PLEASE PUT SOLUTION IN THE SAME FORMAT AS THE IMAGE. THANK YOU!

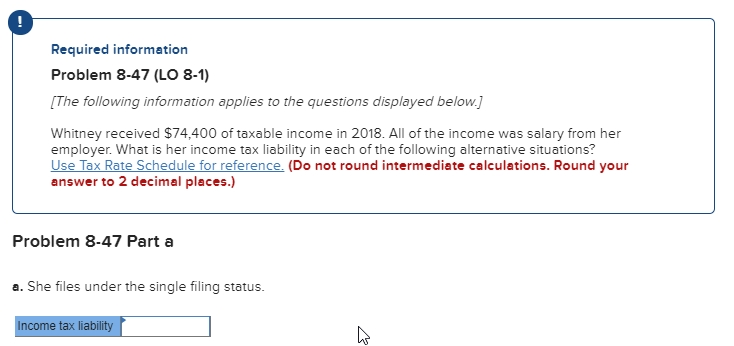

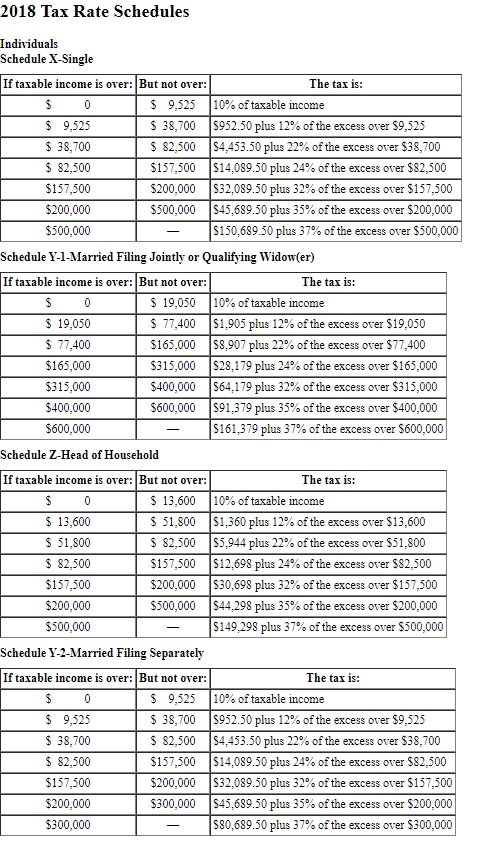

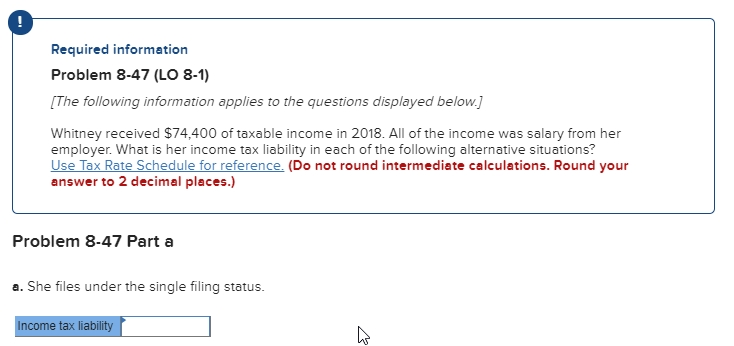

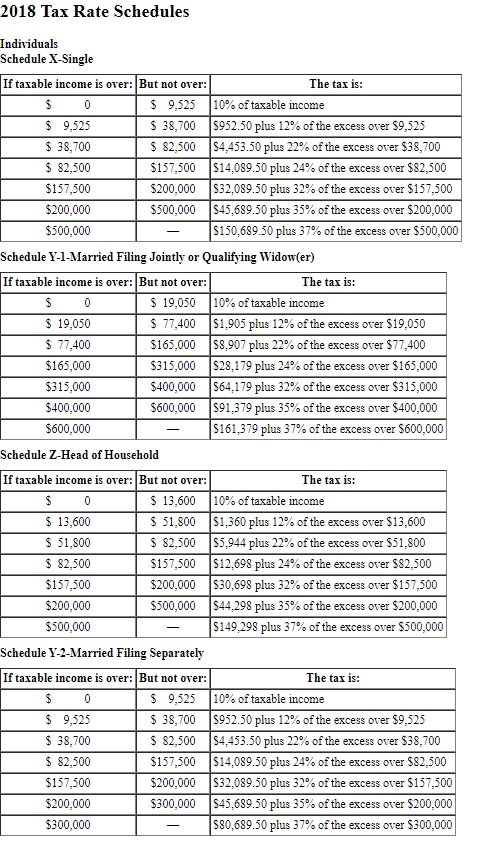

Required information Problem 8-47 (LO 8-1) The following information applies to the questions displayed below.] Whitney received $74,400 of taxable income in 2018. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Problem 8-47 Part a a. She files under the single filing status Income tax liability b. She files a joint tax return with her spouse. Together their taxable income is $74,400. Income tax liability She is married but files a separate tax return. Her taxable income is $74,400. Income tax liability .She files as a head of household. Income tax liability 2018 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 9,525 10% of taxable income 0 $952.50 plus 12% of the excess over $9,525 9,525 38,700 $ 38,700 $ 82,500 $4,453.50 plus 22% of the excess over $38,700 $14,089.50 plus 24% of the excess over $82,500 $32,089.50 plus 32% of the excess over $157,500 82,500 $157,500 $157,500 $200,000 $45,689.50 plus 35% of the excess over $200,000 $150,689.50 plus 37% of the excess over $500,000 $500,000 $200,000 $500,000 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is $ $ 19,050 10% of taxable income 0 $1,905 plus 12% of the excess over $19,050 S8,907 plus 22% of the excess over $77,400 S28,179 plus 24% ofthe excess over $165,000 $64,179 plus 32% of the excess over $315,000 $19,050 77,400 $77,400 $165,000 $165,000 $315,000 $315,000 $400,000 $91,379 plus 35% ofthe excess over $400,000 $161,379 plus 37% of the excess over $600,000 $400,000 $600,000 $600,000 Schedule Z-Head of Household If taxable income is over: But not over: The tax is $ $13,600 10% of taxable income 0 $ 51,800 $ 82,500 S1,360 plus 12% of the excess over $13,600 S5,944 plus 22% of the excess over $51,800 S12,698 plus 24% ofthe excess over $82,500 $30,698 plus 32% of the excess over $157,500 13,600 $51,800 82,500 $157,500 $157,500 $200,000 $44,298 plus 35% of the excess over $200,000 $200,000 $500,000 $149,298 plus 37% of the excess over $500,000 $500,000 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is $ $ 9,525 10% of taxable income 0 $952.50 plus 12% of the excess over $9,525 9,525 38,700 $ 38,700 $ 82,500 $4,453.50 plus 22 % of the excess over $38,700 $14,089.50 plus 24% of the excess over $82,500 $32,089.50 plus 32% of the excess over $157,500 82,500 $157,500 $157,500 $200,000 $45,689.50 plus 35% of the excess over $200,000 $80,689.50 plus 37% of the excess over $300,000 $200,000 $300,000 $300,000