Please provide the correct answers in a similar format

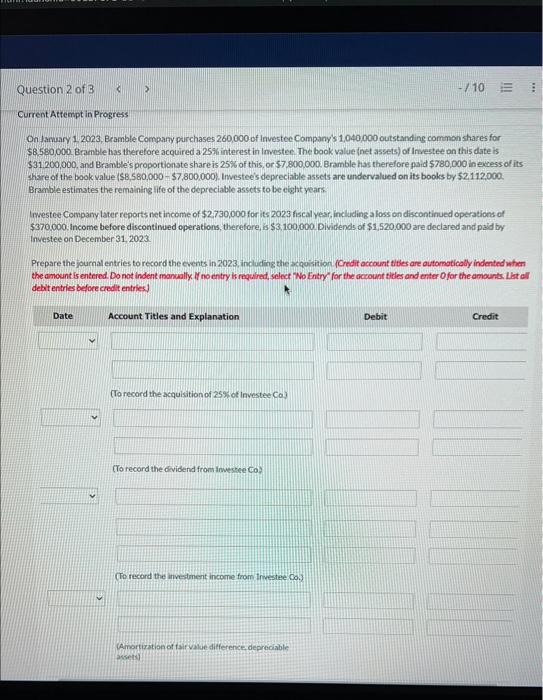

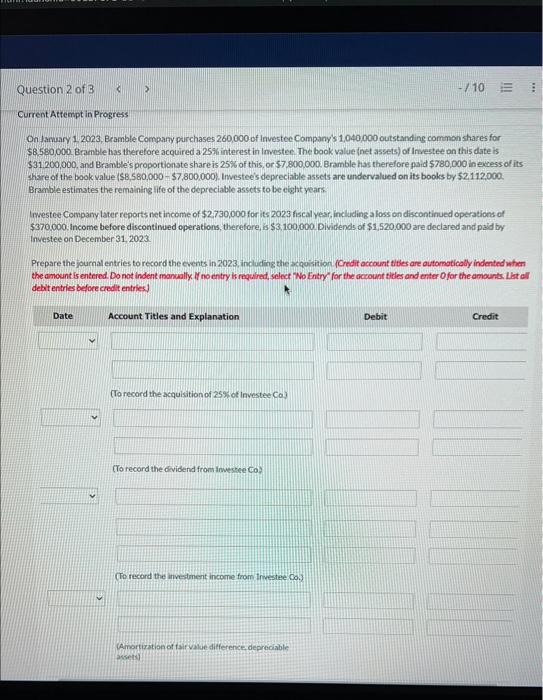

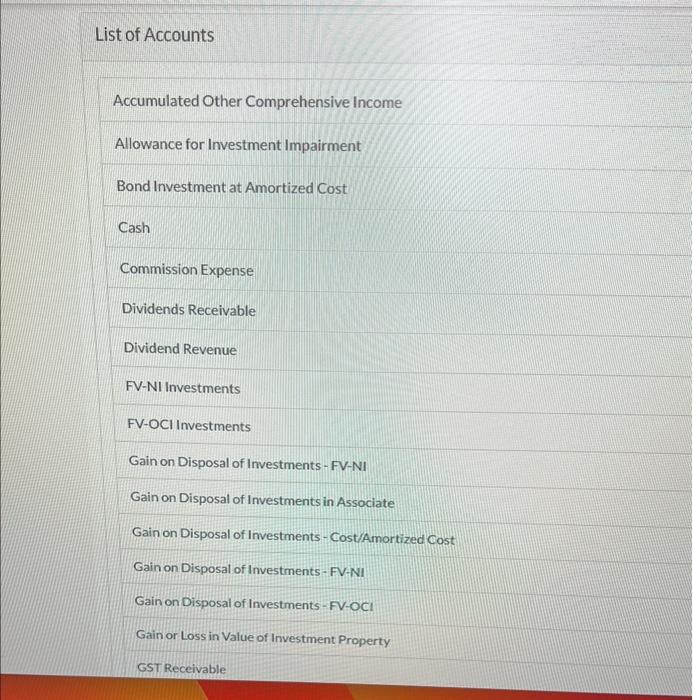

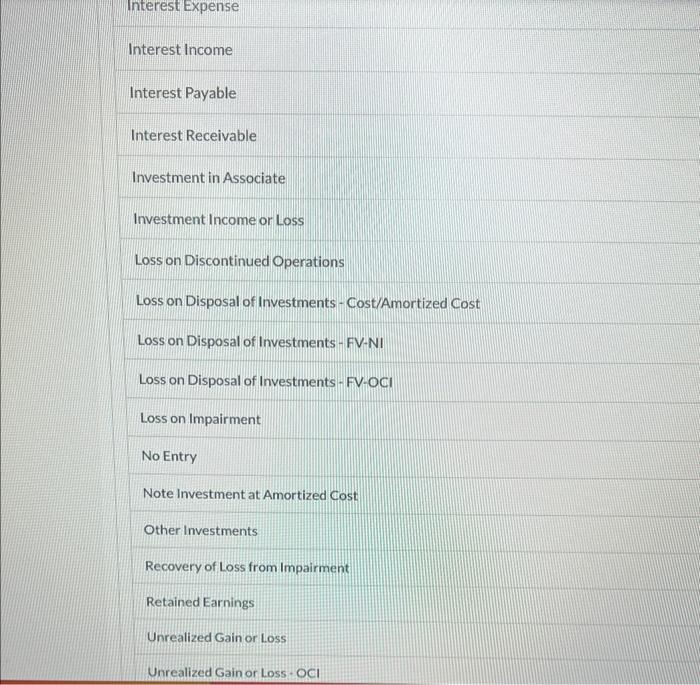

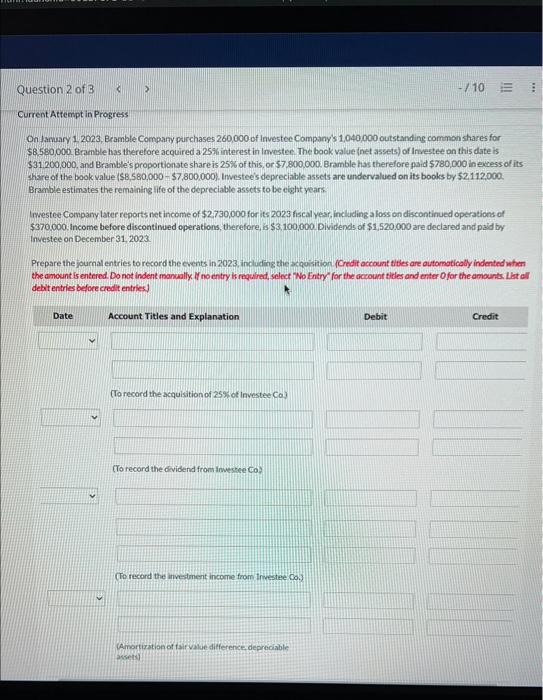

On Jamaary 1. 2023, Eramble Company purchases 260,000 of Investce Company's 1,040,000 outstanding common shares for $8580,000. Bramble has therefore acquired a 25\% interest in Imvestee. The book value (net assets) of Investee on this date is $31200,000, and Branble's proportionste share is 25% of this, or 57,800,000. Bramble has therefore paid $780,000 in excess of its share of the book value $8,580,00057,800,000. Investee's depreciable assets are undervalued on its books by 52,112,000. Bramble estimates the remaining life of the depreciable assets to be eight years. Lmestee Company later reports net income of $2730,000 for its 2023 fiscal year, including a loss on discontinued operations of $370,000. Income before discontimued operations, therefore, is $3,100,000. Dividends of $1,520.000 are declared and paid by Investee on December 31,2023 Prepare the journal entries to record the events in 2023 including the kquisition. (Credit account tibles are automatically indented when the amount is entered Do not indent manually. If no entry is required, select Wo Entry' for the account titles and enter O for the amounts. Wat ol debit entries beforecredlt entries) List of Accounts Accumulated Other Comprehensive Income Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Commission Expense Dividends Receivable Dividend Revenue FV-NI Investments FV-OCl Investments Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments in Associate Gain on Disposal of Investments - Cost/Amortized Cost Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments - FV-OCI Gain or Loss in Value of Investment Property GST Receivable Interest Expense Interest Income Interest Payable Interest Receivable Investment in Associate Investment Income or Loss Loss on Discontinued Operations Loss on Disposal of Investments - Cost/Amortized Cost Loss on Disposal of Investments - FV-NI Loss on Disposal of Investments - FV-OCI Loss on Impairment No Entry Note Investment at Amortized Cost Other Investments Recovery of Loss from Impairment Retained Earnings Unrealized Gain or Loss Unrealized Gain or Loss- OCI On Jamaary 1. 2023, Eramble Company purchases 260,000 of Investce Company's 1,040,000 outstanding common shares for $8580,000. Bramble has therefore acquired a 25\% interest in Imvestee. The book value (net assets) of Investee on this date is $31200,000, and Branble's proportionste share is 25% of this, or 57,800,000. Bramble has therefore paid $780,000 in excess of its share of the book value $8,580,00057,800,000. Investee's depreciable assets are undervalued on its books by 52,112,000. Bramble estimates the remaining life of the depreciable assets to be eight years. Lmestee Company later reports net income of $2730,000 for its 2023 fiscal year, including a loss on discontinued operations of $370,000. Income before discontimued operations, therefore, is $3,100,000. Dividends of $1,520.000 are declared and paid by Investee on December 31,2023 Prepare the journal entries to record the events in 2023 including the kquisition. (Credit account tibles are automatically indented when the amount is entered Do not indent manually. If no entry is required, select Wo Entry' for the account titles and enter O for the amounts. Wat ol debit entries beforecredlt entries) List of Accounts Accumulated Other Comprehensive Income Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Commission Expense Dividends Receivable Dividend Revenue FV-NI Investments FV-OCl Investments Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments in Associate Gain on Disposal of Investments - Cost/Amortized Cost Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments - FV-OCI Gain or Loss in Value of Investment Property GST Receivable Interest Expense Interest Income Interest Payable Interest Receivable Investment in Associate Investment Income or Loss Loss on Discontinued Operations Loss on Disposal of Investments - Cost/Amortized Cost Loss on Disposal of Investments - FV-NI Loss on Disposal of Investments - FV-OCI Loss on Impairment No Entry Note Investment at Amortized Cost Other Investments Recovery of Loss from Impairment Retained Earnings Unrealized Gain or Loss Unrealized Gain or Loss- OCI