Please see attached documents. Prepare the statement of financial position and the comprehensive income statement.

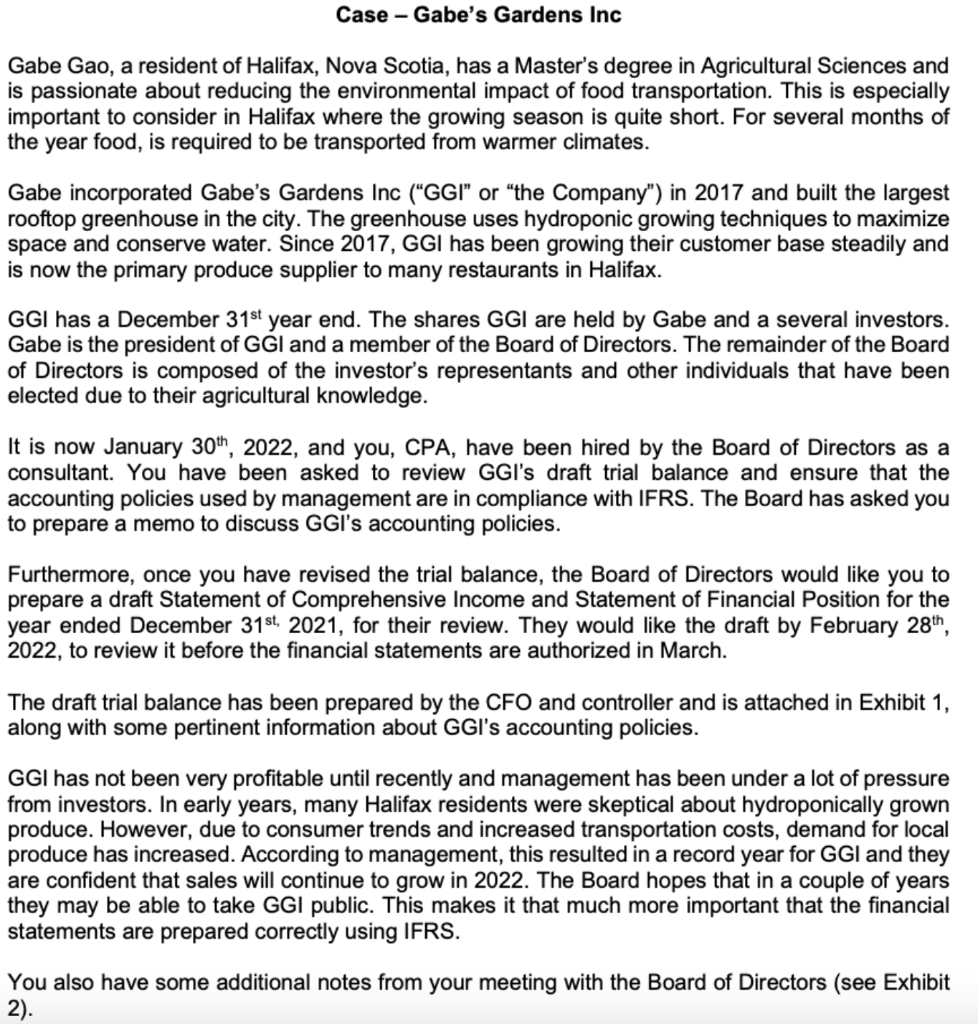

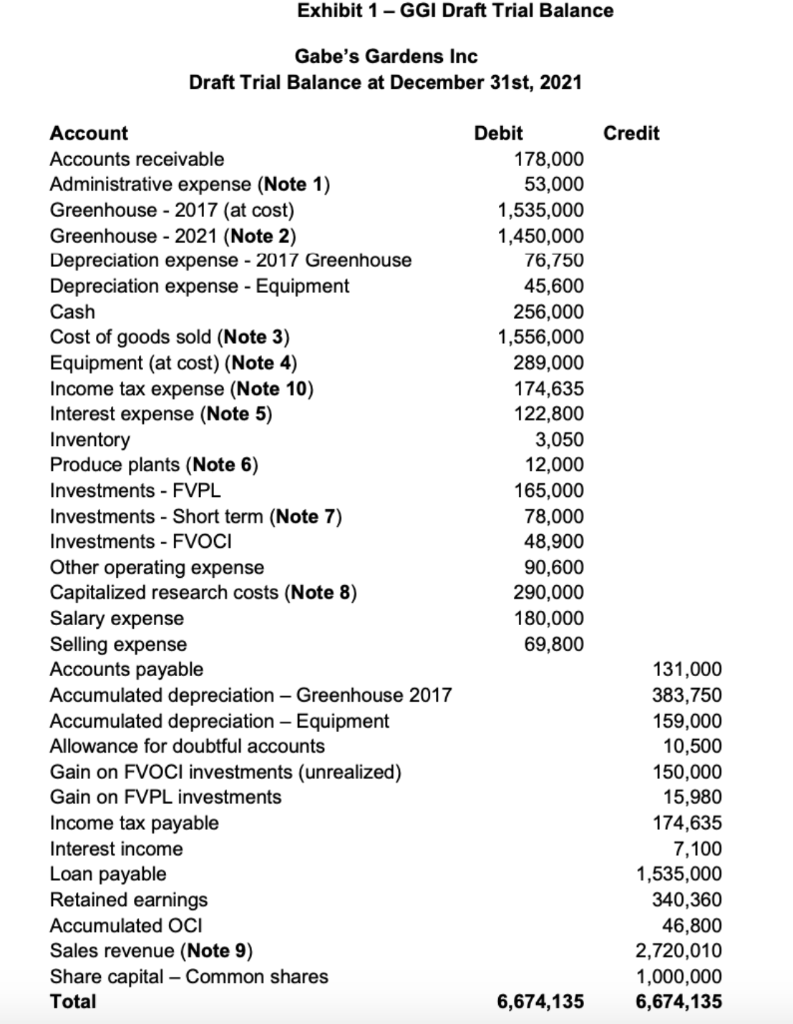

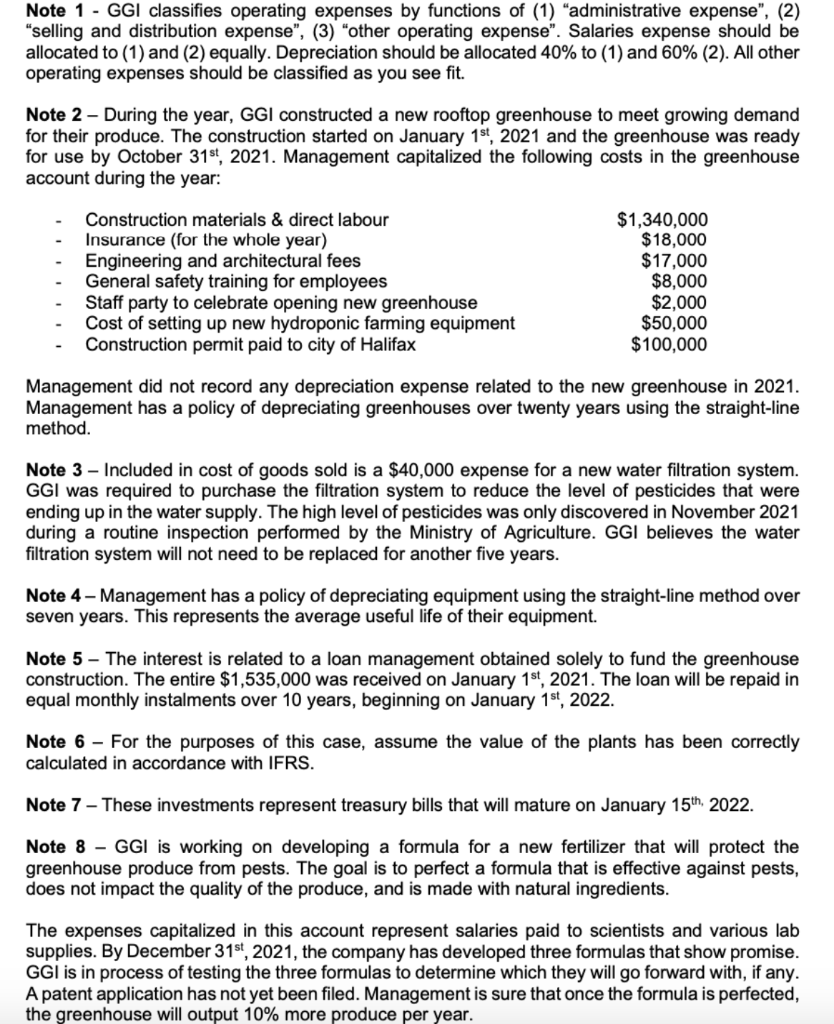

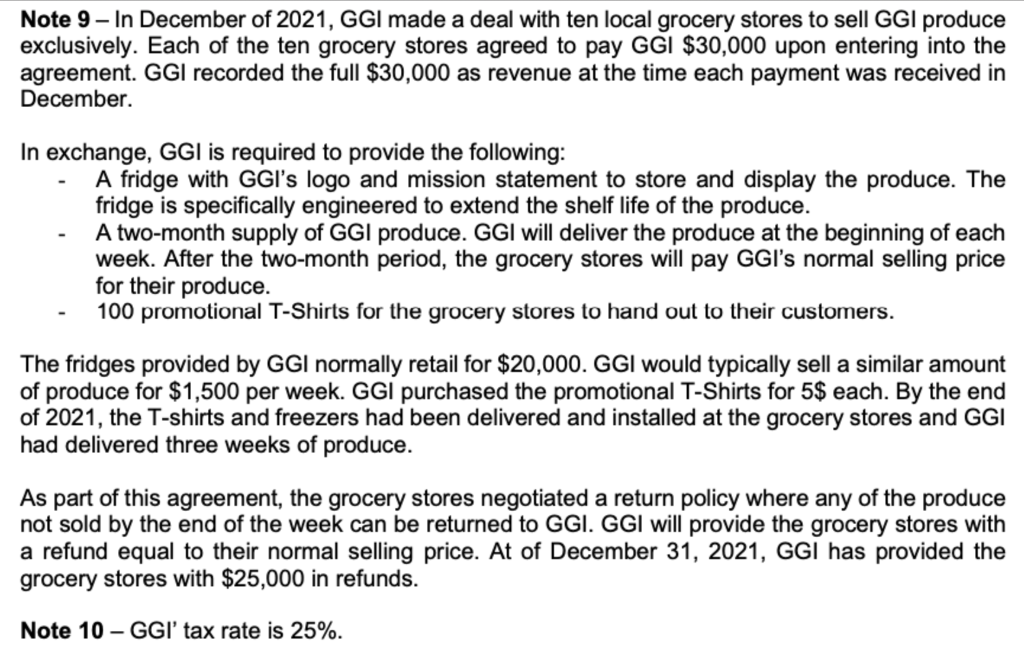

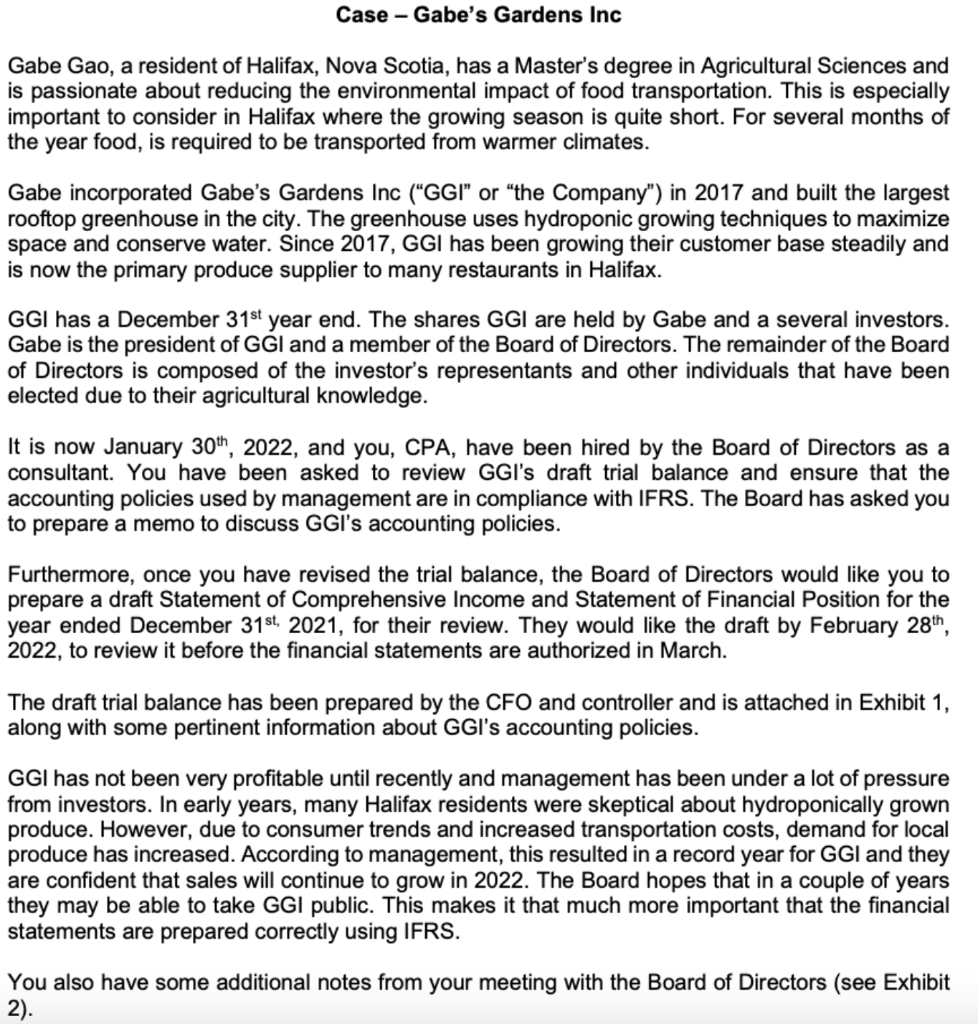

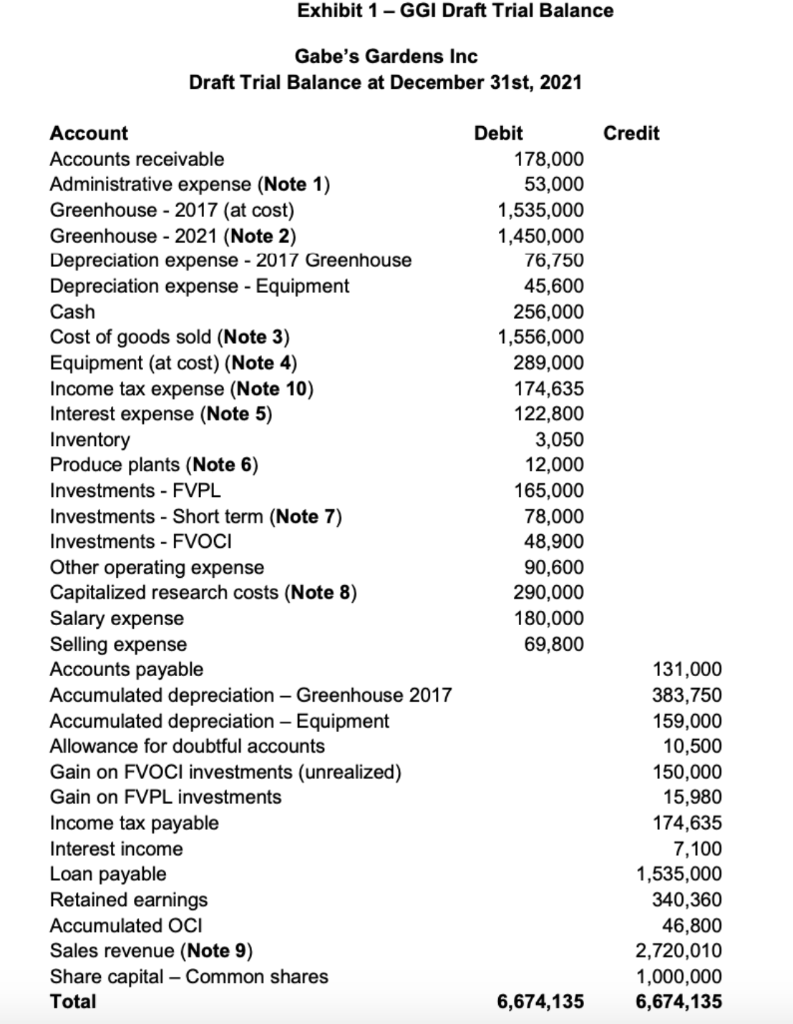

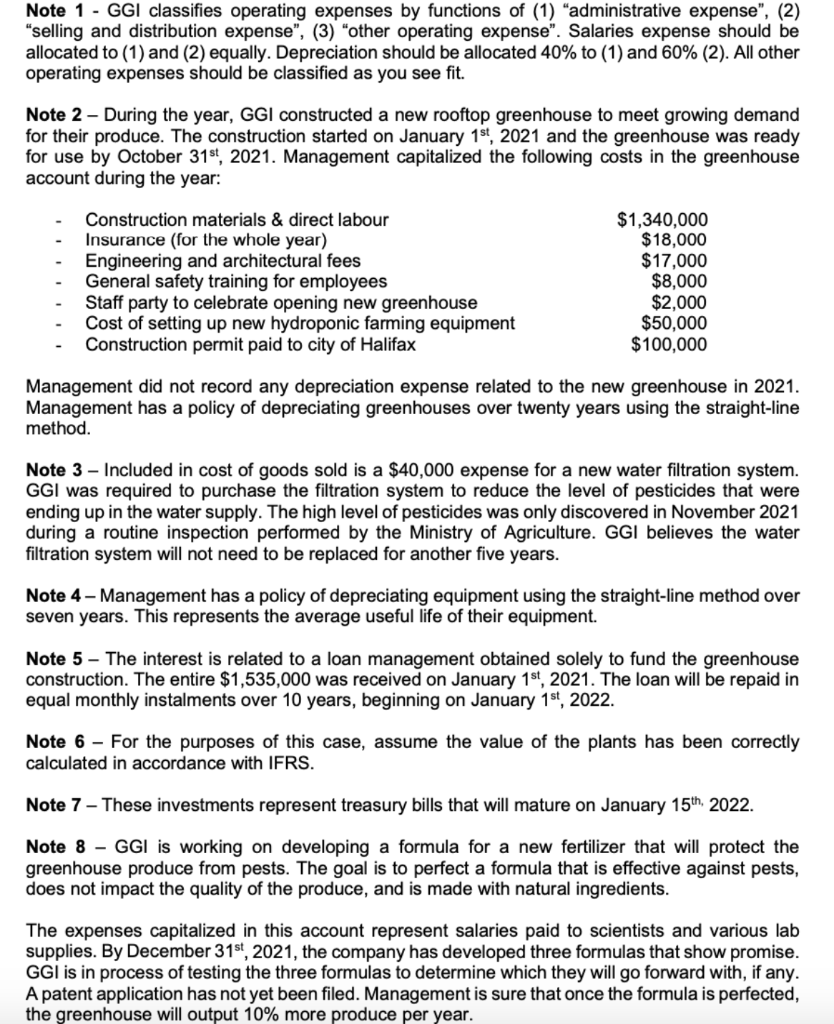

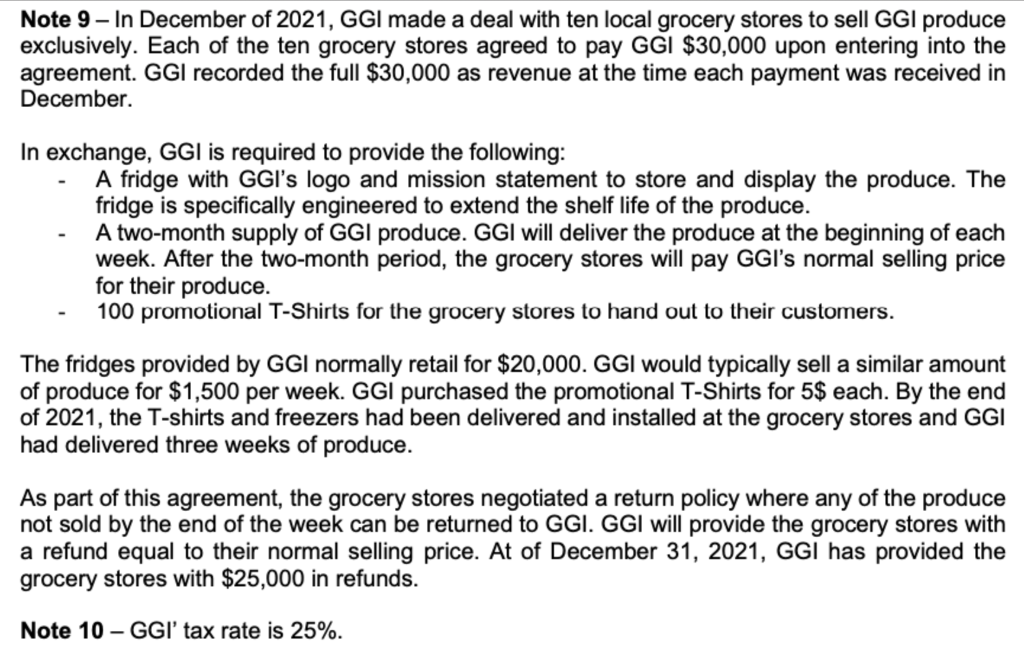

Case - Gabe's Gardens Inc Gabe Gao, a resident of Halifax, Nova Scotia, has a Master's degree in Agricultural Sciences and is passionate about reducing the environmental impact of food transportation. This is especially important to consider in Halifax where the growing season is quite short. For several months of the year food, is required to be transported from warmer climates. Gabe incorporated Gabe's Gardens Inc ("GGI or the Company") in 2017 and built the largest rooftop greenhouse in the city. The greenhouse uses hydroponic growing techniques to maximize space and conserve water. Since 2017, GGI has been growing their customer base steadily and is now the primary produce supplier to many restaurants in Halifax. GGI has a December 31st year end. The shares GGI are held by Gabe and a several investors. Gabe is the president of GGI and a member of the Board of Directors. The remainder of the Board of Directors is composed of the investor's representants and other individuals that have been elected due to their agricultural knowledge. 1 It is now January 30th, 2022, and you, CPA, have been hired by the Board of Directors as a consultant. You have been asked to review GGI's draft trial balance and ensure that the accounting policies used by management are in compliance with IFRS. The Board has asked you to prepare a memo to discuss GGI's accounting policies. Furthermore, once you have revised the trial balance, the Board of Directors would like you to prepare a draft Statement of Comprehensive Income and Statement of Financial Position for the year ended December 31st, 2021, for their review. They would like the draft by February 28th, 2022, to review it before the financial statements are authorized in March. The draft trial balance has been prepared by the CFO and controller and is attached in Exhibit 1, along with some pertinent information about GGI's accounting policies. GGI has not been very profitable until recently and management has been under a lot of pressure from investors. In early years, many Halifax residents were skeptical about hydroponically grown produce. However, due to consumer trends and increased transportation costs, demand for local produce has increased. According to management, this resulted in a record year for GGI and they are confident that sales will continue to grow in 2022. The Board hopes that in a couple of years they may be able to take GGI public. This makes it that much more important that the financial statements are prepared correctly using IFRS. You also have some additional notes from your meeting with the Board of Directors (see Exhibit 2). Exhibit 1-GGI Draft Trial Balance Gabe's Gardens Inc Draft Trial Balance at December 31st, 2021 Credit Account Accounts receivable Administrative expense (Note 1) Greenhouse - 2017 (at cost) Greenhouse - 2021 (Note 2) Depreciation expense - 2017 Greenhouse Depreciation expense - Equipment Cash Cost of goods sold (Note 3) Equipment (at cost) (Note 4) Income tax expense (Note 10) Interest expense (Note 5) Inventory Produce plants (Note 6) Investments - FVPL Investments - Short term (Note 7) Investments - FVOCI Other operating expense Capitalized research costs (Note 8) Salary expense Selling expense Accounts payable Accumulated depreciation - Greenhouse 2017 Accumulated depreciation - Equipment Allowance for doubtful accounts Gain on FVOCI investments (unrealized) Gain on FVPL investments Income tax payable Interest income Loan payable Retained earnings Accumulated OCI Sales revenue (Note 9) Share capital - Common shares Total Debit 178,000 53,000 1,535,000 1,450,000 76,750 45,600 256,000 1,556,000 289,000 174,635 122,800 3,050 12,000 165,000 78,000 48,900 90,600 290,000 180,000 69,800 131,000 383,750 159,000 10,500 150,000 15,980 174,635 7,100 1,535,000 340,360 46,800 2,720,010 1,000,000 6,674,135 6,674,135 Note 1 - GGI classifies operating expenses by functions of (1) administrative expense", (2) "selling and distribution expense", (3) "other operating expense". Salaries expense should be allocated to (1) and (2) equally. Depreciation should be allocated 40% to (1) and 60% (2). All other operating expenses should be classified as you see fit. Note 2 - During the year, GGI constructed a new rooftop greenhouse to meet growing demand for their produce. The construction started on January 1st, 2021 and the greenhouse was ready for use by October 31st, 2021. Management capitalized the following costs in the greenhouse account during the year: Construction materials & direct labour Insurance (for the whole year) Engineering and architectural fees General safety training for employees Staff party to celebrate opening new greenhouse Cost of setting up new hydroponic farming equipment Construction permit paid to city of Halifax $1,340,000 $18,000 $17,000 $8,000 $2,000 $50,000 $100,000 Management did not record any depreciation expense related to the new greenhouse in 2021. Management has a policy of depreciating greenhouses over twenty years using the straight-line method. Note 3 - Included in cost of goods sold is a $40,000 expense for a new water filtration system. GGI was required to purchase the filtration system to reduce the level of pesticides that were ending up in the water supply. The high level of pesticides was only discovered in November 2021 during a routine inspection performed by the Ministry of Agriculture. GGI believes the water filtration system will not need to be replaced for another five years. Note 4 - Management has a policy of depreciating equipment using the straight-line method over seven years. This represents the average useful life of their equipment. Note 5 - The interest is related to a loan management obtained solely to fund the greenhouse construction. The entire $1,535,000 was received on January 1st, 2021. The loan will be repaid in equal monthly instalments over 10 years, beginning on January 1st, 2022. Note 6 - For the purposes of this case, assume the value of the plants has been correctly calculated in accordance with IFRS. Note 7 - These investments represent treasury bills that will mature on January 15th, 2022. Note 8 - GGI is working on developing a formula for a new fertilizer that will protect the greenhouse produce from pests. The goal is to perfect a formula that is effective against pests, does not impact the quality of the produce, and is made with natural ingredients. The expenses capitalized in this account represent salaries paid to scientists and various lab supplies. By December 31st, 2021, the company has developed three formulas that show promise. GGI is in process of testing the three formulas to determine which they will go forward with, if any. A patent application has not yet been filed. Management is sure that once the formula is perfected, the greenhouse will output 10% more produce per year. Note 9 In December of 2021, GGI made a deal with ten local grocery stores to sell GGI produce exclusively. Each of the ten grocery stores agreed to pay GGI $30,000 upon entering into the agreement. GGI recorded the full $30,000 as revenue at the time each payment was received in December In exchange, GGI is required to provide the following: A fridge with GGI's logo and mission statement to store and display the produce. The fridge is specifically engineered to extend the shelf life of the produce. A two-month supply of GGI produce. GGI will deliver the produce at the beginning of each week. After the two-month period, the grocery stores will pay GGI's normal selling price for their produce. 100 promotional T-Shirts for the grocery stores to hand out to their customers. The fridges provided by GGI normally retail for $20,000. GGI would typically sell a similar amount of produce for $1,500 per week. GGI purchased the promotional T-Shirts for 5$ each. By the end of 2021, the T-shirts and freezers had been delivered and installed at the grocery stores and GGI had delivered three weeks of produce. As part of this agreement, the grocery stores negotiated a return policy where any of the produce not sold by the end of the week can be returned to GGI. GGI will provide the grocery stores with a refund equal to their normal selling price. At of December 31, 2021, GGI has provided the grocery stores with $25,000 in refunds. Note 10 - GGI' tax rate is 25%. Case - Gabe's Gardens Inc Gabe Gao, a resident of Halifax, Nova Scotia, has a Master's degree in Agricultural Sciences and is passionate about reducing the environmental impact of food transportation. This is especially important to consider in Halifax where the growing season is quite short. For several months of the year food, is required to be transported from warmer climates. Gabe incorporated Gabe's Gardens Inc ("GGI or the Company") in 2017 and built the largest rooftop greenhouse in the city. The greenhouse uses hydroponic growing techniques to maximize space and conserve water. Since 2017, GGI has been growing their customer base steadily and is now the primary produce supplier to many restaurants in Halifax. GGI has a December 31st year end. The shares GGI are held by Gabe and a several investors. Gabe is the president of GGI and a member of the Board of Directors. The remainder of the Board of Directors is composed of the investor's representants and other individuals that have been elected due to their agricultural knowledge. 1 It is now January 30th, 2022, and you, CPA, have been hired by the Board of Directors as a consultant. You have been asked to review GGI's draft trial balance and ensure that the accounting policies used by management are in compliance with IFRS. The Board has asked you to prepare a memo to discuss GGI's accounting policies. Furthermore, once you have revised the trial balance, the Board of Directors would like you to prepare a draft Statement of Comprehensive Income and Statement of Financial Position for the year ended December 31st, 2021, for their review. They would like the draft by February 28th, 2022, to review it before the financial statements are authorized in March. The draft trial balance has been prepared by the CFO and controller and is attached in Exhibit 1, along with some pertinent information about GGI's accounting policies. GGI has not been very profitable until recently and management has been under a lot of pressure from investors. In early years, many Halifax residents were skeptical about hydroponically grown produce. However, due to consumer trends and increased transportation costs, demand for local produce has increased. According to management, this resulted in a record year for GGI and they are confident that sales will continue to grow in 2022. The Board hopes that in a couple of years they may be able to take GGI public. This makes it that much more important that the financial statements are prepared correctly using IFRS. You also have some additional notes from your meeting with the Board of Directors (see Exhibit 2). Exhibit 1-GGI Draft Trial Balance Gabe's Gardens Inc Draft Trial Balance at December 31st, 2021 Credit Account Accounts receivable Administrative expense (Note 1) Greenhouse - 2017 (at cost) Greenhouse - 2021 (Note 2) Depreciation expense - 2017 Greenhouse Depreciation expense - Equipment Cash Cost of goods sold (Note 3) Equipment (at cost) (Note 4) Income tax expense (Note 10) Interest expense (Note 5) Inventory Produce plants (Note 6) Investments - FVPL Investments - Short term (Note 7) Investments - FVOCI Other operating expense Capitalized research costs (Note 8) Salary expense Selling expense Accounts payable Accumulated depreciation - Greenhouse 2017 Accumulated depreciation - Equipment Allowance for doubtful accounts Gain on FVOCI investments (unrealized) Gain on FVPL investments Income tax payable Interest income Loan payable Retained earnings Accumulated OCI Sales revenue (Note 9) Share capital - Common shares Total Debit 178,000 53,000 1,535,000 1,450,000 76,750 45,600 256,000 1,556,000 289,000 174,635 122,800 3,050 12,000 165,000 78,000 48,900 90,600 290,000 180,000 69,800 131,000 383,750 159,000 10,500 150,000 15,980 174,635 7,100 1,535,000 340,360 46,800 2,720,010 1,000,000 6,674,135 6,674,135 Note 1 - GGI classifies operating expenses by functions of (1) administrative expense", (2) "selling and distribution expense", (3) "other operating expense". Salaries expense should be allocated to (1) and (2) equally. Depreciation should be allocated 40% to (1) and 60% (2). All other operating expenses should be classified as you see fit. Note 2 - During the year, GGI constructed a new rooftop greenhouse to meet growing demand for their produce. The construction started on January 1st, 2021 and the greenhouse was ready for use by October 31st, 2021. Management capitalized the following costs in the greenhouse account during the year: Construction materials & direct labour Insurance (for the whole year) Engineering and architectural fees General safety training for employees Staff party to celebrate opening new greenhouse Cost of setting up new hydroponic farming equipment Construction permit paid to city of Halifax $1,340,000 $18,000 $17,000 $8,000 $2,000 $50,000 $100,000 Management did not record any depreciation expense related to the new greenhouse in 2021. Management has a policy of depreciating greenhouses over twenty years using the straight-line method. Note 3 - Included in cost of goods sold is a $40,000 expense for a new water filtration system. GGI was required to purchase the filtration system to reduce the level of pesticides that were ending up in the water supply. The high level of pesticides was only discovered in November 2021 during a routine inspection performed by the Ministry of Agriculture. GGI believes the water filtration system will not need to be replaced for another five years. Note 4 - Management has a policy of depreciating equipment using the straight-line method over seven years. This represents the average useful life of their equipment. Note 5 - The interest is related to a loan management obtained solely to fund the greenhouse construction. The entire $1,535,000 was received on January 1st, 2021. The loan will be repaid in equal monthly instalments over 10 years, beginning on January 1st, 2022. Note 6 - For the purposes of this case, assume the value of the plants has been correctly calculated in accordance with IFRS. Note 7 - These investments represent treasury bills that will mature on January 15th, 2022. Note 8 - GGI is working on developing a formula for a new fertilizer that will protect the greenhouse produce from pests. The goal is to perfect a formula that is effective against pests, does not impact the quality of the produce, and is made with natural ingredients. The expenses capitalized in this account represent salaries paid to scientists and various lab supplies. By December 31st, 2021, the company has developed three formulas that show promise. GGI is in process of testing the three formulas to determine which they will go forward with, if any. A patent application has not yet been filed. Management is sure that once the formula is perfected, the greenhouse will output 10% more produce per year. Note 9 In December of 2021, GGI made a deal with ten local grocery stores to sell GGI produce exclusively. Each of the ten grocery stores agreed to pay GGI $30,000 upon entering into the agreement. GGI recorded the full $30,000 as revenue at the time each payment was received in December In exchange, GGI is required to provide the following: A fridge with GGI's logo and mission statement to store and display the produce. The fridge is specifically engineered to extend the shelf life of the produce. A two-month supply of GGI produce. GGI will deliver the produce at the beginning of each week. After the two-month period, the grocery stores will pay GGI's normal selling price for their produce. 100 promotional T-Shirts for the grocery stores to hand out to their customers. The fridges provided by GGI normally retail for $20,000. GGI would typically sell a similar amount of produce for $1,500 per week. GGI purchased the promotional T-Shirts for 5$ each. By the end of 2021, the T-shirts and freezers had been delivered and installed at the grocery stores and GGI had delivered three weeks of produce. As part of this agreement, the grocery stores negotiated a return policy where any of the produce not sold by the end of the week can be returned to GGI. GGI will provide the grocery stores with a refund equal to their normal selling price. At of December 31, 2021, GGI has provided the grocery stores with $25,000 in refunds. Note 10 - GGI' tax rate is 25%