Answered step by step

Verified Expert Solution

Question

1 Approved Answer

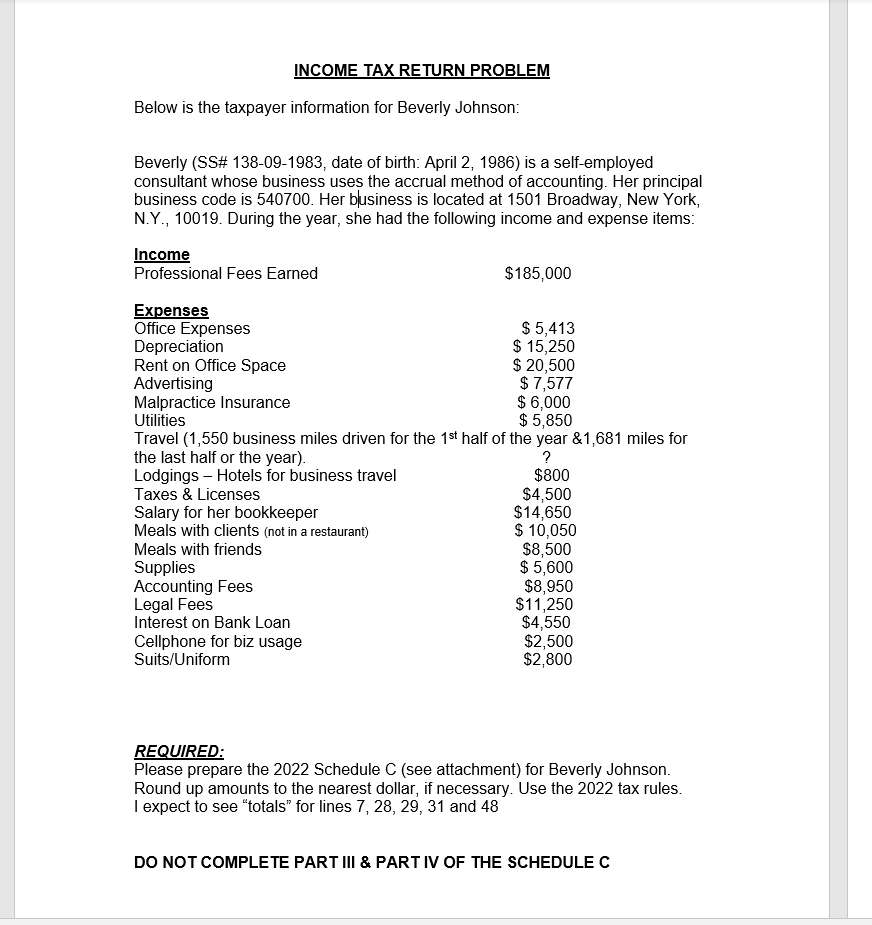

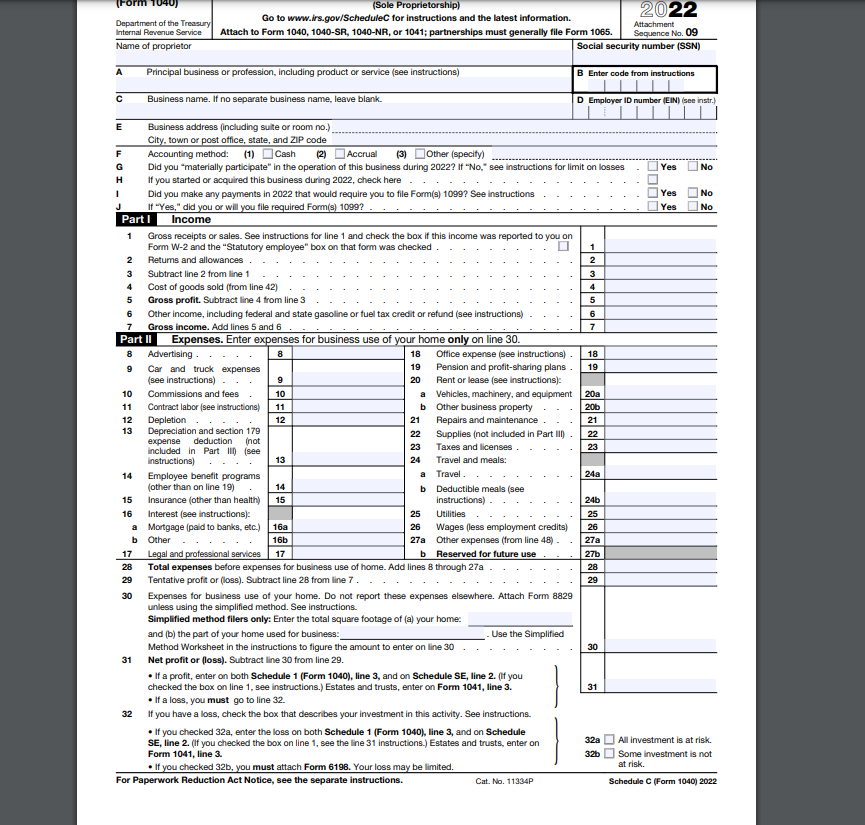

Please prepare the 2022 Schedule C (see attachment) for Beverly Johnson. Round up amounts to the nearest dollar, if necessary. Use the 2022 tax rules.

Please prepare the 2022 Schedule C (see attachment) for Beverly Johnson. Round up amounts to the nearest dollar, if necessary. Use the 2022 tax rules.

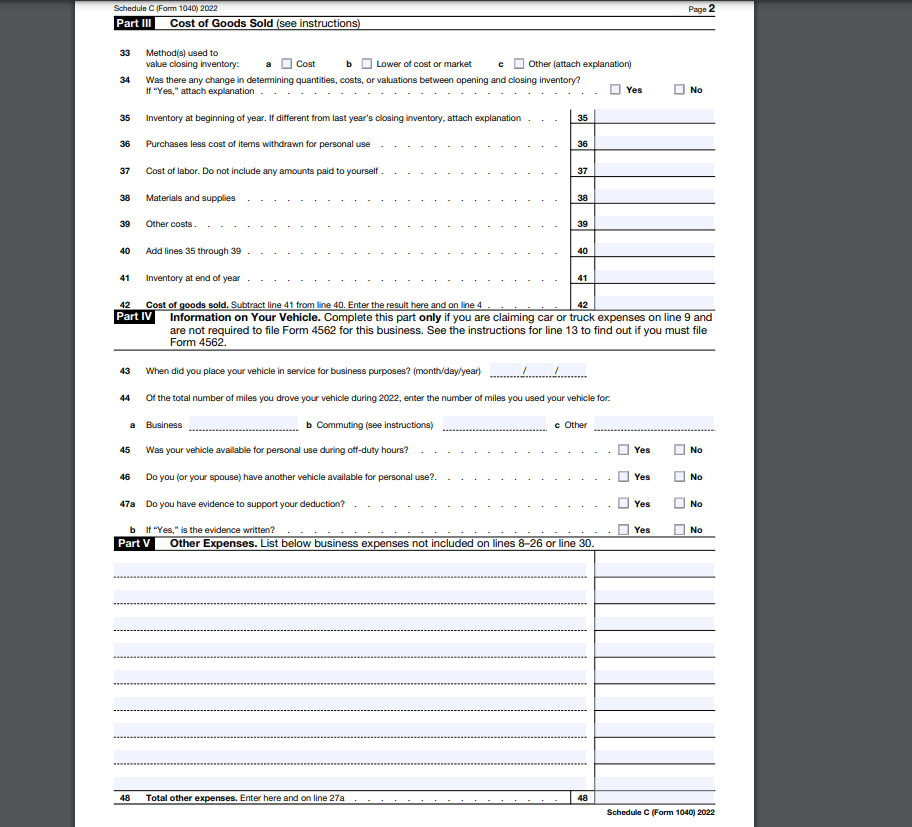

Beverly (SS\# 138-09-1983, date of birth: April 2, 1986) is a self-employed consultant whose business uses the accrual method of accounting. Her principal business code is 540700 . Her blusiness is located at 1501 Broadway, New York, N.Y., 10019. During the year, she had the following income and expense items: Travel (1,550 business miles driven for the 1st half of the year &1,681 miles for the lact half n the vearl REQUIRED: Please prepare the 2022 Schedule C (see attachment) for Beverly Johnson. Round up amounts to the nearest dollar, if necessary. Use the 2022 tax rules. I expect to see "totals" for lines 7,28,29,31 and 48 DO NOT COMPLE TE PART III \& PART IV OF THE SCHEDULE C E Business address (including sulte or room no.) City, town or post office, state, and ZIP code G Did you "materially participate" in the operation of this business during 2022? If "No," see instructions for limit on losses . Yes No H If you started or acquired this business during 2022, check here I Did you make any payments in 2022 that would require you to file Form(s) 1099 ? See instructions . . . . . . . . Yes No Jart I If "Yes," did you Part II Expenses. Enter expenses for business use of your home only on line 30 . 32 If you have a loss, check the box that describes your investment in this activity. See instructions. -Ifyouchecked32a,enterthelossonbothSchedule1(Form1040),line3,andonScheduleSE,line2.(Ifyoucheckedtheboxonline1,seetheline31instructions.)Estatesandtrusts,enteronForm1041,line3.32aAllinvestmentisatrisk.32bSomeinvestmentisnot - If you checked 32b, you must attach Form 6198. Your loss may be limited. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040) 2022 Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562 . Beverly (SS\# 138-09-1983, date of birth: April 2, 1986) is a self-employed consultant whose business uses the accrual method of accounting. Her principal business code is 540700 . Her blusiness is located at 1501 Broadway, New York, N.Y., 10019. During the year, she had the following income and expense items: Travel (1,550 business miles driven for the 1st half of the year &1,681 miles for the lact half n the vearl REQUIRED: Please prepare the 2022 Schedule C (see attachment) for Beverly Johnson. Round up amounts to the nearest dollar, if necessary. Use the 2022 tax rules. I expect to see "totals" for lines 7,28,29,31 and 48 DO NOT COMPLE TE PART III \& PART IV OF THE SCHEDULE C E Business address (including sulte or room no.) City, town or post office, state, and ZIP code G Did you "materially participate" in the operation of this business during 2022? If "No," see instructions for limit on losses . Yes No H If you started or acquired this business during 2022, check here I Did you make any payments in 2022 that would require you to file Form(s) 1099 ? See instructions . . . . . . . . Yes No Jart I If "Yes," did you Part II Expenses. Enter expenses for business use of your home only on line 30 . 32 If you have a loss, check the box that describes your investment in this activity. See instructions. -Ifyouchecked32a,enterthelossonbothSchedule1(Form1040),line3,andonScheduleSE,line2.(Ifyoucheckedtheboxonline1,seetheline31instructions.)Estatesandtrusts,enteronForm1041,line3.32aAllinvestmentisatrisk.32bSomeinvestmentisnot - If you checked 32b, you must attach Form 6198. Your loss may be limited. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040) 2022 Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started