Answered step by step

Verified Expert Solution

Question

1 Approved Answer

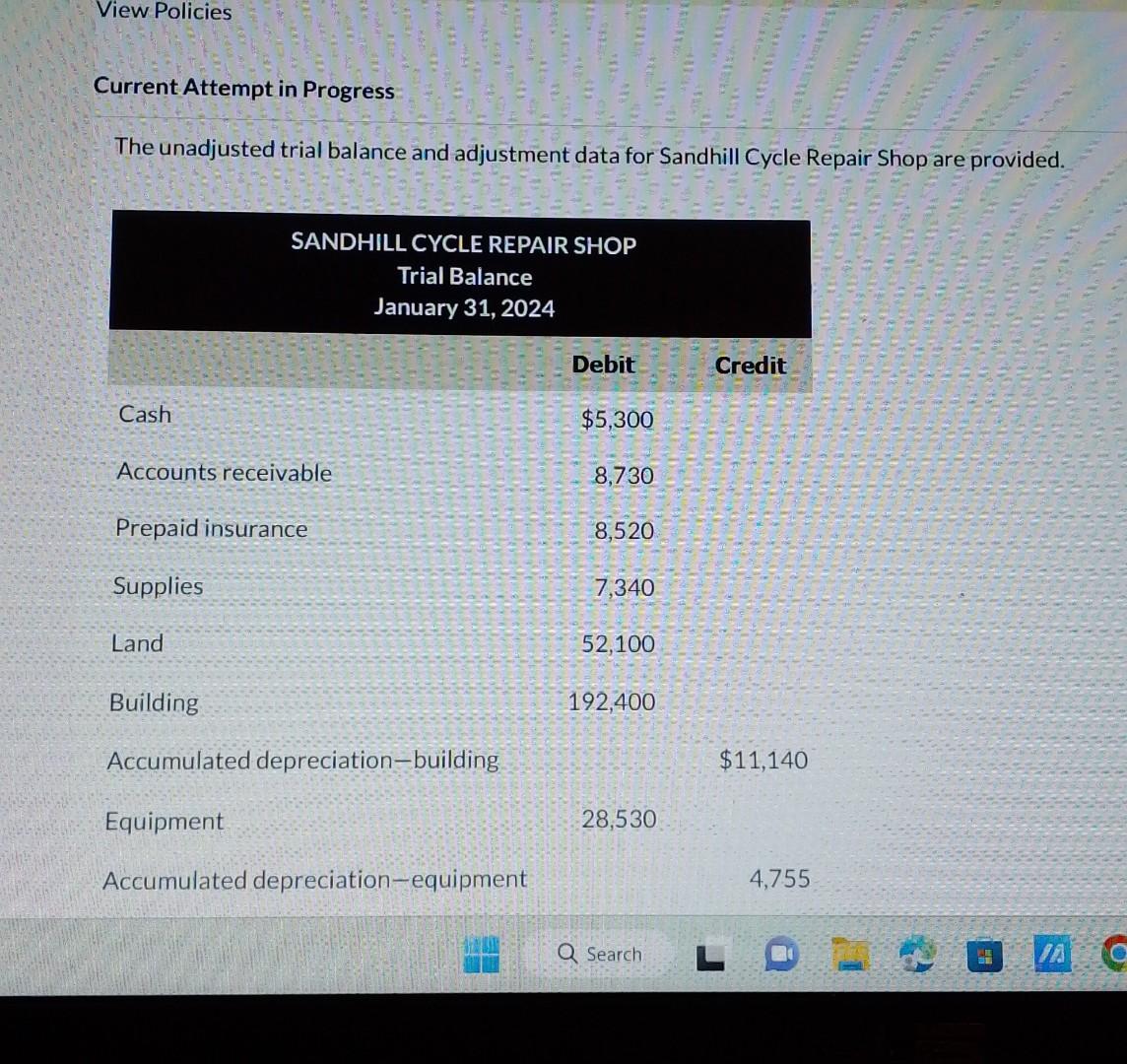

please send full answer Current Attempt in Progress The unadjusted trial balance and adjustment data for Sandhill Cycle Repair Shop are provided. Land 52,100 Building

please send full answer

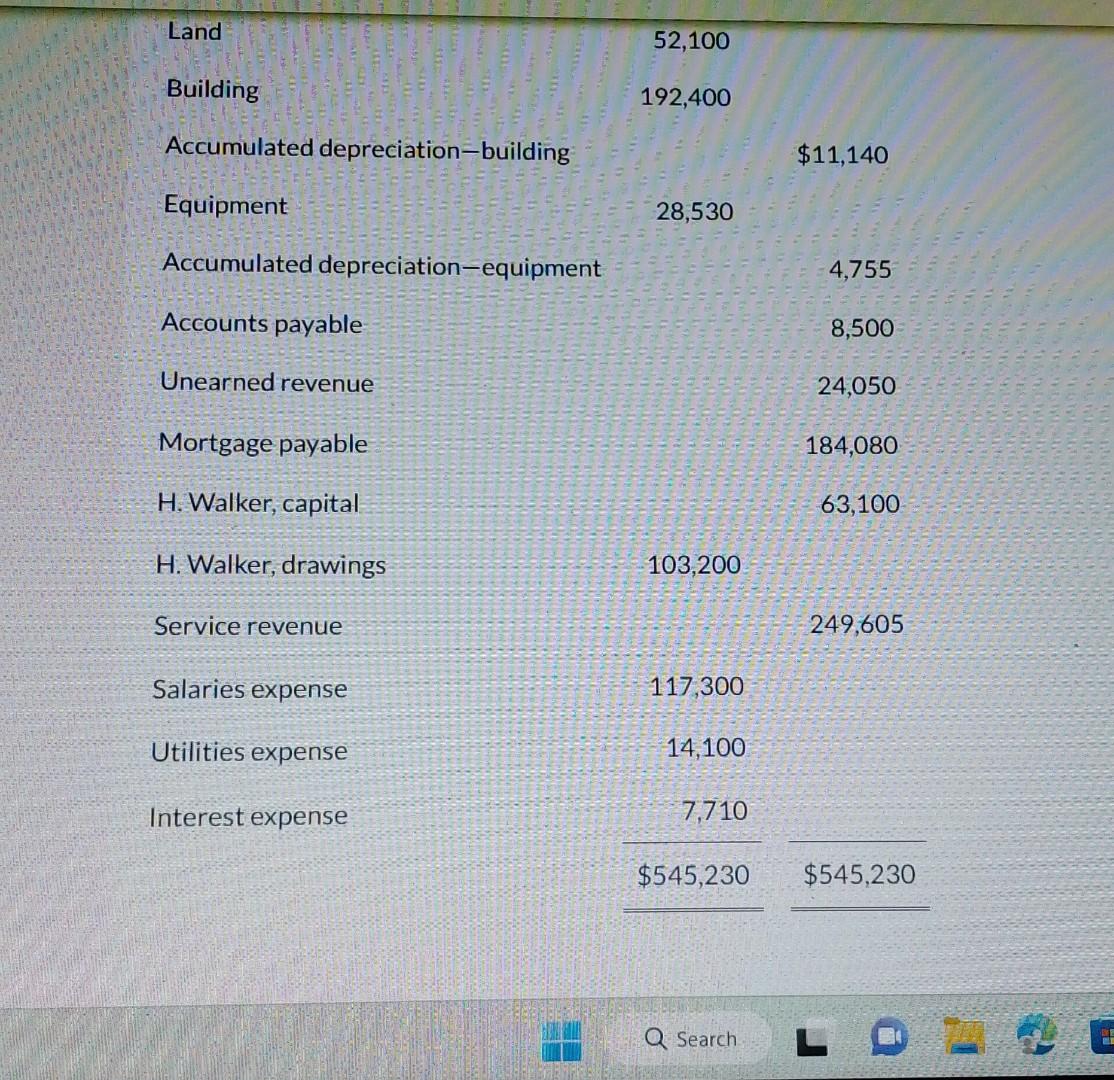

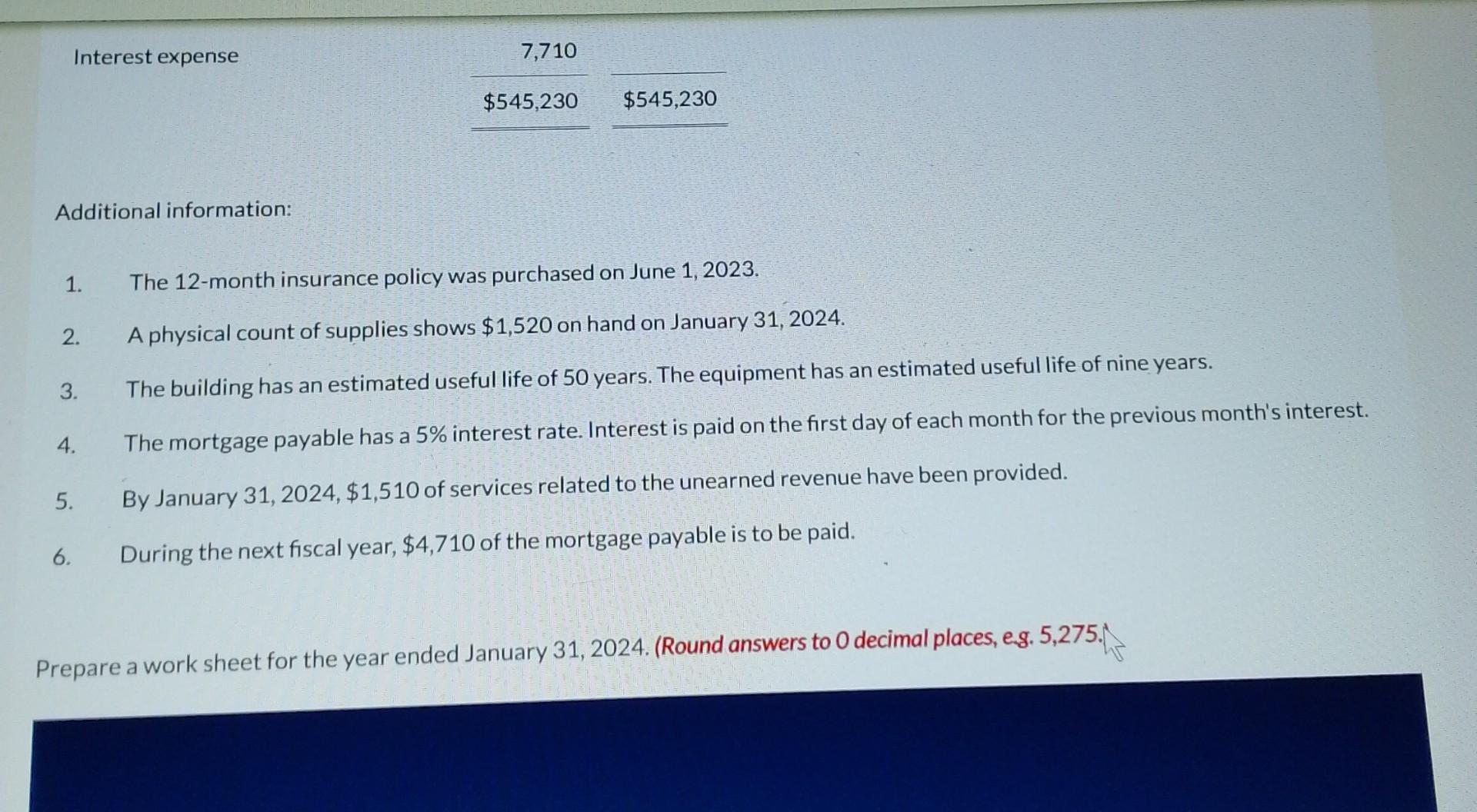

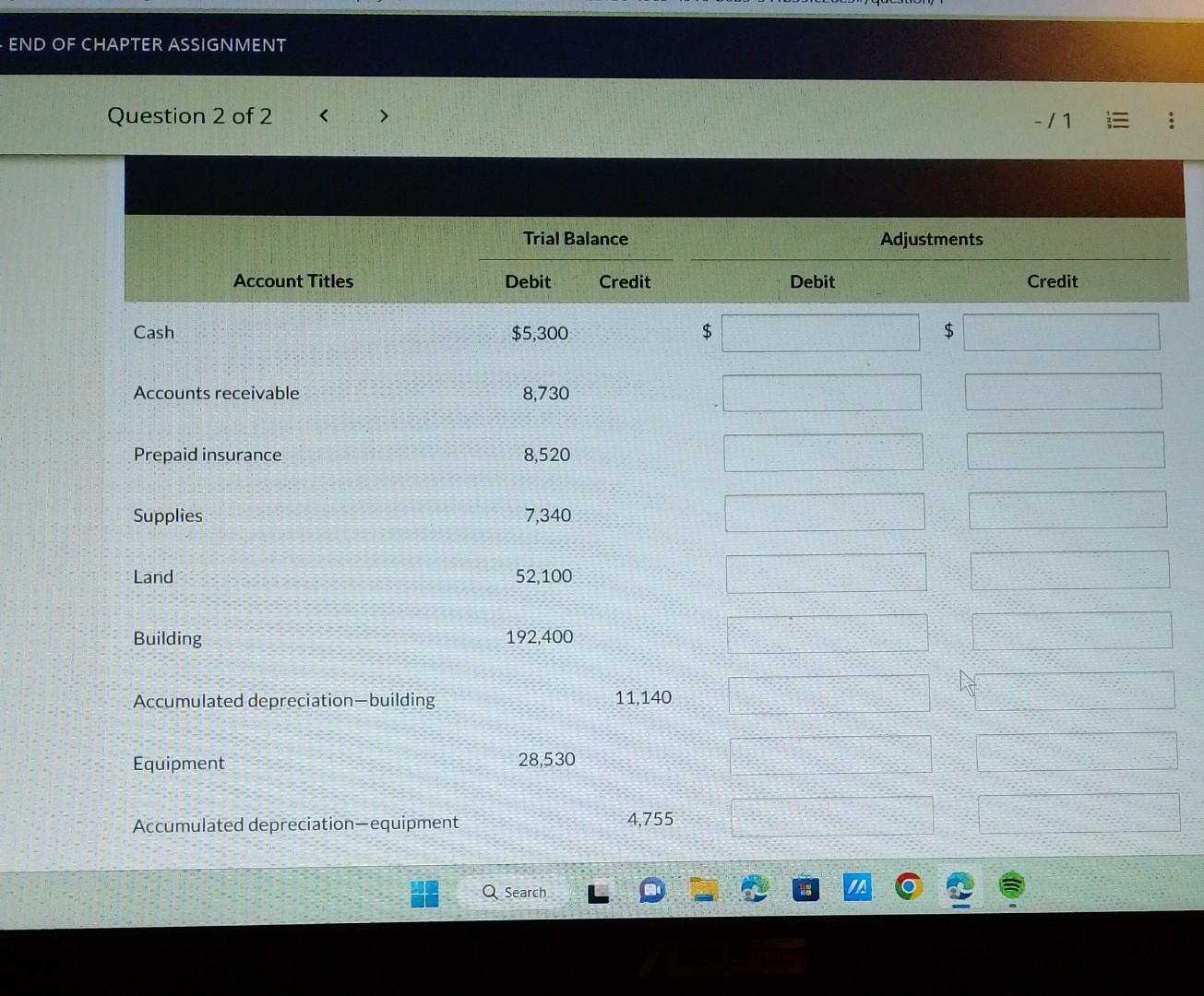

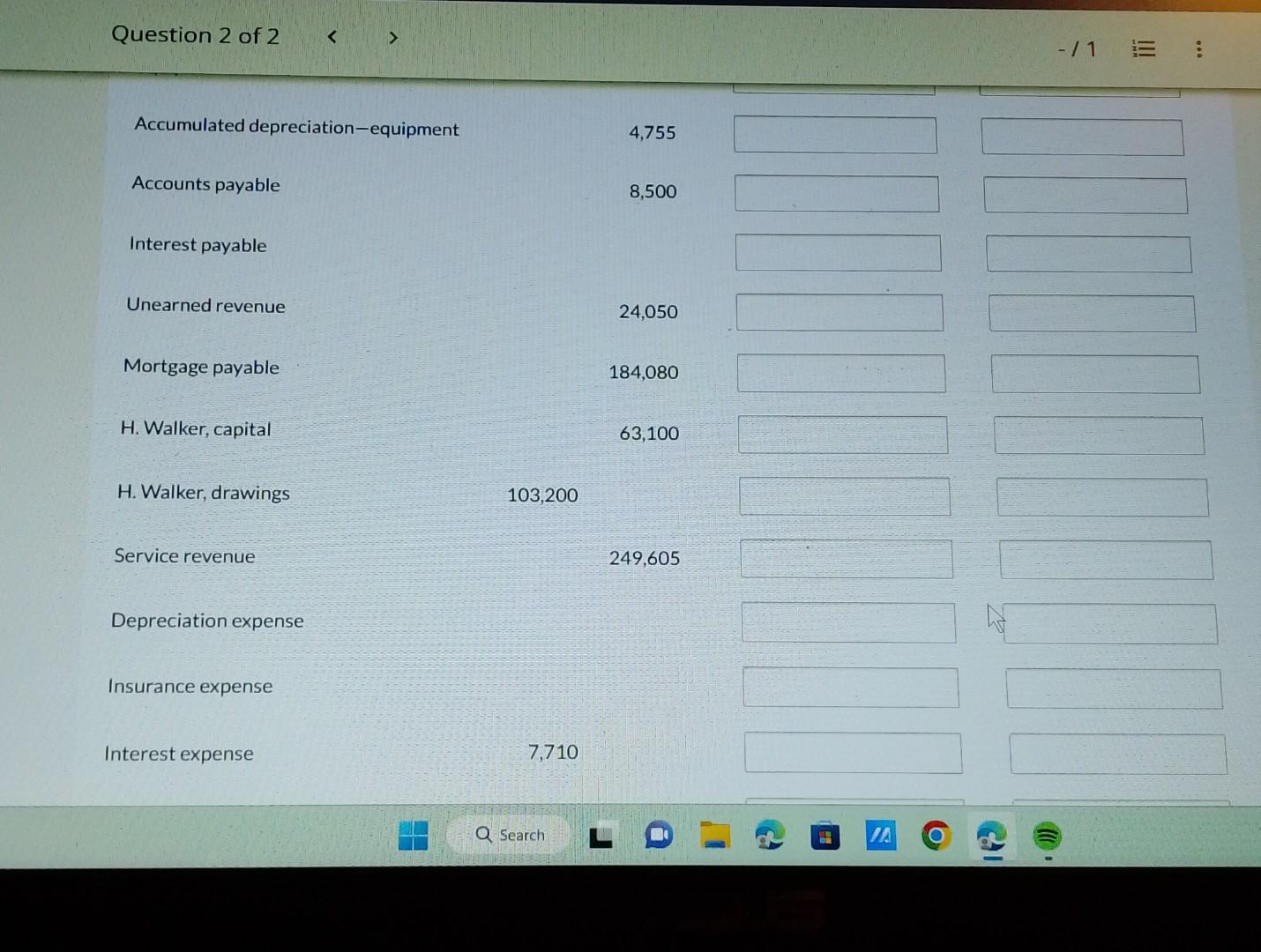

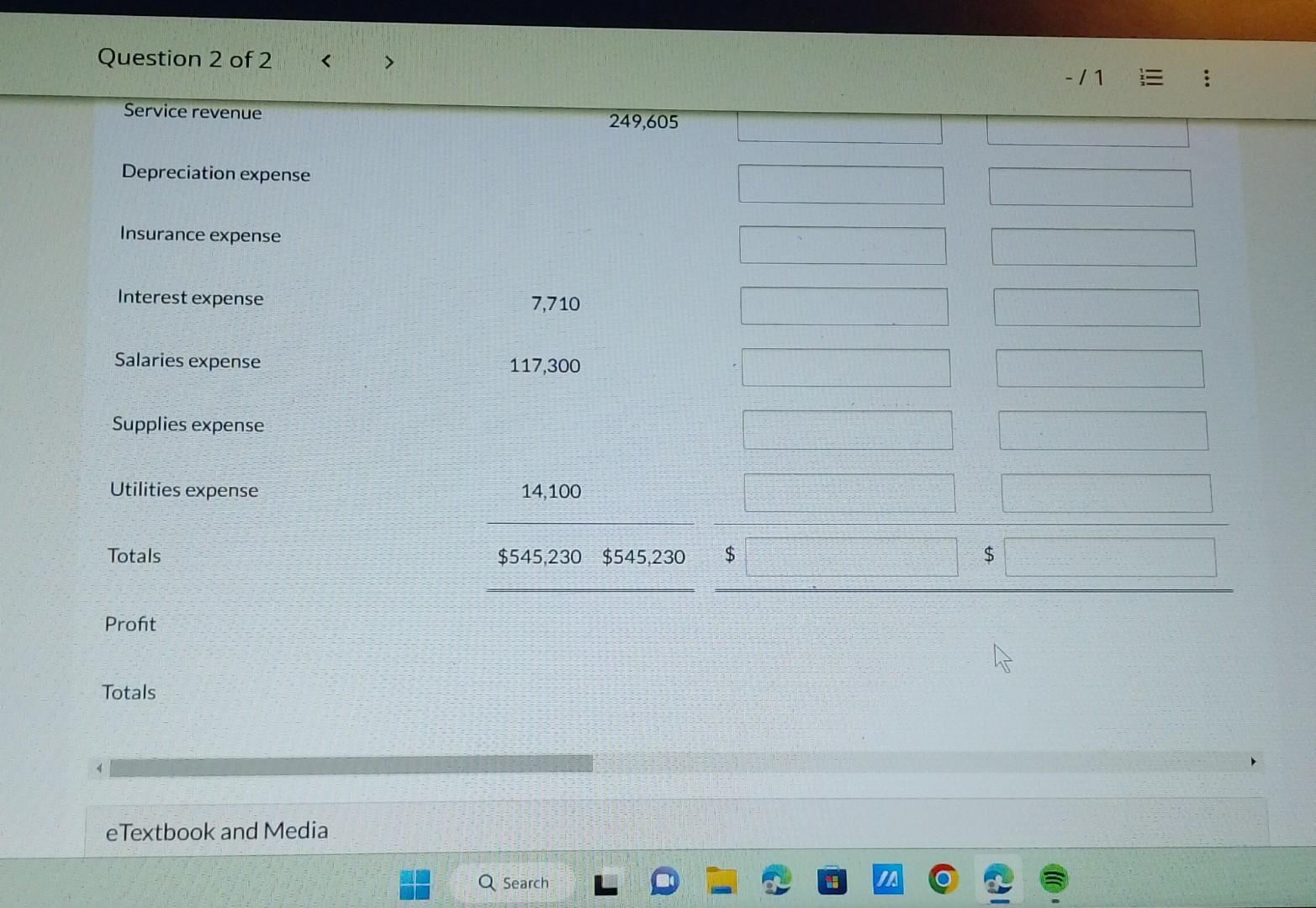

Current Attempt in Progress The unadjusted trial balance and adjustment data for Sandhill Cycle Repair Shop are provided. Land 52,100 Building 192,400 Accumulated depreciation-building $11,140 Equipment 28,530 Accumulated depreciation-equipment 4,755 Accounts payable 8,500 Unearned revenue Mortgage payable 184,080 H. Walker, capital 63,100 H. Walker, drawings 103,200 Service revenue 249,605 Salaries expense 117,300 Utilities expense 14,100 Interest expense Additional information: 1. The 12-month insurance policy was purchased on June 1,2023. 2. A physical count of supplies shows $1,520 on hand on January 31,2024. 3. The building has an estimated useful life of 50 years. The equipment has an estimated useful life of nine years. 4. The mortgage payable has a 5% interest rate. Interest is paid on the first day of each month for the previous month's interest. 5. By January 31,2024,$1,510 of services related to the unearned revenue have been provided. 6. During the next fiscal year, $4,710 of the mortgage payable is to be paid. Prepare a work sheet for the year ended January 31, 2024. (Round answers to 0 decimal places, e.g. 5,275.) END OF CHAPTER ASSIGNMENT Question 2 of 2 Accounts receivable 8,730 Prepaid insurance 8,520 Supplies 7,340 Land 52,100 Building 192,400 Accumulated depreciation-building 11,140 Equipment 28,530 Accumulated depreciation-equipment 4,755 Question 2 of 2 Accumulated depreciation-equipment 4,755 Accounts payable 8,500 Interest payable Unearned revenue 24,050 Mortgage payable 184,080 H. Walker, capital 63,100 H. Walker, drawings 103,200 Service revenue 249,605 Depreciation expense Insurance expense Interest expense 7,710 Question 2 of 2 Service revenue 249,605 Depreciation expense Insurance expense Interest expense Salaries expense 117,300 Supplies expense Utilities expense Totals Profit Totals eTextbook and MediaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started