Answered step by step

Verified Expert Solution

Question

1 Approved Answer

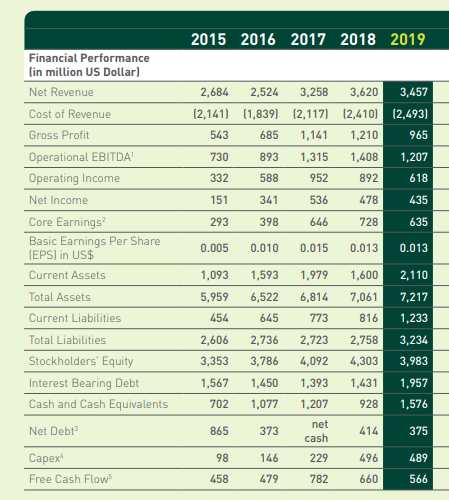

Please review this 3 year financial report (2017-2019) 1. Please review the financial report (2017) and what is the condition of the company? 2. Please

Please review this 3 year financial report (2017-2019)

1. Please review the financial report (2017) and what is the condition of the company?

2. Please review the financial report (2018) and what is the condition of the company?

3. Please review the financial report (2019) and what is the condition of the company?

2015 2016 2017 2018 2019 Financial Performance (in million US Dollar) Net Revenue Cost of Revenue Gross Profit Operational EBITDA Operating Income 2,684 2,524 3,258 3,620 (2,141) (1,839) (2,117) (2,410) 543 685 1,141 1,210 730 893 1,315 1,408 332 588 952 892 3,457 (2,493) 965 1,207 618 Net Income 151 341 536 478 435 293 398 646 728 635 0.005 0.010 0.015 0.013 0.013 1,093 2,110 1,979 6,814 Core Earnings Basic Earnings Per Share (EPS) in US$ Current Assets Total Assets Current Liabilities Total Liabilities Stockholders' Equity Interest Bearing Debt Cash and Cash Equivalents 1,593 6,522 645 1,600 7,061 5,959 454 7,217 1,233 773 816 2,723 3,234 2,606 3,353 2,758 4,303 3,983 2,736 3,786 1,450 1,077 4,092 1,393 1,207 1,431 1,567 702 1,957 928 1,576 Net Debt 865 373 net cash 414 375 98 146 229 496 489 Capex Free Cash Flow 458 479 782 660 566 2015 2016 2017 2018 2019 20.2 27.1 35.0 33.4 27.9 N 27.2 35.4 40.4 38.9 34.9 12.4 23.3 29.2 24.6 17.9 4.5 9.0 13.1 11.1 10.9 2.5 5.2 6.8 6.0 Financial Ratios Gruss Prufit Margin (%) Operational EBITDA margin (%) Operating Margin %) Return on Equity [%] Return on Assets (%) Net Debt to Equity [x] Net Debt to Operational Ebitda [x] Cash from Operations to Capex (x) Current Ratio (x) Operating Statistics Coal Production Sales Volume 0.3 0.1 0.1 0.1 7.9 net cash net cash 1.2 0.4 0.3 0.3 5.2 6.2 4.7 2.4 2.0 2.4 2.5 2.6 2.0 1.7 51.5 52.6 51.8 54.0 58.0 53.1 54.1 51.8 54.4 59.2 Overburden Removal 267.0 234.1 238.7 273.6 272.1 Actual Strip Ratio [x] 5.2 4.5 4.6 5.1 4.7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started