Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Please help, I will rate. Detailed answer please. Applying DuPont Analysis to the Rails In 2001, one of the great holding companies of Canada,

Please Please help, I will rate. Detailed answer please.

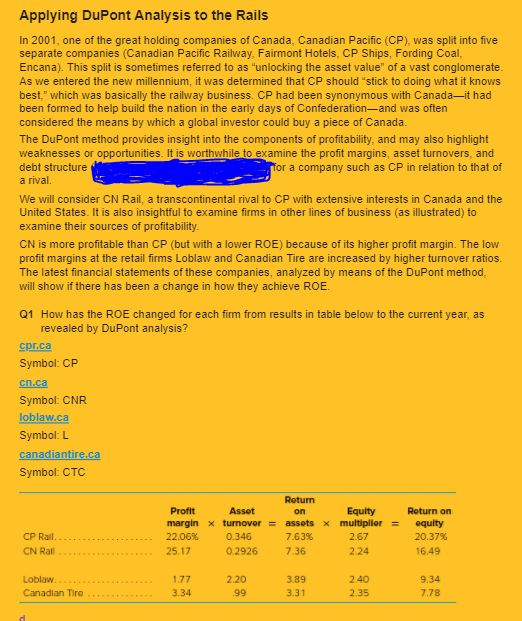

Applying DuPont Analysis to the Rails In 2001, one of the great holding companies of Canada, Canadian Pacific (CP), was split into five separate companies (Canadian Pacific Railway, Fairmont Hotels, CP Ships, Fording Coal Encana). This split is sometimes referred to as "unlocking the asset value of a vast conglomerate As we entered the new millennium, it was determined that CP should stick to doing what it knows best," which was basically the railway business. CP had been synonymous with Canada-it had been formed to help build the nation in the early days of Confederation-and was often considered the means by which a global investor could buy a piece of Canada The DuPont method provides insight into the components of profitability, and may also highlight weaknesses or opportunities. It is wo xamine the profit margins, asset turnovers, and debt structure a rival. a company such as CP in relation to that of We will consider CN Rail, a transcontinental rival to CP with extensive interests in Canada and the United States. It is also insightful to examine firms in other lines of business (as illustrated) to examine their sources of profitability CN is more profitable than CP (but with a lower ROE) because of its higher profit margin. The low profit margins at the retail firms Loblaw and Canadian Tire are increased by higher turnover ratios The latest financial statements of these companies, analyzed by means of the DuPont method will show if there has been a change in how they achieve ROE 01 How has the ROE changed for each firm from results in table below to the current year, as revealed by DuPont analysis? Symbol: CP cn.ca Symbol: CNR loblaw.ca Symbol: L canadiantire.ca Symbol: CTC Rotum Equlty Assot Profit margin tumover assets x multiplier equity 22.06% 0.346 25.17 Roturn on CP Rail CN Rall 7.63% 7.36 2.67 2 24 20.37% 16,49 0.2926 Loblaw Canadlan Tire 1.77 3.34 3.89 2 40 2.35 9.34 7.78 2.20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started