Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE PROVIDE A CLEAR DISCUSSION AND COMPLETE SOLUTIONS (USE TABLE) NO HAND WRITTEN / PICTURE / SCRRENSHOT THANKS JURISDICTION: PHILIPPINE TRAIN LAW Problem. Compute the

PLEASE PROVIDE A CLEAR DISCUSSION AND COMPLETE SOLUTIONS (USE TABLE)

NO HAND WRITTEN / PICTURE / SCRRENSHOT

THANKS

JURISDICTION: PHILIPPINE TRAIN LAW

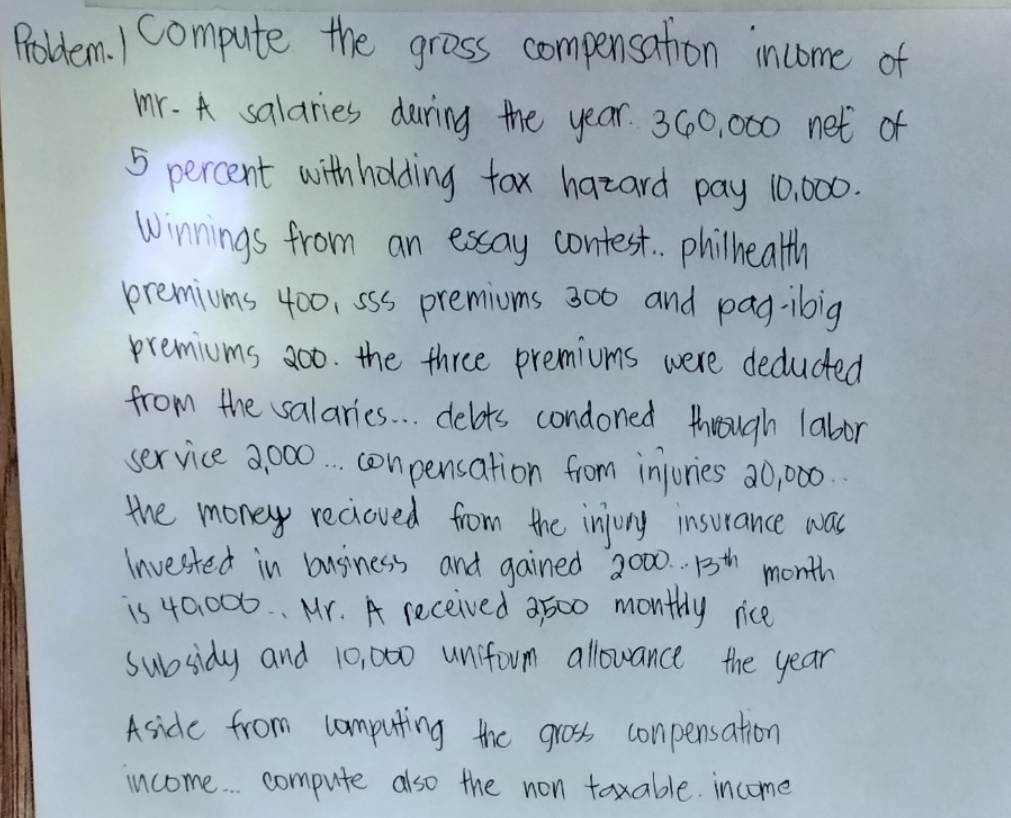

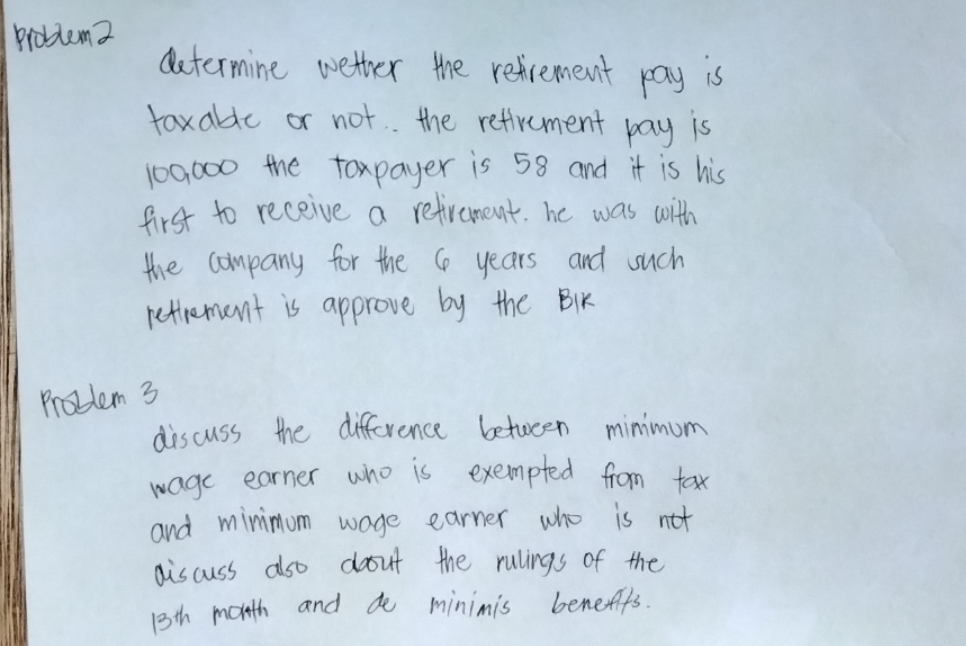

Problem. Compute the gross compensation income of mr. A salaries during the year. 360,000 net of 5 percent with holding tax hazard pay 10.000. Winnings from an essay contest.. philhealth premiums 400, sss premiums 300 and pag-ibig premiums 200. the three premiums were deducted from the salaries... debts condoned through labor service 2,000... compensation from injuries 20,000.. the money recieved from the injury insurance was Invested in business and gained 2000... 13th month is 40,006. Mr. A received 2500 monthly rice Subsidy and 10,000 uniform allowance the year Aside from computing the gross compensation income... compute also the non taxable income

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 Computing Gross Compensation Income and NonTaxable Income for Mr A To compute the gross compensation income of Mr A we need to consider the various components of his income Lets break it dow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started