Answered step by step

Verified Expert Solution

Question

1 Approved Answer

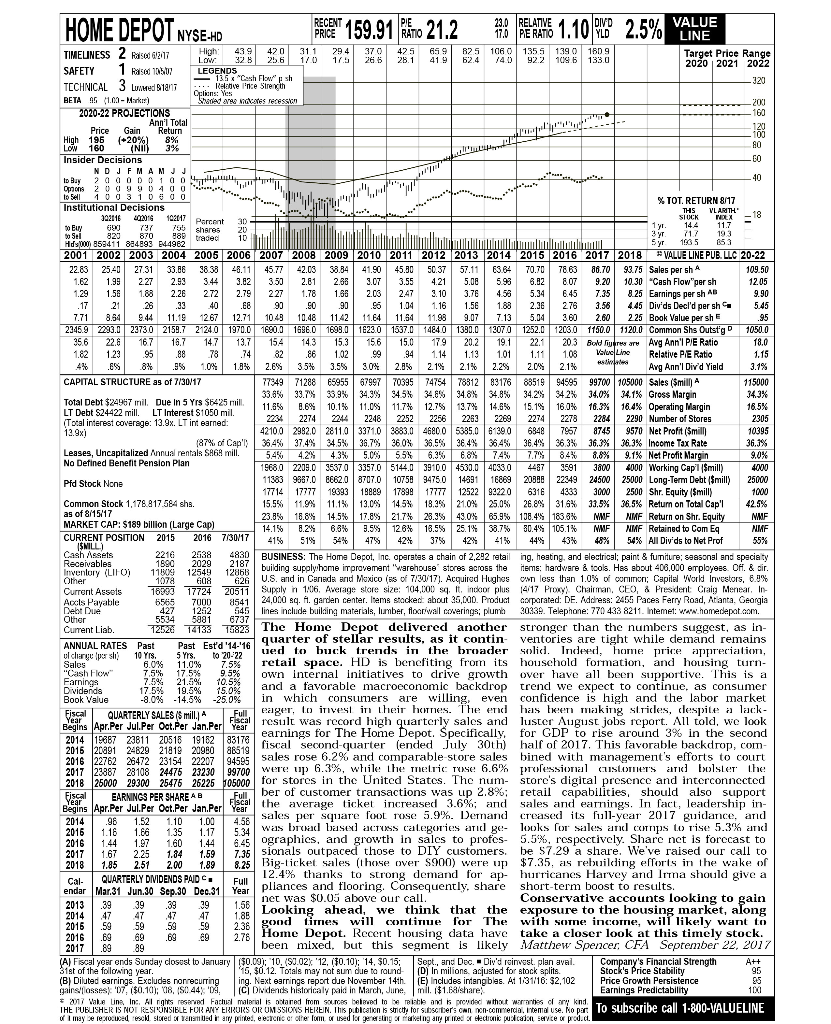

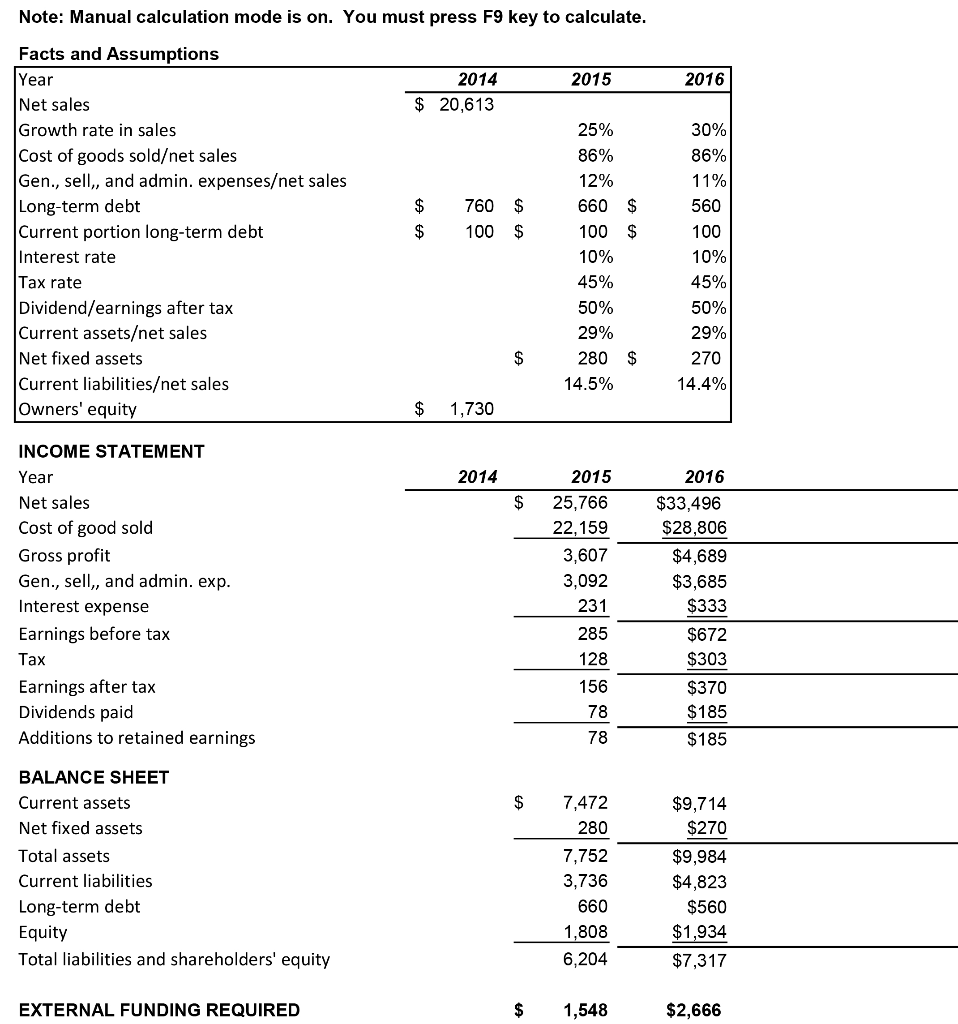

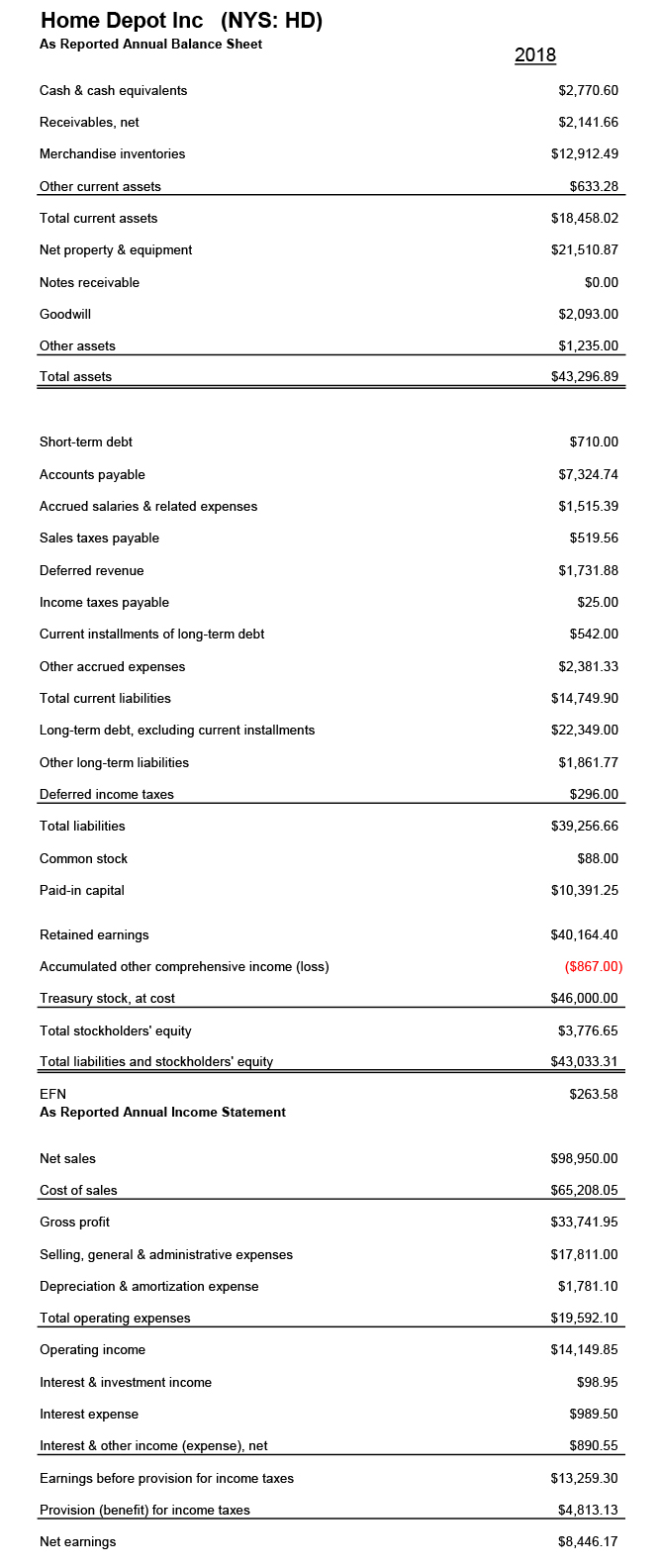

Please review the historical performance and projections on the Home Depot Value Line page, the spreadsheet, and the pro forma income statement and balance sheet.

Please review the historical performance and projections on the Home Depot Value Line page, the spreadsheet, and the pro forma income statement and balance sheet. Submit a complete and thorough 2 paragraph ANALYSIS of the pro forma discussing the majority of the assumptions made to create the pro forma and argue with or against the support of those assumptions and present alternative assumptions if any.

HOME DEPOT NYSE+0 RECENT 159.91 21.2 425 THIS 144 167 147 143 PIE 23.0 RELATIVE DIVD 0/ VALUE PRICE RATIO 17.0 PE RATIO YLD LINE TIMELINESS 2 2017 High 439 420 1 31 1 294 370 699 825 1060 135 S 1390 180g Low 325 25.6 170 Target Price Range 28.1 41.9 62.4 /40) 922 109.6 133.0 SAFETY 1 od 1050 2020 2021 2022 LEGENDS 135 "Cash Flowsh TECHNICAL 3 Luwwed an Relevene Streth 320 Olen: Yes BETA A6 1.09 - Marks) Shadedre des recessiah 200 2020-22 PROJECTIONS -160 Ann'l Total Price Gain Return 120 High 196 100 (+20%) 8% LOW 160 (NO 3% 80 Insider Decisions -G0 NDJ F M A M J J to Buy 20 GODO 100 40 Opions 20000 400 100 310000 Institutional Decisions % TOT. RETURN 8/17 VL ARITH 322116 LONG 102017 Porcent -18 STOCK 30 NDEX 690 shares 1 y. 11.7 Sel 820 20 870 989 3 yr 10 717 Hds000 853411 884893 M4962 193 Syr 1965 653 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 VALUE LINE PUB. LLC 20-22 22.85 25.40 27.31 33.86 38 33 48.11 45.77 42.08 33.84 41.90 45.30 50.37 57.11 70.70 7863 86.70 93.75 Sales per sh 109.50 1.62 1.99 2.27 2.93 3.44 3.82 3.50 2.81 2.88 3.07 3.55 4.21 5.08 5.93 6.BZ 8.07 9.20 10.30 Cash Flow"per sh 12.05 1.29 1.58 1.83 2.26 2.72 2.79 227 1.78 1.68 2.06 2.47 3.10 3.76 4.53 5.34 6.45 7.35 8.25 Earnings per sh AB 9.90 .17 .21 26 .33 40 .EE 90 ..0 .90 .96 1.04 1.16 1.56 1.88 2.36 276 3.56 4.45 Div'ds Decl'd per sh 5.45 7.71 8.64 8.44 11.19 1267 12.71 10.49 10.48 11.42 11.64 11.54 11.98 9.07 7.13 5.04 3.60 2.60 225 Book Value per she .95 2345.9 2293.0 23730 2159.7 2124.0 1970.0 1680.0 1696.0 1699.0 16230 1537.0 14840 1380.0 1207.0 1252.0 1200.0 1150.0 1120.0 Common Shs Outstg 1050.0 356 22.8 16.7 13.7 15.4 153 156 15.0 179 20.2 19.1 22.1 203 Bold war Avg Ann'l PE Ratio 18.0 1.82 1.23 .95 .88 78 .74 82 1.02 ce .34 1.14 1.13 101 1.11 1.03 Velud Line Relative PE Ratio 1.15 .9% 1.0% 1.8% 2.655 3.5% 3.55 3.0% 2.9% 2.14 2.1% 2.25 2.0% 2.1% estima Avg Ann'l Div'd Yield 3.1% CAPITAL STRUCTURE as of 7/30/17 77349 71288 6595567997 70395 74754 78812 83176 88519 94595 99700 105000 Sales (Smilla 115000 33.8% 33.7% 33.3% 34.38 34.5% 34.6% 34.8% 34.8% 34.2% 342% 34.0% 34.1% Gross Margin 34.3% Total Debt $24967 inil. Due in 5 yrs $5425 mill. 11.896 LT Debt S24422 mill. LT Interest S1050 mil. 10.1% 11.09 11.7% 12.75 13.7% 14.6% 14.6% 15.1% 16.0% 16.3% 18.4% Operating Margin 16.5% (Total interest coverage: 13.9x. LT int Barned: 2274 2248 2252 2256 2263 2269 2274 2278 2284 2290 Number of Stores 2305 12.9x1 42100 2982.0 28110 3371.0 3883.0 46800 5385.0 6 1390 6848 7957 8745 9570 Net Profit (Smill 10395 (87% of Cap's 35.45 37.4% 34,5% 38.79 360% 34.5% 36.7% 36 0% 36,5% 38.4% 36.5% 36.4% 36,4% 36.4' 36.3% 36,3% 36.3% Income Tax Rate 36.1% Leases, Uncapitalized Annual rentals SA68 mill. 5.4% 4.2% 4.3% 5.0% 5.5% 6.3% 6.8% 7.4% 7.7% 8.4% 8.8% No Defined Benefit Pension Plan 9.1% Net Profit Margin 9.0% 1968.0 2209.0 3687.0 3357.0 5144.0 3910.0 4530.0 4055.0 4487 3591 3800 4000 Working Cap'l $mill) 4000 Pld Stock None 11383 9537.0 6662.0 8707.0 10758 10758 34750 14391 16869 20386 22349 24500 25000 Long-Term Debt (Smilly 25000 17714 17777 19693 19929 17899 17777 12522 92220 6316 4333 3000 2500 Shr. Equity (Smilly 1000 Common Stock 1,178.817.584 shs. 15.5% 11.94 11.1% 13.09 14.5% 18.3% 21.0% 25.0% 26.89 316% 33.5% 36.5% Return on Total Cap' 42.5% as of 8/15/17 23.3% 18.8% 14.5% 17.8% 21.7% 23.35 43.0% 65.9% 108.4' 183.3% NMF NIMF Return on Shr. Equity NMF MARKET CAP: $189 billion (Large Cap) 14.15 8.2% 6.3% 9.59 1284 18.55 25.1% 38.7% 33.7% 30.4% 105.1% NME NIMF Retained to Com Eq NIMF CURRENT POSITION 2015 2016 7/30/17 4156 518 54% SMILL) 475 42% 42% 415 44% 43% 54% All Div ds to Net Prof 55% Cash Assets 2216 2638 4830 Receivables 1890 BUSINESS: The Home Depot, Inc. operates a chain of 2,292 retailing, heating, and electrical; paint & fumiture; seasonal and speciaty 2029 2187 Invenlory (LIFO) 11009 12549 12866 building supply:home improvement "Warehouse stores across the items: hardware & tools. Has about 406.000 employees. OH. & dir. Other 1078"GOA 6126 U.S. and in Canada and Mexico (es of 7/2017). Acquired Hughes on less than 1.0% of common; Capital World Investors, 6.0% Current Assets 16900 17724 20511 Superly in 1:06. Average store size: 104,000 sq. It incor plus 4/17 Proxy! Chairman, CEO, & President Craig Menear. In Accls Payable 6565 7000 81541 24,000 sq. 1. garden center. Items stocked about 35,000. Product corporated: DE. Address: 2455 Paces Ferry Road, Atlanta, Georgia Debt Due 427 1242 545 lines include building materials, lumber, floor wall cewaringspluma 30:39. Telephone: 770 433 8211. Intemet: www.homedepot.com. Other 5534 5881 6737 Current Liab. 12520 14133 18823 The Home Depot delivered another stronger than the numbers suggest, as in- ANNUAL RATES Past ventories are tight while demand remains Past Est'd 14-16 quarter of stellar results, as it contin ul charge porsli 10 Yrs. ued to buck trends in the broader Solid. Indeed, home price appreciation, 5 Yrs. to 20-22 Salos 6.0% 11.0% 7.5% retail space. HD is benefiting from its household formation, and housing turn- "Cash Flow 7.5% 17.5% 9.5% own internal initiatives to drive growth over have all been supportive. This is a Farnings 7.5% 21.5% 10.5% Dividends 17.5% 19.5% 15.01 and a favorable macroeconomic backdrop trend we expect to continue, as consumer Book Value -8.0% -14.5% -25.0% in which consumers are willing, even confidence is higli and the labor market Fiscal QUARTERLY SALES (Smilla Full eager, to invest in their homes. The end has been making stricles, despite a lack- Fisca Begins Apr.Per Jul.Per Oct.Per Jan.Per Year result was record high quarterly sales and luster August jobs report. All told, we look 2014 15687 23811 20516 19162 earnings for The Home Depot. Specifically 83178 for GDP to rise around 3% in the second 2015 20391 24829 21819 20960 88519 fiscal second-quarter (ended July 30th) half of 2017. This favorable backdrop, com- 2016 22762 26472 23154 22207 94595 sales rose 6.2% and comparable store sales bined with management's efforts to court 2017 23887 28108 24475 23230 99700 were up 6.3%, while the metric rose 6.6% professional customers and toolster the 2018 25000 2930025476 26225 05000 for stores in the United States. The num- store's digital presence and interconnected Fiscal EARNINGS PER SHARE A B Full, ber of customer transactions was up 2.8%; retail capabilities, should also support Year Begins Apr.Per Jul.Per Oct.Per Jan.Per Year the average ticket increased 3.6%; and sales and earnings. In fact, leadership in- 2014 sales per square foot rose 5.9%. Dernand creased its full-year 2017 guidance, and .98 1.52 1.10 1.00 4.58 2016 1.16 1.66 1.35 1.17 5.34 was broad based cuss categories and ge- looks for sales and corps to rise 5.3% and 2016 1.44 1.97 1.60 1.44 6.45 ographics, and growth in sales to profos 5.5%, respectively. Share net is forecast to 2017 1.67 2.25 1.84 1.59 7.36 sionals outpaced those to DIY customers. be 57.29 a share. We've raised our call to 2018 1.85 2.51 2.00 1.89 8.25 Big-ticket sales (those over $900) were up $7.35, as rebuilding efforts in the wake of Cal QUARTERLY DIVIDENDS PAID Full 12.4% thanks to strong demand for ap- hurricanes Harvey and Irma should give a endar Mar 31 Jun 30 Sep.30 Dec.31 Year pliances and flooring. Consequently, share short-term boost to results. net was $0.05 above our call. 2013 .39 39 .39 .39 1.56 Conservative accounts looking to gain 2014 .47 47 47 1.85 Looking ahead, we think that the exposure to the housing market, along 2016 .59 59 59 59 2.36 good times will continue for The with some income, will likely want to 2016 .69 69 .69 2.78 Home Depot. Recent housing data have take a closer look at this timely stock. 2017 .89 89 been mixed, but this segment is likely Matthew Spencer, CEA September 22, 2017 (A) Fiscal year ends Sunday closest to January 150.00): 10. (SJ.02X '12. (10.10): 14, $0.15; Sept., and Dec. - Div'd rainvest. plan aval. Company's Financial Strength A++ 31st of the following year. '15, $0.12. Totals may not sur due to round (D) In milions, acjusted for stock splits Stock's Price Stability 95 (B) Diluted earrings. Excludes norrecurring ing. Next earrings report de November 14th. (E) Includes intangibles. At 131/16: 32,102 Price Growth Persistence gairslasses 07 ($0.101; 18, (S0.44) 'DA ICT Didens historicaly paid in March, June, mil. ($1.6dishare Earnings Predictability 2017 Value Line Inc. Alghts reserved Fathul malerial is tarted from sources believed to be riable and is provided without warranties of any kind THE PUBLISHER IS NOT ESIONSIBLE FOR ANY ERRORS OR UMSSIONS HEREN. This publication is strictly for users on commercio, Istemal use. No par to subscribe call 1-800-VALUELINE of I may be rexocused resc sised Ted in any printed, eecrcnic erotte Tom used for generating elngail pred tedionic pucavce u prod.d. 3756 11M Note: Manual calculation mode is on. You must press F9 key to calculate. 2015 2016 2014 $ 20,613 $ Facts and Assumptions Year Net sales Growth rate in sales Cost of goods soldet sales Gen., sell,, and admin. expenseset sales Long-term debt Current portion long-term debt Interest rate Tax rate Dividend/earnings after tax Current assetset sales Net fixed assets Current liabilitieset sales Owners' equity 760 $ 100 $ $ 25% 86% 12% 660 $ 100 $ 10% 45% 50% 29% 280 $ 14.5% 30% 86% 11% 560 100 10% 45% 50% 29% 270 14.4% $ $ 1,730 2014 $ INCOME STATEMENT Year Net sales Cost of good sold Gross profit Gen., sell, and admin. exp. Interest expense Earnings before tax Tax Earnings after tax Dividends paid Additions to retained earnings 2015 25,766 22,159 3,607 3,092 231 2016 $33,496 $28,806 $4,689 $3,685 $333 285 128 156 $672 $303 $370 $185 $185 78 78 $ BALANCE SHEET Current assets Net fixed assets Total assets Current liabilities Long-term debt Equity Total liabilities and shareholders' equity 7,472 280 7,752 3,736 660 1,808 6,204 $9,714 $270 $9,984 $4,823 $560 $1,934 $7,317 EXTERNAL FUNDING REQUIRED $ 1,548 $2,666 Home Depot Inc (NYS: HD) As Reported Annual Balance Sheet 2018 Cash & cash equivalents $2,770.60 Receivables, net $2,141.66 Merchandise inventories $12,912.49 Other current assets $633.28 Total current assets $18,458.02 Net property & equipment $21,510.87 Notes receivable $0.00 Goodwill $2,093.00 Other assets $1,235.00 Total assets $43,296.89 Short-term debt $710.00 Accounts payable $7,324.74 Accrued salaries & related expenses $1,515.39 Sales taxes payable $519.56 Deferred revenue $1,731.88 Income taxes payable $25.00 Current installments of long-term debt $542.00 Other accrued expenses $2,381.33 Total current liabilities $14,749.90 Long-term debt, excluding current installments $22,349.00 Other long-term liabilities $1,861.77 Deferred income taxes $296.00 Total liabilities $39,256.66 Common stock $88.00 Paid-in capital $10,391.25 Retained earnings $40,164.40 Accumulated other comprehensive income (loss) ($867.00) Treasury stock, at cost $46,000.00 Total stockholders' equity $3.776.65 Total liabilities and stockholders' equity $43,033.31 EFN $263.58 As Reported Annual Income Statement Net sales $98,950.00 Cost of sales $65,208.05 Gross profit $33,741.95 Selling, general & administrative expenses $17,811.00 $1,781.10 Depreciation & amortization expense Total operating expenses $19,592.10 Operating income $14,149.85 Interest & investment income $98.95 Interest expense $989.50 Interest & other income (expense), net $890.55 Earnings before provision for income taxes $13,259.30 Provision (benefit) for income taxes $4,813.13 Net earnings $8,446.17 HOME DEPOT NYSE+0 RECENT 159.91 21.2 425 THIS 144 167 147 143 PIE 23.0 RELATIVE DIVD 0/ VALUE PRICE RATIO 17.0 PE RATIO YLD LINE TIMELINESS 2 2017 High 439 420 1 31 1 294 370 699 825 1060 135 S 1390 180g Low 325 25.6 170 Target Price Range 28.1 41.9 62.4 /40) 922 109.6 133.0 SAFETY 1 od 1050 2020 2021 2022 LEGENDS 135 "Cash Flowsh TECHNICAL 3 Luwwed an Relevene Streth 320 Olen: Yes BETA A6 1.09 - Marks) Shadedre des recessiah 200 2020-22 PROJECTIONS -160 Ann'l Total Price Gain Return 120 High 196 100 (+20%) 8% LOW 160 (NO 3% 80 Insider Decisions -G0 NDJ F M A M J J to Buy 20 GODO 100 40 Opions 20000 400 100 310000 Institutional Decisions % TOT. RETURN 8/17 VL ARITH 322116 LONG 102017 Porcent -18 STOCK 30 NDEX 690 shares 1 y. 11.7 Sel 820 20 870 989 3 yr 10 717 Hds000 853411 884893 M4962 193 Syr 1965 653 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 VALUE LINE PUB. LLC 20-22 22.85 25.40 27.31 33.86 38 33 48.11 45.77 42.08 33.84 41.90 45.30 50.37 57.11 70.70 7863 86.70 93.75 Sales per sh 109.50 1.62 1.99 2.27 2.93 3.44 3.82 3.50 2.81 2.88 3.07 3.55 4.21 5.08 5.93 6.BZ 8.07 9.20 10.30 Cash Flow"per sh 12.05 1.29 1.58 1.83 2.26 2.72 2.79 227 1.78 1.68 2.06 2.47 3.10 3.76 4.53 5.34 6.45 7.35 8.25 Earnings per sh AB 9.90 .17 .21 26 .33 40 .EE 90 ..0 .90 .96 1.04 1.16 1.56 1.88 2.36 276 3.56 4.45 Div'ds Decl'd per sh 5.45 7.71 8.64 8.44 11.19 1267 12.71 10.49 10.48 11.42 11.64 11.54 11.98 9.07 7.13 5.04 3.60 2.60 225 Book Value per she .95 2345.9 2293.0 23730 2159.7 2124.0 1970.0 1680.0 1696.0 1699.0 16230 1537.0 14840 1380.0 1207.0 1252.0 1200.0 1150.0 1120.0 Common Shs Outstg 1050.0 356 22.8 16.7 13.7 15.4 153 156 15.0 179 20.2 19.1 22.1 203 Bold war Avg Ann'l PE Ratio 18.0 1.82 1.23 .95 .88 78 .74 82 1.02 ce .34 1.14 1.13 101 1.11 1.03 Velud Line Relative PE Ratio 1.15 .9% 1.0% 1.8% 2.655 3.5% 3.55 3.0% 2.9% 2.14 2.1% 2.25 2.0% 2.1% estima Avg Ann'l Div'd Yield 3.1% CAPITAL STRUCTURE as of 7/30/17 77349 71288 6595567997 70395 74754 78812 83176 88519 94595 99700 105000 Sales (Smilla 115000 33.8% 33.7% 33.3% 34.38 34.5% 34.6% 34.8% 34.8% 34.2% 342% 34.0% 34.1% Gross Margin 34.3% Total Debt $24967 inil. Due in 5 yrs $5425 mill. 11.896 LT Debt S24422 mill. LT Interest S1050 mil. 10.1% 11.09 11.7% 12.75 13.7% 14.6% 14.6% 15.1% 16.0% 16.3% 18.4% Operating Margin 16.5% (Total interest coverage: 13.9x. LT int Barned: 2274 2248 2252 2256 2263 2269 2274 2278 2284 2290 Number of Stores 2305 12.9x1 42100 2982.0 28110 3371.0 3883.0 46800 5385.0 6 1390 6848 7957 8745 9570 Net Profit (Smill 10395 (87% of Cap's 35.45 37.4% 34,5% 38.79 360% 34.5% 36.7% 36 0% 36,5% 38.4% 36.5% 36.4% 36,4% 36.4' 36.3% 36,3% 36.3% Income Tax Rate 36.1% Leases, Uncapitalized Annual rentals SA68 mill. 5.4% 4.2% 4.3% 5.0% 5.5% 6.3% 6.8% 7.4% 7.7% 8.4% 8.8% No Defined Benefit Pension Plan 9.1% Net Profit Margin 9.0% 1968.0 2209.0 3687.0 3357.0 5144.0 3910.0 4530.0 4055.0 4487 3591 3800 4000 Working Cap'l $mill) 4000 Pld Stock None 11383 9537.0 6662.0 8707.0 10758 10758 34750 14391 16869 20386 22349 24500 25000 Long-Term Debt (Smilly 25000 17714 17777 19693 19929 17899 17777 12522 92220 6316 4333 3000 2500 Shr. Equity (Smilly 1000 Common Stock 1,178.817.584 shs. 15.5% 11.94 11.1% 13.09 14.5% 18.3% 21.0% 25.0% 26.89 316% 33.5% 36.5% Return on Total Cap' 42.5% as of 8/15/17 23.3% 18.8% 14.5% 17.8% 21.7% 23.35 43.0% 65.9% 108.4' 183.3% NMF NIMF Return on Shr. Equity NMF MARKET CAP: $189 billion (Large Cap) 14.15 8.2% 6.3% 9.59 1284 18.55 25.1% 38.7% 33.7% 30.4% 105.1% NME NIMF Retained to Com Eq NIMF CURRENT POSITION 2015 2016 7/30/17 4156 518 54% SMILL) 475 42% 42% 415 44% 43% 54% All Div ds to Net Prof 55% Cash Assets 2216 2638 4830 Receivables 1890 BUSINESS: The Home Depot, Inc. operates a chain of 2,292 retailing, heating, and electrical; paint & fumiture; seasonal and speciaty 2029 2187 Invenlory (LIFO) 11009 12549 12866 building supply:home improvement "Warehouse stores across the items: hardware & tools. Has about 406.000 employees. OH. & dir. Other 1078"GOA 6126 U.S. and in Canada and Mexico (es of 7/2017). Acquired Hughes on less than 1.0% of common; Capital World Investors, 6.0% Current Assets 16900 17724 20511 Superly in 1:06. Average store size: 104,000 sq. It incor plus 4/17 Proxy! Chairman, CEO, & President Craig Menear. In Accls Payable 6565 7000 81541 24,000 sq. 1. garden center. Items stocked about 35,000. Product corporated: DE. Address: 2455 Paces Ferry Road, Atlanta, Georgia Debt Due 427 1242 545 lines include building materials, lumber, floor wall cewaringspluma 30:39. Telephone: 770 433 8211. Intemet: www.homedepot.com. Other 5534 5881 6737 Current Liab. 12520 14133 18823 The Home Depot delivered another stronger than the numbers suggest, as in- ANNUAL RATES Past ventories are tight while demand remains Past Est'd 14-16 quarter of stellar results, as it contin ul charge porsli 10 Yrs. ued to buck trends in the broader Solid. Indeed, home price appreciation, 5 Yrs. to 20-22 Salos 6.0% 11.0% 7.5% retail space. HD is benefiting from its household formation, and housing turn- "Cash Flow 7.5% 17.5% 9.5% own internal initiatives to drive growth over have all been supportive. This is a Farnings 7.5% 21.5% 10.5% Dividends 17.5% 19.5% 15.01 and a favorable macroeconomic backdrop trend we expect to continue, as consumer Book Value -8.0% -14.5% -25.0% in which consumers are willing, even confidence is higli and the labor market Fiscal QUARTERLY SALES (Smilla Full eager, to invest in their homes. The end has been making stricles, despite a lack- Fisca Begins Apr.Per Jul.Per Oct.Per Jan.Per Year result was record high quarterly sales and luster August jobs report. All told, we look 2014 15687 23811 20516 19162 earnings for The Home Depot. Specifically 83178 for GDP to rise around 3% in the second 2015 20391 24829 21819 20960 88519 fiscal second-quarter (ended July 30th) half of 2017. This favorable backdrop, com- 2016 22762 26472 23154 22207 94595 sales rose 6.2% and comparable store sales bined with management's efforts to court 2017 23887 28108 24475 23230 99700 were up 6.3%, while the metric rose 6.6% professional customers and toolster the 2018 25000 2930025476 26225 05000 for stores in the United States. The num- store's digital presence and interconnected Fiscal EARNINGS PER SHARE A B Full, ber of customer transactions was up 2.8%; retail capabilities, should also support Year Begins Apr.Per Jul.Per Oct.Per Jan.Per Year the average ticket increased 3.6%; and sales and earnings. In fact, leadership in- 2014 sales per square foot rose 5.9%. Dernand creased its full-year 2017 guidance, and .98 1.52 1.10 1.00 4.58 2016 1.16 1.66 1.35 1.17 5.34 was broad based cuss categories and ge- looks for sales and corps to rise 5.3% and 2016 1.44 1.97 1.60 1.44 6.45 ographics, and growth in sales to profos 5.5%, respectively. Share net is forecast to 2017 1.67 2.25 1.84 1.59 7.36 sionals outpaced those to DIY customers. be 57.29 a share. We've raised our call to 2018 1.85 2.51 2.00 1.89 8.25 Big-ticket sales (those over $900) were up $7.35, as rebuilding efforts in the wake of Cal QUARTERLY DIVIDENDS PAID Full 12.4% thanks to strong demand for ap- hurricanes Harvey and Irma should give a endar Mar 31 Jun 30 Sep.30 Dec.31 Year pliances and flooring. Consequently, share short-term boost to results. net was $0.05 above our call. 2013 .39 39 .39 .39 1.56 Conservative accounts looking to gain 2014 .47 47 47 1.85 Looking ahead, we think that the exposure to the housing market, along 2016 .59 59 59 59 2.36 good times will continue for The with some income, will likely want to 2016 .69 69 .69 2.78 Home Depot. Recent housing data have take a closer look at this timely stock. 2017 .89 89 been mixed, but this segment is likely Matthew Spencer, CEA September 22, 2017 (A) Fiscal year ends Sunday closest to January 150.00): 10. (SJ.02X '12. (10.10): 14, $0.15; Sept., and Dec. - Div'd rainvest. plan aval. Company's Financial Strength A++ 31st of the following year. '15, $0.12. Totals may not sur due to round (D) In milions, acjusted for stock splits Stock's Price Stability 95 (B) Diluted earrings. Excludes norrecurring ing. Next earrings report de November 14th. (E) Includes intangibles. At 131/16: 32,102 Price Growth Persistence gairslasses 07 ($0.101; 18, (S0.44) 'DA ICT Didens historicaly paid in March, June, mil. ($1.6dishare Earnings Predictability 2017 Value Line Inc. Alghts reserved Fathul malerial is tarted from sources believed to be riable and is provided without warranties of any kind THE PUBLISHER IS NOT ESIONSIBLE FOR ANY ERRORS OR UMSSIONS HEREN. This publication is strictly for users on commercio, Istemal use. No par to subscribe call 1-800-VALUELINE of I may be rexocused resc sised Ted in any printed, eecrcnic erotte Tom used for generating elngail pred tedionic pucavce u prod.d. 3756 11M Note: Manual calculation mode is on. You must press F9 key to calculate. 2015 2016 2014 $ 20,613 $ Facts and Assumptions Year Net sales Growth rate in sales Cost of goods soldet sales Gen., sell,, and admin. expenseset sales Long-term debt Current portion long-term debt Interest rate Tax rate Dividend/earnings after tax Current assetset sales Net fixed assets Current liabilitieset sales Owners' equity 760 $ 100 $ $ 25% 86% 12% 660 $ 100 $ 10% 45% 50% 29% 280 $ 14.5% 30% 86% 11% 560 100 10% 45% 50% 29% 270 14.4% $ $ 1,730 2014 $ INCOME STATEMENT Year Net sales Cost of good sold Gross profit Gen., sell, and admin. exp. Interest expense Earnings before tax Tax Earnings after tax Dividends paid Additions to retained earnings 2015 25,766 22,159 3,607 3,092 231 2016 $33,496 $28,806 $4,689 $3,685 $333 285 128 156 $672 $303 $370 $185 $185 78 78 $ BALANCE SHEET Current assets Net fixed assets Total assets Current liabilities Long-term debt Equity Total liabilities and shareholders' equity 7,472 280 7,752 3,736 660 1,808 6,204 $9,714 $270 $9,984 $4,823 $560 $1,934 $7,317 EXTERNAL FUNDING REQUIRED $ 1,548 $2,666 Home Depot Inc (NYS: HD) As Reported Annual Balance Sheet 2018 Cash & cash equivalents $2,770.60 Receivables, net $2,141.66 Merchandise inventories $12,912.49 Other current assets $633.28 Total current assets $18,458.02 Net property & equipment $21,510.87 Notes receivable $0.00 Goodwill $2,093.00 Other assets $1,235.00 Total assets $43,296.89 Short-term debt $710.00 Accounts payable $7,324.74 Accrued salaries & related expenses $1,515.39 Sales taxes payable $519.56 Deferred revenue $1,731.88 Income taxes payable $25.00 Current installments of long-term debt $542.00 Other accrued expenses $2,381.33 Total current liabilities $14,749.90 Long-term debt, excluding current installments $22,349.00 Other long-term liabilities $1,861.77 Deferred income taxes $296.00 Total liabilities $39,256.66 Common stock $88.00 Paid-in capital $10,391.25 Retained earnings $40,164.40 Accumulated other comprehensive income (loss) ($867.00) Treasury stock, at cost $46,000.00 Total stockholders' equity $3.776.65 Total liabilities and stockholders' equity $43,033.31 EFN $263.58 As Reported Annual Income Statement Net sales $98,950.00 Cost of sales $65,208.05 Gross profit $33,741.95 Selling, general & administrative expenses $17,811.00 $1,781.10 Depreciation & amortization expense Total operating expenses $19,592.10 Operating income $14,149.85 Interest & investment income $98.95 Interest expense $989.50 Interest & other income (expense), net $890.55 Earnings before provision for income taxes $13,259.30 Provision (benefit) for income taxes $4,813.13 Net earnings $8,446.17Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started