Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please post summary entries to in T accounts. Don't do the excel tables looking things. Do actual T accounts that literally look like the letter

Please post summary entries to in T accounts. Don't do the excel tables looking things. Do actual T accounts that literally look like the letter T Please and thank you! Also please explain the entries as to why its credited or debited to help me understand and be able to do it on my own in the future, thanks!

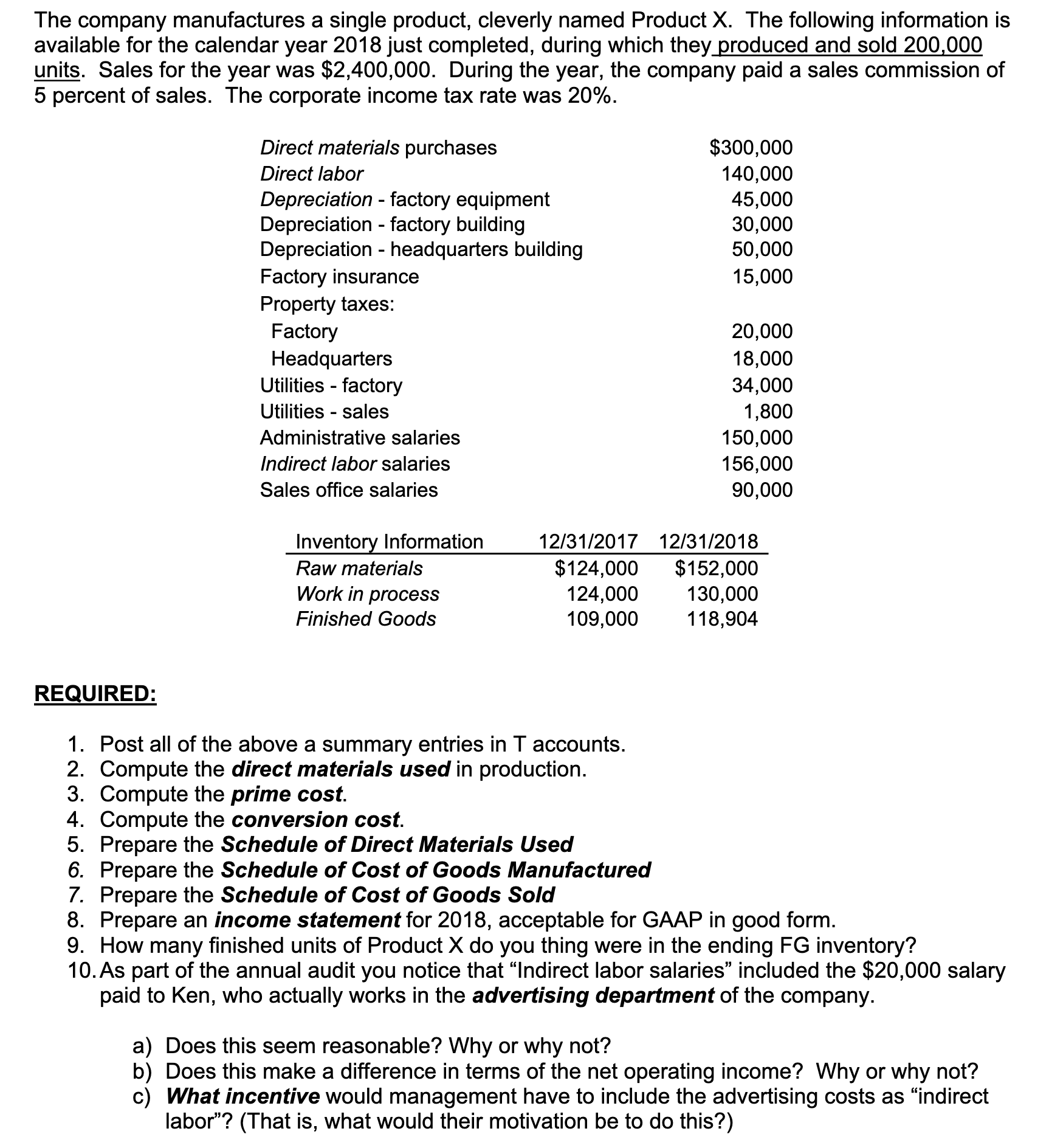

The company manufactures a single product, cleverly named Product X. The following information is available for the calendar year 2018 just completed, during which they produced and sold 200,000 units. Sales for the year was $2,400,000. During the year, the company paid a sales commission of 5 percent of sales. The corporate income tax rate was 20%. REQUIRED: 1. Post all of the above a summary entries in T accounts. 2. Compute the direct materials used in production. 3. Compute the prime cost. 4. Compute the conversion cost. 5. Prepare the Schedule of Direct Materials Used 6. Prepare the Schedule of Cost of Goods Manufactured 7. Prepare the Schedule of Cost of Goods Sold 8. Prepare an income statement for 2018, acceptable for GAAP in good form. 9. How many finished units of Product X do you thing were in the ending FG inventory? 10. As part of the annual audit you notice that "Indirect labor salaries" included the $20,000 salary paid to Ken, who actually works in the advertising department of the company. a) Does this seem reasonable? Why or why not? b) Does this make a difference in terms of the net operating income? Why or why not? c) What incentive would management have to include the advertising costs as "indirect labor"? (That is, what would their motivation be to do this?)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started