Please review my assignment and let me know if I have calculated correctly.

Thank you.

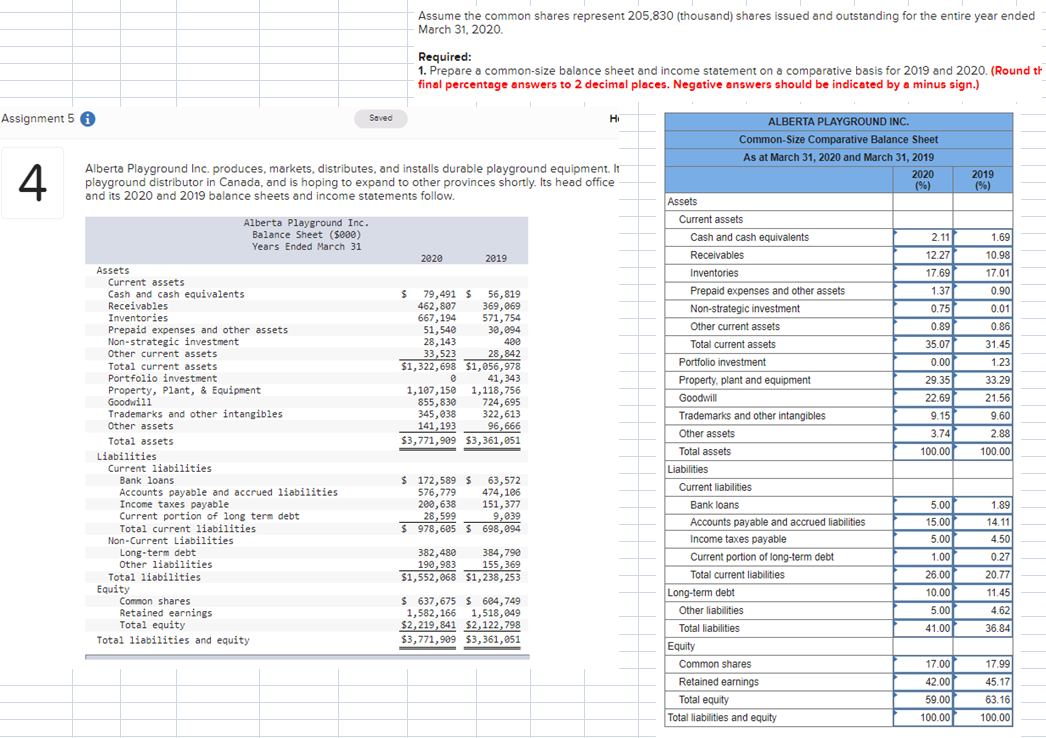

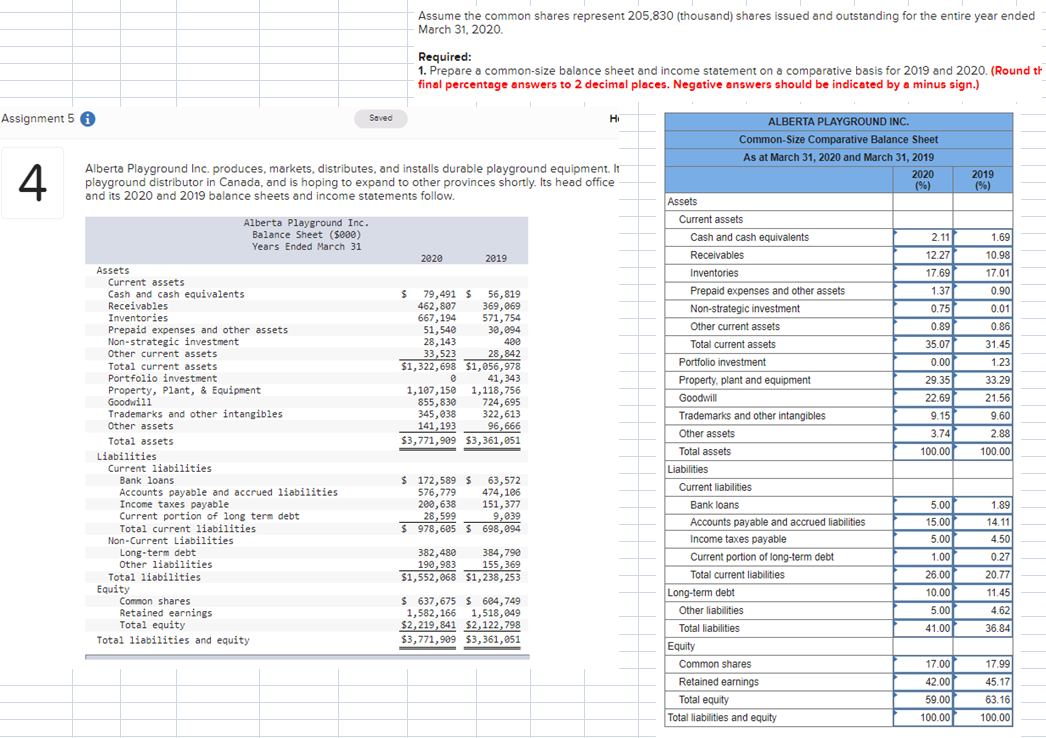

Assume the common shares represent 205,830 (thousand) shares issued and outstanding for the entire year ended March 31, 2020 Required: 1. Prepare a common-size balance sheet and income statement on a comparative basis for 2019 and 2020. (Roundth final percentage answers to 2 decimal places. Negative answers should be indicated by a minus sign.) Assignment 5 Saved HI 4 Alberta Playground Inc. produces, markets, distributes, and installs durable playground equipment. It playground distributor in Canada, and is hoping to expand to other provinces shortly. Its head office and its 2020 and 2019 balance sheets and income statements follow. 2019 (%) Alberta Playground Inc. Balance Sheet (5000) Years Ended March 31 1.69 2020 2019 $ 79,491 $ 56,819 462,897 369,069 667,194 571, 754 51,540 30,094 28,143 400 33,523 28,842 $1,322,698 $1,056,978 @ 41,343 1,107,150 1,118,756 855,830 724,695 345,038 322,613 141,193 96,666 $3,771,989 $3,361,051 10.98 17.01 0.90 0.01 0.86 31.45 1.23 33.29 Assets Current assets Cash and cash equivalents Receivables Inventories Prepaid expenses and other assets Non-strategic investment Other current assets Total current assets Portfolio investment Property, Plant, & Equipment Goodwill Trademarks and other intangibles Other assets Total assets Liabilities Current liabilities Bank loans Accounts payable and accrued liabilities Income taxes payable Current portion of long term debt Total current liabilities Non-Current Liabilities Long-term debt Other liabilities Total liabilities Equity Common shares Retained earnings Total equity Total liabilities and equity ALBERTA PLAYGROUND INC. Common-Size Comparative Balance Sheet As at March 31, 2020 and March 31, 2019 2020 (%) Assets Current assets Cash and cash equivalents 2.11 Receivables 12.27 Inventories 17.69 Prepaid expenses and other assets 1.37 Non-strategic investment 0.75 Other current assets 0.89 Total current assets 35.07 Portfolio investment 0.00 Property, plant and equipment 29.35 Goodwill 22.69 Trademarks and other intangibles 9.15 Other assets 3.74 Total assets 100.00 Liabilities Current liabilities Bank loans 5.00 Accounts payable and accrued liabilities 15.00 Income taxes payable 5.00 Current portion of long-term debt 1.00 Total current liabilities 26.00 Long-term debt 10.00 Other liabilities 5.00 Total liabilities 41.00 Equity Common shares 17.00 Retained earnings 42.00 Total equity 59.00 Total liabilities and equity 100.00 21.56 9.60 2.88 100.00 $ 172,589 $ 63,572 576,779 474, 106 202,638 151,377 28,599 9,039 $ 978,605 $ 698,094 382,480 384,790 190,983 155,369 $1,552,068 $1,238, 253 1.89 14.11 4.50 0.27 20.77 11.45 4.62 $ 637,675 $ 604,749 1,582,166 1,518,849 $2,219,841 $2,122,798 $3,771,999 $3,361,051 36.84 17.99 45.17 63.16 100.00