Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please read the question carefully and answer sincerely, and answer as soon as you can. A partial answer would be rated negative. But, a Complete

Please read the question carefully and answer sincerely, and answer as soon as you can. A partial answer would be rated negative. But, a Complete and sincere answer would be rated positive instantly. Thank you

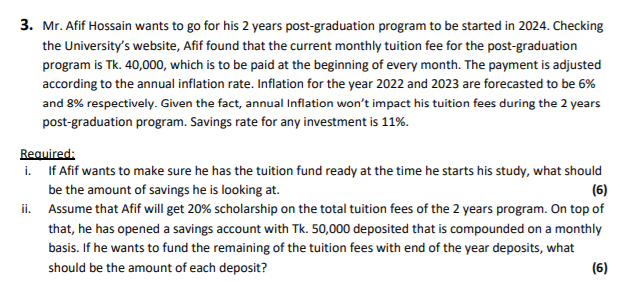

3. Mr. Afif Hossain wants to go for his 2 years post-graduation program to be started in 2024. Checking the University's website, Afif found that the current monthly tuition fee for the post-graduation program is Tk. 40,000, which is to be paid at the beginning of every month. The payment is adjusted according to the annual inflation rate. Inflation for the year 2022 and 2023 are forecasted to be 6% and 8% respectively. Given the fact, annual Inflation won't impact his tuition fees during the 2 years post-graduation program. Savings rate for any investment is 11%. Required: i. If Afif wants to make sure he has the tuition fund ready at the time he starts his study, what should be the amount of savings he is looking at. (6) ii. Assume that Afif will get 20% scholarship on the total tuition fees of the 2 years program. On top of that, he has opened a savings account with Tk. 50,000 deposited that is compounded on a monthly basis. If he wants to fund the remaining of the tuition fees with end of the year deposits, what should be the amount of each deposit? (6)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started