Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please refer to Figure 9 below a. The left two bar graphs show that the US has its largest net debtor position with China

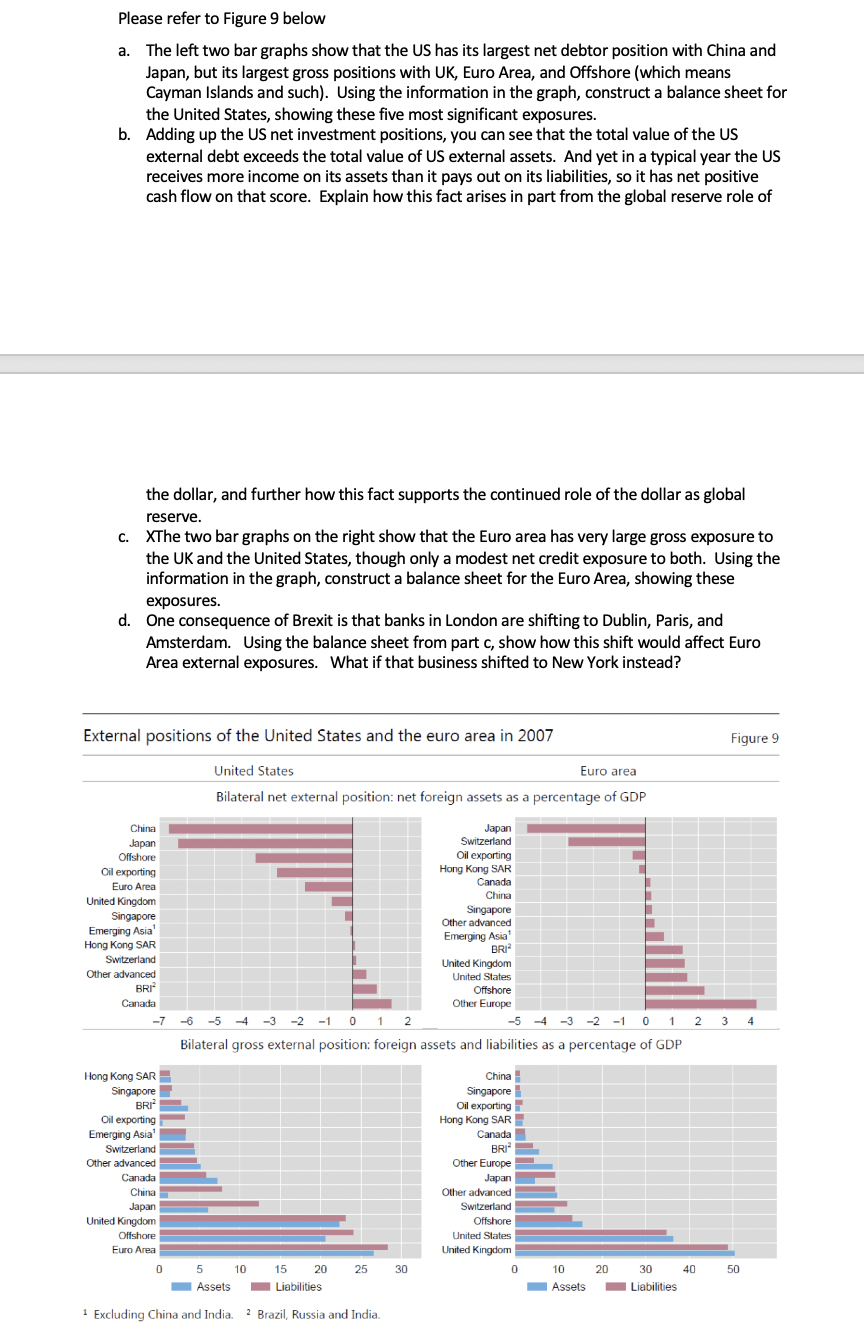

Please refer to Figure 9 below a. The left two bar graphs show that the US has its largest net debtor position with China and Japan, but its largest gross positions with UK, Euro Area, and Offshore (which means Cayman Islands and such). Using the information in the graph, construct a balance sheet for the United States, showing these five most significant exposures. b. Adding up the US net investment positions, you can see that the total value of the US external debt exceeds the total value of US external assets. And yet in a typical year the US receives more income on its assets than it pays out on its liabilities, so it has net positive cash flow on that score. Explain how this fact arises in part from the global reserve role of the dollar, and further how this fact supports the continued role of the dollar as global reserve. c. XThe two bar graphs on the right show that the Euro area has very large gross exposure to the UK and the United States, though only a modest net credit exposure to both. Using the information in the graph, construct a balance sheet for the Euro Area, showing these exposures. d. One consequence of Brexit is that banks in London are shifting to Dublin, Paris, and Amsterdam. Using the balance sheet from part c, show how this shift would affect Euro Area external exposures. What if that business shifted to New York instead? External positions of the United States and the euro area in 2007 China Japan Offshore Oil exporting Euro Area United Kingdom Singapore Emerging Asia Hong Kong SAR Switzerland Other advanced BRI Canada Hong Kong SAR Singapore BRI Oil exporting Emerging Asia United Kingdom United States Offshore Other Europe -7 -6 -5-4-3-2-1 0 1 2 -5 -4 -3 -2 -10 1 2 3 4 Bilateral gross external position: foreign assets and liabilities as a percentage of GDP Switzerland Other advanced Canada China Japan United Kingdom Offshore Euro Area United States Euro area Bilateral net external position: net foreign assets as a percentage of GDP 0 5 Assets 15 Liabilities Excluding China and India. 2 Brazil, Russia and India. 10 20 25 Japan Switzerland Oil exporting Hong Kong SAR Canada China 30 Singapore Other advanced Emerging Asia BRI China Singapore Oil exporting Hong Kong SAR Canada BRI Other Europe Japan Other advanced Switzerland Offshore United States United Kingdom 0 10 Assets 20 30 Liabilities Figure 9 40 50

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started