Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please read question carefully, this question is unique when compared to similar questions posted before. 1) An importer of Swiss watches has an account payable

please read question carefully, this question is unique when compared to similar questions posted before.

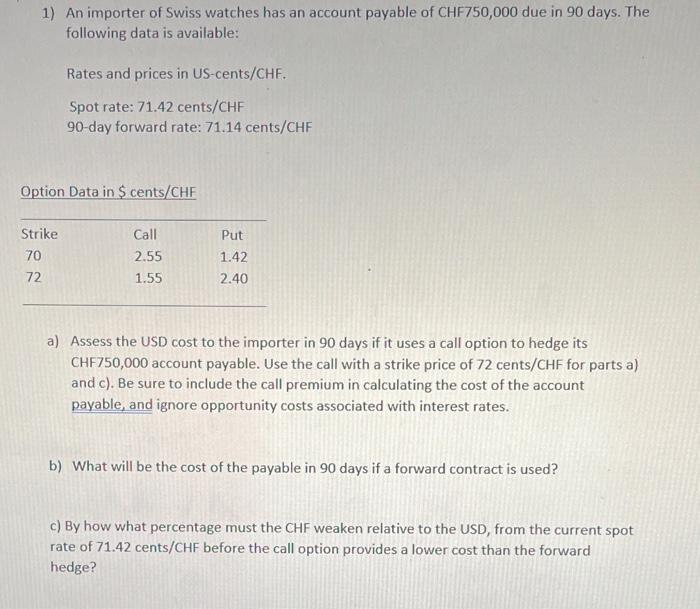

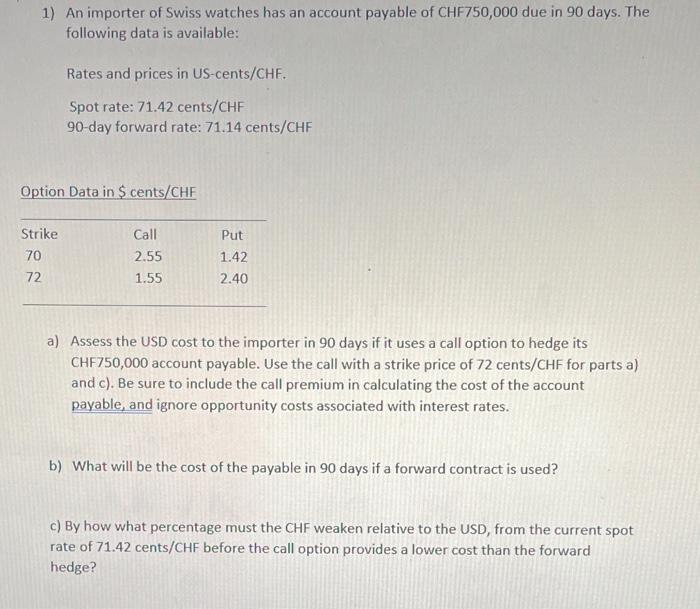

1) An importer of Swiss watches has an account payable of CHF750,000 due in 90 days. The following data is available: Rates and prices in US-cents/CHF. Spot rate: 71.42 cents/CHF 90-day forward rate: 71.14 cents/CHF Option Data in $ cents/CHF Strike 70 72 Call 2.55 1.55 Put 1.42 2.40 a) Assess the USD cost to the importer in 90 days if it uses a call option to hedge its CHF750,000 account payable. Use the call with a strike price of 72 cents/CHF for parts a) and c). Be sure to include the call premium in calculating the cost of the account payable, and ignore opportunity costs associated with interest rates. b) What will be the cost of the payable in 90 days if a forward contract is used? c) By how what percentage must the CHF weaken relative to the USD, from the current spot rate of 71.42 cents/CHF before the call option provides a lower cost than the forward hedge? 1) An importer of Swiss watches has an account payable of CHF750,000 due in 90 days. The following data is available: Rates and prices in US-cents/CHF. Spot rate: 71.42 cents/CHF 90-day forward rate: 71.14 cents/CHF Option Data in $ cents/CHF Strike 70 72 Call 2.55 1.55 Put 1.42 2.40 a) Assess the USD cost to the importer in 90 days if it uses a call option to hedge its CHF750,000 account payable. Use the call with a strike price of 72 cents/CHF for parts a) and c). Be sure to include the call premium in calculating the cost of the account payable, and ignore opportunity costs associated with interest rates. b) What will be the cost of the payable in 90 days if a forward contract is used? c) By how what percentage must the CHF weaken relative to the USD, from the current spot rate of 71.42 cents/CHF before the call option provides a lower cost than the forward hedge

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started