please put the answers to the questions in order :)

please put the answers to the questions in order :)

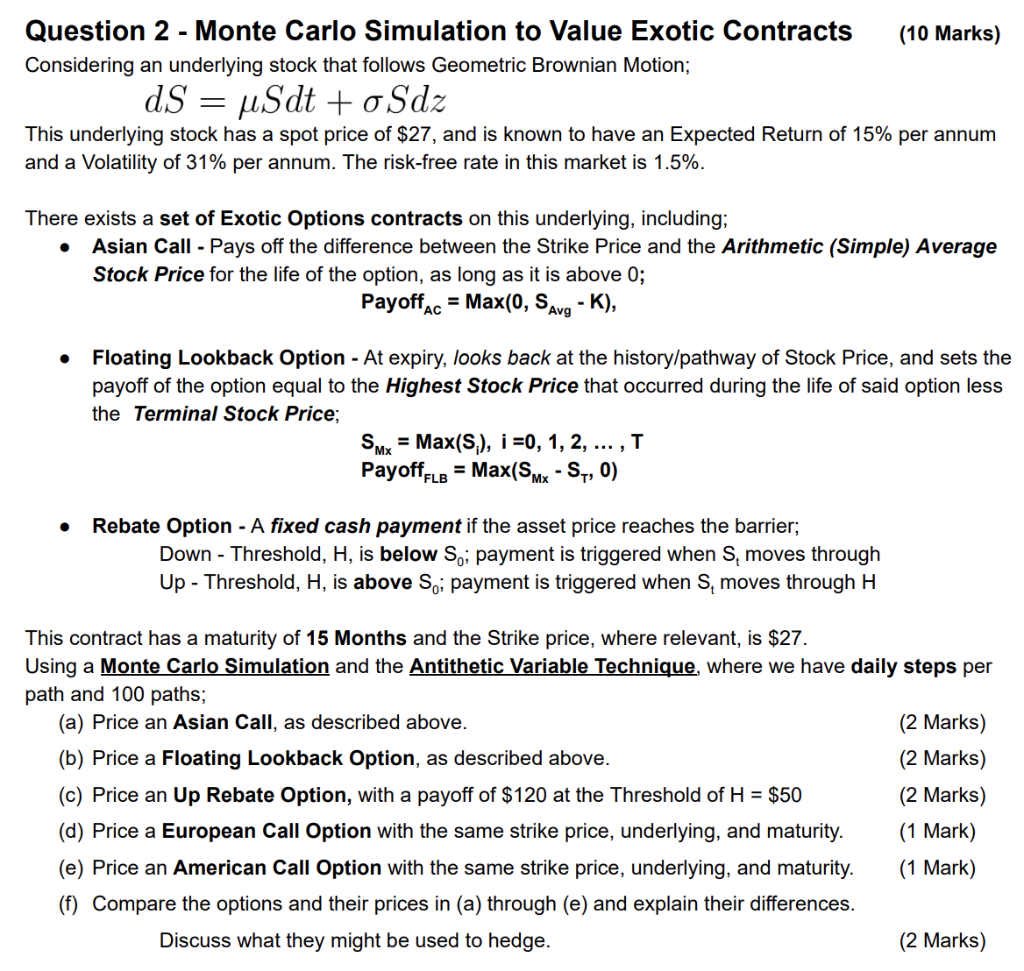

Question 2 - Monte Carlo Simulation to Value Exotic Contracts (10 Marks) Considering an underlying stock that follows Geometric Brownian Motion; dS = u.Sdt +oSdz This underlying stock has a spot price of $27, and is known to have an Expected Return of 15% per annum and a Volatility of 31% per annum. The risk-free rate in this market is 1.5%. There exists a set of Exotic Options contracts on this underlying, including; Asian Call - Pays off the difference between the Strike Price and the Arithmetic (Simple) Average Stock Price for the life of the option, as long as it is above 0; Payoffac = Max(0, SA - K), Avg Floating Lookback Option - At expiry, looks back at the history/pathway of Stock Price, and sets the payoff of the option equal to the Highest Stock Price that occurred during the life of said option less the Terminal Stock Price; SMx = Max(S), i =0, 1, 2, ...,T Payoffple = Max(SMx - S, 0) Rebate Option - A fixed cash payment if the asset price reaches the barrier; Down - Threshold, H, is below So; payment is triggered when S, moves through Up - Threshold, H, is above So; payment is triggered when S, moves through H This contract has a maturity of 15 Months and the Strike price, where relevant, is $27. Using a Monte Carlo Simulation and the Antithetic Variable Technique, where we have daily steps per path and 100 paths; (a) Price an Asian Call, as described above. (2 Marks) (b) Price a Floating Lookback Option, as described above. (2 Marks) (c) Price an Up Rebate Option, with a payoff of $120 at the Threshold of H = $50 (2 Marks) (d) Price a European Call Option with the same strike price, underlying, and maturity. (1 Mark) (e) Price an American Call Option with the same strike price, underlying, and maturity. (1 Mark) (f) Compare the options and their prices in (a) through (e) and explain their differences. Discuss what they might be used to hedge. (2 Marks) Question 2 - Monte Carlo Simulation to Value Exotic Contracts (10 Marks) Considering an underlying stock that follows Geometric Brownian Motion; dS = u.Sdt +oSdz This underlying stock has a spot price of $27, and is known to have an Expected Return of 15% per annum and a Volatility of 31% per annum. The risk-free rate in this market is 1.5%. There exists a set of Exotic Options contracts on this underlying, including; Asian Call - Pays off the difference between the Strike Price and the Arithmetic (Simple) Average Stock Price for the life of the option, as long as it is above 0; Payoffac = Max(0, SA - K), Avg Floating Lookback Option - At expiry, looks back at the history/pathway of Stock Price, and sets the payoff of the option equal to the Highest Stock Price that occurred during the life of said option less the Terminal Stock Price; SMx = Max(S), i =0, 1, 2, ...,T Payoffple = Max(SMx - S, 0) Rebate Option - A fixed cash payment if the asset price reaches the barrier; Down - Threshold, H, is below So; payment is triggered when S, moves through Up - Threshold, H, is above So; payment is triggered when S, moves through H This contract has a maturity of 15 Months and the Strike price, where relevant, is $27. Using a Monte Carlo Simulation and the Antithetic Variable Technique, where we have daily steps per path and 100 paths; (a) Price an Asian Call, as described above. (2 Marks) (b) Price a Floating Lookback Option, as described above. (2 Marks) (c) Price an Up Rebate Option, with a payoff of $120 at the Threshold of H = $50 (2 Marks) (d) Price a European Call Option with the same strike price, underlying, and maturity. (1 Mark) (e) Price an American Call Option with the same strike price, underlying, and maturity. (1 Mark) (f) Compare the options and their prices in (a) through (e) and explain their differences. Discuss what they might be used to hedge. (2 Marks)

please put the answers to the questions in order :)

please put the answers to the questions in order :)