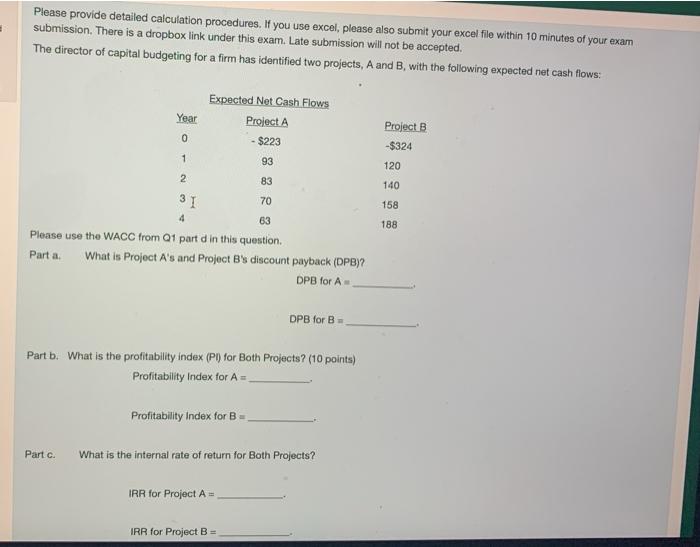

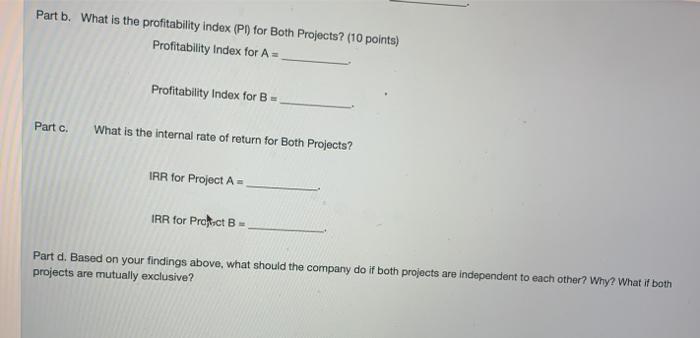

Please provide detailed calculation procedures. If you use excel, please also submit your excel file within 10 minutes of your exam submission. There is a dropbox link under this exam. Late submission will not be accepted. The director of capital budgeting for a firm has identified two projects, A and B with the following expected net cash flows: Expected Net Cash Flows Project A Year 0 - $223 Project B -$324 120 1 93 2 83 140 31 70 158 4 63 188 Please use the WACC from Q1 part d in this question Part a What is Project A's and Project Bs discount payback (DPB)? DPB for A DPB for B Part b. What is the profitability index (Pl) for Both Projects ? (10 points) Profitability Index for A Profitability Index for B - Part c. What is the internal rate of return for Both Projects? IRR for Project A = IRR for Project B- Part b. What is the profitability index (P) for Both Projects? (10 points) Profitability Index for A = Profitability Index for B- Part c. What is the internal rate of return for Both Projects? IRR for Project A - IRR for Protoct B- Part d. Based on your findings above, what should the company do if both projects are independent to each other? Why? What if both projects are mutually exclusive? Please provide detailed calculation procedures. If you use excel, please also submit your excel file within 10 minutes of your exam submission. There is a dropbox link under this exam. Late submission will not be accepted. The director of capital budgeting for a firm has identified two projects, A and B with the following expected net cash flows: Expected Net Cash Flows Project A Year 0 - $223 Project B -$324 120 1 93 2 83 140 31 70 158 4 63 188 Please use the WACC from Q1 part d in this question Part a What is Project A's and Project Bs discount payback (DPB)? DPB for A DPB for B Part b. What is the profitability index (Pl) for Both Projects ? (10 points) Profitability Index for A Profitability Index for B - Part c. What is the internal rate of return for Both Projects? IRR for Project A = IRR for Project B- Part b. What is the profitability index (P) for Both Projects? (10 points) Profitability Index for A = Profitability Index for B- Part c. What is the internal rate of return for Both Projects? IRR for Project A - IRR for Protoct B- Part d. Based on your findings above, what should the company do if both projects are independent to each other? Why? What if both projects are mutually exclusive