Question

Question 1: Senior management has been very concerned about the implication of the recent cash flow situation for the firm and its investors. You have

Question 1:

Senior management has been very concerned about the implication of the recent cash flow situation for the firm and its investors. You have been asked to identify specific issues that have adversely impacted the free cash flow and propose a solution going forward. Please note there may be more than one area of concern that needs to be addressed.

Question 2:

The senior management of your company is concerned about the firms return to shareholders, ROE. In particular, they are concerned that recent growth may not be value enhancing. Using the data provided, evaluate the ROE and make specific suggestions for improving it.

Question 3:

Given your analysis of the firms results for the questions above (1 and 2), provide a brief explanation of the impact of these issues on the cost of debt funding (rd) for this firm. You should use a general expression for determining an interest rate to address this question and frame your answer.

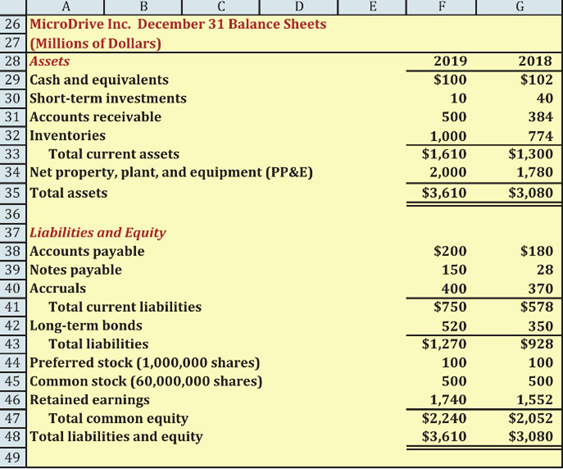

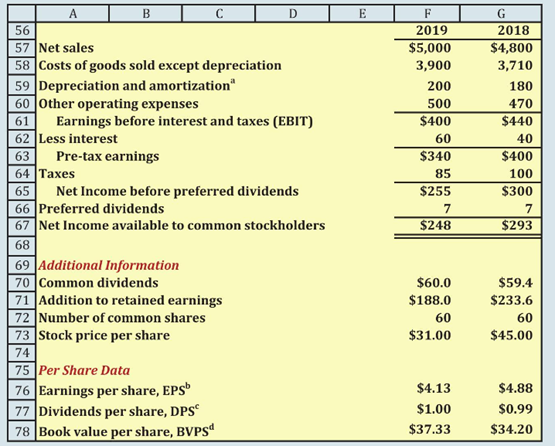

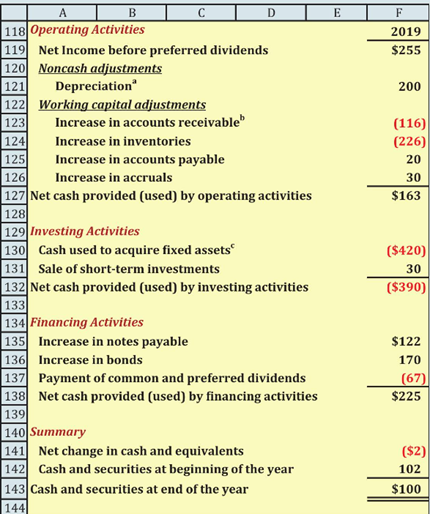

A C 26 MicroDrive Inc. December 31 Balance Sheets B 27 (Millions of Dollars) 28 Assets 29 Cash and equivalents 30 Short-term investments 31 Accounts receivable 32 Inventories 33 34 Net property, plant, and equipment (PP&E) 35 Total assets Total current assets 36 37 Liabilities and Equity 38 Accounts payable 39 Notes payable 40 Accruals 41 42 Long-term bonds 43 Total liabilities 44 Preferred stock (1,000,000 shares) 45 Common stock (60,000,000 shares) 46 Retained earnings 47 Total common equity 48 Total liabilities and equity 49 Total current liabilities F 2019 $100 10 500 1,000 $1,610 2,000 $3,610 $200 150 400 $750 520 $1,270 100 500 1,740 $2,240 $3,610 G 2018 $102 40 384 774 $1,300 1,780 $3,080 $180 28 370 $578 350 $928 100 500 1,552 $2,052 $3,080 A B 56 57 Net sales 58 Costs of goods sold except depreciation 59 Depreciation and amortization" 60 Other operating expenses 61 Earnings before interest and taxes (EBIT) 62 Less interest 63 64 Taxes 65 66 Preferred dividends 67 Net Income available to common stockholders 68 Pre-tax earnings D Net Income before preferred dividends 69 Additional Information 70 Common dividends 71 Addition to retained earnings 72 Number of common shares 73 Stock price per share 74 75 Per Share Data 76 Earnings per share, EPS 77 Dividends per share, DPS 78 Book value per share, BVPSd E F 2019 $5,000 3,900 200 500 $400 60 $340 85 $255 7 $248 $60.0 $188.0 60 $31.00 $4.13 $1.00 $37.33 G 2018 $4,800 3,710 180 470 $440 40 $400 100 $300 7 $293 $59.4 $233.6 60 $45.00 $4.88 $0.99 $34.20 A B 118 Operating Activities 119 Net Income before preferred dividends 120 Noncash adjustments 121 C Depreciation 122 Working capital adjustments 123 124 125 126 127 Net cash provided (used) by operating activities 128 Increase in accounts receivable D Increase in inventories Increase in accounts payable Increase in accruals 129 Investing Activities 130 Cash used to acquire fixed assets 131 Sale of short-term investments 132 Net cash provided (used) by investing activities 133 134 Financing Activities 135 Increase in notes payable 136 Increase in bonds 137 Payment of common and preferred dividends 138 Net cash provided (used) by financing activities 139 140 Summary 141 Net change in cash and equivalents 142 Cash and securities at beginning of the year 143 Cash and securities at end of the year 144 E F 2019 $255 200 (116) (226) 20 30 $163 ($420) 30 ($390) $122 170 (67) $225 ($2) 102 $100 A C 26 MicroDrive Inc. December 31 Balance Sheets B 27 (Millions of Dollars) 28 Assets 29 Cash and equivalents 30 Short-term investments 31 Accounts receivable 32 Inventories 33 34 Net property, plant, and equipment (PP&E) 35 Total assets Total current assets 36 37 Liabilities and Equity 38 Accounts payable 39 Notes payable 40 Accruals 41 42 Long-term bonds 43 Total liabilities 44 Preferred stock (1,000,000 shares) 45 Common stock (60,000,000 shares) 46 Retained earnings 47 Total common equity 48 Total liabilities and equity 49 Total current liabilities F 2019 $100 10 500 1,000 $1,610 2,000 $3,610 $200 150 400 $750 520 $1,270 100 500 1,740 $2,240 $3,610 G 2018 $102 40 384 774 $1,300 1,780 $3,080 $180 28 370 $578 350 $928 100 500 1,552 $2,052 $3,080 A B 56 57 Net sales 58 Costs of goods sold except depreciation 59 Depreciation and amortization" 60 Other operating expenses 61 Earnings before interest and taxes (EBIT) 62 Less interest 63 64 Taxes 65 66 Preferred dividends 67 Net Income available to common stockholders 68 Pre-tax earnings D Net Income before preferred dividends 69 Additional Information 70 Common dividends 71 Addition to retained earnings 72 Number of common shares 73 Stock price per share 74 75 Per Share Data 76 Earnings per share, EPS 77 Dividends per share, DPS 78 Book value per share, BVPSd E F 2019 $5,000 3,900 200 500 $400 60 $340 85 $255 7 $248 $60.0 $188.0 60 $31.00 $4.13 $1.00 $37.33 G 2018 $4,800 3,710 180 470 $440 40 $400 100 $300 7 $293 $59.4 $233.6 60 $45.00 $4.88 $0.99 $34.20 A B 118 Operating Activities 119 Net Income before preferred dividends 120 Noncash adjustments 121 C Depreciation 122 Working capital adjustments 123 124 125 126 127 Net cash provided (used) by operating activities 128 Increase in accounts receivable D Increase in inventories Increase in accounts payable Increase in accruals 129 Investing Activities 130 Cash used to acquire fixed assets 131 Sale of short-term investments 132 Net cash provided (used) by investing activities 133 134 Financing Activities 135 Increase in notes payable 136 Increase in bonds 137 Payment of common and preferred dividends 138 Net cash provided (used) by financing activities 139 140 Summary 141 Net change in cash and equivalents 142 Cash and securities at beginning of the year 143 Cash and securities at end of the year 144 E F 2019 $255 200 (116) (226) 20 30 $163 ($420) 30 ($390) $122 170 (67) $225 ($2) 102 $100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started