Please provide analysis of income statement and balance sheet

Please provide analysis of income statement and balance sheet

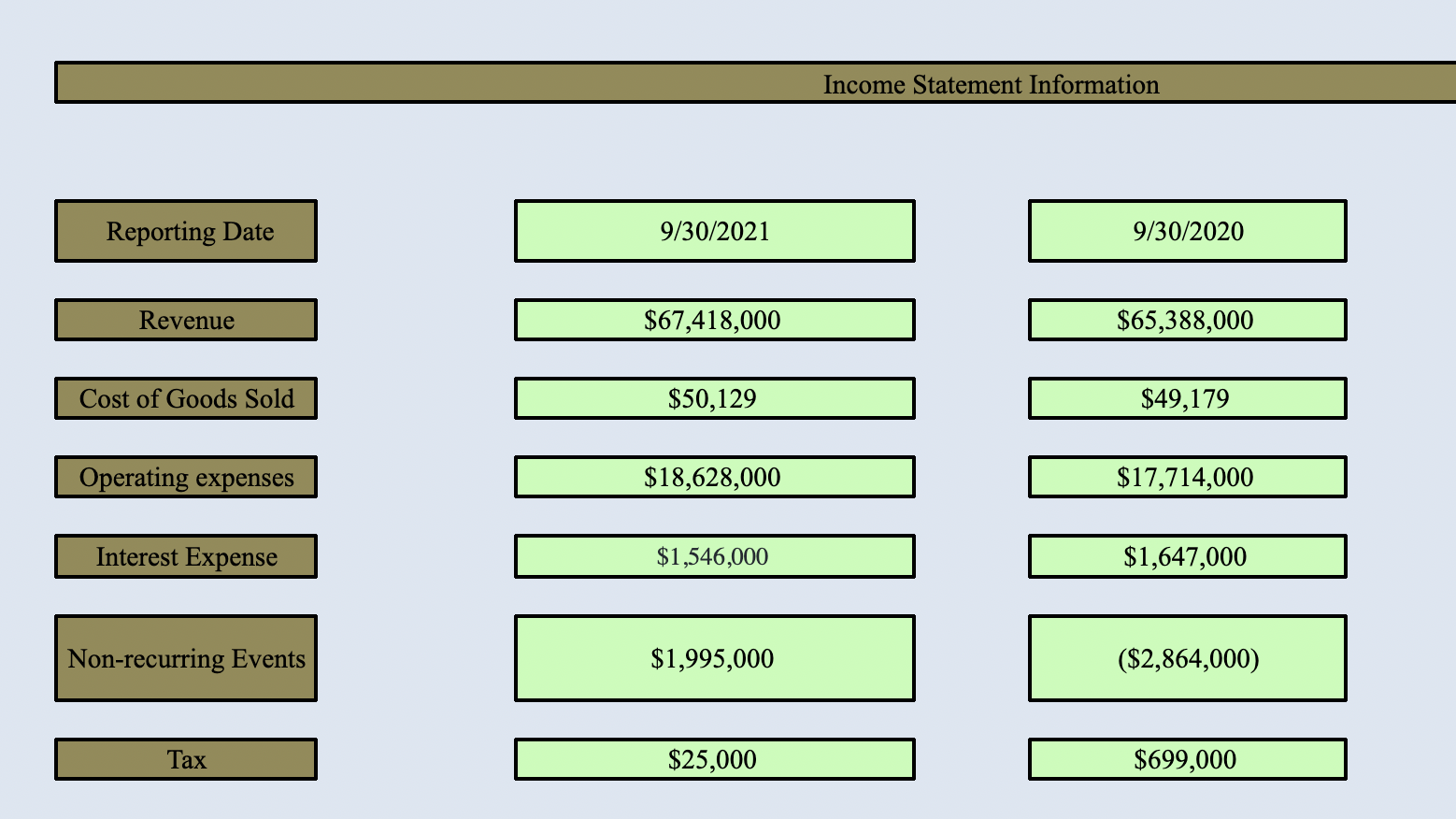

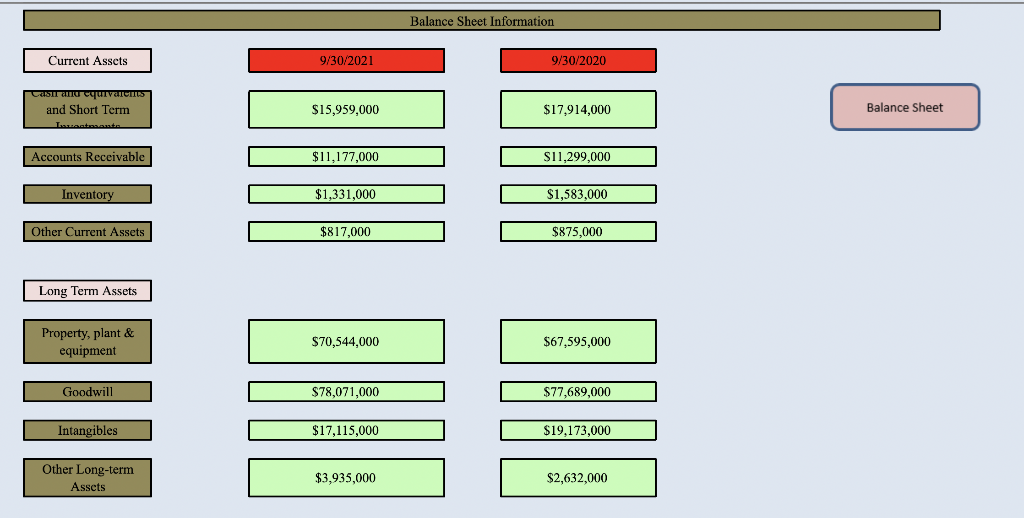

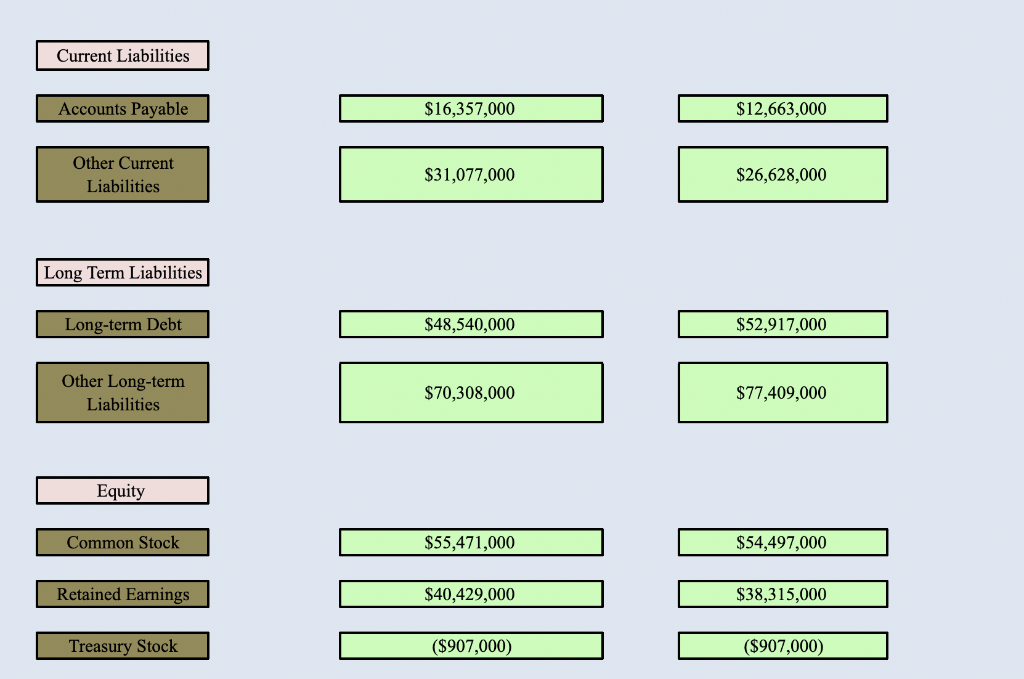

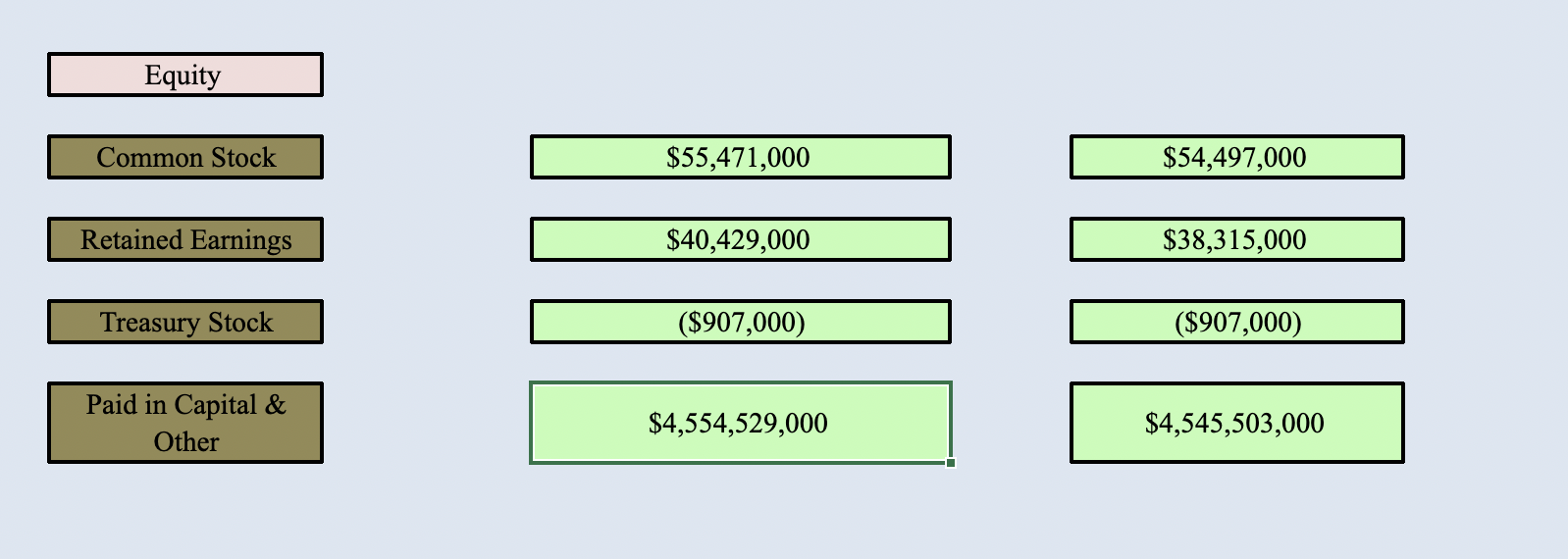

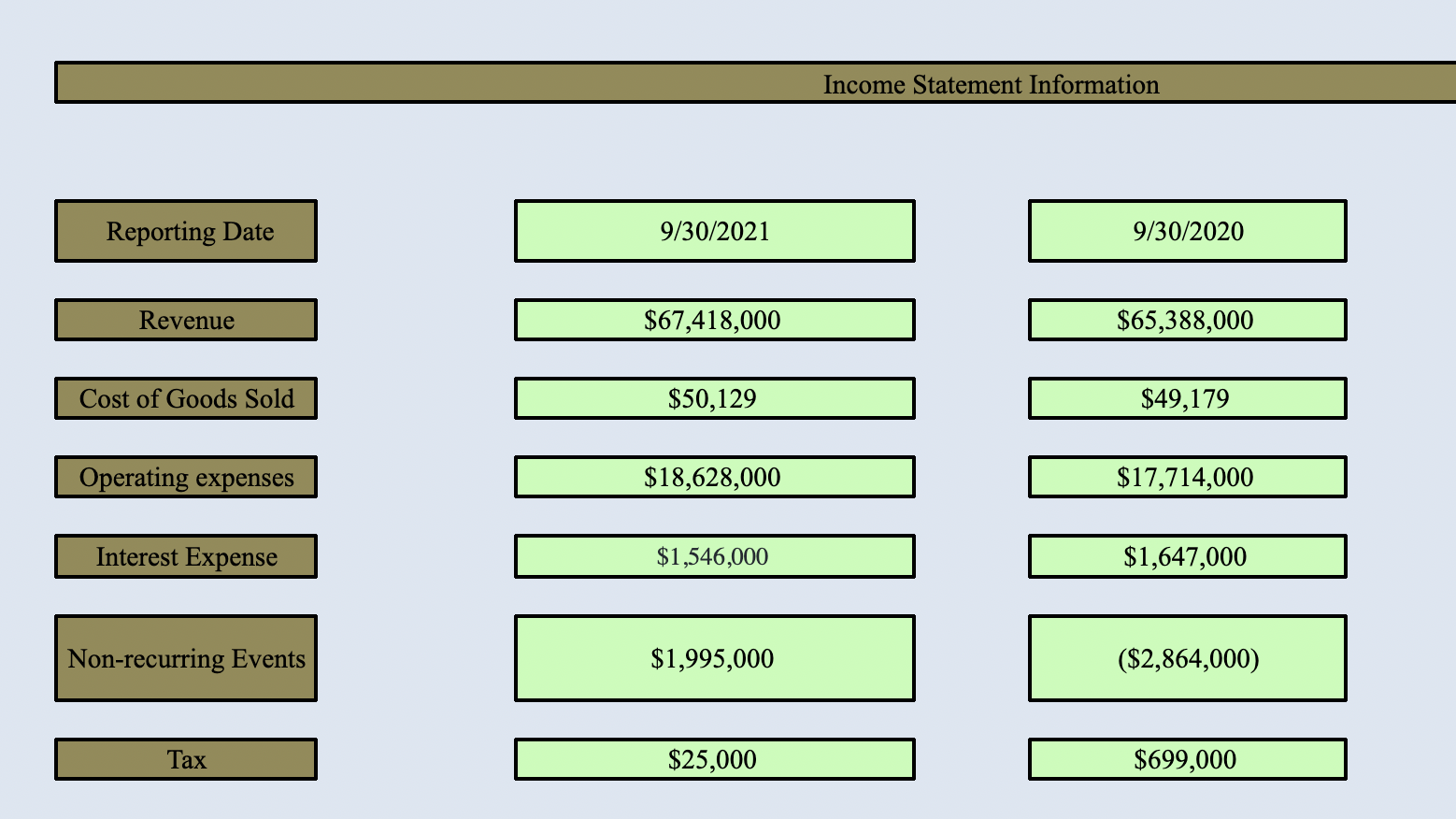

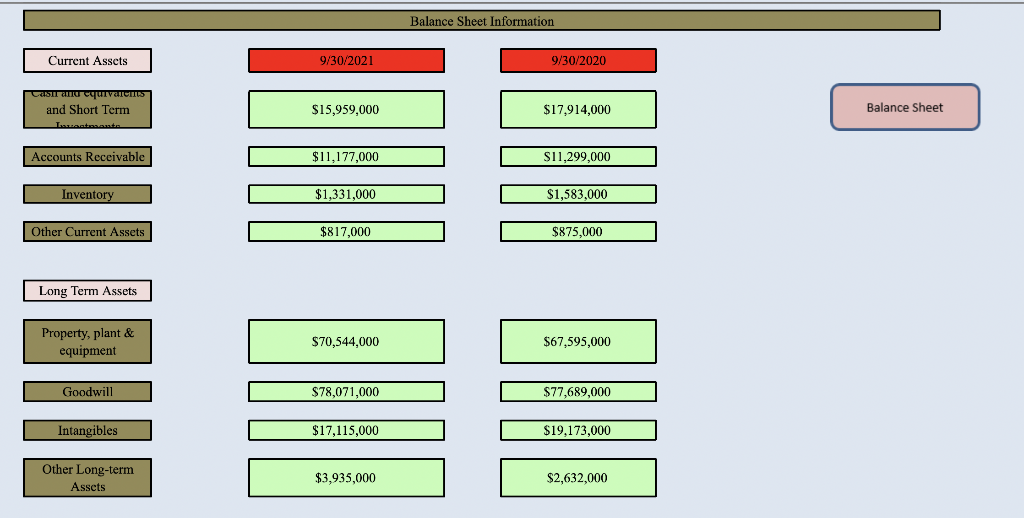

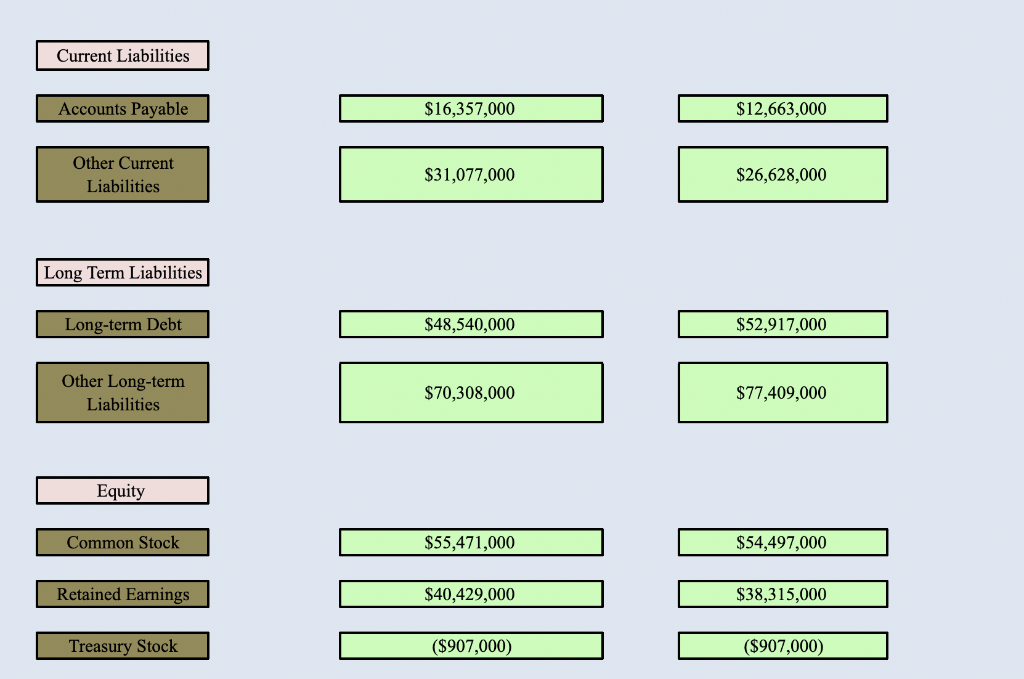

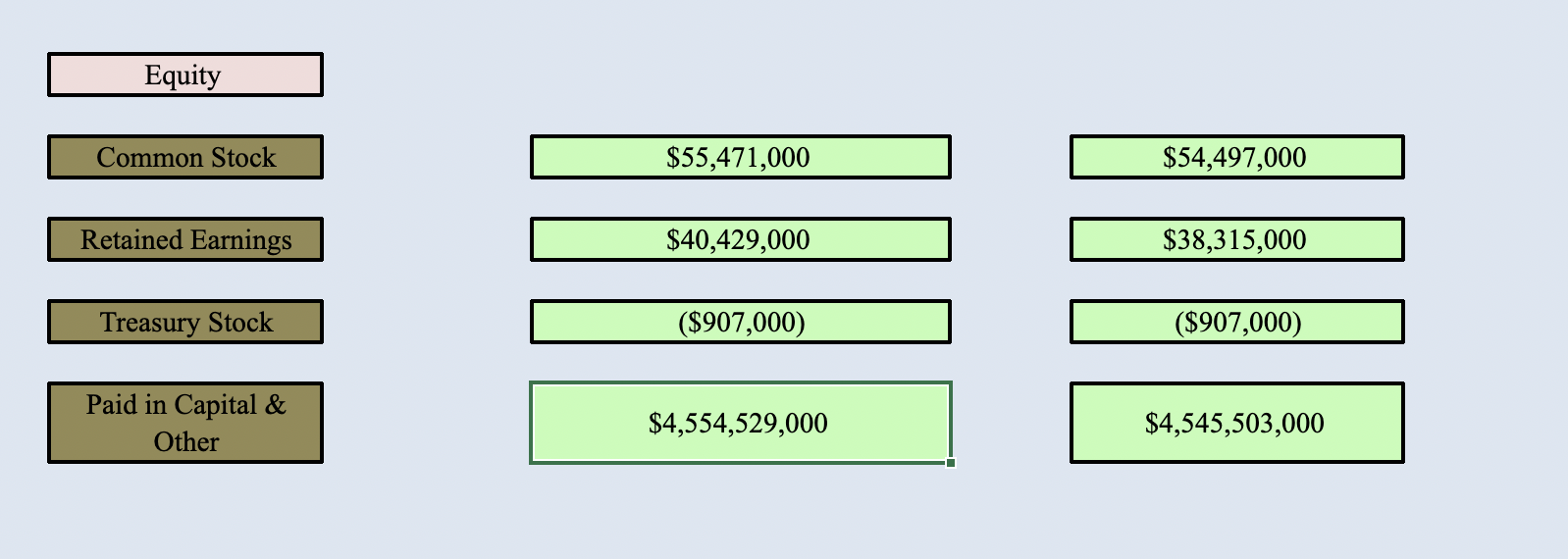

Income Statement Information Reporting Date 9/30/2021 9/30/2020 Revenue $67,418,000 $65,388,000 Cost of Goods Sold $50,129 $49,179 Operating expenses $18,628,000 $17,714,000 Interest Expense $1,546,000 $1,647,000 Non-recurring Events $1,995,000 ($2,864,000) Tax $25,000 $699,000 Balance Sheet Information Balance Sheet Accounts Receivable $11,177,000 $11,299,000 Inventory $1,331,000 $1,583,000 Other Current Assets $817,000 $875,000 Long Term Assets $78,071,000 $77,689,000 Intangibles $17,115,000 $19,173,000 \begin{tabular}{|c|} \hline Other Long-term \\ Assets \\ \hline \end{tabular} $2,632,000 Current Liabilities Accounts Payable \begin{tabular}{|c|} \hline Other Current \\ Liabilities \\ \hline \end{tabular} $31,077,000 $26,628,000 Long Term Liabilities Long-term Debt $48,540,000 $52,917,000 \begin{tabular}{|c|} \hline Other Long-term Liabilities \\ \hline \end{tabular} $70,308,000 $77,409,000 Equity Common Stock $55,471,000 $54,497,000 Retained Earnings $40,429,000 $38,315,000 Treasury Stock ($907,000) ($907,000) Equity Common Stock $55,471,000 \begin{tabular}{|} $54,497,000 \\ \hline \end{tabular} Retained Earnings $40,429,000 $38,315,000 Treasury Stock ($907,000) ($907,000) \begin{tabular}{c} Paid in Capital \& \\ Other \\ \hline \end{tabular} $4,554,529,000 $4,545,503,000 Income Statement Information Reporting Date 9/30/2021 9/30/2020 Revenue $67,418,000 $65,388,000 Cost of Goods Sold $50,129 $49,179 Operating expenses $18,628,000 $17,714,000 Interest Expense $1,546,000 $1,647,000 Non-recurring Events $1,995,000 ($2,864,000) Tax $25,000 $699,000 Balance Sheet Information Balance Sheet Accounts Receivable $11,177,000 $11,299,000 Inventory $1,331,000 $1,583,000 Other Current Assets $817,000 $875,000 Long Term Assets $78,071,000 $77,689,000 Intangibles $17,115,000 $19,173,000 \begin{tabular}{|c|} \hline Other Long-term \\ Assets \\ \hline \end{tabular} $2,632,000 Current Liabilities Accounts Payable \begin{tabular}{|c|} \hline Other Current \\ Liabilities \\ \hline \end{tabular} $31,077,000 $26,628,000 Long Term Liabilities Long-term Debt $48,540,000 $52,917,000 \begin{tabular}{|c|} \hline Other Long-term Liabilities \\ \hline \end{tabular} $70,308,000 $77,409,000 Equity Common Stock $55,471,000 $54,497,000 Retained Earnings $40,429,000 $38,315,000 Treasury Stock ($907,000) ($907,000) Equity Common Stock $55,471,000 \begin{tabular}{|} $54,497,000 \\ \hline \end{tabular} Retained Earnings $40,429,000 $38,315,000 Treasury Stock ($907,000) ($907,000) \begin{tabular}{c} Paid in Capital \& \\ Other \\ \hline \end{tabular} $4,554,529,000 $4,545,503,000

Please provide analysis of income statement and balance sheet

Please provide analysis of income statement and balance sheet