Answered step by step

Verified Expert Solution

Question

1 Approved Answer

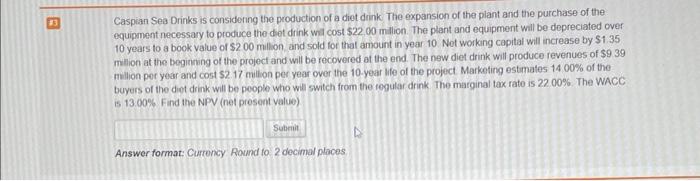

Please show all calculations!! You can display them through excel but please also use a financial calculator to show NPV. Thank you so much!! Caspian

Please show all calculations!! You can display them through excel but please also use a financial calculator to show NPV. Thank you so much!!

Caspian Sea Drinks is considening the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the det dirk wil cost 522,00 million. The plant and equipment will be depreciated over 10 years to a bock value of $2.00 millon and sold for that amount in year 10 Not working capital will increase by $1.35 milion at the beginzing of the project and will be recovered at the end. The new diet drink will produce revenues of $939 milion per year and cost 52.17 million per year over the 10 -year life of the project Marketing estimates 14.00% of the buyers of the dipt drink will be people who will switch from the regular drink. The marginal tax rate is 2200%. The WACC is 13,00%. Find the NPV (net present valuo) Answer format: Curtency Round to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started