please read and answer questions 1-4

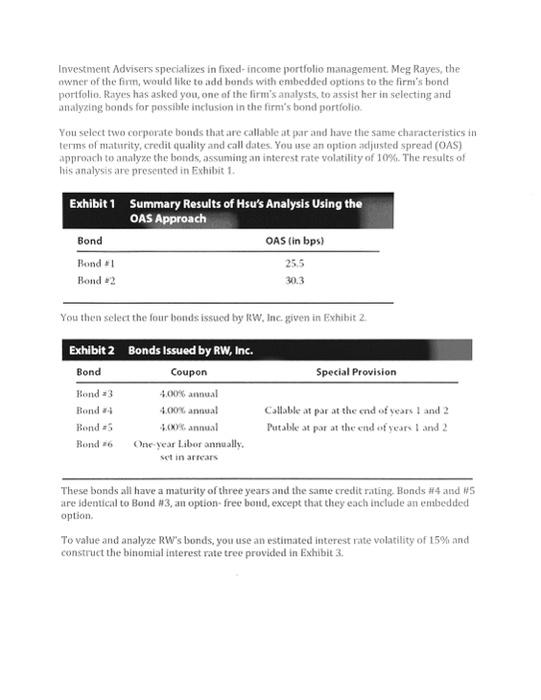

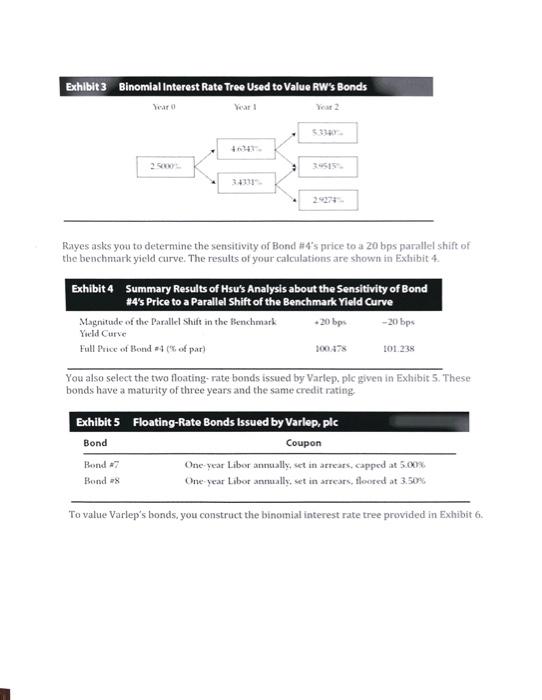

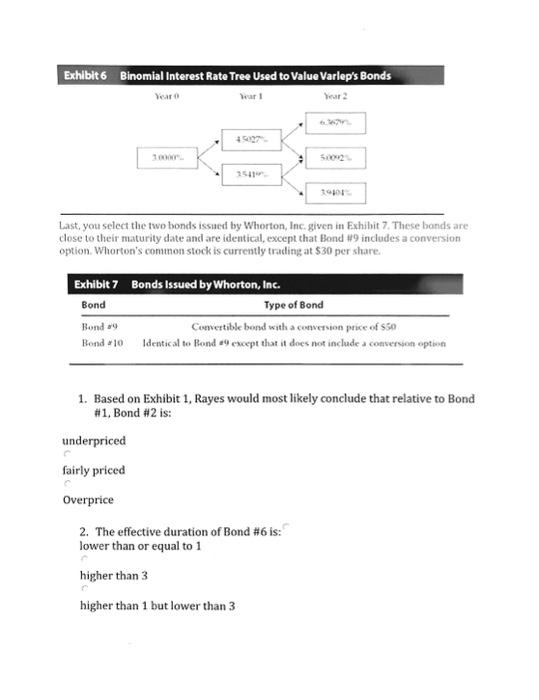

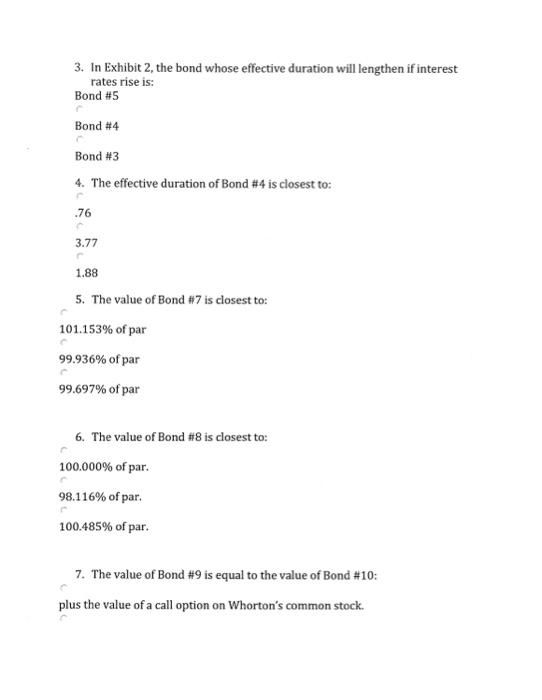

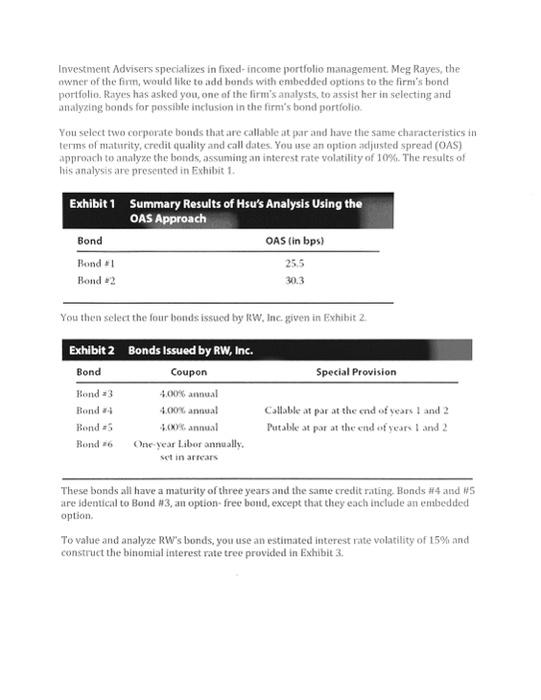

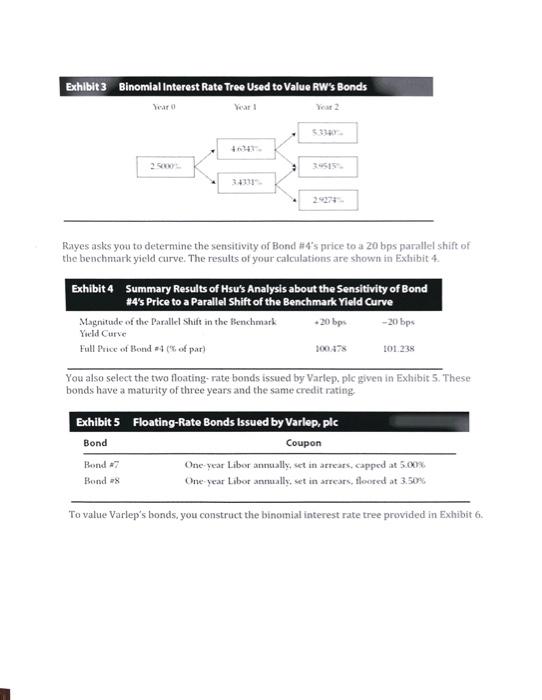

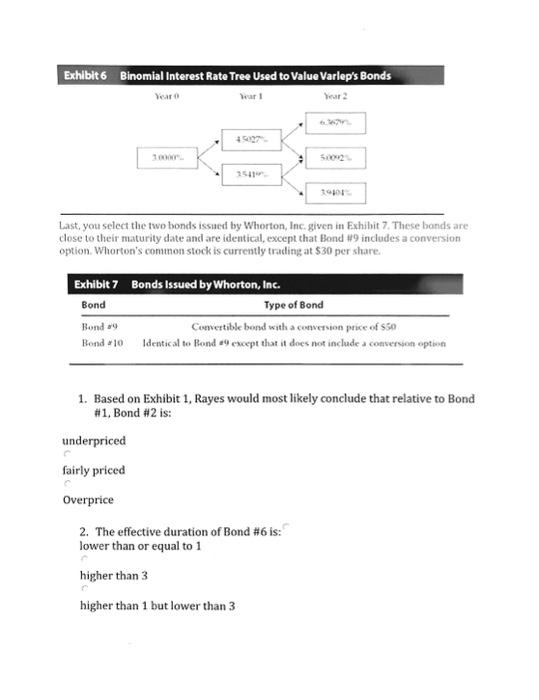

Investment Advisers specializes in fixed-income portfolio managenent. Meg Rayes, the awner of the firm, would like to add bonds with embedded options to the firn's bond portfolio. Rayes has asked you, one of the firm's analysts, to assist her in selecting and analyzing bonds for possible inclusion in the firmi's bond portiolio. You select two corporate bonds that are callable at par and have the same characteristics in terms of matirity, credit quality and call dates. You ase an option adjusted spread (OAS) approach to analyze the bouds, assuming an interest rate volatility of 10%. The results of his analysis are presented in Exhilsit 1. You then select the four bonds issued by Rw, Inc, given in Exhibit 2 These bonds all have a maturity of three years and the same credit rating. Bonds #4 and 15 are identical to Bond 43 , an option- free bond, except that they each include an embedded option. To value and analyze RW's bonds, you use an estimated interest rate volatility of 15% and construct the binomial interest rate tree provided in Exhibit 3. Rayes asks you to determine the sensitivity of Bond 14 's price to a 20 bps parallel shift of the benchmark yield curve. The results of your calculations are shown in Exhibit 4. You also select the two floating- rate bonds issued by Varlep. plc given in Exhibit 5. These bonds have a maturity of three years and the same credit rating, To value Varlep's bonds, you construct the binomial interest rate tree provided in Exhibit 6. Last, you select the two bonds issued by Whorton, Inc. given in Exhibit 7. These bonds are dose to their maturity date and are identical, except that Bond #9 includes a conversion option. Whorton's conumon stock is currently traditg at $30 per share. 1. Based on Exhibit 1, Rayes would most likely conclude that relative to Bond \#1, Bond \#2 is: underpriced fairly priced Overprice 3. In Exhibit 2, the bond whose effective duration will lengthen if interest rates rise is: Bond #5 Bond #4 Bond #3 4. The effective duration of Bond \#4 is closest to: .76 3.77 1.88 5. The value of Bond #7 is closest to: 101.153% of par 99.936% of par 99.697% of par 6. The value of Bond #8 is closest to: 100.000% of par. 98.116% of par. 100.485% of par. 7. The value of Bond #9 is equal to the value of B ond #10 : plus the value of a call option on Whorton's common stock