Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE POST THE EXCEL FORULUMAS AND SOLVE IN EXCEL!!!!! $1,000,000 $550.000 1 2 3 4 5 10% 20% 40% 20% 10% $850,000 $950,000 $1,150.000 $1,500,000

PLEASE POST THE EXCEL FORULUMAS AND SOLVE IN EXCEL!!!!!

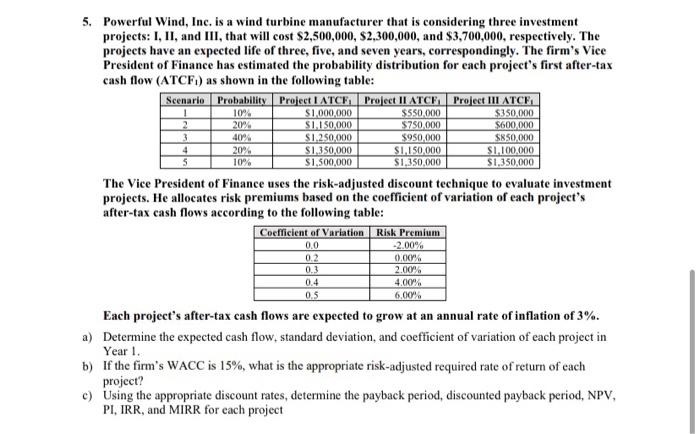

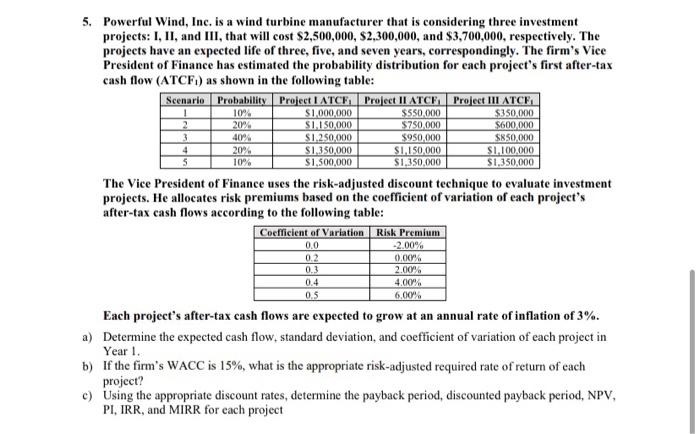

$1,000,000 $550.000 1 2 3 4 5 10% 20% 40% 20% 10% $850,000 $950,000 $1,150.000 $1,500,000 5. Powerful Wind, Inc. is a wind turbine manufacturer that is considering three investment projects: I, II, and III, that will cost $2,500,000, $2,300,000, and $3,700,000, respectively. The projects have an expected life of three, five, and seven years, correspondingly. The firm's Vice President of Finance has estimated the probability distribution for each project's first after-tax cash flow (ATCFI) as shown in the following table: Scenario Probability Project I ATCE Project ILATCE Project III ATCE $350.000 SI 150.000 $750,000 $600,000 $1,250,000 $1,350,000 $1,100,000 $1,350,000 $1,350,000 The Vice President of Finance uses the risk-adjusted discount technique to evaluate investment projects. He allocates risk premiums based on the coefficient of variation of each project's after-tax cash flows according to the following table: Coefficient of Variation Risk Premium 0.0 -2.00% 02 0.00% 2.00% 0.4 4.00% 0.5 6.00% Each project's after-tax cash flows are expected to grow at an annual rate of inflation of 3%. a) Determine the expected cash flow, standard deviation, and coefficient of variation of each project in Year 1. b) If the firm's WACC is 15%, what is the appropriate risk-adjusted required rate of return of each project? c) Using the appropriate discount rates, determine the payback period, discounted payback period, NPV, PI, IRR, and MIRR for each project 03

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started