Answered step by step

Verified Expert Solution

Question

1 Approved Answer

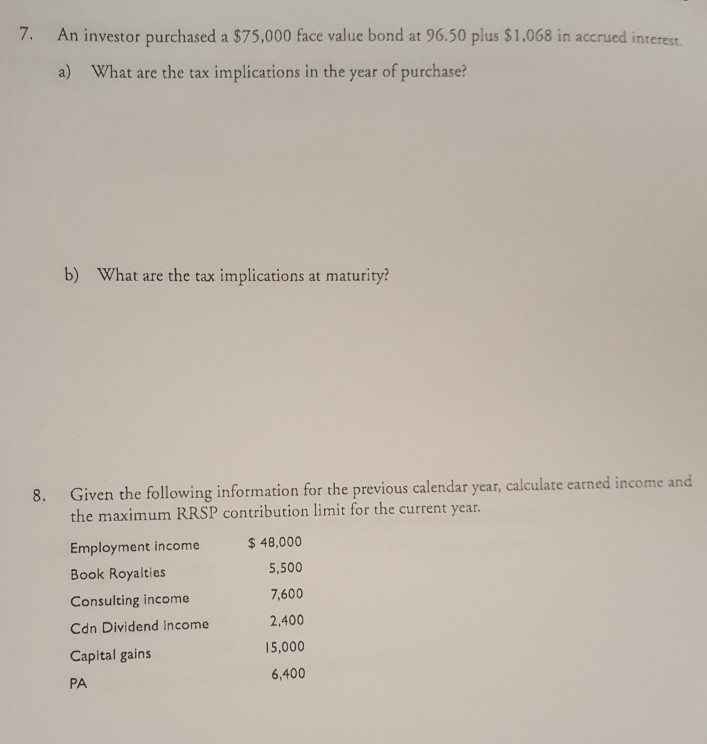

please please help I will rate definately rate. please please all the question. 7. An investor purchased a $75,000 face value bond at 96.50 plus

please please help I will rate definately rate. please please all the question.

7. An investor purchased a $75,000 face value bond at 96.50 plus $1,068 in accrued interest a) What are the tax implications in the year of purchase? b) What are the tax implications at maturity? Given the following information for the previous calendar year, calculate earned income and the maximum RRSP contribution limit for the current yeat. Employment income Book Royalties Consulting income Cdn Dividend income Capital gains PA $48,000 5,500 7,600 2,400 15,000 6,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started