Please only give answers where there are blanks and not where I have already answered. Thank you in advance!

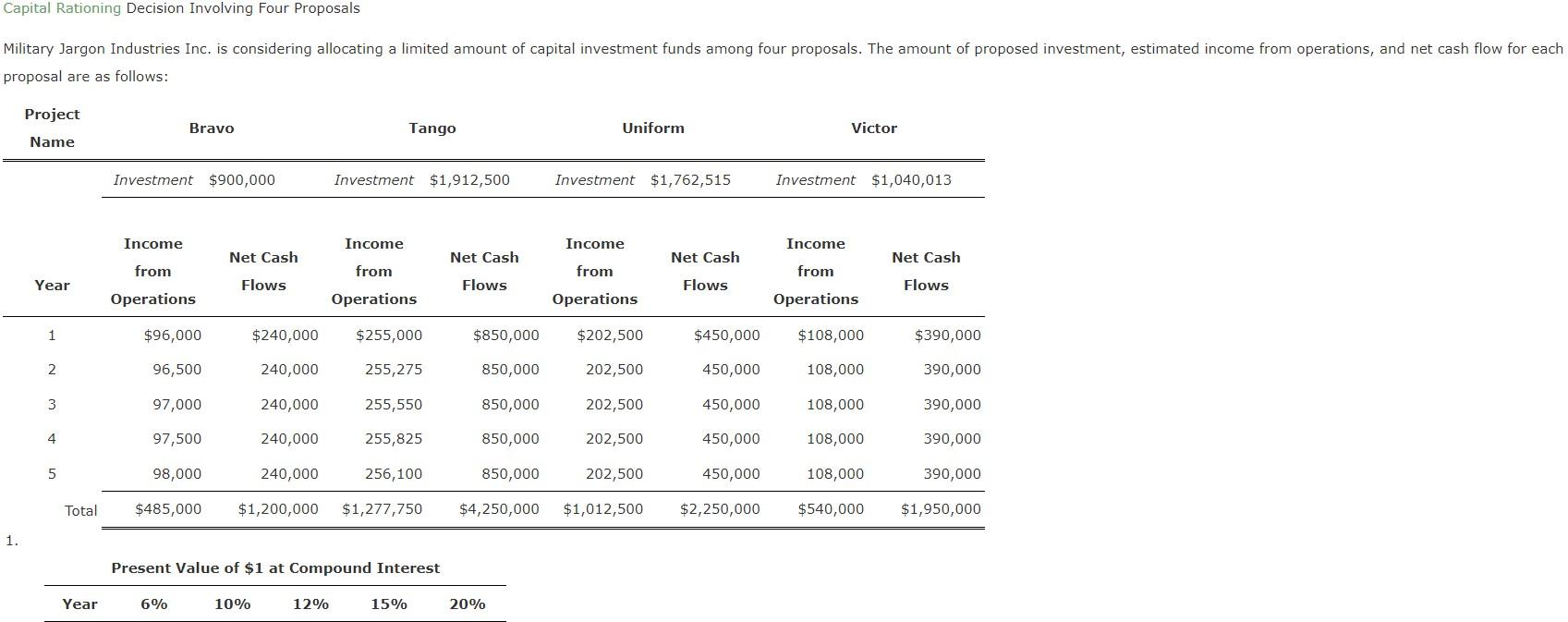

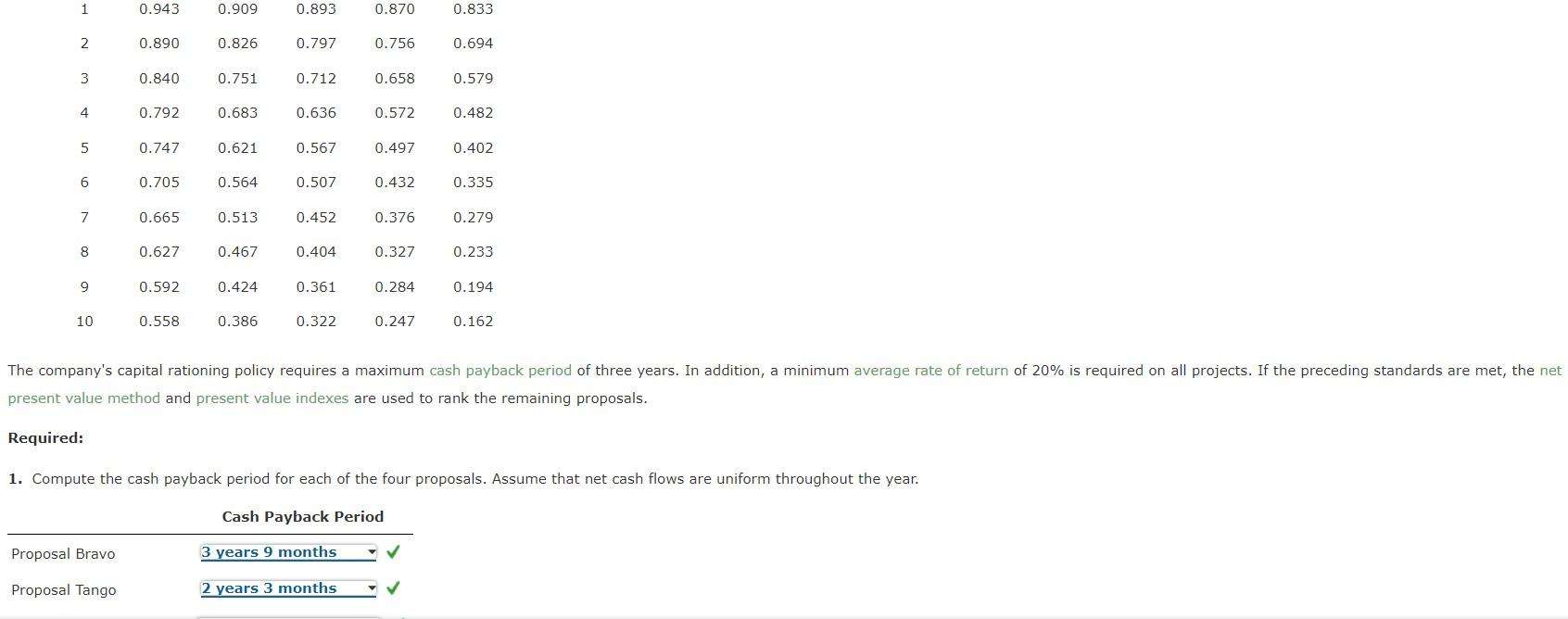

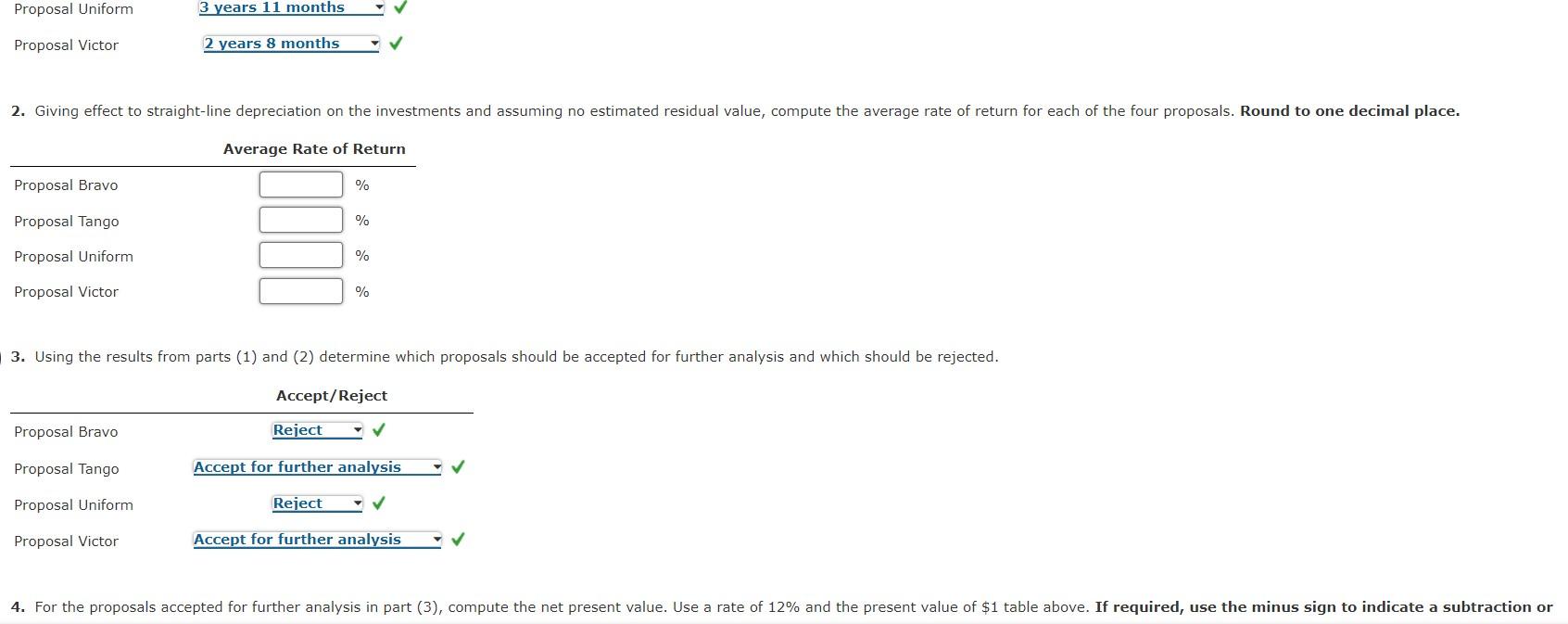

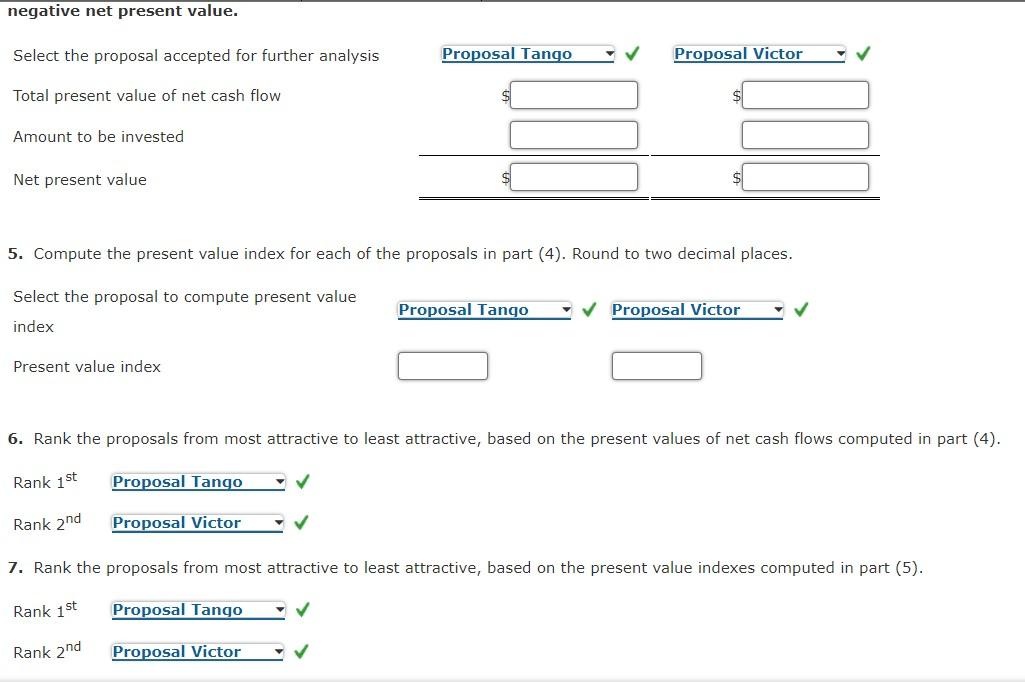

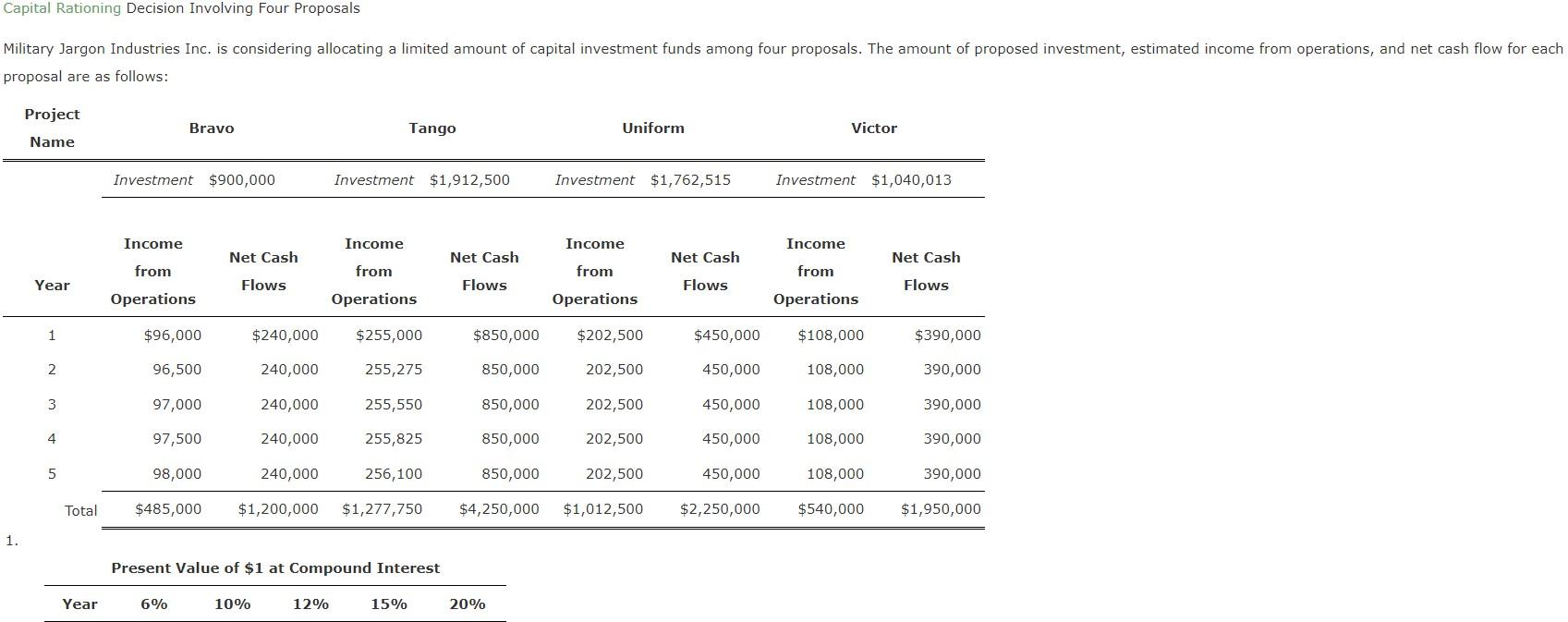

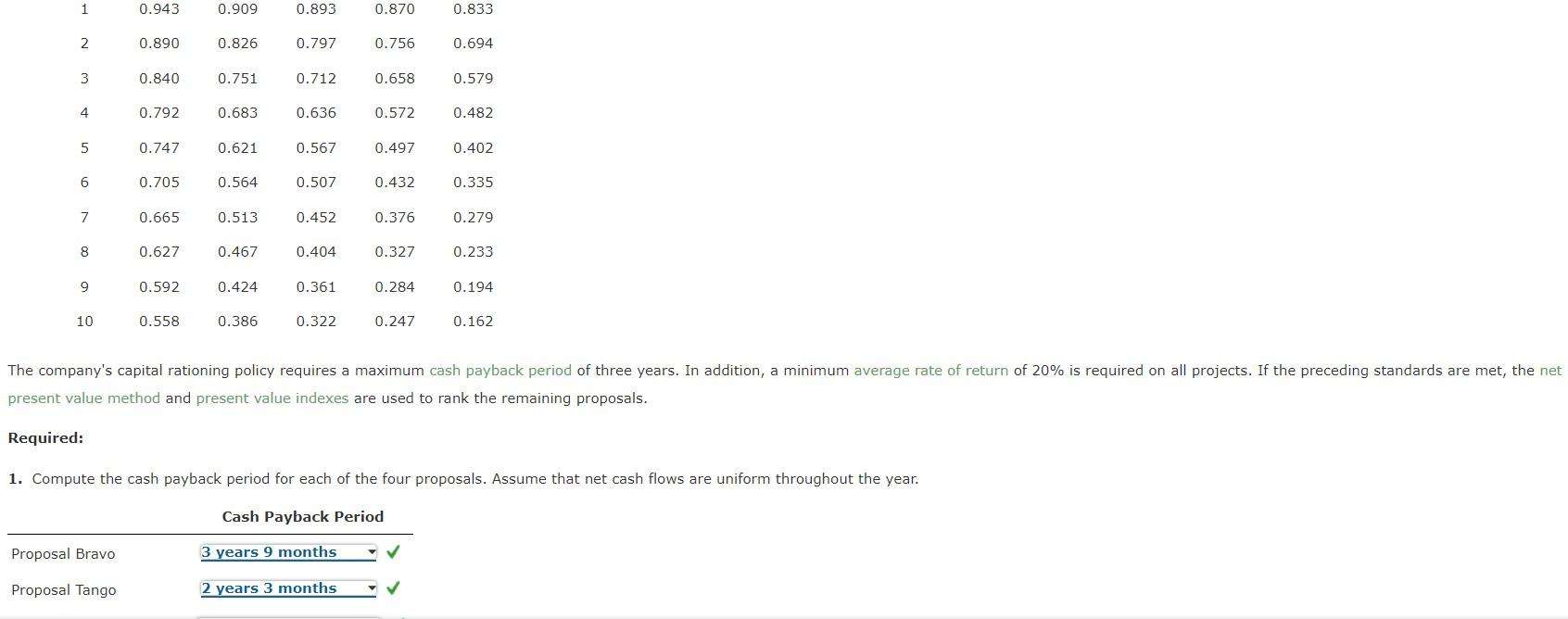

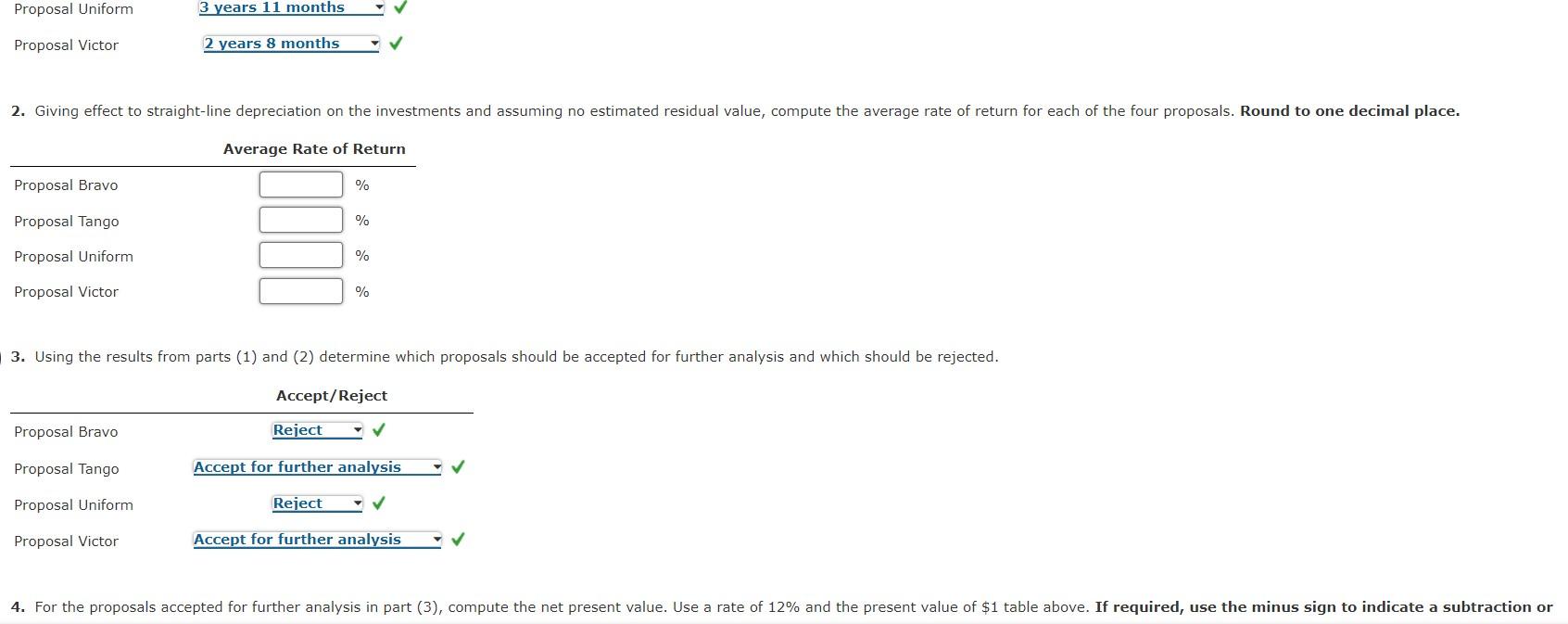

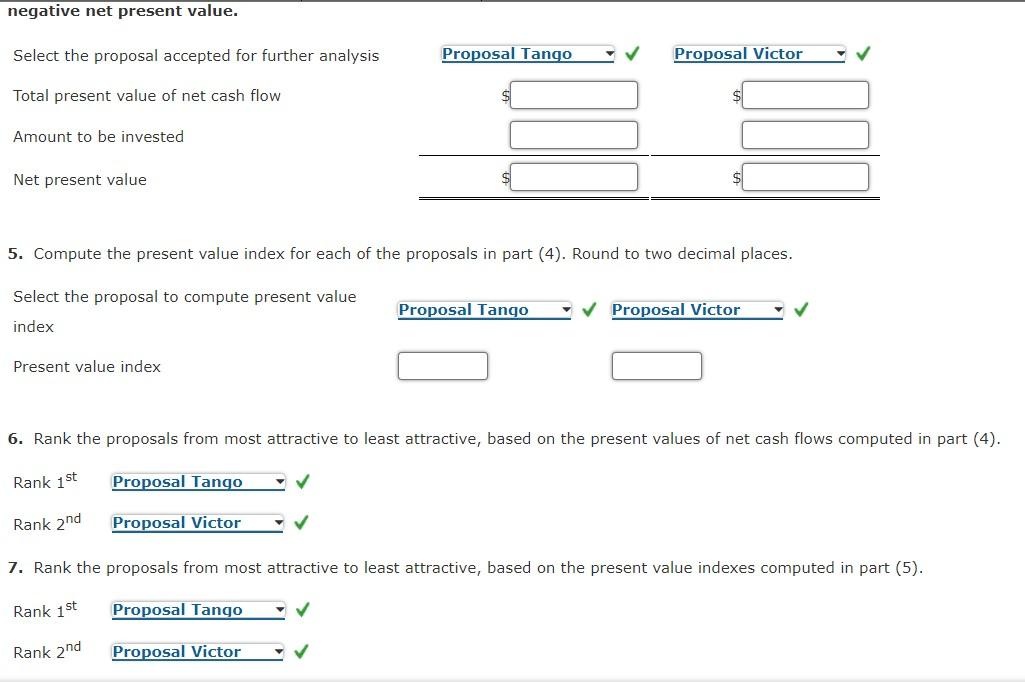

proposal are as follows: +. Present Value of $1 at Compound Interest present value method and present value indexes are used to rank the remaining proposals. Required: 1. Compute the cash payback period for each of the four proposals. Assume that net cash flows are uniform throughout the year. ProposalUniformProposalVictor3years11months2years8months Average Rate of Return \begin{tabular}{lr} \hline Proposal Bravo & \\ Proposal Tango & \\ Proposal Uniform & \\ Proposal Victor & \end{tabular} 3. Using the results from parts (1) and (2) determine which proposals should be accepted for further analysis and which should be rejected. \begin{tabular}{lc} & Accept/Reject \\ \hline Proposal Bravo & Reject \\ Proposal Tango & Accept for further analysis \\ Proposal Uniform & Reject \\ Proposal Victor & Accept for further analysis \end{tabular} 5. Compute the present value index for each of the proposals in part (4). Round to two decimal places. 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). Rank 1st Rank 2nd 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). Rank1st Rank 2nd proposal are as follows: +. Present Value of $1 at Compound Interest present value method and present value indexes are used to rank the remaining proposals. Required: 1. Compute the cash payback period for each of the four proposals. Assume that net cash flows are uniform throughout the year. ProposalUniformProposalVictor3years11months2years8months Average Rate of Return \begin{tabular}{lr} \hline Proposal Bravo & \\ Proposal Tango & \\ Proposal Uniform & \\ Proposal Victor & \end{tabular} 3. Using the results from parts (1) and (2) determine which proposals should be accepted for further analysis and which should be rejected. \begin{tabular}{lc} & Accept/Reject \\ \hline Proposal Bravo & Reject \\ Proposal Tango & Accept for further analysis \\ Proposal Uniform & Reject \\ Proposal Victor & Accept for further analysis \end{tabular} 5. Compute the present value index for each of the proposals in part (4). Round to two decimal places. 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). Rank 1st Rank 2nd 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). Rank1st Rank 2nd