Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please refer to HW4_data.doc for quotes on Intel stock options. Consider the following positions on the Intel stock. For each of the positions choose the

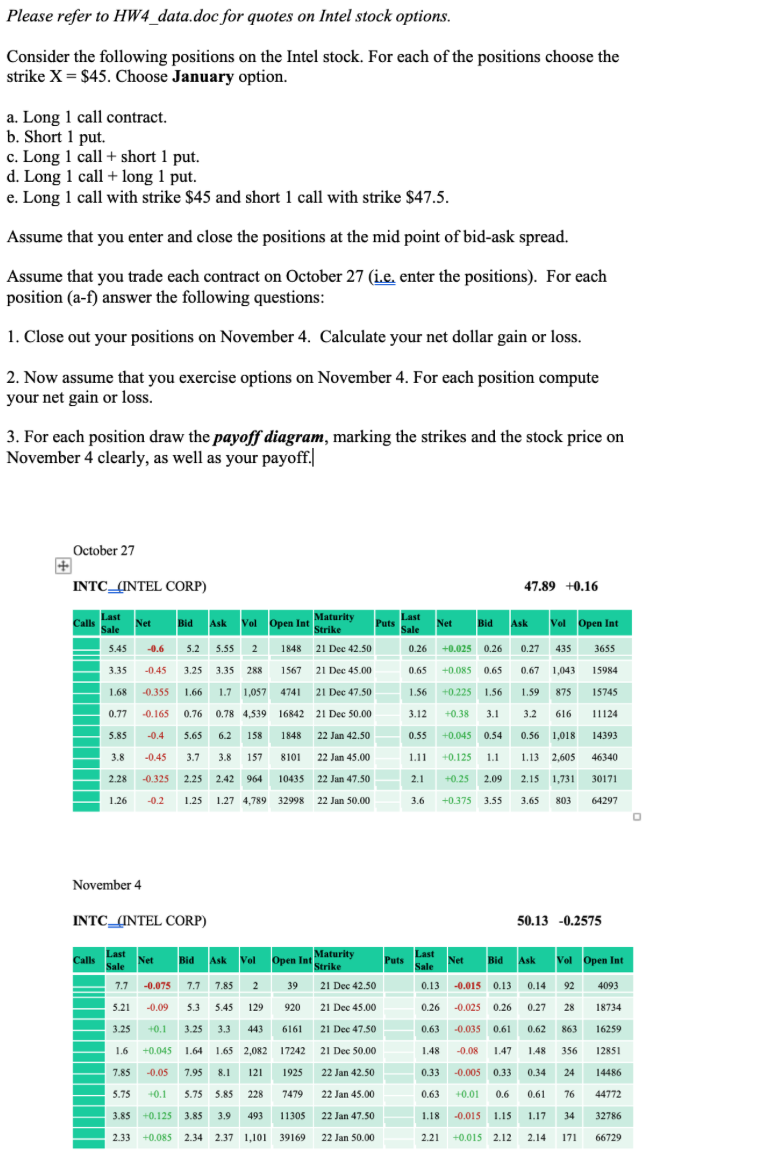

Please refer to HW4_data.doc for quotes on Intel stock options. Consider the following positions on the Intel stock. For each of the positions choose the strike X = $45. Choose January option. a. Long 1 call contract. b. Short 1 put. c. Long 1 call + short 1 put. d. Long 1 call + long 1 put. e. Long 1 call with strike $45 and short 1 call with strike $47.5. Assume that you enter and close the positions at the mid point of bid-ask spread. Assume that you trade each contract on October 27 (ie. enter the positions). For each position (a-f) answer the following questions: 1. Close out your positions on November 4. Calculate your net dollar gain or loss. 2. Now assume that you exercise options on November 4. For each position compute your net gain or loss. 3. For each position draw the payoff diagram, marking the strikes and the stock price on November 4 clearly, as well as your payoff. October 27 INTC_(INTEL CORP) 47.89 +0.16 Calls Net Bid Ask Vol Open Int +0.025 0.26 0.27 435 3655 +0.085 0.65 15984 0.67 1,043 1.59 875 +0.225 1.56 15745 Last Maturity Net Bid Ask Last Vol Open Int Puts Sale Strike Sale 5.45 -0.6 5.2 5.55 2 1848 21 Dec 42.50 0.26 3.35 -0.45 3.25 3.35 288 1567 21 Dec 45.00 0.65 1.68 -0.355 1.66 1.7 1,057 4741 21 Dec 47.50 1.56 0.77 -0.165 0.76 0.78 4,539 16842 21 Dec 50.00 3.12 5.85 -0.4 5.65 6.2 158 1848 22 Jan 42.50 0.55 3.8 -0.45 3.7 3.8 157 8101 22 Jan 45.00 1.11 2.28 -0.325 2.25 2.42964 10435 22 Jan 47.50 2.1 1.26 -0.2 1.25 1.27 4,789 32998 22 Jan 50.00 3.6 +0.38 3.1 3.2 616 11124 14393 +0.045 0.54 0.56 1,018 +0.125 1.1 1.13 2,605 46340 30171 +0.25 2.09 2.15 1,731 3.65 803 +0.375 3.55 64297 November 4 4 INTC_(INTEL CORP) 50.13 -0.2575 Calls Puts Last Sale Net Bid Ask Vol Open Int 4093 0.13 -0.015 0.13 0.14 92 0.26 -0.025 0.26 0.27 28 18734 0.63 -0.035 0.61 0.62 863 16259 Last Net Bid Sale Ask Vol Open Int Maturity Strike 7.7 -0.075 7.7 7.852 39 21 Dec 42.50 5.21 -0.09 5.3 5.45 5.45 129 920 21 Dec 45.00 3.25 +0.1 3.25 3.3 443 6161 21 Dec 47.50 1.6 +0.045 1.64 1.65 2,082 17242 21 Dec 50.00 7.85 -0.05 7.95 8.1 121 1925 22 Jan 42.50 5.75 +0.1 5.75 5.85 228 7479 22 Jan 45.00 3.85 +0.125 3.85 3.9 493 11305 22 Jan 47.50 1.48 -0.08 1.47 1.48 356 12851 0.33 -0.005 0.33 0.34 24 14486 0.63 +0.01 0.6 0.61 76 44772 1.18 -0.015 1.15 1.17 34 32786 2.33 +0.085 2.34 2.37 1,101 39169 22 Jan 50.00 2.21 +0.015 2.12 2.14 171 66729 Please refer to HW4_data.doc for quotes on Intel stock options. Consider the following positions on the Intel stock. For each of the positions choose the strike X = $45. Choose January option. a. Long 1 call contract. b. Short 1 put. c. Long 1 call + short 1 put. d. Long 1 call + long 1 put. e. Long 1 call with strike $45 and short 1 call with strike $47.5. Assume that you enter and close the positions at the mid point of bid-ask spread. Assume that you trade each contract on October 27 (ie. enter the positions). For each position (a-f) answer the following questions: 1. Close out your positions on November 4. Calculate your net dollar gain or loss. 2. Now assume that you exercise options on November 4. For each position compute your net gain or loss. 3. For each position draw the payoff diagram, marking the strikes and the stock price on November 4 clearly, as well as your payoff. October 27 INTC_(INTEL CORP) 47.89 +0.16 Calls Net Bid Ask Vol Open Int +0.025 0.26 0.27 435 3655 +0.085 0.65 15984 0.67 1,043 1.59 875 +0.225 1.56 15745 Last Maturity Net Bid Ask Last Vol Open Int Puts Sale Strike Sale 5.45 -0.6 5.2 5.55 2 1848 21 Dec 42.50 0.26 3.35 -0.45 3.25 3.35 288 1567 21 Dec 45.00 0.65 1.68 -0.355 1.66 1.7 1,057 4741 21 Dec 47.50 1.56 0.77 -0.165 0.76 0.78 4,539 16842 21 Dec 50.00 3.12 5.85 -0.4 5.65 6.2 158 1848 22 Jan 42.50 0.55 3.8 -0.45 3.7 3.8 157 8101 22 Jan 45.00 1.11 2.28 -0.325 2.25 2.42964 10435 22 Jan 47.50 2.1 1.26 -0.2 1.25 1.27 4,789 32998 22 Jan 50.00 3.6 +0.38 3.1 3.2 616 11124 14393 +0.045 0.54 0.56 1,018 +0.125 1.1 1.13 2,605 46340 30171 +0.25 2.09 2.15 1,731 3.65 803 +0.375 3.55 64297 November 4 4 INTC_(INTEL CORP) 50.13 -0.2575 Calls Puts Last Sale Net Bid Ask Vol Open Int 4093 0.13 -0.015 0.13 0.14 92 0.26 -0.025 0.26 0.27 28 18734 0.63 -0.035 0.61 0.62 863 16259 Last Net Bid Sale Ask Vol Open Int Maturity Strike 7.7 -0.075 7.7 7.852 39 21 Dec 42.50 5.21 -0.09 5.3 5.45 5.45 129 920 21 Dec 45.00 3.25 +0.1 3.25 3.3 443 6161 21 Dec 47.50 1.6 +0.045 1.64 1.65 2,082 17242 21 Dec 50.00 7.85 -0.05 7.95 8.1 121 1925 22 Jan 42.50 5.75 +0.1 5.75 5.85 228 7479 22 Jan 45.00 3.85 +0.125 3.85 3.9 493 11305 22 Jan 47.50 1.48 -0.08 1.47 1.48 356 12851 0.33 -0.005 0.33 0.34 24 14486 0.63 +0.01 0.6 0.61 76 44772 1.18 -0.015 1.15 1.17 34 32786 2.33 +0.085 2.34 2.37 1,101 39169 22 Jan 50.00 2.21 +0.015 2.12 2.14 171 66729

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started