Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE refer to data table and requirements for your answer as necessary. PLEASE Right click on image and open image in new tab if text

PLEASE refer to data table and requirements for your answer as necessary.

PLEASE Right click on image and open image in new tab if text is too blurry.

PLEASE type out your answer or use Excel as it is easier to read than handwriting.

PLEASE round all answers as necessary.

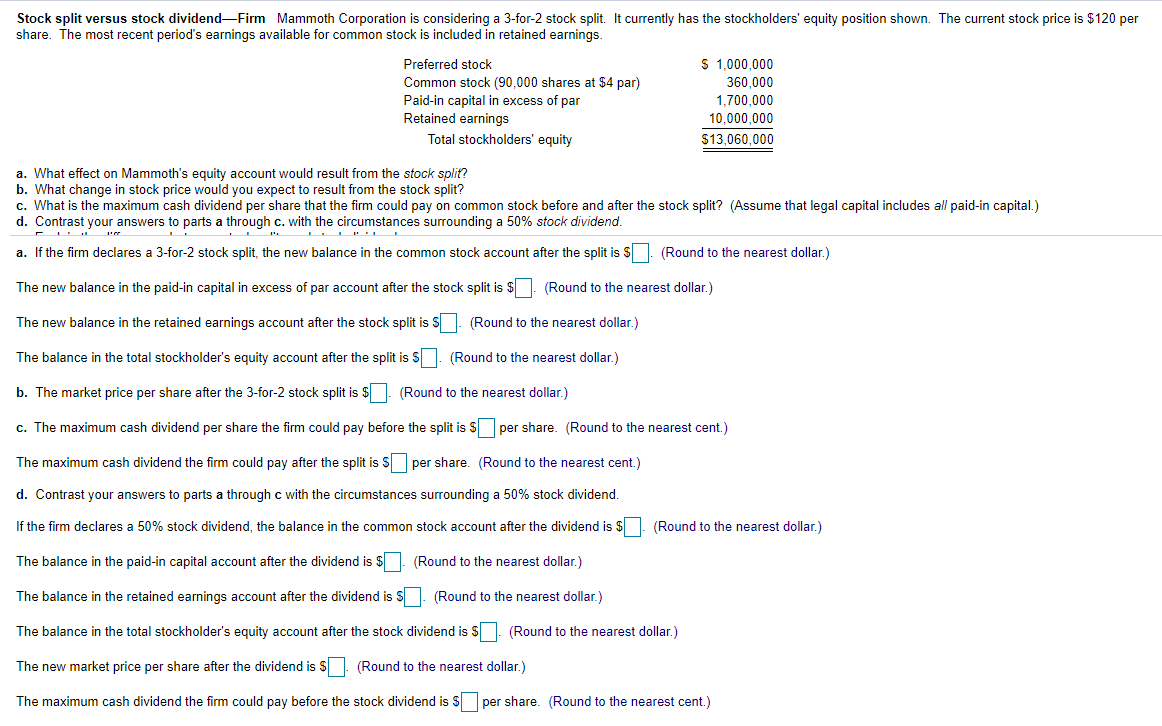

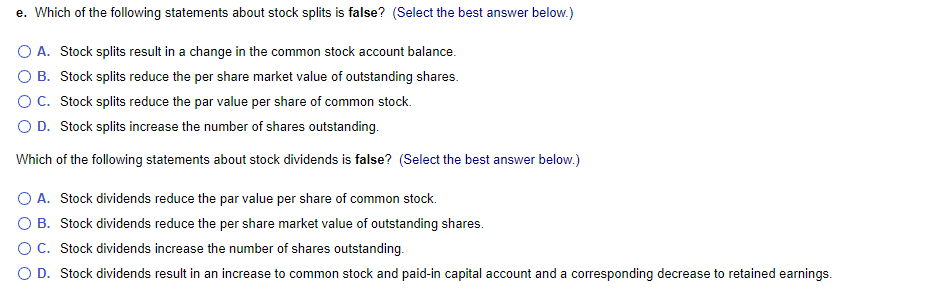

Stock split versus stock dividendFirm Mammoth Corporation is considering a 3-for-2 stock split. It currently has the stockholders' equity position shown. The current stock price is $120 per share. The most recent period's earnings available for common stock is included in retained earnings. Preferred stock S 1,000,000 Common stock (90,000 shares at $4 par) 360,000 Paid-in capital in excess of par 1,700,000 Retained earnings 10,000,000 Total stockholders' equity $13,060,000 a. What effect on Mammoth's equity account would result from the stock split? b. What change in stock price would you expect to result from the stock split? c. What is the maximum cash dividend per share that the firm could pay on common stock before and after the stock split? (Assume that legal capital includes all paid-in capital.) d. Contrast your answers to parts a through c. with the circumstances surrounding a 50% stock dividend. a. If the firm declares a 3-for-2 stock split, the new balance in the common stock account after the split is $. (Round to the nearest dollar.) The new balance in the paid-in capital in excess of par account after the stock split is $. (Round to the nearest dollar.) The new balance in the retained earnings account after the stock split is $ (Round to the nearest dollar.) The balance in the total stockholder's equity account after the split is $. (Round to the nearest dollar.) b. The market price per share after the 3-for-2 stock split is $ (Round to the nearest dollar.) c. The maximum cash dividend per share the firm could pay before the split is $ per share. (Round to the nearest cent.) The maximum cash dividend the firm could pay after the split is sper share. (Round to the nearest cent.) d. Contrast your answers to parts a through c with the circumstances surrounding a 50% stock dividend. If the firm declares a 50% stock dividend, the balance in the common stock account after the dividend is $. (Round to the nearest dollar.) The balance in the paid-in capital account after the dividend is $ (Round to the nearest dollar.) The balance in the retained earnings account after the dividend is $ (Round to the nearest dollar.) The balance in the total stockholder's equity account after the stock dividend is $. (Round to the nearest dollar.) The new market price per share after the dividend is $. (Round to the nearest dollar.) The maximum cash dividend the firm could pay before the stock dividend is $ per share. (Round to the nearest cent.) e. Which of the following statements about stock splits is false? (Select the best answer below.) O A. Stock splits result in a change in the common stock account balance. B. Stock splits reduce the per share market value of outstanding shares. O C. Stock splits reduce the par value per share of common stock. O D. Stock splits increase the number of shares outstanding. Which of the following statements about stock dividends is false? (Select the best answer below.) O A. Stock dividends reduce the par value per share of common stock. O B. Stock dividends reduce the per share market value of outstanding shares. O C. Stock dividends increase the number of shares outstanding. OD. Stock dividends result in an increase to common stock and paid-in capital account and a corresponding decrease to retained earningsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started