Answered step by step

Verified Expert Solution

Question

1 Approved Answer

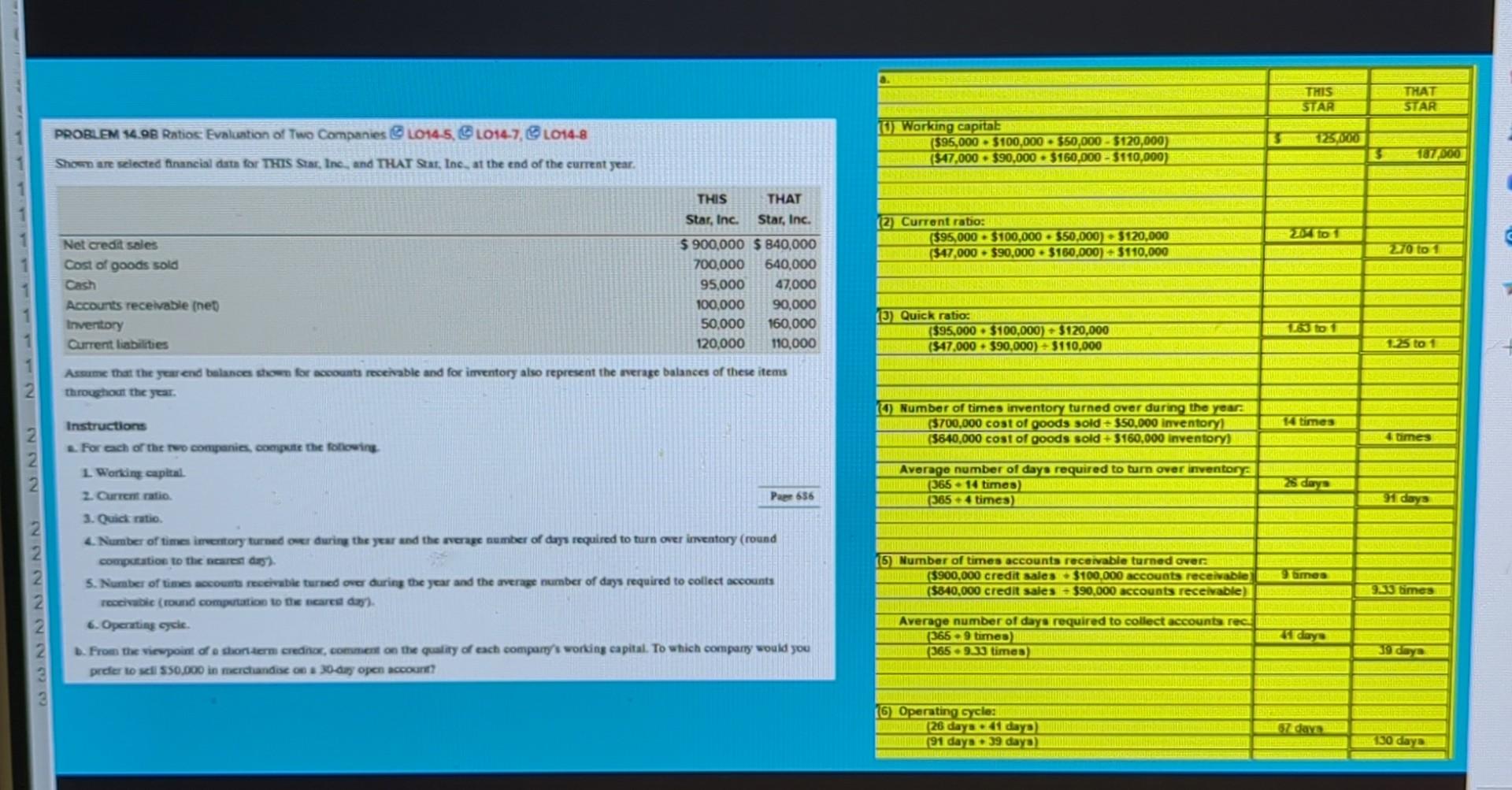

please refer to the image below as a sample. Shown are selected financial data for Another World and Imports, Inc., at the end of the

please refer to the image below as a sample.

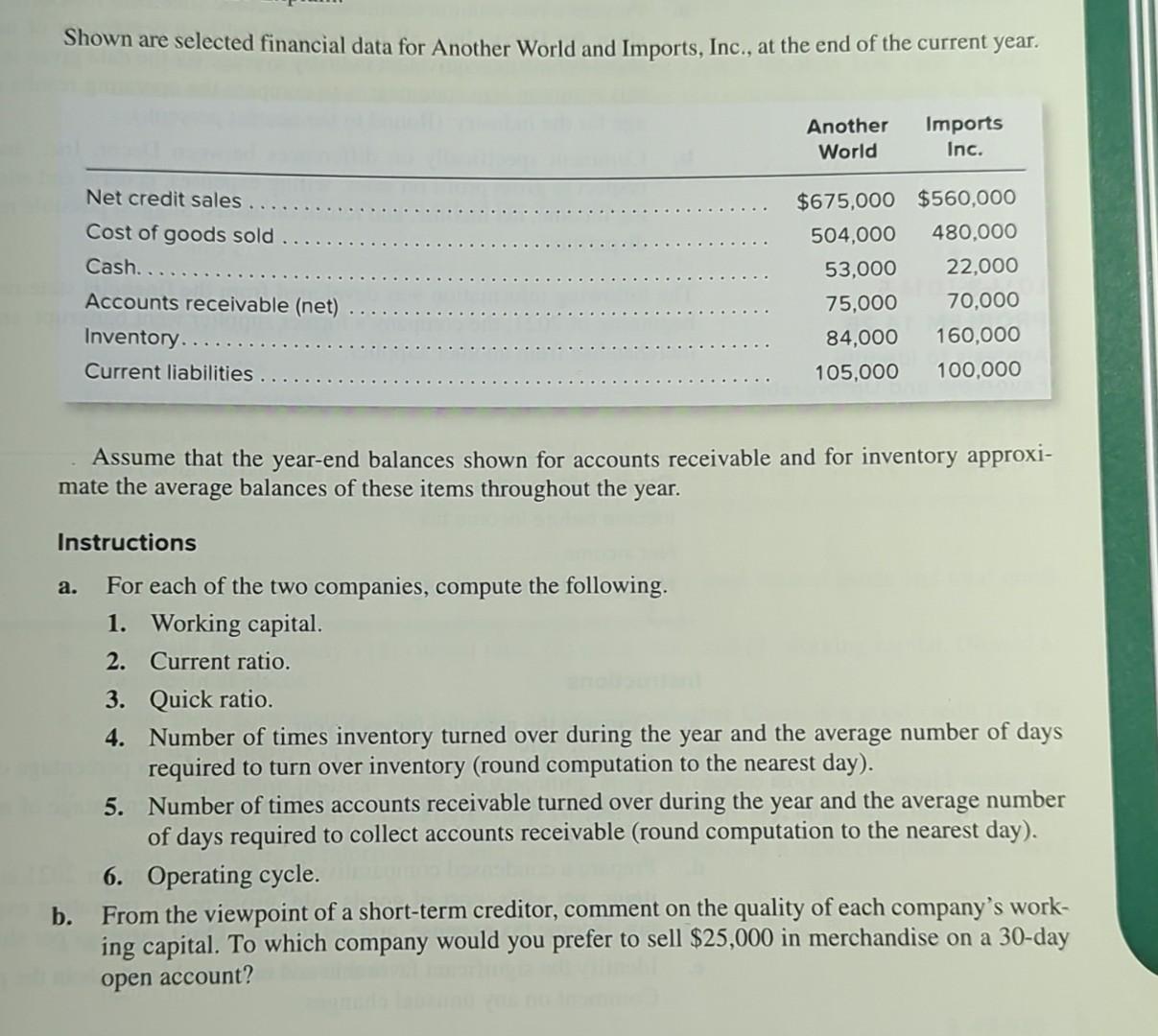

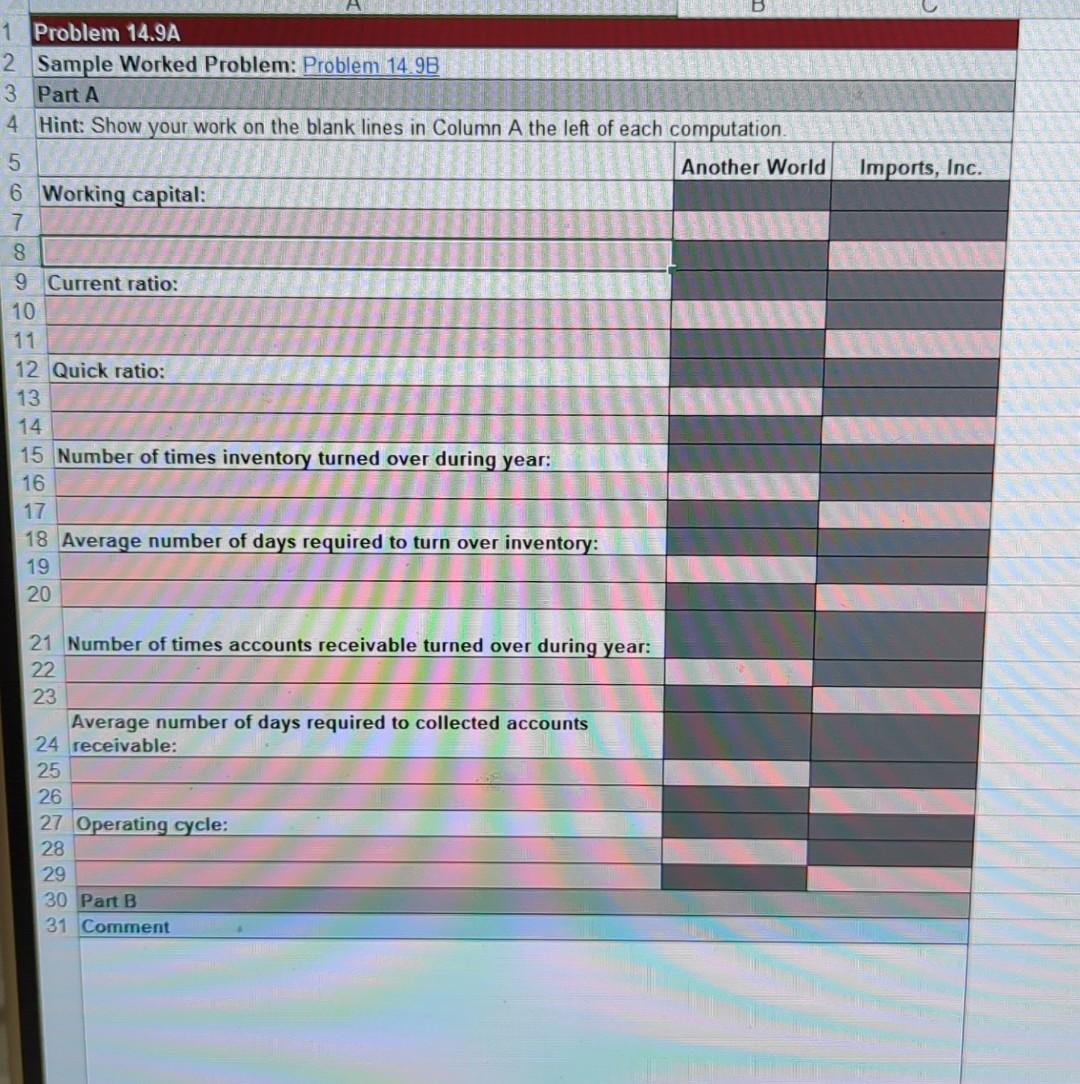

Shown are selected financial data for Another World and Imports, Inc., at the end of the current year. Assume that the year-end balances shown for accounts receivable and for inventory approximate the average balances of these items throughout the year. Instructions a. For each of the two companies, compute the following. 1. Working capital. 2. Current ratio. 3. Quick ratio. 4. Number of times inventory turned over during the year and the average number of days required to turn over inventory (round computation to the nearest day). 5. Number of times accounts receivable turned over during the year and the average number of days required to collect accounts receivable (round computation to the nearest day). 6. Operating cycle. b. From the viewpoint of a short-term creditor, comment on the quality of each company's working capital. To which company would you prefer to sell $25,000 in merchandise on a 30 -day open account? Problem 14.9A Shom are seiected financial dart for THIS Star, Ine, and THUT Star, Inc, at the end of the current jear. Assume that the yearend belances shomn for accounts receivable and for imentory alvo represent the nerage balances of these items throughour the year. Instructions 2. For ach of the two companies, compent the folhowing. 1. Working captral. 2 Currerr ratio. 3. Quid ratio. 4. Number of time imertory turned over during the year and the nerage number of drgs required to turn over imentory (round compuration to the neares aros. 5. Number of times accoumb receivabie turned over during the year and the average number of days required to collect accounts 6. Operating ogcic

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started