Answered step by step

Verified Expert Solution

Question

1 Approved Answer

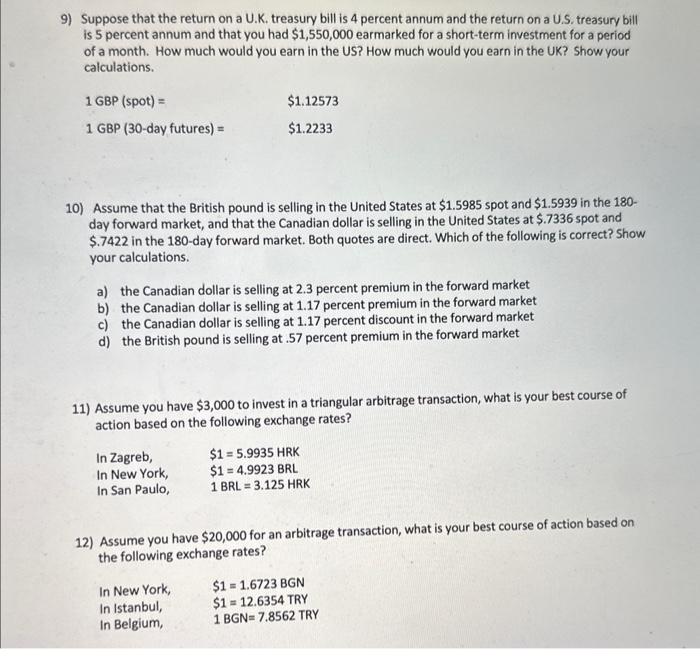

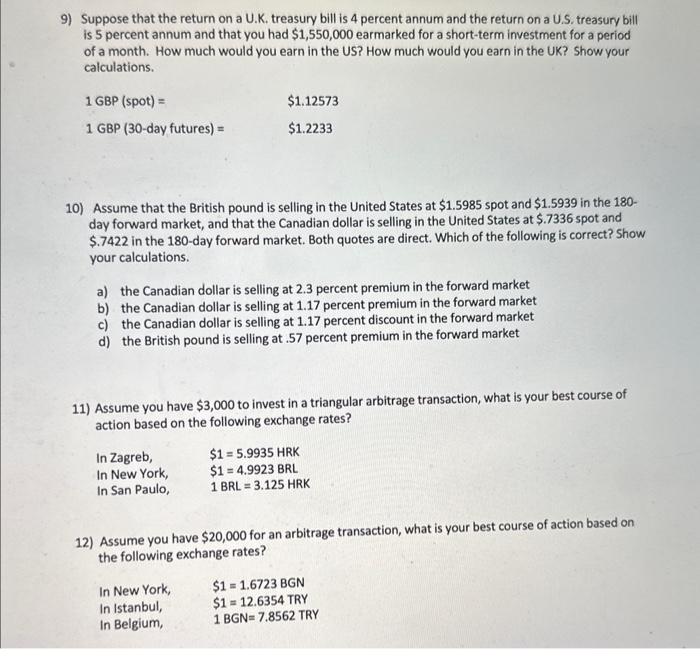

Please show all calculations. 9) Suppose that the return on a U.K. treasury bill is 4 percent annum and the return on a U.S. treasury

Please show all calculations.

9) Suppose that the return on a U.K. treasury bill is 4 percent annum and the return on a U.S. treasury bill is 5 percent annum and that you had $1,550,000 earmarked for a short-term investment for a period of a month. How much would you earn in the US? How much would you earn in the UK? Show your calculations. 1GBP(spot)=1GBP(30-dayfutures)=$1.12573$1.2233 10) Assume that the British pound is selling in the United States at $1.5985 spot and $1.5939 in the 180 day forward market, and that the Canadian dollar is selling in the United States at $.7336 spot and $.7422 in the 180-day forward market. Both quotes are direct. Which of the following is correct? Show your calculations. a) the Canadian dollar is selling at 2.3 percent premium in the forward market b) the Canadian dollar is selling at 1.17 percent premium in the forward market c) the Canadian dollar is selling at 1.17 percent discount in the forward market d) the British pound is selling at .57 percent premium in the forward market 11) Assume you have $3,000 to invest in a triangular arbitrage transaction, what is your best course of action based on the following exchange rates? InZagreb,InNewYork,InSanPaulo,$1=5.9935HRK$1=4.9923BRL1BRL=3.125HRK 12) Assume you have $20,000 for an arbitrage transaction, what is your best course of action based on the following exchange rates? In New York, $1=1.6723BGN In Istanbul, $1=12.6354 TRY In Belgium, 1BGN=7.8562 TRY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started