Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide excel keys for answers according to my provided sheet number, dont copy paste the existing answers Computing Variance Analysis Patterson, Inc. has provided

Please provide excel keys for answers according to my provided sheet number, dont copy paste the existing answers

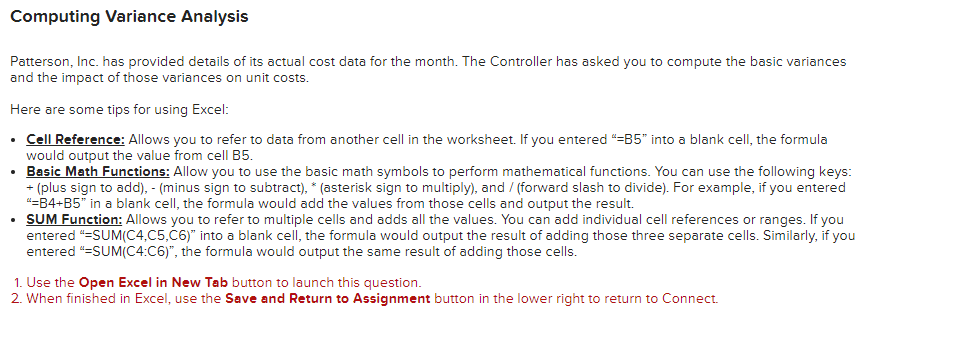

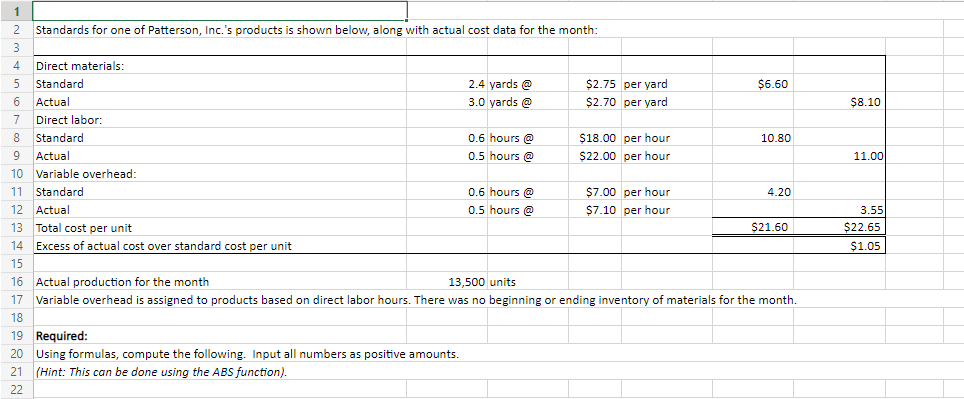

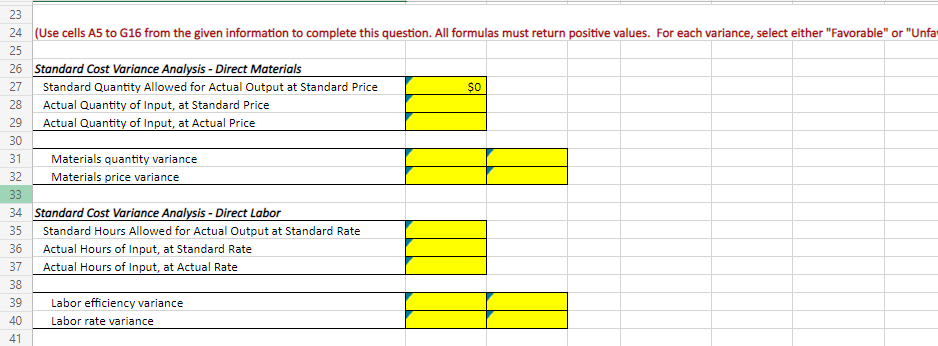

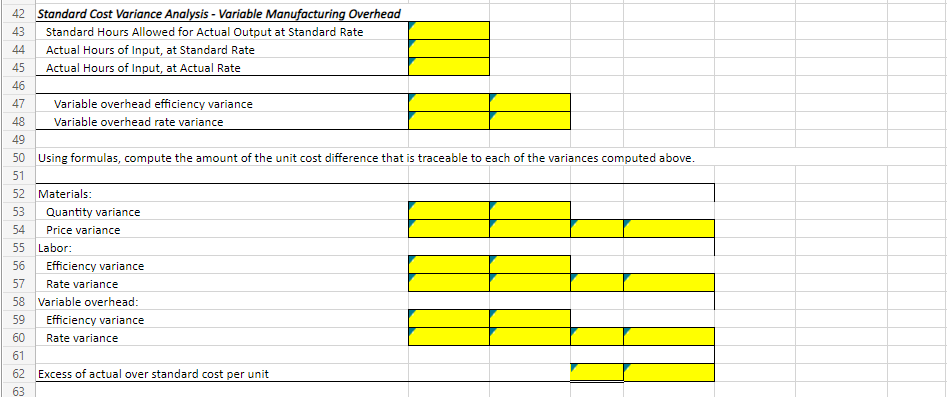

Computing Variance Analysis Patterson, Inc. has provided details of its actual cost data for the month. The Controller has asked you to compute the basic variances and the impact of those variances on unit costs. Here are some tips for using Excel: - Cell Reference: Allows you to refer to data from another cell in the worksheet. If you entered "=B5" into a blank cell, the formula would output the value from cell B5. - Basic Math Functions: Allow you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add), - (minus sign to subtract), (asterisk sign to multiply), and / (forward slash to divide). For example, if you entered "B4+B5" in a blank cell, the formula would add the values from those cells and output the result. - SUM Function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges. If you entered " =SUM(C4,C5,C6)" " into a blank cell, the formula would output the result of adding those three separate cells. Similarly, if you entered "=SUM(C4:C6)", the formula would output the same result of adding those cells. 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect. 16 Actual production for the month 13,500 units 17 Variable overhead is assigned to products based on direct labor hours. There was no beginning or ending inventory of materials for the month. 18 19 Required: 20 Using formulas, compute the following. Input all numbers as positive amounts. 21 (Hint: This can be done using the ABS function). 23 24 (Use cells A5 to G16 from the given information to complete this question. All formulas must return positive values. For each variance, select either "Favorable" or "Unfar \begin{tabular}{|l|l|l|} \hline 25 & & \\ \hline 26 & Standard Cost Variance Analysis - Direct Materials \\ \cline { 2 - 3 } 27 & Standard Quantity Allowed for Actual Output at Standard Price & $0 \\ \hline 28 & Actual Quantity of Input, at Standard Price & \\ \cline { 2 - 3 } 29 & Actual Quantity of Input, at Actual Price & \\ \cline { 2 - 4 } & & \end{tabular} \begin{tabular}{|l|l|l|} \hline 42 & \multicolumn{2}{|l|}{ Standard Cost Variance Analysis - Variable Manufacturing Overhead } \\ \hline 43 & Standard Hours Allowed for Actual Output at Standard Rate & \\ \hline 44 & Actual Hours of Input, at Standard Rate \\ \hline 45 & Actual Hours of Input, at Actual Rate & \\ \hline \end{tabular} Using formulas, compute the amount of the unit cost difference that is traceable to each of the variances computed above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started