Answered step by step

Verified Expert Solution

Question

1 Approved Answer

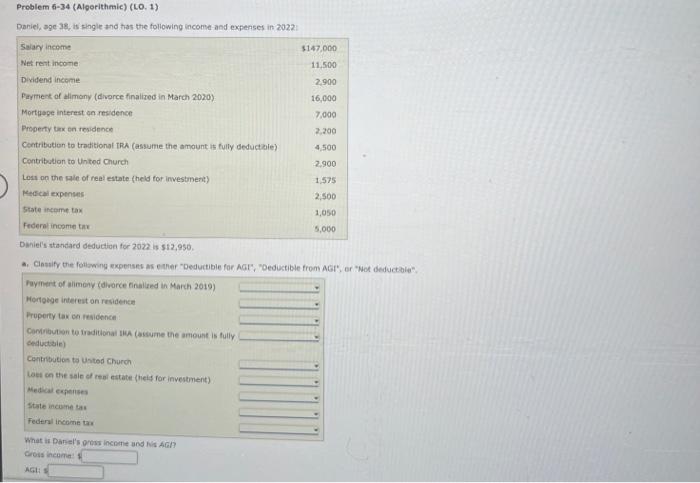

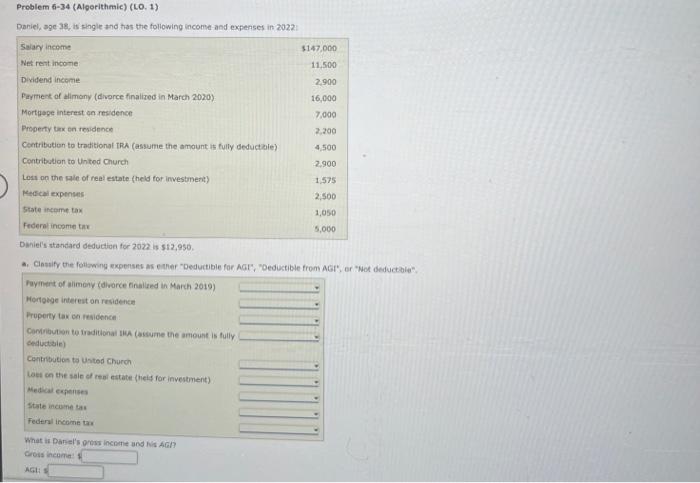

please provide the answers. thank you Problem 6-34 (Algorithnic) (L0. 1) Dariel, age-38, is single and thas the following income and exfenses in 2022 :

please provide the answers. thank you

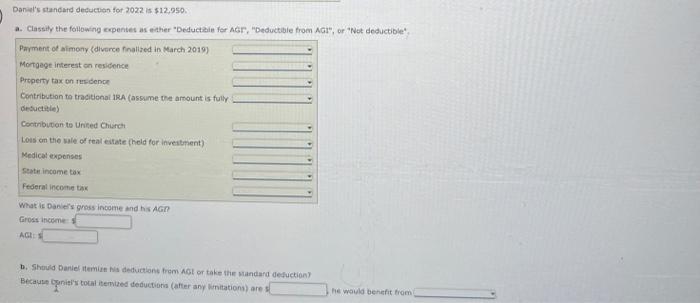

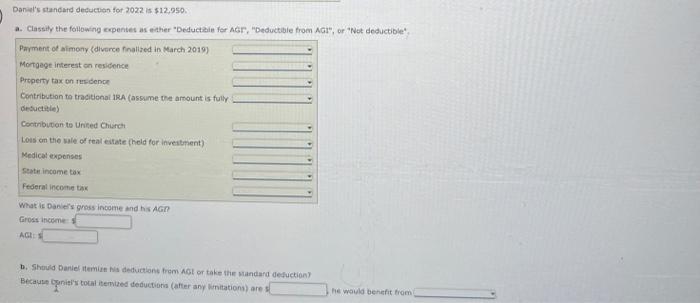

Problem 6-34 (Algorithnic) (L0. 1) Dariel, age-38, is single and thas the following income and exfenses in 2022 : DWhiel's rtathaed deductioe for 2022 is 512,950 . Cinstify the followng expenses as emher "Deductbie far hat", "Deductible froms AgI", or "Not deducthia" Daniel's standurd defucuen for 2022 is $12,950. a. Classity the following expentes as either "Deductaile for ACF, "Deductibie from AGI", or "Not deductible". What is Danie's grass intome and his AGI? Grost income hert: b. Should Dariel itemize Wa deductions from AGt or take the Mandard defuction) Because Conisi's tocal itemized deductions (after any Wmitationa) are f he waula behefit trom

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started