Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide the excel work of this Firm A is a multinational corporation with a subsidiary in the U.K that remits all their earnings to

Please provide the excel work of this

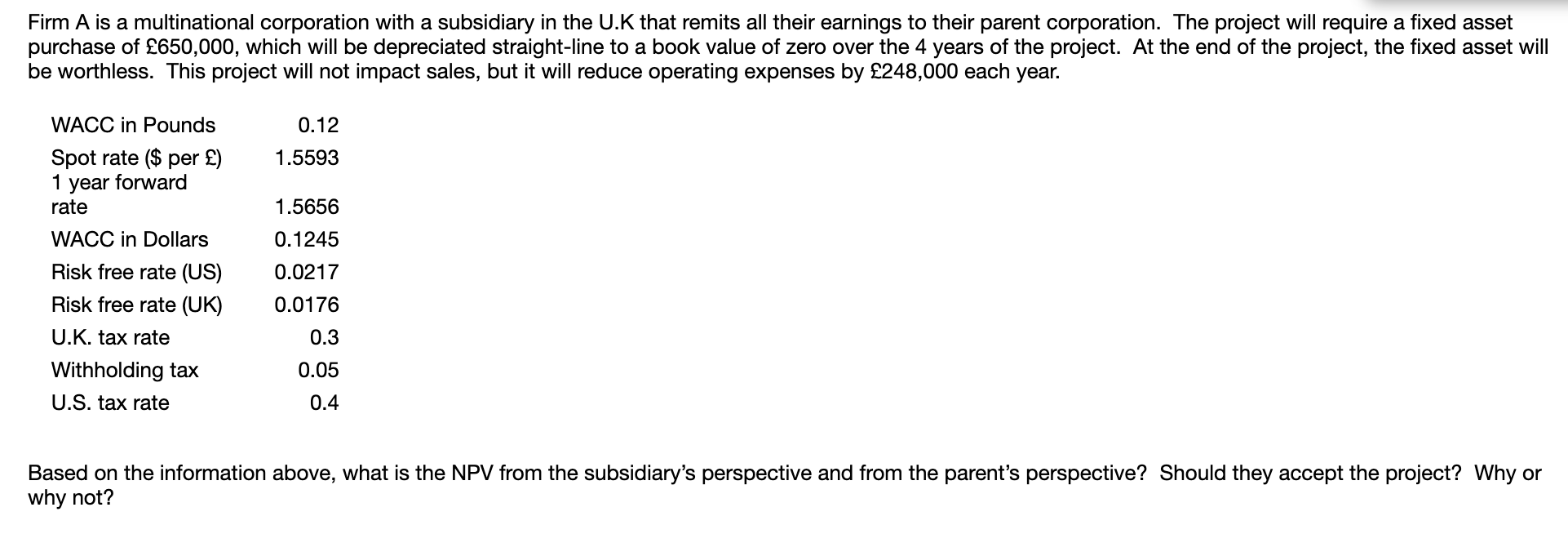

Firm A is a multinational corporation with a subsidiary in the U.K that remits all their earnings to their parent corporation. The project will require a fixed asset purchase of 650,000, which will be depreciated straight-line to a book value of zero over the 4 years of the project. At the end of the project, the fixed asset will be worthless. This project will not impact sales, but it will reduce operating expenses by 248,000 each year. 0.12 1.5593 WACC in Pounds Spot rate ($ per ) 1 year forward rate WACC in Dollars Risk free rate (US) Risk free rate (UK) U.K. tax rate Withholding tax U.S. tax rate 1.5656 0.1245 0.0217 0.0176 0.3 0.05 0.4 toy Based on the information above, what is the NPV from the subsidiary's perspective and from the parent's perspective? Should they accept the project? Why or why not? Firm A is a multinational corporation with a subsidiary in the U.K that remits all their earnings to their parent corporation. The project will require a fixed asset purchase of 650,000, which will be depreciated straight-line to a book value of zero over the 4 years of the project. At the end of the project, the fixed asset will be worthless. This project will not impact sales, but it will reduce operating expenses by 248,000 each year. 0.12 1.5593 WACC in Pounds Spot rate ($ per ) 1 year forward rate WACC in Dollars Risk free rate (US) Risk free rate (UK) U.K. tax rate Withholding tax U.S. tax rate 1.5656 0.1245 0.0217 0.0176 0.3 0.05 0.4 toy Based on the information above, what is the NPV from the subsidiary's perspective and from the parent's perspective? Should they accept the project? Why or why notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started