Please see attached:(Table attached below)

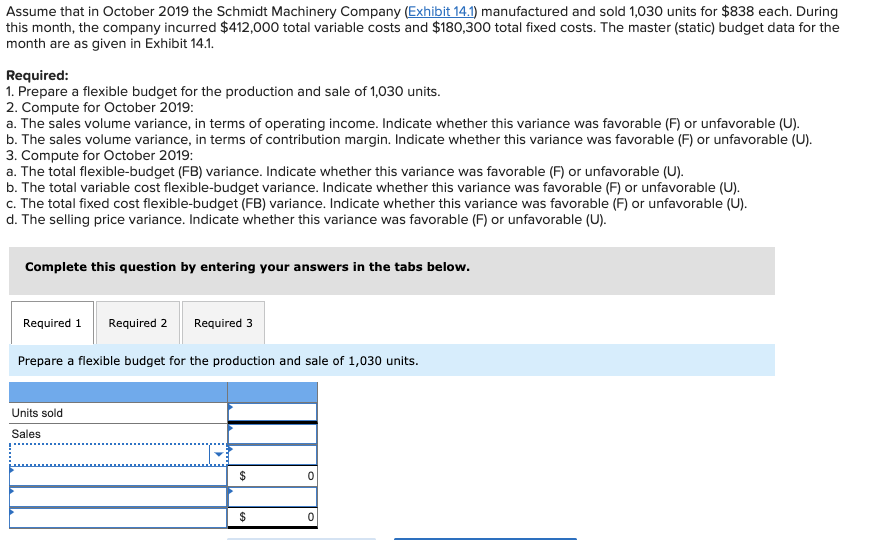

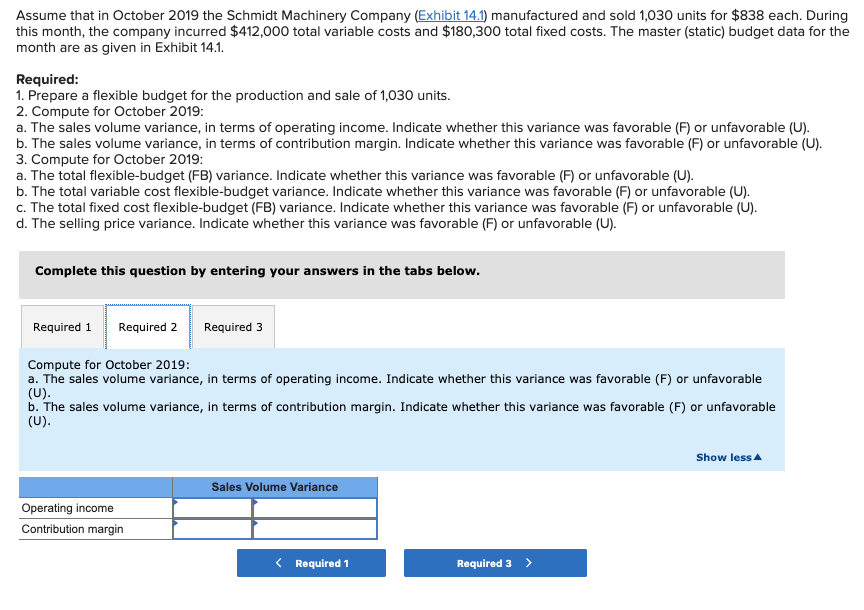

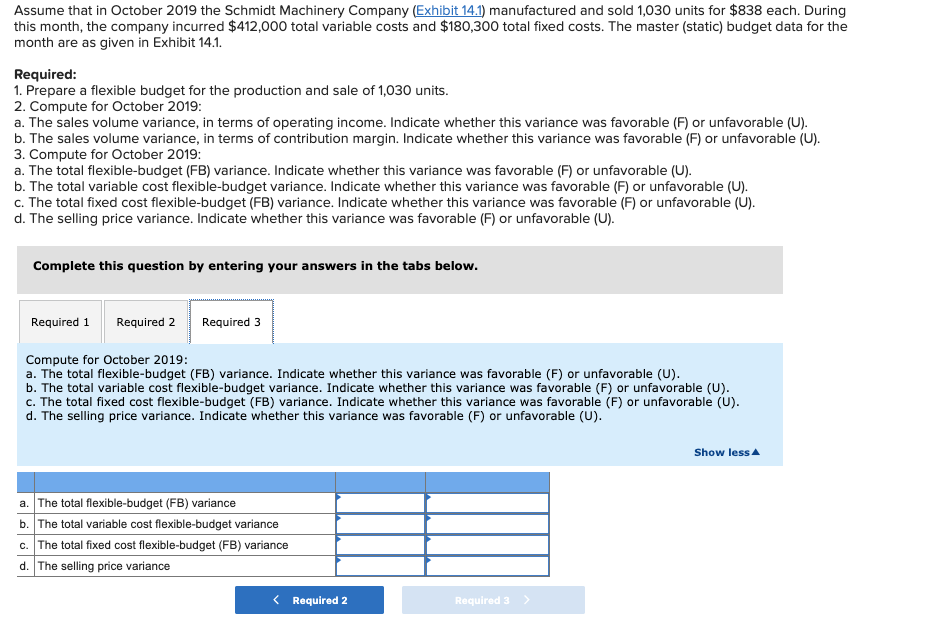

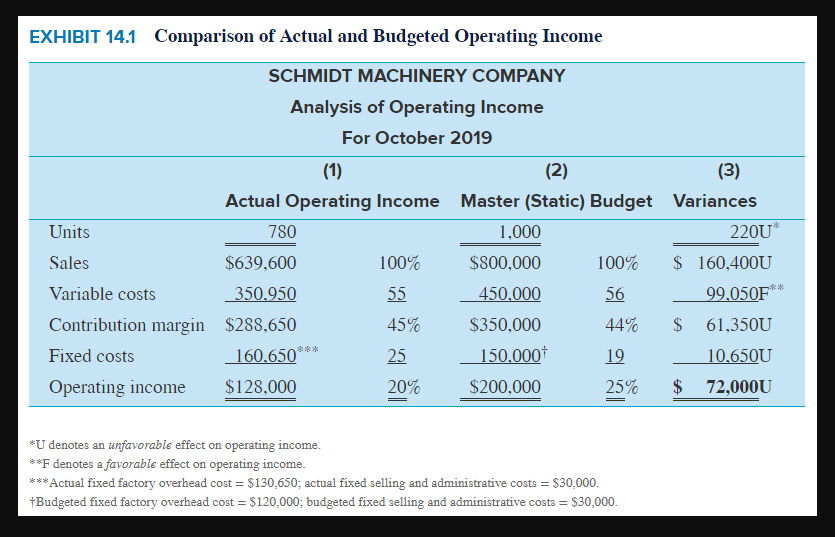

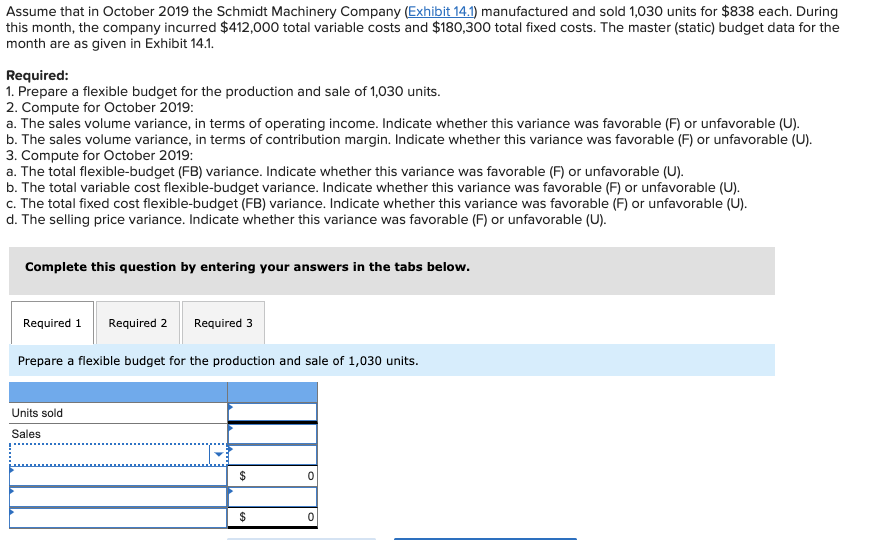

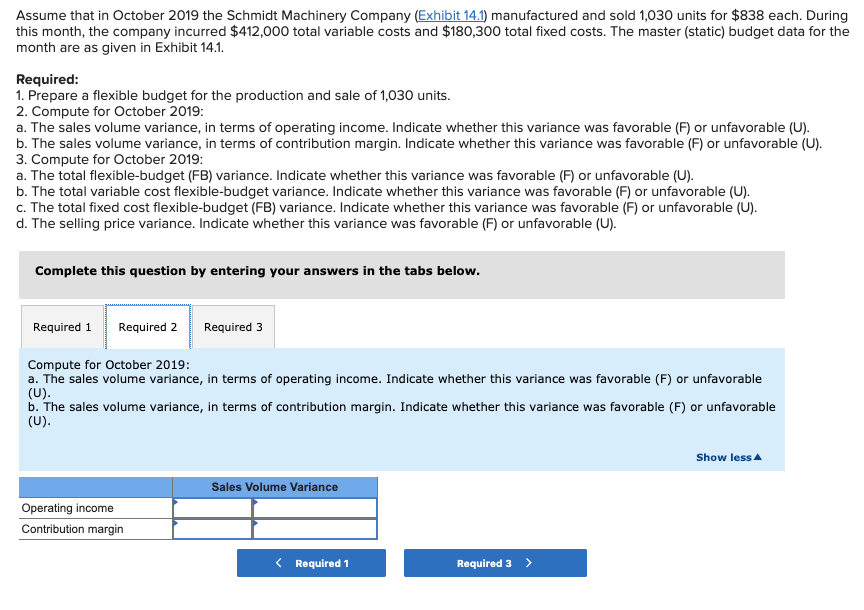

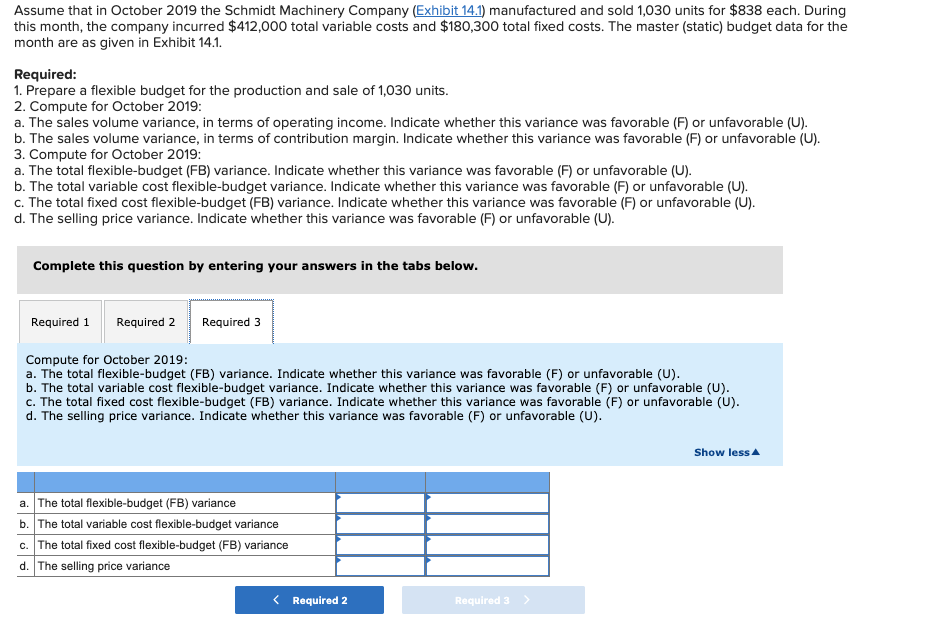

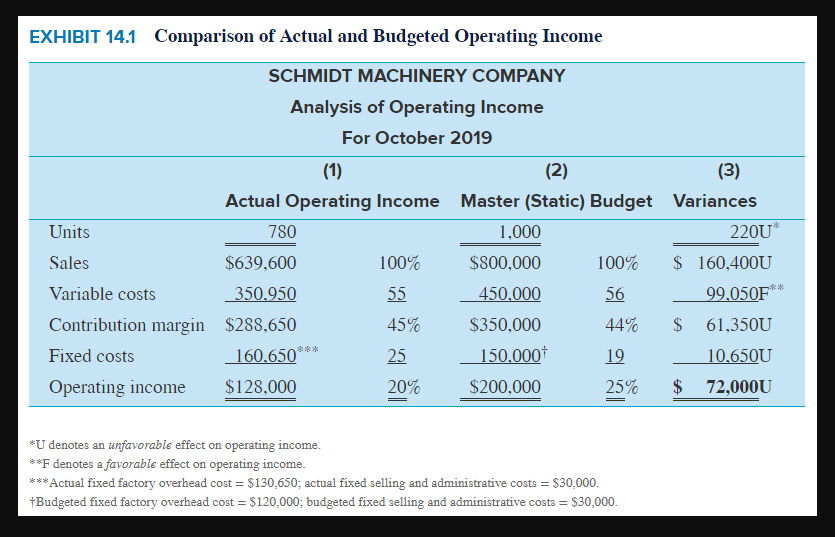

Assume that in October 2019 the Schmidt Machinery Company (Exhibit 14.1) manufactured and sold 1,030 units for $838 each. During this month, the company incurred $412,000 total variable costs and $180,300 total fixed costs. The master (static) budget data for the month are as given in Exhibit 14.1. Required: 1. Prepare a flexible budget for the production and sale of 1,030 units. 2. Compute for Octobe a. The sales volume variance, in terms of operating income. Indicate whether this variance was favorable (F) or unfavorable (U). b. The sales volume variance, in terms of contribution margin. Indicate whether this variance was favorable (F) or unfavorable (U). 3. Compute for October 2019: a. The total flexible-budget (FB) variance. Indicate whether this variance was favorable (F) or unfavorable (U). b. The total variable cost flexible-budget variance. Indicate whether this variance was favorable (F) or unfavorable (U). c. The total fixed cost flexible-budget (FB) variance. Indicate whether this variance was favorable (F) or unfavorable (U). d. The selling price variance. Indicate whether this variance was favorable (F) or unfavorable (U). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a flexible budget for the production and sale of 1,030 units. Units sold Sales Assume that in October 2019 the Schmidt Machinery Company (Exhibit 14.1) manufactured and sold 1,030 units for $838 each. During this month, the company incurred $412,000 total variable costs and $180,300 total fixed costs. The master (static) budget data for the month are as given in Exhibit 14.1. Required: 1. Prepare a flexible budget for the production and sale of 1,030 units. 2. Compute for October 2019: a. The sales volume variance, in terms of operating income. Indicate whether this variance was favorable (F) or unfavorable (U). b. The sales volume variance, in terms of contribution margin. Indicate whether this variance was favorable (F) or unfavorable (U). 3. Compute for October 2019: a. The total flexible-budget (FB) variance. Indicate whether this variance was favorable (F) or unfavorable (U). b. The total variable cost flexible-budget variance. Indicate whether this variance was favorable (F) or unfavorable (U). c. The total fixed cost flexible-budget (FB) variance. Indicate whether this variance was favorable (F) or unfavorable (U). d. The selling price variance. Indicate whether this variance was favorable (F) or unfavorable (U). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute for October 2019: a. The sales volume variance, in terms of operating income. Indicate whether this variance was favorable (F) or unfavorable (U). b. The sales volume variance, in terms of contribution margin. Indicate whether this variance was favorable (F) or unfavorable (U). Show less Sales Volume Variance Operating income Contribution margin Required 1 Required 3 > Assume that in October 2019 the Schmidt Machinery Company (Exhibit 14.1) manufactured and sold 1,030 units for $838 each. During this month, the company incurred $412,000 total variable costs and $180,300 total fixed costs. The master (static) budget data for the month are as given in Exhibit 14.1. Required: 1. Prepare a flexible budget for the production and sale of 1,030 units. 2. Compute for October 2019: a. The sales volume variance, in terms of operating income. Indicate whether this variance was favorable (F) or unfavorable (U). b. The sales volume variance, in terms of contribution margin. Indicate whether this variance was favorable (F) or unfavorable (U). 3. Compute for October 2019: a. The total flexible-budget (FB) variance. Indicate whether this variance was favorable (F) or unfavorable (U). b. The total variable cost flexible-budget variance. Indicate whether this variance was favorable (F) or unfavorable (U). C. The total fixed cost flexible-budget (FB) variance. Indicate whether this variance was favorable (F) or unfavorable (U). d. The selling price variance. Indicate whether this variance was favorable (F) or unfavorable (U). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute for October 2019: a. The total flexible-budget (FB) variance. Indicate whether this variance was favorable (F) or unfavorable (U). b. The total variable cost flexible-budget variance. Indicate whether this variance was favorable (F) or unfavorable (U). c. The total fixed cost flexible-budget (FB) variance. Indicate whether this variance was favorable (F) or unfavorable (U). d. The selling price variance. Indicate whether this variance was favorable (F) or unfavorable (U). Show less a. The total flexible-budget (FB) variance b. The total variable cost flexible-budget variance c. The total fixed cost flexible-budget (FB) variance d. The selling price variance