Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please solve only C and D parts of this question perfectly and urgently. mention each answer as you give and do it on paper.

please please solve only C and D parts of this question perfectly and urgently. mention each answer as you give and do it on paper. I will give positive rating if you solve mentioned parts(C,D) of this question perfectly

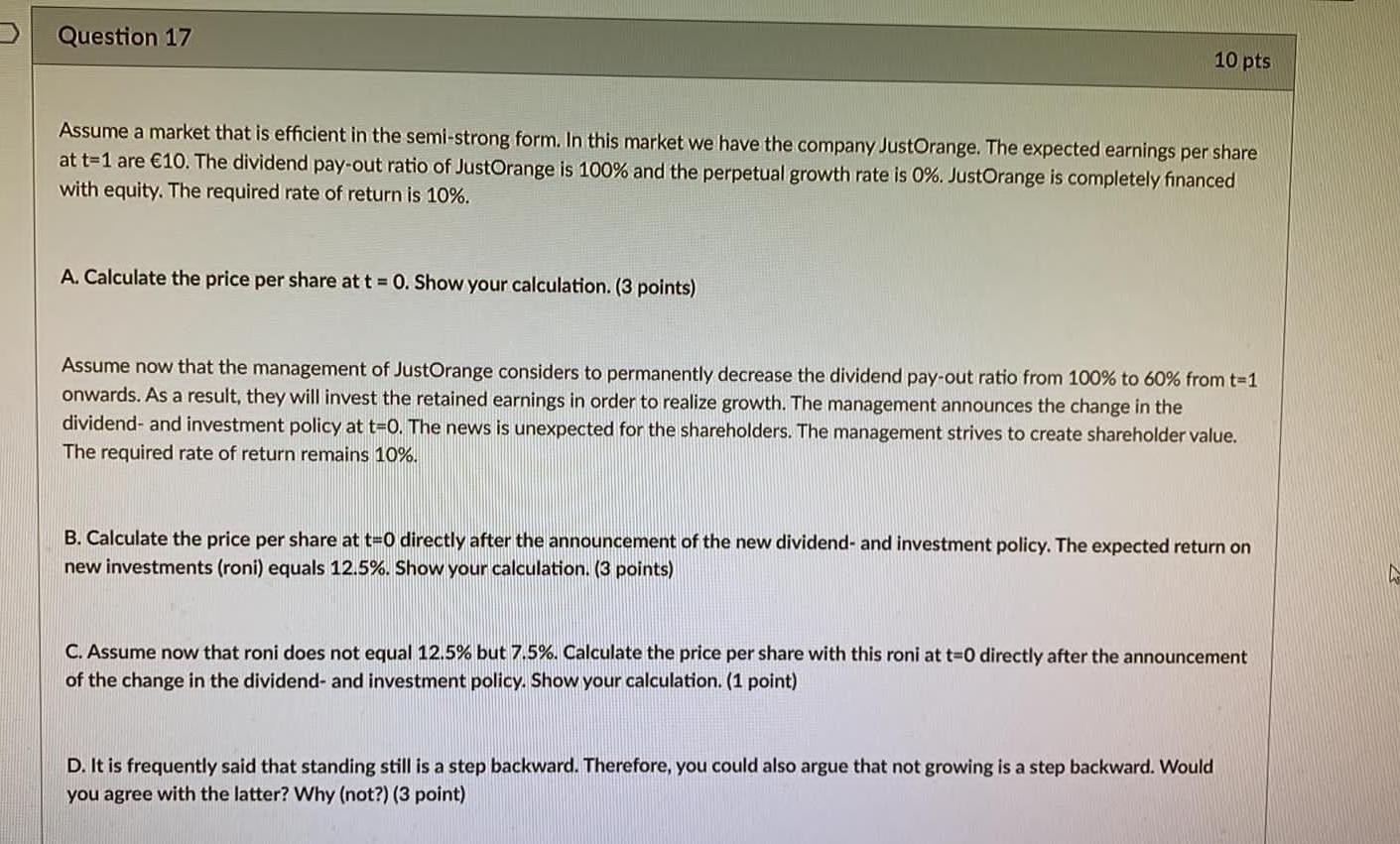

Question 17 10 pts Assume a market that is efficient in the semi-strong form. In this market we have the company JustOrange. The expected earnings per share at t=1 are 10. The dividend pay-out ratio of JustOrange is 100% and the perpetual growth rate is 0%. JustOrange is completely financed with equity. The required rate of return is 10%. A. Calculate the price per share at t = 0. Show your calculation. (3 points) Assume now that the management of JustOrange considers to permanently decrease the dividend pay-out ratio from 100% to 60% from t=1 onwards. As a result, they will invest the retained earnings in order to realize growth. The management announces the change in the dividend- and investment policy at t=0. The news is unexpected for the shareholders. The management strives to create shareholder value. The required rate of return remains 10%. B. Calculate the price per share at t=0 directly after the announcement of the new dividend- and investment policy. The expected return on new investments (roni) equals 12.5%. Show your calculation. (3 points) C. Assume now that roni does not equal 12.5% but 7.5%. Calculate the price per share with this roni at t=0 directly after the announcement of the change in the dividend- and investment policy. Show your calculation. (1 point) D. It is frequently said that standing still is a step backward. Therefore, you could also argue that not growing is a step backward. Would you agree with the latter? Why (not?) (3 point)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started