Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show how you got the answers! Apple Inc. (ticker: AAPL) is considering installing a new and highly sophisticated computer system in one of its

please show how you got the answers!

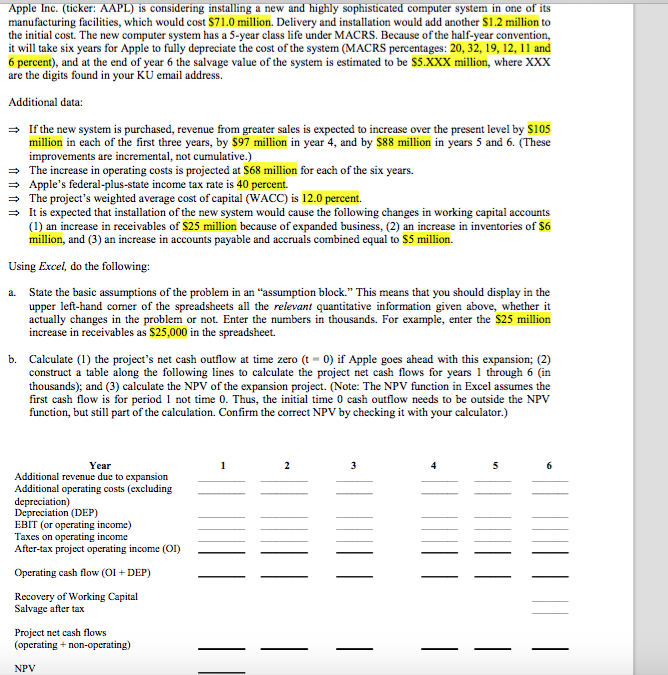

Apple Inc. (ticker: AAPL) is considering installing a new and highly sophisticated computer system in one of its manufacturing facilities, which would cost S71.0 million. Deliver)' and installation would add another SI .2 million to the initial cost. The new computer system has a 5-year class life under MACRS. Because of the half-year convention, it will take six years for Apple to fully depreciate the cost of the system (MACRS percentages: 20.32. 19, 12. 11 and 6 percent), and at the end of year 6 the salvage value of the system is estimated to be S5.XXX million, where XXX are the digits found in your KU email address. Additional data: If the new system is purchased, revenue from greater sales is expected to increase over the present level by SI 05 million in each of the first three years, by S97 million in year 4. and by S88 million in years 5 and 6. (These improvements are incremental, not cumulative.) The increase in operating costs is projected at S68 million for each of the six years. Apple's federal-pi us-site income tax rate is 40 percent. The project's weighted average cost of capital (WACC) is 12.0 percent. It is expected that installation of the new system would cause the following changes in working capital accounts (1) an increase in receivables of S25 million because of expanded business. (2) an increase in inventories of S6 million, and (3) an increase in accounts payable and accruals combined equal to S5 million. Using Excel, do the following: State the basic assumptions of the problem in an "assumption block." This means that you should display in the upper left-hand comer of the spreadsheets all the relevant quantitative information given above, whether it actually changes in the problem or not. Enter the numbers in thousands. For example, enter the S25 million increase in receivables as S25.000 in the spreadsheet Calculate (l) the project's net cash outflow at time zero (t = 0) if Apple goes ahead with this expansion; (2) construct a table along the following lines to calculate the project net cash flows for years 1 through 6 (in thousands); and (3) calculate the NPV of the expansion project. (The NPV function in Excel assumes the first cash flow is for period I not time 0. Thus, the initial time 0 cash outflow needs to be outside the NPV function, but still part of the calculation. Confirm the correct NPV by checking it with your calculator.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started