Answered step by step

Verified Expert Solution

Question

1 Approved Answer

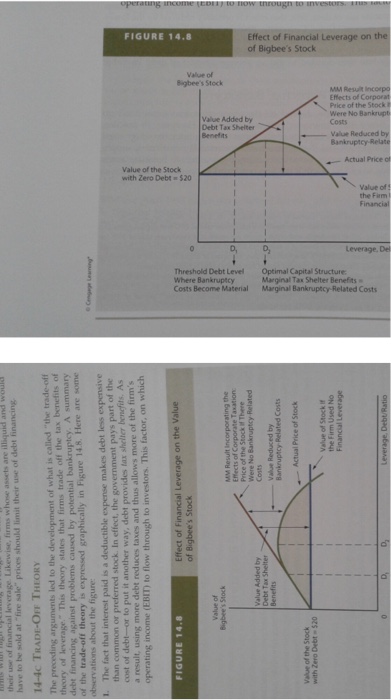

Please refer to the curved line in figure 14.8 on page 486 in the textbook the reason for the following: The line initially has an

Please refer to the curved line in figure 14.8 on page 486 in the textbook the reason for the following: The line initially has an upward slope, but gradually begins to slope downward as you move further out along the horizontal axis.

e to be sold at "fire sale" prices should limit their use of debt financing 14-4c TRADE-OFF THEORY their use of financial leverage preceding arguments led to the development of what is called "the trade-off A summary od leverage. This theory states that firms trade off the tax benefits of caused by potential bankruptcy debt of the trade-off theory is expressed graphically in Figure 14.8. Here are observations about the figure The fact that interest paid is a deductible expense ma than common or preferred stock. In effect, the government cost of debt--or kes debt less expensive pays part of the to put it another way, debt provides tax shelter benefits. As a result, using more debt reduces taxes and thus allows more of the firm's operating income (EBIT) to flow through to investors. This factor, on which on the Value FIGURE 14.8 Value of MM Result incorporating the Price of the Stock There Costs Value Reduced by Value Added by Debt Tax Shelter Actual Price of Stock Value of the Stock with Zero Debt-$20 Value of Stock if the Firm Used No Financial Leverage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started