Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all handwritten work/formulas (not on excel) solve 8,9,10,11,12 please. will upvote and much appreciate it! Please solve 8,9,10,11,14. will upvote. thank you in

please show all handwritten work/formulas (not on excel) solve 8,9,10,11,12 please. will upvote and much appreciate it!

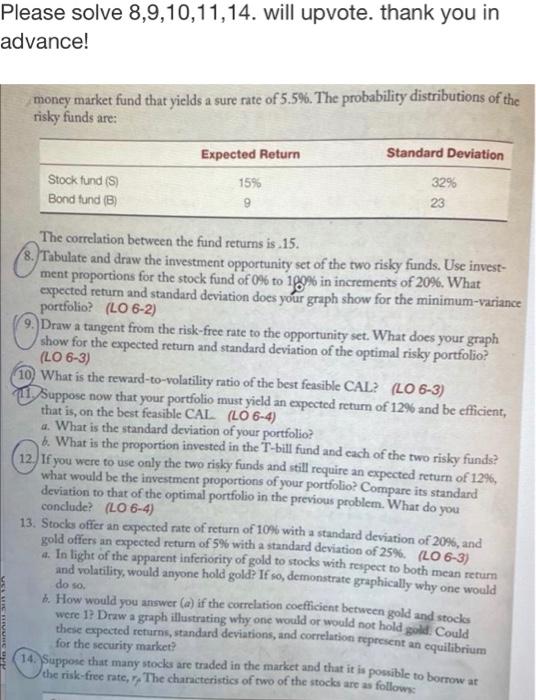

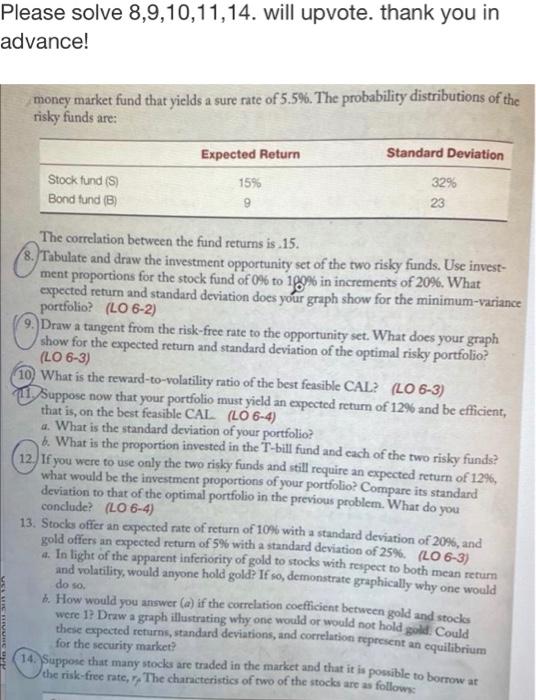

Please solve 8,9,10,11,14. will upvote. thank you in advance! money market fund that yields a sure rate of 5.5%. The probability distributions of the risky funds are: Expected Return Standard Deviation Stock fund (S) Bond tund (B) 15% 9 32% 23 The correlation between the fund returns is 15. 8. Tabulate and draw the investment opportunity set of the two risky funds. Use invest- ment proportions for the stock fund of 0% to 199% in increments of 20%. What expected return and standard deviation does your graph show for the minimum-variance portfolio? (LO 6-2) 9. Draw a tangent from the risk-free rate to the opportunity set. What does your graph show for the expected return and standard deviation of the optimal risky portfolio? (LO 6-3) What is the reward-to-volatility ratio of the best feasible CAL? (LO 6-3) 11. Suppose now that your portfolio must yield an expected return of 12% and be efficient, that is, on the best feasible CAL (LO 6-4) a. What is the standard deviation of your portfolio? . What is the proportion invested in the T-bill fund and cach of the two risky funds? 12. If you were to use only the two risky funds and still require an expected return of 12%, what would be the investment proportions of your portfolio? Compare its standard deviation to that of the optimal portfolio in the previous problem. What do you conclude? (LO 6-4) 13. Stocks offer an expected rate of return of 10% with a standard deviation of 20%, and gold offers an expected return of 5% with a standard deviation of 25%. (206-3) 4. In light of the apparent inferiority of gold to stocks with respect to both mean return and volatility, would anyone hold gold? If so, demonstrate graphically why one would 1. How would you answer (@) if the correlation coefficient between gold and stocks were 1? Draw a graph illustrating why one would or would not hold gold. Could these expected returns, standard deviations, and correlation represent an equilibrium the security market? 14. Suppone that many stocks are traded in the market and that it is possible to borrow at the risk-free rate, , The characteristics of two of the stocks are as follows do so. Please solve 8,9,10,11,14. will upvote. thank you in advance! money market fund that yields a sure rate of 5.5%. The probability distributions of the risky funds are: Expected Return Standard Deviation Stock fund (S) Bond tund (B) 15% 9 32% 23 The correlation between the fund returns is 15. 8. Tabulate and draw the investment opportunity set of the two risky funds. Use invest- ment proportions for the stock fund of 0% to 199% in increments of 20%. What expected return and standard deviation does your graph show for the minimum-variance portfolio? (LO 6-2) 9. Draw a tangent from the risk-free rate to the opportunity set. What does your graph show for the expected return and standard deviation of the optimal risky portfolio? (LO 6-3) What is the reward-to-volatility ratio of the best feasible CAL? (LO 6-3) 11. Suppose now that your portfolio must yield an expected return of 12% and be efficient, that is, on the best feasible CAL (LO 6-4) a. What is the standard deviation of your portfolio? . What is the proportion invested in the T-bill fund and cach of the two risky funds? 12. If you were to use only the two risky funds and still require an expected return of 12%, what would be the investment proportions of your portfolio? Compare its standard deviation to that of the optimal portfolio in the previous problem. What do you conclude? (LO 6-4) 13. Stocks offer an expected rate of return of 10% with a standard deviation of 20%, and gold offers an expected return of 5% with a standard deviation of 25%. (206-3) 4. In light of the apparent inferiority of gold to stocks with respect to both mean return and volatility, would anyone hold gold? If so, demonstrate graphically why one would 1. How would you answer (@) if the correlation coefficient between gold and stocks were 1? Draw a graph illustrating why one would or would not hold gold. Could these expected returns, standard deviations, and correlation represent an equilibrium the security market? 14. Suppone that many stocks are traded in the market and that it is possible to borrow at the risk-free rate, , The characteristics of two of the stocks are as follows do so

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started