Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide details of solution Q7) It is January 9,2015 . The price of a Treasury bond with a 14% coupon that matures on October

please provide details of solution

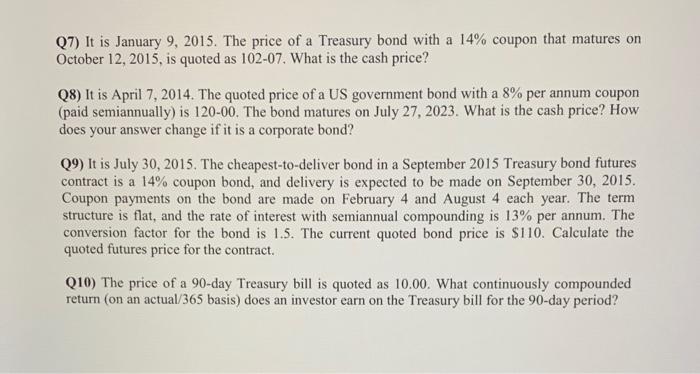

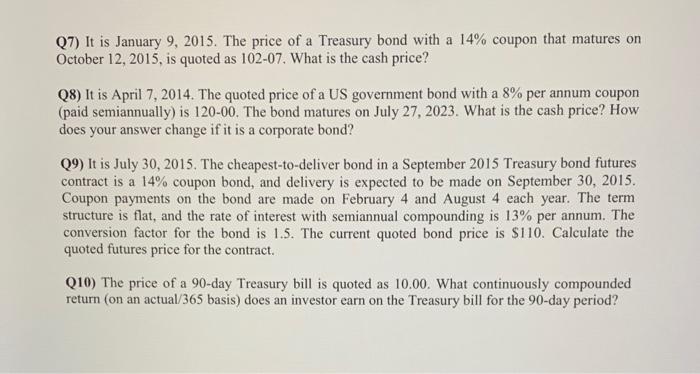

Q7) It is January 9,2015 . The price of a Treasury bond with a 14% coupon that matures on October 12,2015 , is quoted as 10207. What is the cash price? Q8) It is April 7, 2014. The quoted price of a US government bond with a 8% per annum coupon (paid semiannually) is 120-00. The bond matures on July 27,2023 . What is the cash price? How does your answer change if it is a corporate bond? Q9) It is July 30, 2015. The cheapest-to-deliver bond in a September 2015 Treasury bond futures contract is a 14\% coupon bond, and delivery is expected to be made on September 30, 2015. Coupon payments on the bond are made on February 4 and August 4 each year. The term structure is flat, and the rate of interest with semiannual compounding is 13% per annum. The conversion factor for the bond is 1.5. The current quoted bond price is $110. Calculate the quoted futures price for the contract. Q10) The price of a 90-day Treasury bill is quoted as 10.00. What continuously compounded return (on an actual/365 basis) does an investor earn on the Treasury bill for the 90 -day period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started