Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show a complete step-by-step solution thank you! Computing and Evaluating Inventory and PPE Turnovers Intel Corporation reports the following financial statement amounts in its

Please show a complete step-by-step solution thank you!

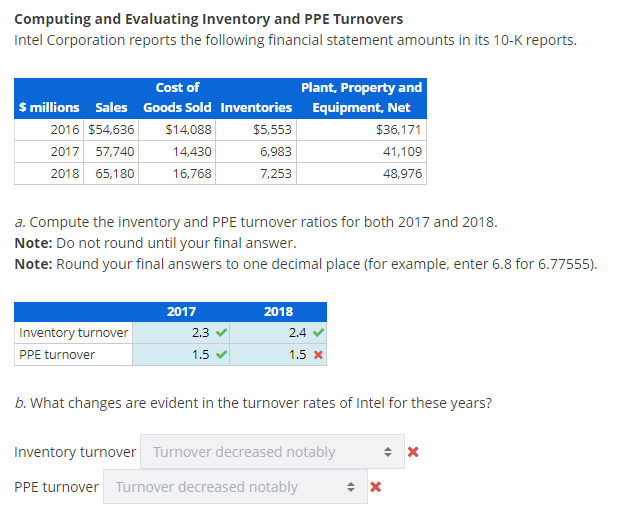

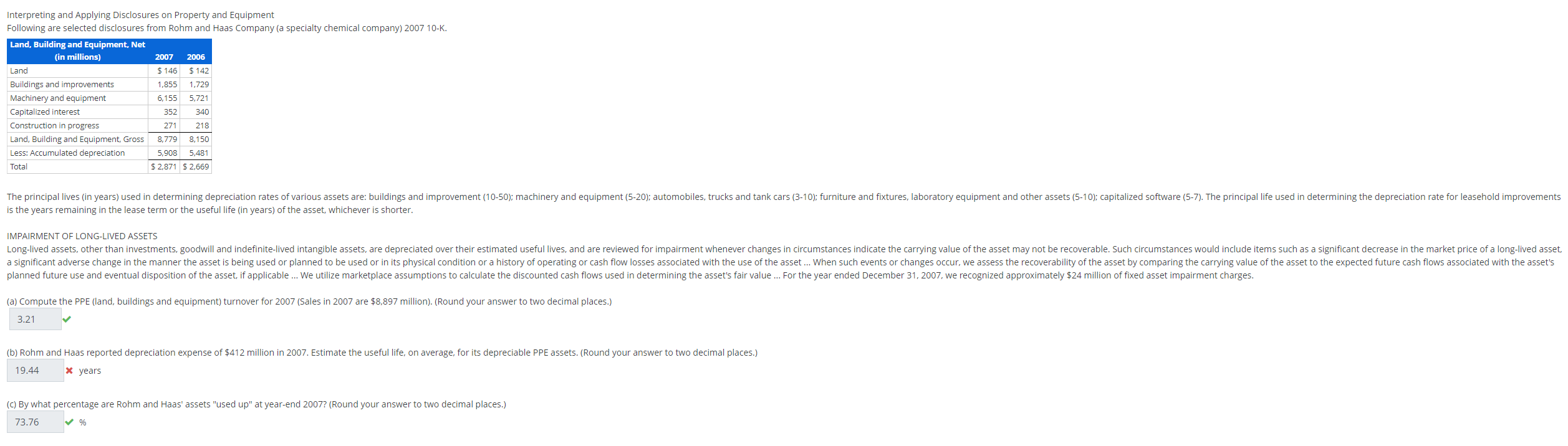

Computing and Evaluating Inventory and PPE Turnovers Intel Corporation reports the following financial statement amounts in its 10K reports. a. Compute the inventory and PPE turnover ratios for both 2017 and 2018. Note: Do not round until your final answer. Note: Round your final answers to one decimal place (for example, enter 6.8 for 6.77555 ). b. What changes are evident in the turnover rates of Intel for these years? IMPAIRMENT OF LONG-LIVED ASSET a significant adverse change in the manner the asset is being used or planned to be used or in its physical condition or a history of operating or cash fl planned future use and eventual disposition of the asset, if applicable ... We utilize marketplace assumptions to calculate the discounted cash flows use (a) con (a) Compute the PPE (land, buildings and equipment) turnover for 2007 (Sales in 2007 are $8,897 million). (Round your answer to two decimal places.) (b) Rohm and Haas repo x years (c) By what percentage are Rohm and Haas' assets "Used up" at year-end 2007? (Round your answer to two decimal places.)

Computing and Evaluating Inventory and PPE Turnovers Intel Corporation reports the following financial statement amounts in its 10K reports. a. Compute the inventory and PPE turnover ratios for both 2017 and 2018. Note: Do not round until your final answer. Note: Round your final answers to one decimal place (for example, enter 6.8 for 6.77555 ). b. What changes are evident in the turnover rates of Intel for these years? IMPAIRMENT OF LONG-LIVED ASSET a significant adverse change in the manner the asset is being used or planned to be used or in its physical condition or a history of operating or cash fl planned future use and eventual disposition of the asset, if applicable ... We utilize marketplace assumptions to calculate the discounted cash flows use (a) con (a) Compute the PPE (land, buildings and equipment) turnover for 2007 (Sales in 2007 are $8,897 million). (Round your answer to two decimal places.) (b) Rohm and Haas repo x years (c) By what percentage are Rohm and Haas' assets "Used up" at year-end 2007? (Round your answer to two decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started