Please prepare the journal entries for Oct - Dec and prepare the adjustment journal entries at year end(Dec 31)

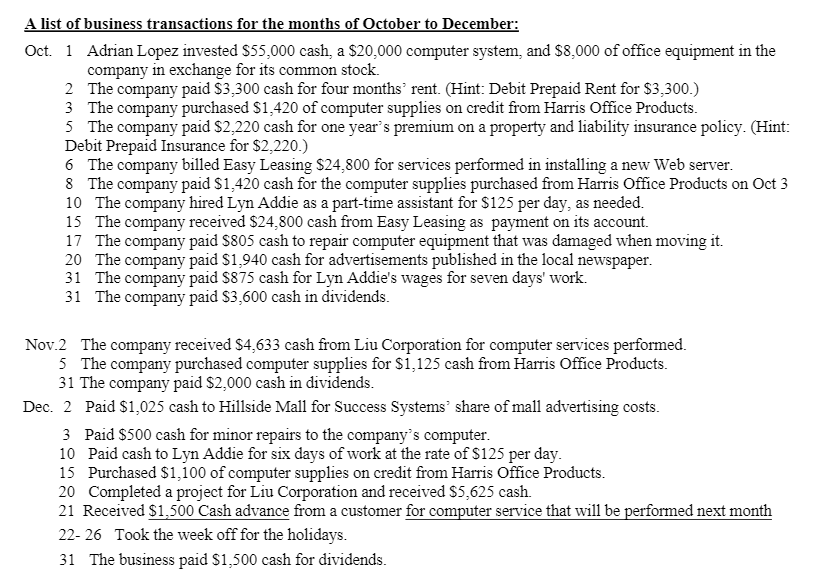

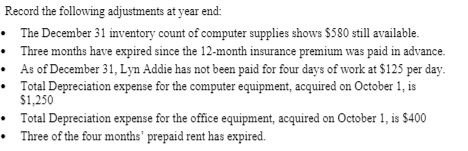

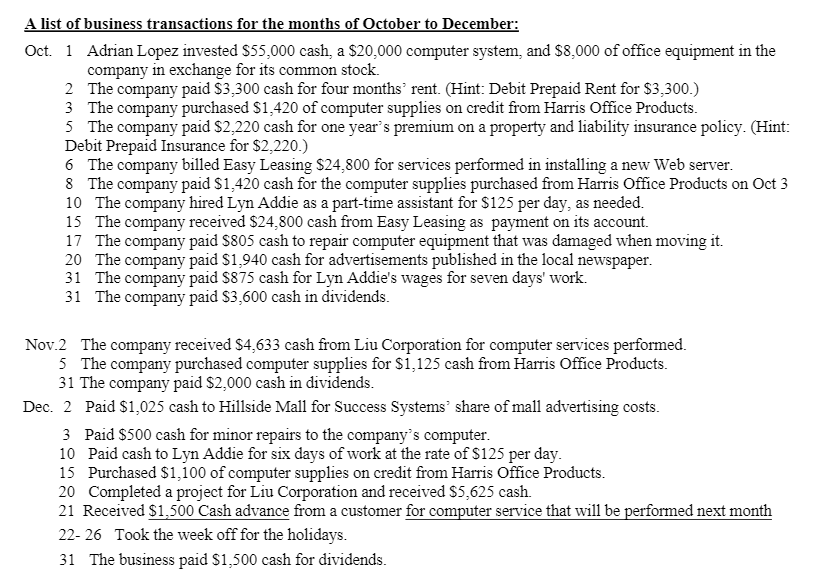

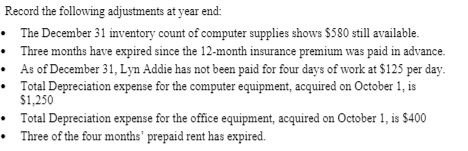

A list of business transactions for the months of October to December: Oct. 1 Adrian Lopez invested $55.000 cash, a $20,000 computer system, and $8,000 of office equipment in the company in exchange for its common stock. 2 The company paid $3.300 cash for four months rent. (Hint: Debit Prepaid Rent for $3,300.) 3 The company purchased $1,420 of computer supplies on credit from Harris Office Products. 5 The company paid $2,220 cash for one year's premium on a property and liability insurance policy. (Hint: Debit Prepaid Insurance for $2,220.) 6 The company billed Easy Leasing $24,800 for services performed in installing a new Web server. 8 The company paid $1,420 cash for the computer supplies purchased from Harris Office Products on Oct 3 10 The company hired Lyn Addie as a part-time assistant for $125 per day, as needed. 15 The company received $24.800 cash from Easy Leasing as payment on its account. 17 The company paid $805 cash to repair computer equipment that was damaged when moving it. 20 The company paid $1,940 cash for advertisements published in the local newspaper. 31 The company paid $875 cash for Lyn Addie's wages for seven days' work. 31 The company paid $3,600 cash in dividends. Nov.2 The company received $4,633 cash from Liu Corporation for computer services performed. 5 The company purchased computer supplies for $1,125 cash from Harris Office Products. 31 The company paid $2,000 cash in dividends. Dec. 2 Paid $1,025 cash to Hillside Mall for Success Systems' share of mall advertising costs. 3 Paid $500 cash for minor repairs to the company's computer. 10 Paid cash to Lyn Addie for six days of work at the rate of $125 per day. 15 Purchased $1,100 of computer supplies on credit from Harris Office Products. 20 Completed a project for Liu Corporation and received $5,625 cash. 21 Received $1,500 Cash advance from a customer for computer service that will be performed next month 22-26 Took the week off for the holidays. 31 The business paid $1,500 cash for dividends. Record the following adjustments at year end: The December 31 inventory count of computer supplies shows $580 still available. Three months have expired since the 12-month insurance premium was paid in advance. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day. Total Depreciation expense for the computer equipment, acquired on October 1, is $1,250 Total Depreciation expense for the office equipment, acquired on October 1, is $400 Three of the four months' prepaid rent has expired