Question

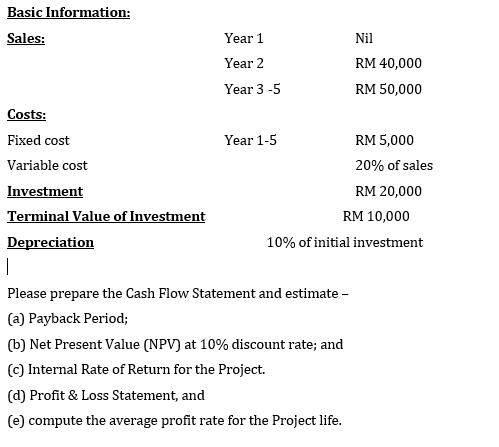

Prepare the Cash Flow Statement based on following information Basic Information: Sales: Year 1 Nil Year 2 RM 40,000 Year 3 -5 RM 50,000 Costs:

Prepare the Cash Flow Statement based on following information

Basic Information: Sales: Year 1 Nil Year 2 RM 40,000 Year 3 -5 RM 50,000 Costs: Fixed cost Year 1-5 RM 5,000 Variable cost 20% of sales Investment RM 20,000 Terminal Value of Investment RM 10,000 Depreciation 10% of initial investment Please prepare the Cash Flow Statement and estimate - (a) Payback Period; (b) Net Present Value (NPV) at 10% discount rate; and (c) Internal Rate of Return for the Project. (d) Profit & Loss Statement, and (e) compute the average profit rate for the Project life.

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

QUESTION SUMMARY With the data of sales fixed and variable costs calculate Payback NPV and IRR of the project Solution Initial Investment 20000 Termin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics

Authors: Douglas Bernheim, Michael Whinston

2nd edition

73375853, 978-0073375854

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App