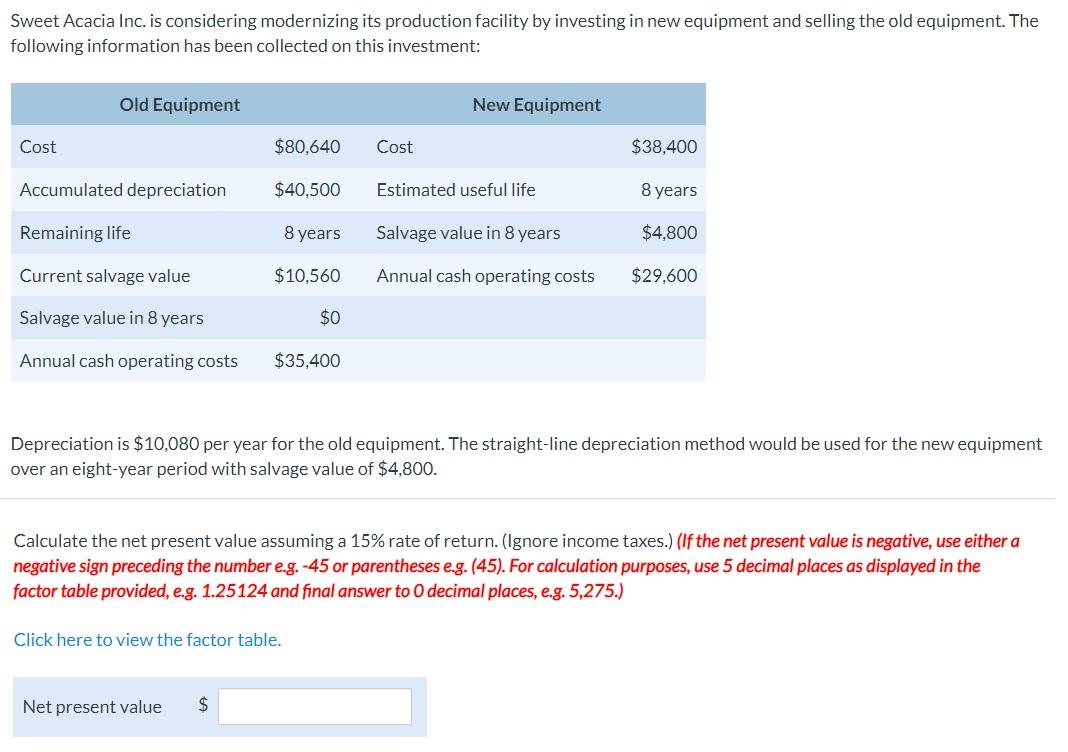

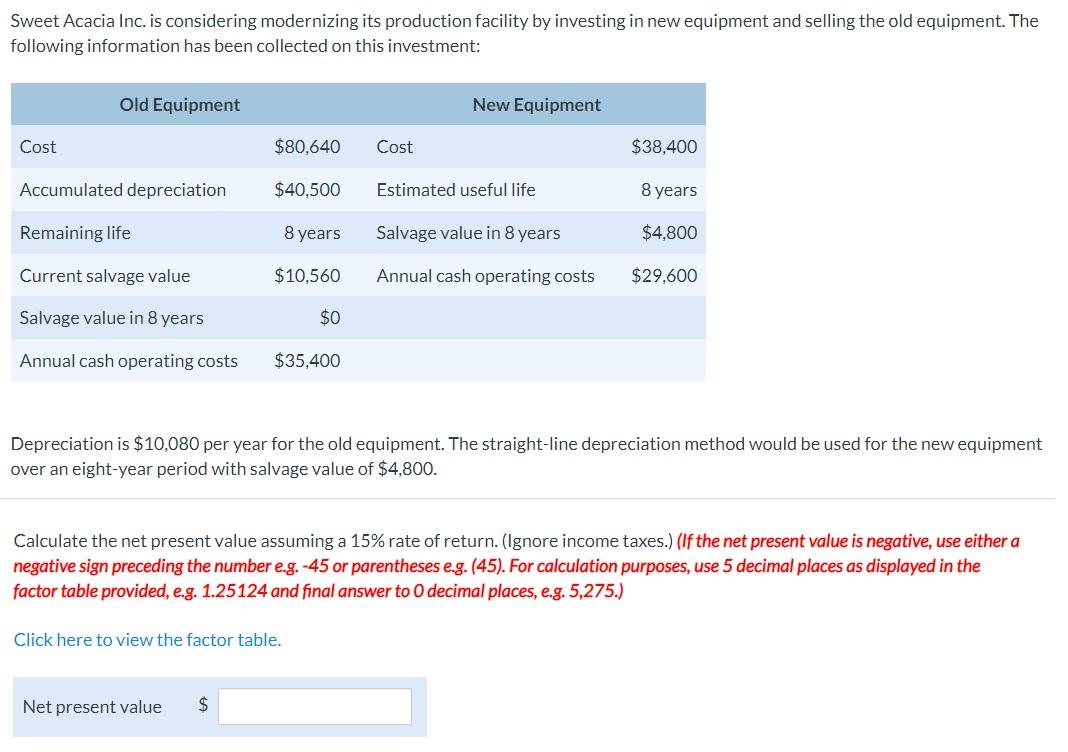

Sweet Acacia Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been collected on this investment: Old Equipment New Equipment Cost $80,640 Cost $38,400 Accumulated depreciation $40,500 Estimated useful life 8 years Remaining life 8 years Salvage value in 8 years $4,800 Current salvage value $10,560 Annual cash operating costs $29,600 Salvage value in 8 years $0 Annual cash operating costs $35,400 Depreciation is $10,080 per year for the old equipment. The straight-line depreciation method would be used for the new equipment over an eight-year period with salvage value of $4,800. Calculate the net present value assuming a 15% rate of return. (Ignore income taxes.) (If the net present value is negative, use either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25124 and final answer to 0 decimal places, e.g. 5,275.) Click here to view the factor table. Net present value $ Sweet Acacia Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been collected on this investment: Old Equipment New Equipment Cost $80,640 Cost $38,400 Accumulated depreciation $40,500 Estimated useful life 8 years Remaining life 8 years Salvage value in 8 years $4,800 Current salvage value $10,560 Annual cash operating costs $29,600 Salvage value in 8 years $0 Annual cash operating costs $35,400 Depreciation is $10,080 per year for the old equipment. The straight-line depreciation method would be used for the new equipment over an eight-year period with salvage value of $4,800. Calculate the net present value assuming a 15% rate of return. (Ignore income taxes.) (If the net present value is negative, use either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25124 and final answer to 0 decimal places, e.g. 5,275.) Click here to view the factor table. Net present value $