Question

Please prepare for journal entries for Wildhorse Company The following transactions occurred in April and May. Both companies use a perpetual inventory system and the

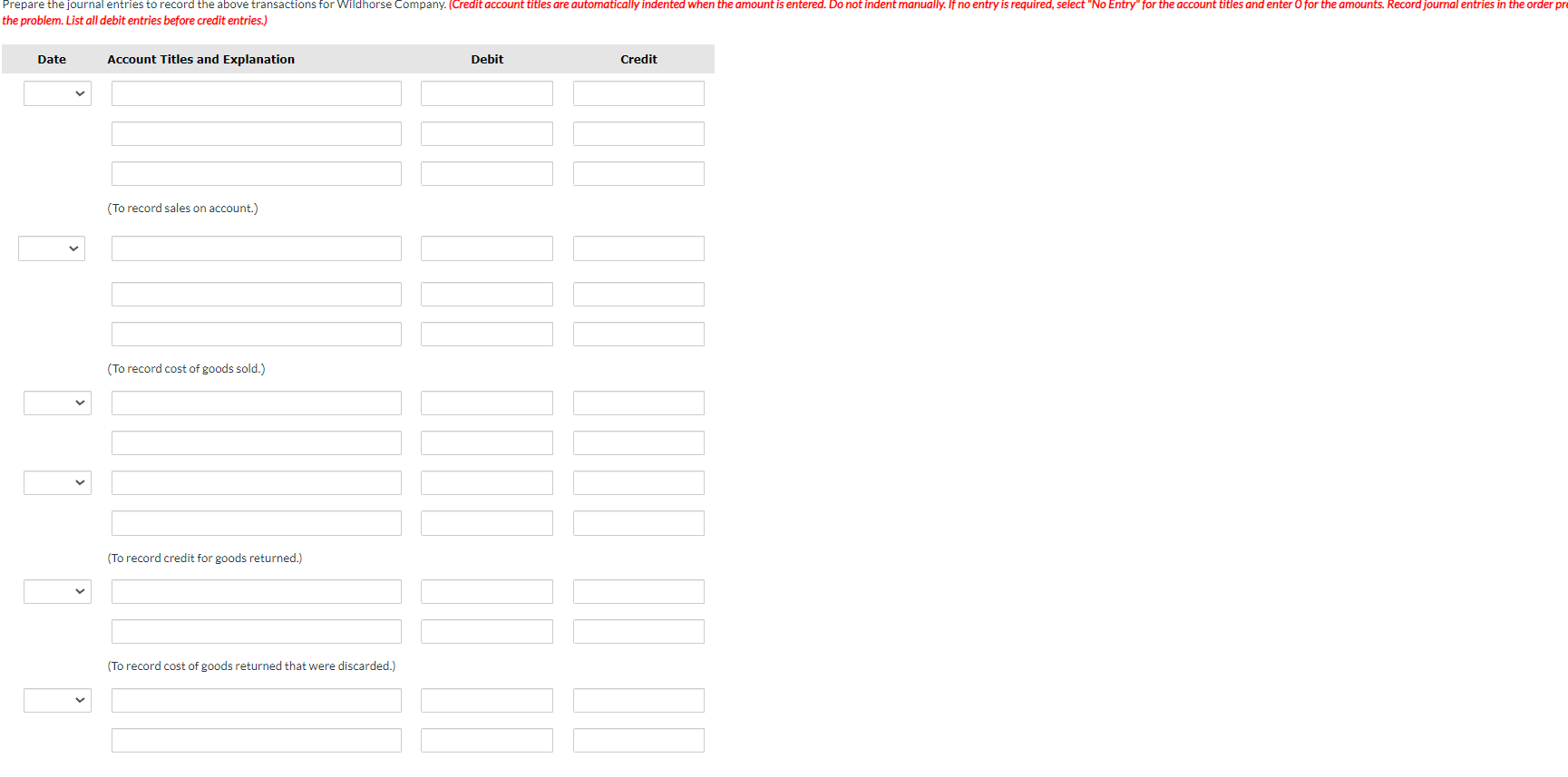

Please prepare for journal entries for Wildhorse Company The following transactions occurred in April and May. Both companies use a perpetual inventory system and the contract-based approach for revenue recognition. Wildhorse Company's management estimates returns at 20% of sales and has a stated return policy of 20 days from the date of sale.

Apr. 5 Fleck Company purchased merchandise from Wildhorse Company for $12,000, terms n//30, FOB shipping point. Wildhorse paid $8,040 for the merchandise.

April 6 The correct company paid freight costs of $400.

April 8 Fleck Company returned damaged merchandise to Wildhorse Company and was given a purchase allowance of $2,200. Wildhorse determined the merchandise could not be repaired and sent it to the recyclers. The merchandise had cost Wildhorse $1,474.

May 4 Fleck paid the amount due to wildhorse company in full. Date: Account Titles : Debit: Credit

the problem. List all debit entries before credit entries.) (To record sales on account.) (To record cost of goods sold.) (To record credit for goods returned.) (To record cost of goods returned that were discarded.) Debit Credit

the problem. List all debit entries before credit entries.) (To record sales on account.) (To record cost of goods sold.) (To record credit for goods returned.) (To record cost of goods returned that were discarded.) Debit Credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started